investment viewpoints

Swiss credit: spotlight on inflation and ESG

In keeping with our holistic approach, we delve into two issues facing investors in Swiss credit today. As the global debate about inflation intensifies, how could our Swiss strategies benefit from a structural bias for credit risk? Amid incomplete ESG analytics, how do we actively engage with Swiss issuers for a more complete picture?

As the global economic recovery gathers pace, rising inflation has triggered widespread debate about whether price increases will prove transitory or persistent. For us, the main issue is whether central banks will respond to inflation in a timely and correct manner. The US Federal Reserve has already brought forward its expectations for initial US rate hikes to 2023, somewhat soothing market jitters. We expect the Fed to clarify its timing on tapering quantitative easing next month, but caution that market volatility often accompanies such important communication concerning the possible reduction in asset purchases in the future.

Our base case is for a continued recovery, paired with myriad risks arising from: the Delta variant and vaccine efficacy; the re-opening of economies; employment growth; the trajectory for inflation; and the effectiveness of fiscal stimulus. Predicting outcomes can be difficult in this environment. While uncertainty remains pronounced, measures of volatility are only slowly starting to price in the increasing risks around pandemic variants. This does not change our opinion, however, that investors believe central bank and government measures will work.

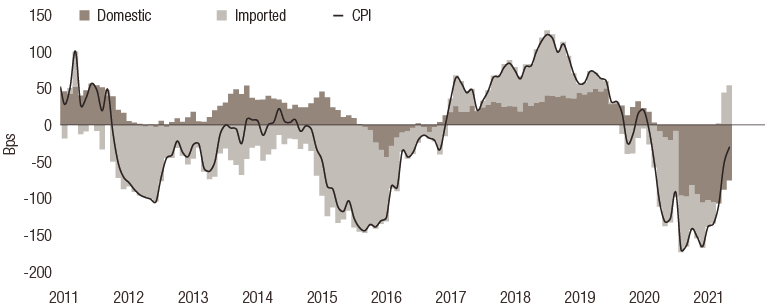

Global moves sway Swiss inflation

As has been the case historically, global developments are likely to set the tone for inflationary developments in Switzerland. Price rises in the country are largely imported through the Swiss franc, whereas domestic inflation is contained and has not surpassed 0.5% for more than a decade (see Figure 1). The Swiss National Bank (SNB) continues to reaffirm that the franc remains “highly valued” but we note that the currency has depreciated recently against a trade-weighted basket of currencies. This has yet to drive price rises, however, and makes the SNB likely to continue undershooting its 2% inflation target, in line with the central bank’s own inflation forecasts.

Figure 1. Imported vs domestic inflation in Switzerland

Source: LOIM, Bloomberg. For illustrative purposes only. Data as of May 2021.

Generally, the Swiss economy has performed well, suffering only a minimal GDP trough from the pandemic and currently accelerating quickly. That said, a negative GDP print in the second quarter will likely enable the SNB to be more comfortable with its full-year 2021 target of 3.5%.

Meanwhile, questions about the proficiency of the SNB’s tools are percolating. With rates deeply negative at -0.75%, the bank has favoured interventions in FX markets to depreciate the franc. Yet monetary policy has thus far failed to achieve the bank’s targets, leading to questions about how long it can continue on this path before the balance between risk and reward changes.

Concerns about longer-term inflation or ambiguous US taper timing could feed into CHF-denominated bond portfolios, especially those that are long duration. For any given yield in our Swiss strategies, we prefer credit over rates risk by moving prudently down the credit spectrum. This preference enables us to additionally benefit from the historically negative correlation between rates and spreads, and mitigates the risk from a long duration bond position that could be more exposed to correlations and global developments.

Engagement to enhance ESG analysis

Managing duration and credit risk is one part of our holistic approach to building portfolios that seek to provide yield1 where it is scarce, while concurrently meeting LOIM’s firm-wide commitment to sustainability. Sustainability is part of our DNA, running through everything we do, from managing our clients’ assets to running our firm. A key emphasis for the Swiss fixed income team is engagement with issuers, an area we believe has heightened importance due to the particularities of the Swiss market.

The CHF-denominated corporate bond universe is comprised of many small and medium-sized companies, many of which are not listed. As a result, insights on the environmental, social and governance (ESG) qualities of these companies is often incomplete. Self-reported disclosures by these companies, for instance on carbon emissions or water usage, is generally more limited. Similarly, coverage of such names by third-party providers (such as Sustainalytics, Inrate and Trucost) is also more restricted. This means that fewer details are generally available off-the-shelf, and necessitates additional engagement and analysis.

Figure 2 breaks down the ESG coverage of the SBI investment grade index for corporate bonds, illustrating that only a small proportion of the market is covered by traditional providers such as Sustainalytics. While some gaps can be filled by using other providers such as Inrate, a full picture remains elusive and makes direct communication with issuers pivotal.

Figure 2. LOIM’s breakdown of ESG coverage in the SBI AAA-BBB index

Source: SIX, LOIM calculations. Data as of 30 June 2021.

Disclosure and accountability

We aim to create more comprehensive coverage by using Sustainalytics, Inrate and Trucost (where available) but combine this with our analysis and engagement for greater accuracy in our ESG and sustainability assessments. This gives investors the most complete picture possible. Our engagement with smaller issuers encompasses two main areas:

- Promoting better disclosure and transparency on ESG practices using quantitative targets. We aim to begin or amplify discussions to make companies aware of the need to fully communicate information about their business practices. Such discussions are collaborative and we seek to share our support and expertise from both sustainability and investment perspectives, and as engagers through our stewardship specialists.

- Driving greater company accountability and dedication to publishing regular sustainability reports with concrete targets. For instance, this could involve enhancing a company’s commitment to decarbonisation and aligning a company’s temperature trajectory with the goals of the Paris Agreement. We use the Oxford Martin Principles for Climate-Conscious Investment as the guiding framework for our stewardship to ensure companies have understood and incorporated the required global path towards a net-zero economy.

Our engagement efforts are driven by our conviction that understanding companies’ alignment to emerging sustainability challenges is key to assessing their risk exposure. We also believe that to understand such risk exposure, we must go beyond backward-looking metrics. Forward-looking metrics tell us not where a company is today, but its direction of travel, helping us to assess a company’s fitness for the future.

One example of these capabilities is our ability to assess the alignment of companies’ emission trajectories to relevant decarbonisation pathways. By assessing a company’s current and self-declared progress and commitments on decarbonisation, we may begin to identify the companies best-positioned to capitalise on the climate transition, as well as identify specific and systemic risks for those companies that have not understood the urgency and nature of the shift to a net-zero economy.

Engaging with issuers involves ongoing dialogue in order to drive long-term change. We work in partnership with companies to address concerns and produce effective solutions.

As the spectre of inflation resurges for the first time in decades, the structural bias for credit in our Swiss portfolios offers investors a shorter duration for any given yield than a rates-only portfolio. We favour credit for both yield pick-up and diversification benefits, and highlight the added value of credit typically being negatively correlated with rates risk. Rounding out our holistic approach, we actively engage with smaller domestic issuers to improve ESG analytics and give investors the fullest picture of potential pitfalls and prospects.

Sources

1 Target performance/risk represents a portfolio construction goal. It does not represent past performance/risk and may not be representative of actual future performance/risk. There can be no assurance that the investment objective will be achieved or that there will be a return on capital or that a substantial loss will not be incurred.

Informazioni importanti.

For professional investor use only

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited . which is authorized and regulated by the FCA.

©2021 Lombard Odier IM. All rights reserved.