investment viewpoints

Convertible trendwatch: pandemic accelerators

This paper forms part of a series exploring thematic shifts in convertible bonds driven by the pandemic, the economic recovery and longer-term structural trends.

The pandemic catalysed change across the globe. Following rapid expansion, the convertible bond universe offers investors the potential to tap into trends that have accelerated as a result of the Covid-19 virus. Many areas of the economy were transformed by restrictions that triggered increased working and consuming from home, as technology facilitated remote communication and online services. We call such trends ‘pandemic accelerators,’ and prioritise them as part of our investment approach.

The areas we identify as pandemic accelerators with a positive outlook are: telehealth, online food delivery, e-learning and semiconductors. Even once pandemic restrictions ease fully, we expect enduring shifts in these areas as habits become entrenched due to consumers preferring the ease and convenience of new solutions.

Why convertibles for trends?

Primary issuance trends favour investing via convertibles, in our opinion. High-growth companies are well represented in convertible debt, having chosen the convertible bond market as an efficient way to raise capital at a time of spectacular growth linked to the effects of the pandemic. For instance, technology companies represent close to a quarter of the convertibles market, followed by the communications, consumer discretionary and industrial sectors.

Companies that disrupt their field often prefer using convertible bond issuance for financing purposes. Tapping the asset class is one way that smaller or younger companies can access funding at a low cost as well as diversify their funding sources. As such, convertibles often offer investors a steady stream of access to disruptors and the growth potential they afford.

Convertible bonds could also present advantages compared to investing directly in a conventional equity. High-growth companies typically show a propensity for improving credit quality, further increasing the measure of downside protection from the bond floor element of convertibles, in our view. This would benefit investors in case of a correction.

Indeed, many growth companies in the convertible universe are quickly improving their credit metrics1, according to our analysis. For instance, they usually tend to display low financial leverage and improving free cash flows. Finally, their balance sheets often evolve very quickly: by the time they need to refinance their convertible borrowing, many could have stronger financial metrics, in our view.

Of course, investors in convertibles still benefit from upside equity participation through the optionality in the bond. The recent rotation from growth to value stocks, and the simultaneous cheapening of the asset class are particularly pronounced for convertible bonds issued by high-growth names, in our opinion. Therefore, we believe it is an opportune moment for investors to take advantage of the full potential of the asset class, and highlight the strong potential we see in pandemic-driven trends.

Health and wellness move online

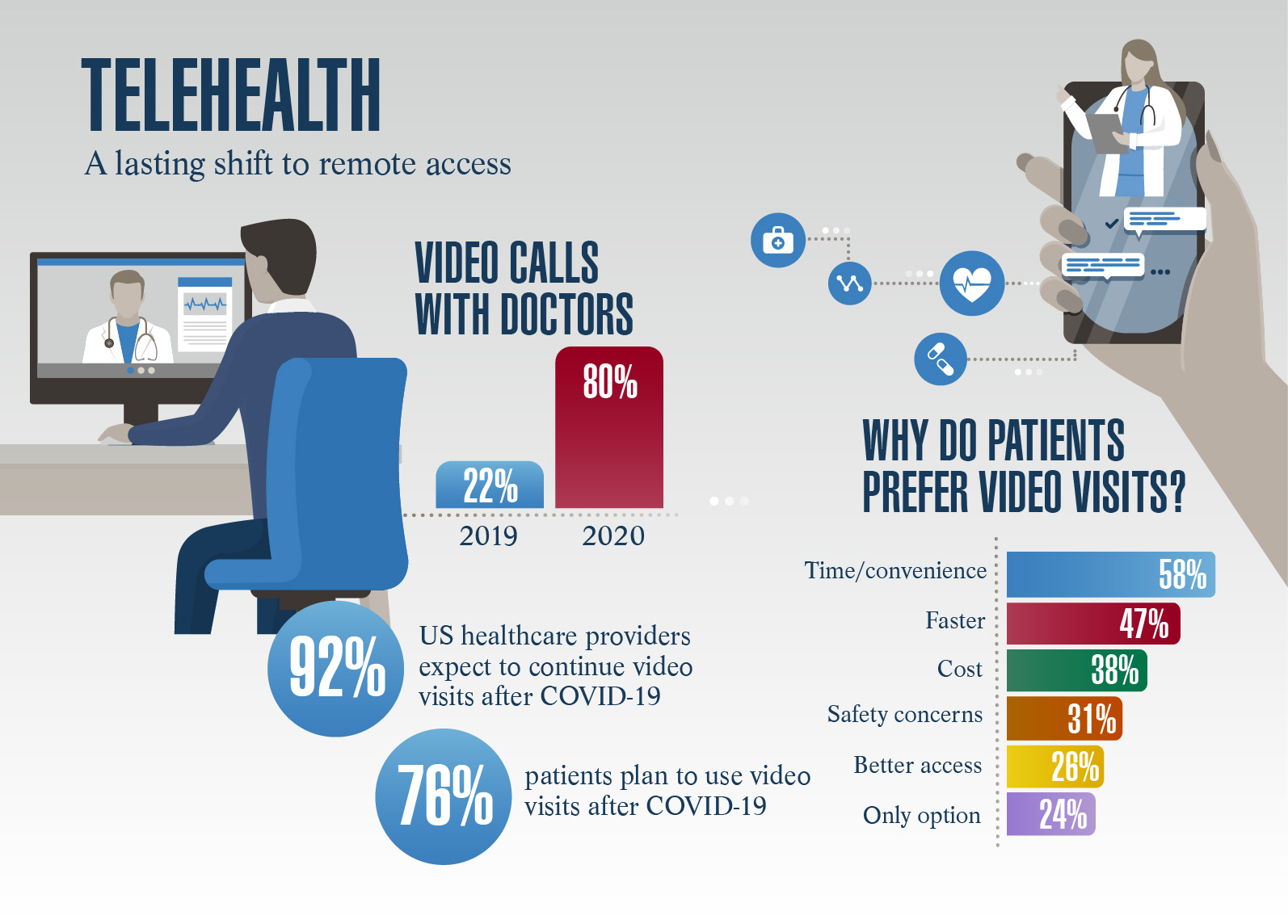

The delivery of healthcare and wellness services was upended by the pandemic, and online health consultations, meditation apps and internet fitness classes became mainstream. Restrictions meant that in person visits to the doctor or gym were no longer possible, thereby shifting users towards remote access.

We believe that a significant proportion of healthcare services will continue being delivered online permanently, even after the pandemic has passed. Many patients prefer online consultations for their convenience and privacy, as well as the fact they require no physical contact.

Source. LOIM, Amwell 2020 physician and consumer survey. For illustrative purposes only.

For us, telehealth is also a broader theme encompassing companies linked to online delivery of pharmaceuticals as well as remote testing (or diagnostics). Online pharmacies enable customers to purchase over-the-counter medications using the internet, and are increasingly offering online ordering and delivery of prescription medication, too.

In the fitness space, we believe some consumers will continue to favour online classes and packages, even after gyms re-open. Brands that offer subscription services to deliver wellness remotely stand to gain the most, in our opinion, and have the potential to disrupt the traditional fitness industry.

A taste for food delivery

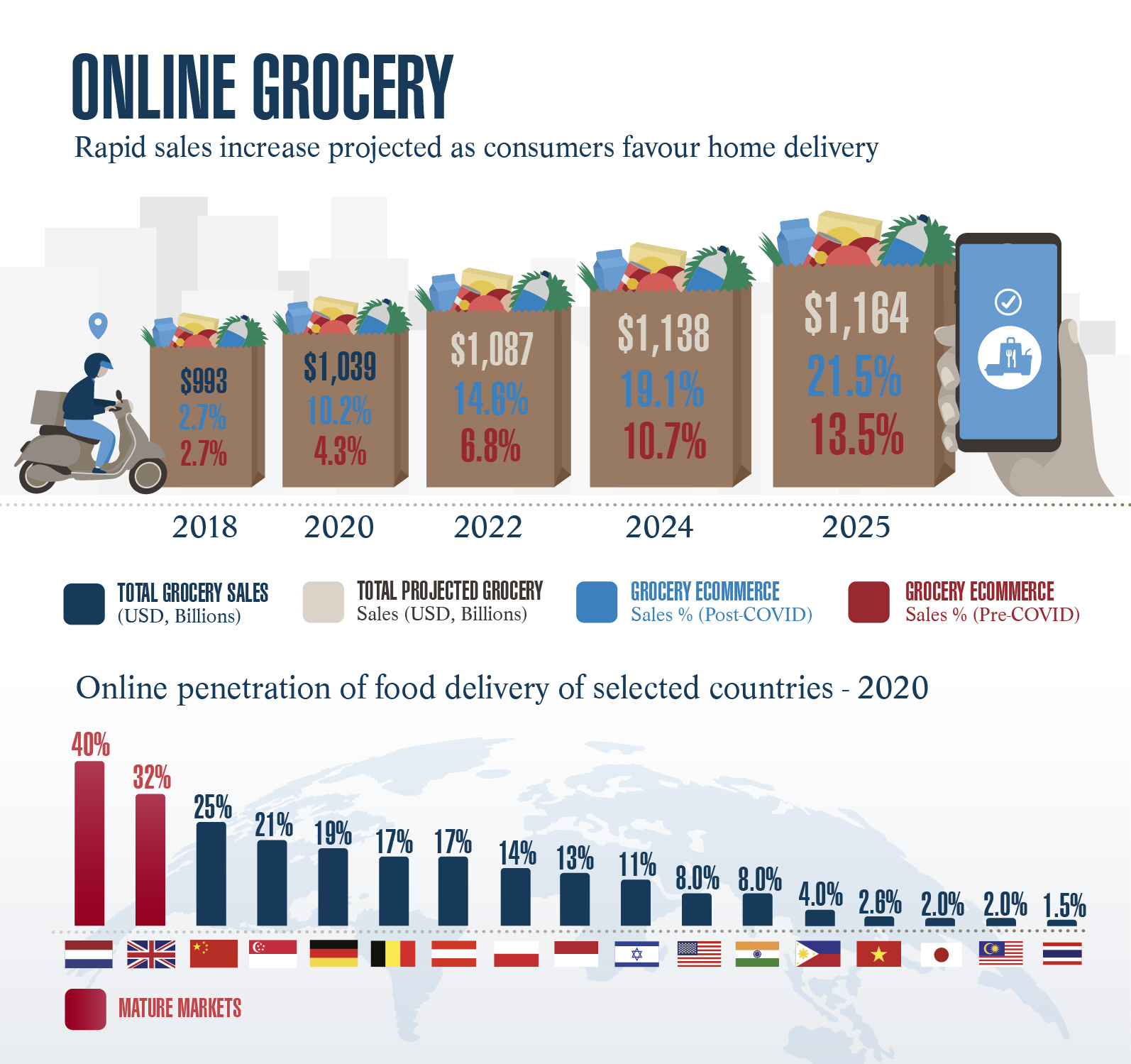

The migration to e-commerce hastened as the pandemic progressed, and we expect the behavioural shift will prove lasting. Within e-commerce, online grocery sales have soared over the past months as consumers favoured home food delivery over in-store food shopping. There was also a clear uptick in takeaway or prepared food being delivered. Regardless of the pandemic, this trend looks set to endure because consumers value the ease and time savings. Globally, the total addressable market (TAM) for online food services is expected to rise to USD10.8tn by 2022, according to Prosus. This compares to a market size of just USD9.1 tn in 2018.

In the US, we expect online grocery shopping to grow to more than 20% of the overall grocery market. Globally, the market remains under-penetrated, in our opinion, and only the UK and Dutch markets are considered mature. In countries where online penetration rates are still at low levels, we expect adoption to increase fast, especially in emerging markets.

Delivery synergies

Grocery deliveries are now leveraging the logistics provided by takeaway deliveries, and we foresee further synergies: for instance, a single driver could eventually deliver takeaway and the weekly grocery shop simultaneously. This blending from the logistics side also favours mobility companies that provide both taxi services and takeaway delivery.

Going forward, we see the leveraging of delivery services helping to improve companies’ profitability due to greater efficiencies. Currently, the market is in consolidation mode and some of the companies linked to this trend are using convertible funding to expand by either purchasing new customer bases or buying other companies.

The logistics behind the delivery operations involve yet another dimension. Logistics refer to the technology companies that run fulfilment centres for large grocers and develop robotics to optimise the food-delivery process. Robotics are created precisely to select fresh fruit, which can be delicate and have specific handling requirements to avoid damage. Such robotics are developed internally and externally, and the contracts to run the fulfilment centres are global, providing solid upside potential for growth, in our opinion.

Lastly, we note the development in Asia of community shopping. This involves several consumers from different households teaming up to buy items in bulk in order to benefit from discounts and offers. Community group buying is proving popular in China, and we expect it to support those companies catering to it.

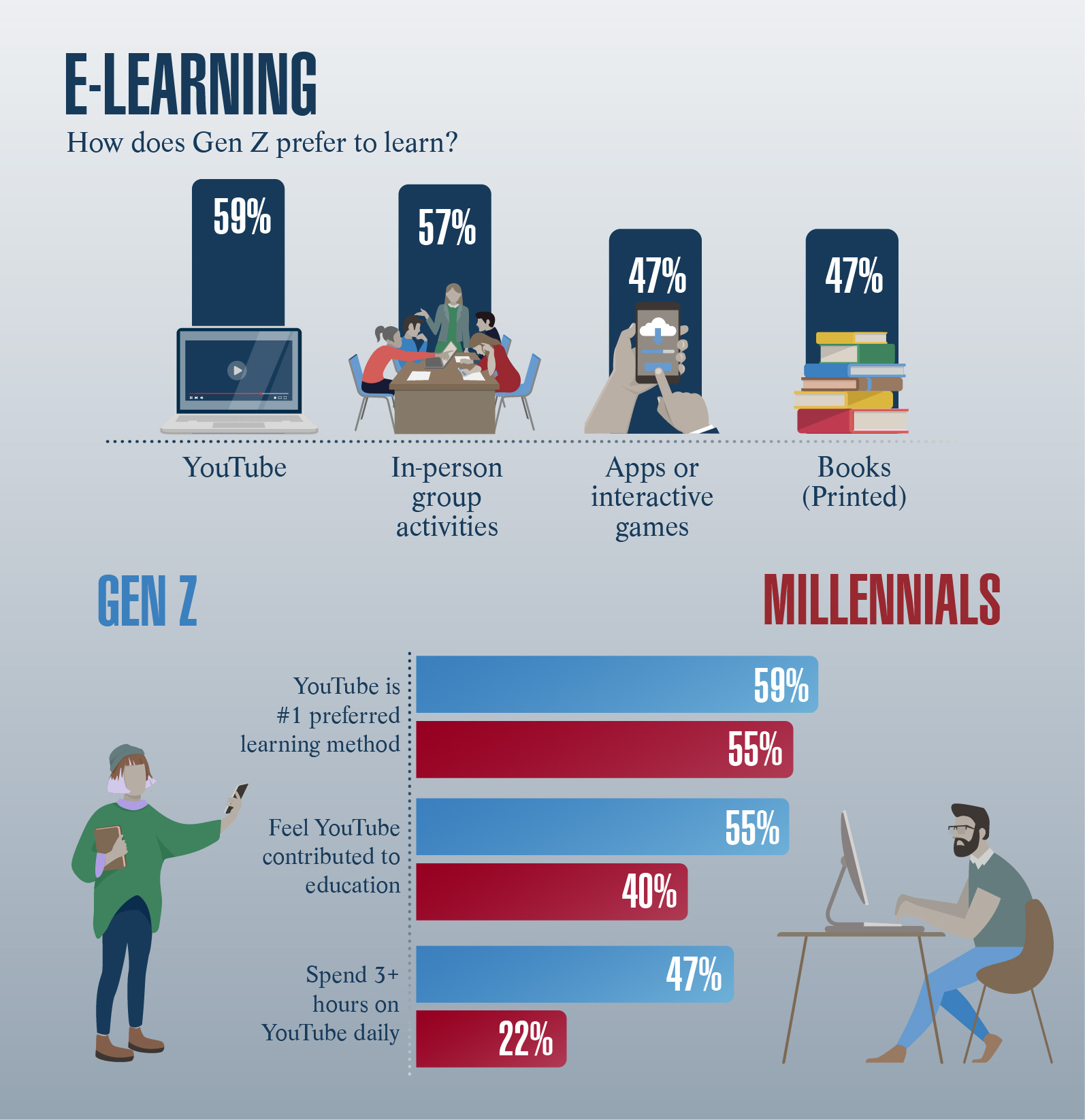

Preferring e-learning

Some 93% of US households with school-age children engaged some form of distance learning during the pandemic, according to the US Census Bureau. We believe such remote learning will persist because there are clear indicators that students prefer e-learning. This inclination was already apparent before the pandemic due to generational shifts: Gen Z favours video-based learning.

Source: LOIM, The Harris Poll (2018) and Pearson. For illustrative purposes only.

E-learning is already filtering through to all aspects of education such as adult or further education, educational courses, training seminars and corporate learning. This growth is also likely to support technology companies creating the tools to deliver learning remotely, in our opinion. Research and Markets expects the global e-learning market to reach USD325 bn in size by 2025, compared to USD107 bn in 2015.

The move to online education could be disruptive for universities, in our opinion. In the US, online tutorials can be used to earn a diploma, enabling students to take the course in their own time and, often, alongside working. Whereas face-to-face learning frequently incurs boarding and travel costs, distance learning does not. As such, the trend opens up education to all adults at a fraction of the cost. We see this broadening access to educational opportunities and providing an important equality aspect to this trend.

Semiconductors: demand abounds

Amid clear signs of a surge in demand, we expect the pandemic to continue to accelerate a positive outlook for companies involved in technology hardware and semiconductors. In the short-term, however, capacity constraints are weighing on the industry.

The pandemic accelerated the pace of digitalisation, forcing businesses to adopt cloud-based services at a faster pace and, in turn, increasing the need for semiconductors. Individuals working from home as well as the shift to digital recreational activities stoked demand for electronics such as laptops, computer monitors, consoles, televisions and other devices. Semiconductor manufacturers have thus experienced heightened requirements for chips, exposing bottlenecks in the supply chain, as well as opportunities for expansive development, in our view.

As the economy re-opens, we believe that demand for semiconductors will increase further due to greater adoption of electric vehicles; the expansion of 5G, or fifth-generation wireless connectivity, and smartphones; and the development of the internet of things2.

From telehealth to semiconductors, and food delivery to online learning, we believe some trends accelerated by the pandemic are here to stay. As with all disruptive change, volatility is an accompanying factor for the companies involved in future consumption patterns. We believe the convertible bond market could offer compelling risk-adjusted exposure to such disruptors.