investment viewpoints

Climate bonds: investing with impact in the race to net zero

Climate change is a defining challenge of this generation.

Over the next years, investment in climate mitigation and adaptation needs to be scaled up drastically. Investment requirements in the energy system alone are expected to increase to US$ 5 trillion per year by 2030, up from just over US$ 2 trillion today1. Additional investment will be required in infrastructure, nature-based solutions, and the circular economy. But how do investors access these climate opportunities?

Enter climate bonds. A growing and increasingly diverse climate-bond market could help meet the need for this impact capital. One vehicle focused on climate bonds is the Global Climate Bond strategy, launched in March 2017 through a strategic partnership between Lombard Odier Investment Managers (LOIM) and Affirmative Investment Management (AIM).

Global Climate Bond: impact without compromise

The strategy targets mainstream returns and does have an environmental and social impact2. It finances projects in areas like renewable energy, sustainable transport and climate-resilient infrastructure that mitigate or help adapt to the effects of climate change.

The portfolio is aligned to the UN Sustainable Development Goals (SDGs) and the Paris Agreement. Still, we believe it’s important to go beyond alignment and measure and evidence the environmental and social outcomes arising from the investment. This is captured in the Global Climate Bond Impact Report.

The report details how investors have supported efforts to mitigate climate change and promote resilience to its effects. In 2020, the strategy supported 2,330 such projects and initiatives—almost double of the previous year3, largely due to a significant rise in the AUM from last year.

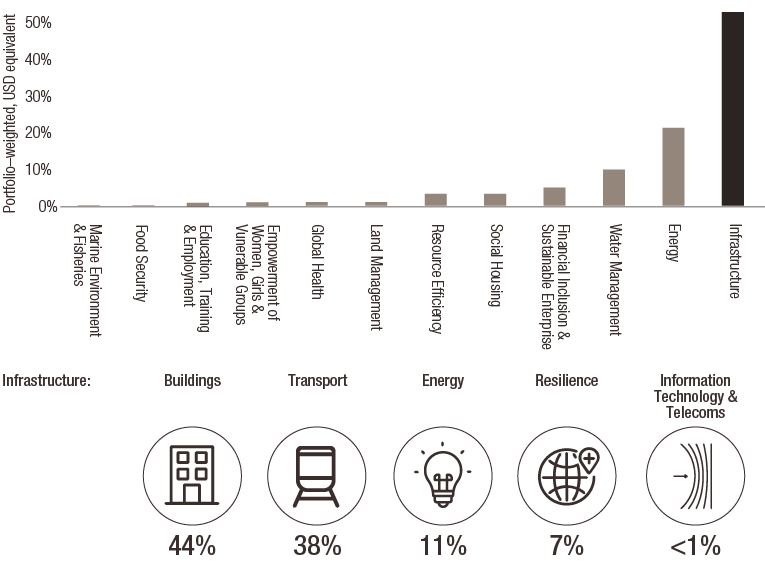

Portfolio allocations

Infrastructure, energy and water were the top three sectors where the impact bond proceeds were allocated. Infrastructure projects included clean transport networks, green buildings, resilience measures and information and communication technology. Buildings were the biggest beneficiary within infrastructure sector constituting a 44% share.

The portfolio also supported 15 of the 17 UN SDGs with the biggest allocation to goals of affordable and clean energy, sustainable cities and communities, and climate action. Mitigation-focused activities constituted 74% of the portfolio whilst 15% was allocated to adaptation-focused projects.

In 2020, the top three sectors that impact bond proceeds were allocated to were environmentally focused.

|

51% Infrastructure |

Hard and soft infrastructure promoting inclusive, climate–resilient, low carbon built environment; for example, clean transport networks, green buildings, resilience measures, information and communication technology. |

Over 7,000 daily passenger capacity supported in low carbon transport. Over 23,000m2 of buildings (by floor area) constructed/refurbished to higher energy efficiency standards |

|

24% Energy |

Renewable energy generation, modern energy access, energy storage and energy efficiency technologies. |

215MW of renewable energy generation capacity supported |

|

|

Water resources management, wastewater treatment, sanitation, water efficiency measures. |

Over 6 million m3 of wastewater treated annually |

Source: AIM Impact report 2020, For Illustrative purposes only

Top portfolio components

Source: AIM Impact report 2020, For Illustrative purposes only

Quality versus quantity

Whilst quantitative measures of impact are important, not all impacts can be verified by numbers. Qualitative observations of impacts achieved complement the hard data and help show how we support several SDGs.

For instance, Burkina Faso, a landlocked country in West Africa, has one of the lowest electrification rates and the most expensive electricity costs within the region. To support the country in scaling up its electrification through solar energy, the FMO Entrepreneurial Development Bank4, a holding in our portfolio, is providing a loan to help finance the development and construction of the Kodeni solar project5.

The solar-power plant is expected to have an annual energy generation capacity of 67.2 GWh. This aligns with SDGs seven and eight – affordable and clean energy and climate action – and could help achieve the government’s target of increasing the nation’s electrification rate to 80%.

Projects like these matter because the rapid scaling up of renewable energy capacity is essential to meet the world’s growing energy demands while reducing overall greenhouse gas emissions. Lack of access to electricity also hurts economic development and impacts people's health and wellbeing – making investments in renewables paramount.

Similarly, power company Vattenfall’s6 Hydrogen Breakthrough Ironmaking Technology project in Sweden is helping fund the production of the world’s first fossil-fuel-free steel by 20267, using green hydrogen and virtually no carbon footprint8. Steel currently accounts for 7% of global carbon emissions and a successful rollout of the project could result in cutting Sweden’s carbon emissions by 10%9.

Other key highlights of the impact report include:

- 126,600 tons of greenhouse gas emissions avoided per year, equating to 70% emissions savings10, compared to a baseline derived from the IEA’s Stated Policies scenario, and calculated using the Carbon Yield® methodology co-developed by AIM

- A coverage ratio of over 90%

- Over 2,330 projects supported in over 160 countries, equating to three quarters of the globe

- Weighted Average Carbon Intensity (WACI)11,12 of about 64 tCO2e/ US$m revenue versus 225 tCO2 e/US$m revenue for the benchmark Barclays Global Aggregate Bond Index, implying a 71% reduction in carbon intensity versus the benchmark

The full report can be downloaded from the Global Climate Bond strategy page.

sources

5 FMO (2021), Sustainability Bonds Newsletter

6 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document

7 SSAB, Timeline for HYBRIT and fossil-free steel

8 Vattenfall (2021), Green bond investor report March 2021

9 Vattenfall (2021), Green bond investor report March 2021

11 The WACI should be regarded as an assessment of the carbon profile for the share of the portfolio covered by the analysis. The WACI was calculated by maintaining original portfolio weights. The same approach was used for the benchmark.

12 Conducting an issuer-level GHG analysis on fixed income portfolios is a detailed exercise that does not currently benefit from the methodological standardisation and data availability that the equity space has. Moreover, the mapping of sub/supra-national securities and the selection of the most appropriate GHG emission intensity indicator for sovereign bonds are still matters for debate. We have adopted a conservative approach, accepting this may lead to overestimation of the carbon intensity of our portfolios. For example, given the lack of harmonised datasets for sub-national entities, we mapped sub-sovereign issuers to their respective country; for countries’ GHG emissions, territorial emissions were used, even though that might cause double-counting across asset classes. A simplified example of the potential double-counting is a portfolio comprising bonds issued by a corporate domiciled and operating in a country whose government bonds are also held in the same portfolio. The corporate issuer’s emissions arising from domestic sites would also be counted as part of the territorial emissions associated with government bonds issued by the country where the domestic sites are located. These approaches were necessary because of the lack of well-established alternatives.

Informazioni importanti.

RISERVATO AGLI INVESTITORI PROFESSIONISTI

Il presente documento è stato pubblicato da Lombard Odier Funds (Europe) S.A., una società per azioni di diritto lussemburghese avente sede legale a 291, route d’Arlon, 1150 Lussemburgo, autorizzata e regolamentata dalla CSSF quale Società di gestione ai sensi della direttiva europea 2009/65/CE e successive modifiche e della direttiva europea 2011/61/UE sui gestori di fondi di investimento alternativi (direttiva AIFM). Scopo della Società di gestione è la creazione, promozione, amministrazione, gestione e il marketing di OICVM lussemburghesi ed esteri, fondi d’investimento alternativi ("AIF") e altri fondi regolamentati, strumenti di investimento collettivo e altri strumenti di investimento, nonché l’offerta di servizi di gestione di portafoglio e consulenza per gli investimenti.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari. Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento. Non dovrebbero essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Funds (Europe) S.A. ©2021 Lombard Odier IM. Tutti i diritti riservati.