investment viewpoints

Convertible trendwatch: finding long-term growth

This paper forms part of a series exploring thematic shifts in the convertible bond market driven by the pandemic, the economic recovery and longer-term structural trends.

Two structural themes in convertible bonds preceded the pandemic and continue to offer powerful promise with a long-term view, in our opinion. First, healthcare using genetics-based diagnostics is making rapid advances, and looks set to revolutionise cancer detection and treatment. Second, the transition to renewable energy is proceeding apace, and with it, related demand for commodities to manufacture the low-carbon technology required for a net-zero future.

At LOIM, we prioritise investing thematically in convertible bonds in order to identify beneficial upside opportunities stemming from the embedded equity option. Many companies acting as disruptors in their fields have financed themselves using convertible borrowing, giving investors ample access to growth potential. At the same time, the asset class has typically provided better volatility-adjusted returns than conventional equities due to the measure of downside protection afforded by the bond floor element. This asymmetric return profile is one of the key benefits of investing in convertible bonds.

Healthcare: DNA diagnostics

Healthcare diagnostics are increasingly exploiting the vast potential of genetics to identify disease. Such analysis includes DNA decoding procedures that are far less invasive than traditional methods, and have the potential to transform the diagnosis, treatment and oversight of cancer. Over the next decade, we see strong potential for new technologies to cause a paradigm shift in oncology and enjoy significant growth from the current, early stages of the market.

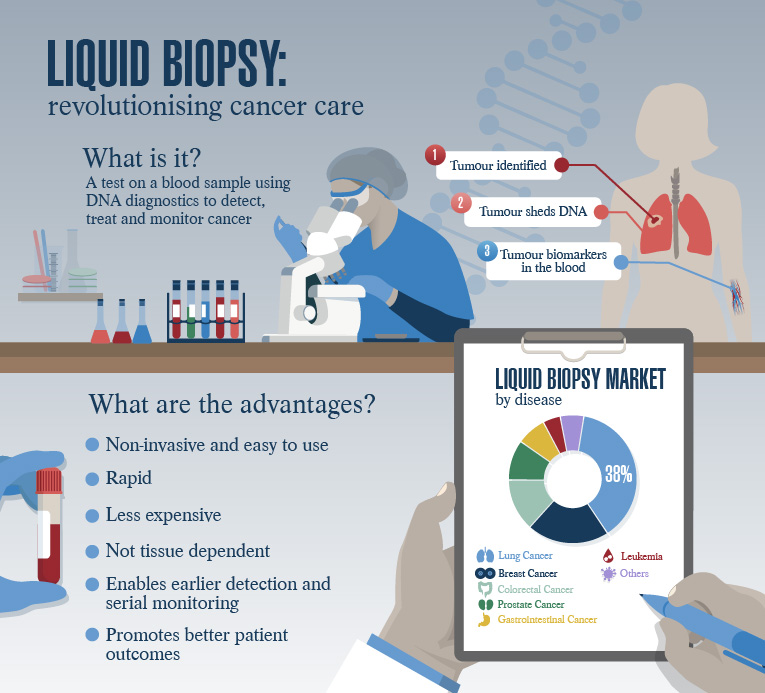

One such technology is liquid biopsy, involving a test on a blood sample to look for cancer cells that are circulating in the blood1. It can be used to find cancer at an early stage, plan or monitor treatment, and detect recurrence. The procedure is a low-risk, minimally invasive and rapid one. As such, it is favoured by patients who wish to avoid the risks, potential pain and high costs associated with traditional tissue biopsies.

Source: LOIM, Cowen, Future Market Insights. For illustrative purposes only.

Other forms of genetic diagnostics based on biomarkers include stool-based screening for colorectal cancer, which is non-invasive and reduces the need for a colonoscopy.

DNA-based techniques are also promising for minimum residual disease (MRD). Following successful treatment of a patient’s cancer, residual cancerous cells often remain in the body. Even if all cancer cells are successfully eliminated and the patient is in remission, cancers can recur in time. After treatment, MRD testing is used on a regular and ongoing basis to detect the recurrence of cancer as soon as possible, when it can be treated most effectively.

A large, addressable and under-penetrated market

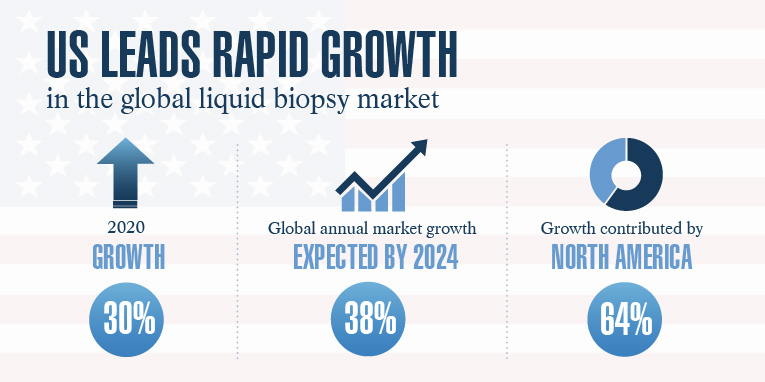

Still in its infancy, the liquid biopsy market is large and under-penetrated. The US total addressable market could be substantial: recurrence detection alone provides an estimated market of USD50bn, which could easily expand to USD130bn if early detection and asymptomatic cases were included. There is also clear growth potential in the non-US market.

We estimate the total addressable market for colorectal cancer screening to be USD18bn: this market is currently only 5% penetrated, providing significant opportunities, in our view.

Commercialising products amid growing M&A

Social and financial advantages

Genetic diagnostics and treatment offer both social and financial advantages for patients and healthcare providers. Conventional cancer diagnosis and treatment are very costly, and can involve lengthy and interventionist processes. DNA-based diagnostics help reduce costs by catching cancer earlier, thereby making it more treatable, and rapidly performing tests. This reduces the expenditure for both patients and healthcare providers, and enables funds to be spent in other parts of the healthcare system.

From a social perspective, genetic diagnostics can speed up treatment, prevent recurrence and help improve patient outcomes.

Transition to renewable energy

Already underway before Covid-19, the transition to renewable energy continues to gain momentum and clearly reflects the sustainability revolution in progress. At Lombard Odier, we believe the economy is already transitioning towards an economic model that is geared towards leveraging the vast value creation opportunities that sustainability has to offer. The vision for that future is an economy that is Circular, Lean, Inclusive and Clean, or the CLIC™ economy. Renewable energy is clearly part of both a circular and cleaner economy.

Institutional investors are increasingly shifting their portfolios away from carbon-intensive assets in favour of greener and climate-aligned sources of energy. Renewables are now becoming cost competitive with hydrocarbon fuels, and a number of cleantech companies are already benefiting and have attractive long-term prospects, in our opinion. But the transition still has a long way to run.

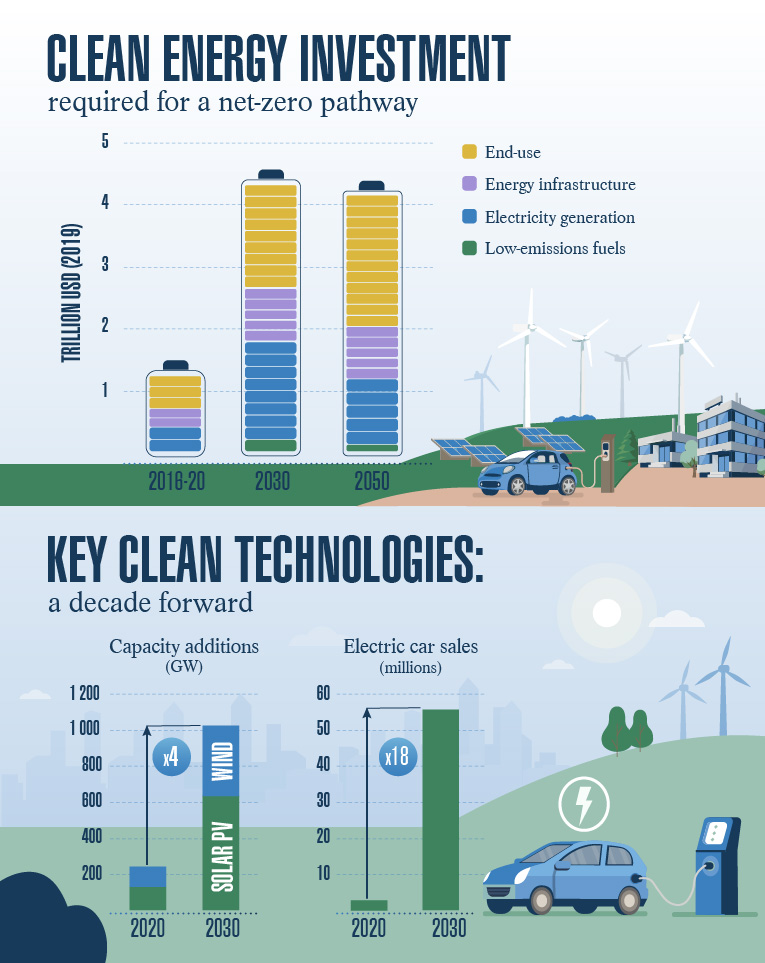

The International Energy Agency (IEA) estimates current investment in clean energy technologies at USD 750 billion. To put the world on track to reach net-zero emissions by 2050, this would need to triple in the 2020s. Areas we see as being exposed to this long-term trend include:

- Utilities with a high proportion of renewable-energy capacity

- Industrial manufacturers with capabilities in electrical engineering and mobility

- Specialty chemical companies involved in building construction materials, and bonding/sealing adhesives for electric vehicles

The role of government policy

Global government policies to drive greener solutions in public spaces form one driver in the push to renewables. Today, close to 80% of the world economy is subject to some form of net-zero target. The European Green Deal aims to transform the EU into a resource-efficient economy, ensuring: no net emissions of greenhouse gases by 2050; economic growth decoupled from resource use; and no person and no place left behind.

Policy initiatives are also funding the infrastructure needed for the transition to electric vehicles, as evidenced by the UK’s recent GBP300 million commitment to low-carbon projects and charging points. Last year, the Chinese government extended subsidies for electric vehicles by two years to 2022.

Regulatory goals give greater social reach to this theme. Governments are increasingly addressing their responsibility to fund the transition to net-zero carbon emissions in all areas, including the electrification of urban spaces, for instance. Converting public lighting, such as street lamps and traffic lights, to solar power gives greater scope for society to benefit from non-polluting technology. Indeed, cities are increasingly adopting sensors for temperature, light, pressure, sound, and humidity to increase their efficiency and become more sustainable. As we get closer to the COP26 climate conference in Glasgow in November, further government announcements on present and future decarbonisation policies are likely.

Such developments in renewables are likely to support semiconductor makers, sensor manufacturers and electric vehicle companies, in our opinion.

Green capex to drive commodities demand

The push to build sustainable technologies and infrastructure is already leading to strong demand for commodities, such as metals, and there is talk of a new commodity supercycle. Commodities are highly correlated to global Purchasing Manager’s Index (PMI) readings and rising bond yields, not to mention supportive government policy, which often leads to greater infrastructure spending. Commodities could also provide a potential inflation hedge amid rising price pressure, in our opinion. A weaker dollar typically supports higher commodity prices, as does Chinese demand, which represents 50% of commodities demand globally.

Policies focused on social needs (instead of financial stability) are also creating commodity-intensive economic growth. Governments in the US, Europe and China are supporting green investment and efforts to narrow income disparities. We note that assistance to poor households typically has a disproportionate effect on consumption patterns and in turn supports commodity prices. Lastly, green investment—in electric-charging stations, for instance, and wind farms—is commodity-intensive.

Copper: pennies from heaven?

Copper is one beneficiary of this increased demand. Our equities team forecasts global copper consumption will grow 60% to 45.3mt by 2040 as policymakers and companies work to combat climate change and move towards net-zero emissions. Hydrocarbons will give way to renewable energy as solar and wind become more dominant globally in the coming decades. Copper is key in the machinery and infrastructure required for this change.

Underinvestment has characterised some parts of the mining sector, and in particular copper mining, for many years. The imbalance means that supply could lag demand and propel elevated prices for some time, in our view. Our Asia fixed income team expects structural demand for base metals to be one medium-term factor leading to more persistent inflation.

Based on demand expectations to fuel the climate transition, and coupled with massive government stimulus, we are positive on select portions of the mining sector. The transition to net zero and to a CLICTM economy may bring significant changes for the mining industry. Coal mining is particularly poorly positioned, and we do not invest in companies with significant exposure to this activity.

More broadly, the transition to more circular business models may depress demand for some commodities, such as iron ore. Other materials, however, face potential upsides linked to these environmental transitions. Necessary investments in transport electrification and renewable energy, for instance, will require significant volumes of materials such as copper, lithium, nickel, cobalt and rare earths, only some of which can likely be supplied from recycling. Increased production of these and other materials will be necessary, with increased care to be taken not only with respect to the type of materials extracted, but also the manner of extraction.

Shaping the future

Investing thematically in the convertible bond market offers investors the opportunity to tap into long-term growth potential from the changes shaping society now and in the future. With its signature asymmetric return profile, the asset class offers both a measure of downside protection from the bond floor as well as strong upside potential from the embedded equity option. From genetics-based healthcare diagnostics to renewable energy, our team uses its expertise to identify the companies we believe could benefit most.

Sources

1Source: National Cancer Institute

2Source: FactSet, company data. Refers to selected transactions over USD35m within diagnostics since 2017.

Informazioni importanti.

For professional investor use only

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited . which is authorized and regulated by the FCA.

©2021 Lombard Odier IM. All rights reserved.