private assets

Private credit assets: catalysts for climate impact

Need to know

|

|---|

The COP26 climate summit played a pivotal role in opening investors' eyes to the harsh reality our world will face if we do not act quickly to reduce CO2 emissions on a global scale, but it also shed light on the many opportunities available for investors to capture if they choose to invest in and harness the power of nature.

“The window is still open, scientifically, to act,” according to Professor Johan Rockström, architect of the nine planetary boundaries – environmental thresholds for humanity recently popularised by the Netflix documentary, “Breaking Boundaries”.

During the Zero-Hour Sessions, an event convened by Lombard Odier during COP26, Rockström stressed that our planet – “a complex, adaptive, self-regulating biophysical system” – has tipping points which, if triggered, cause “self-enforced drift in the wrong direction”.

While the stability of our planet, and the economic activity it supports, depends on humanity keeping within these science-based thresholds and avoiding the “no-go zones” beyond them, we have already broken through four limits: toxic waste, air pollution, freshwater overuse and agrochemical pollution – and are on course for transgressing a critical fifth boundary: keeping global warming within 1.5°C above pre-industrial levels.

According to the IEA, COP26 commitments reduced the forecast global temperature rise from 2.7°C to 1.8°C1. While further policy impetus is essential in directing real decarbonisation throughout the economy, private sector resources must be marshalled to realise the required emissions reductions. The financing gap to put the world on a path to net zero is estimated to be USD $32 trillion in the next decade2.

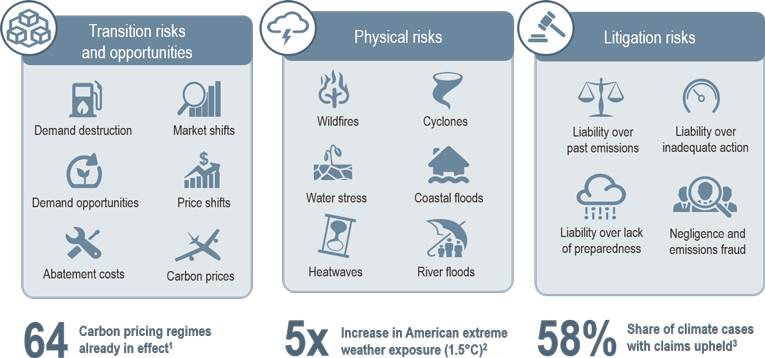

New arenas of risk and opportunity

Economy-wide decarbonisation presents new variables to consider in evaluating risk-adjusted returns as transitional, physical and liability risks increasingly factor into corporate profitability and valuations:

- Transitional risk includes shifts in demand among climate-aware consumers, companies’ ability to reduce emissions and the impact of higher carbon costs and regulation

- Physical risk includes the damage caused by more frequent extreme weather events and the associated degradation of agricultural yields and less-productive labour forces

- Liability risk includes historical responsibility for climate change among companies and sovereigns, as well as mitigation and adaptation costs

Three categories of climate risk for investors

Source: LOIM as at December 2021.

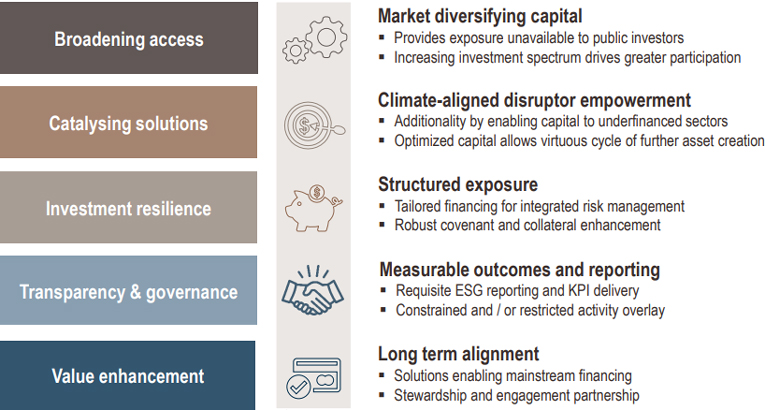

Forward-looking investors may identify public and private businesses that are mitigating climate risk and acting on the opportunities generated by the transition. Lombard Odier believes there are significant opportunities available to advance the transition to net zero through not just traditional public equity and debt markets, but also through private markets. While private equity capital has been well-deployed towards sustainable finance, we believe the broad versatility of solutions-oriented private credit is positioned to play an important role in accelerating the transition into a low-carbon carbon-resilient economy.

Private credit opportunities aligned with the net-zero transition

Source: LOIM as at December 2021.

Climate commitment

The forces driving the net-zero transition are clear. COP26 provided further evidence of policy and social tipping points for recommitting to the Paris Agreement’s 1.5°C threshold. The private sector is delivering novel solutions today to profitably adapt and reduce carbon emissions, while improving resilience. Frameworks such as Rockström’s planetary boundaries provide a guide for investors who seek businesses that are adapting their business models to be profitable in a sustainable future.

“There is no question about the direction of travel anymore,” Rockström said. “The question is: can we act fast enough in order to land in a safe operating space for humanity?”

Much of the answer lies in action within the real economy, where private credit is essential to catalysing and scaling additional impact.

The LOIM Sustainable Private Credit solution

Using our private credit skillset in combination with our Sustainable Investment Research, Strategy and Stewardship team, we have built an infrastructure to be able to assess opportunities to lend to companies that require financing to strengthen operations that help advance the transition to net zero.

The Private Credit team is well known throughout funding circles as ‘go to’ managers enabling tailored financing to businesses aligned to the transitional theme within quick timeframes.

The opportunities the team accesses range from lending to help a company create renewable-electricity storage in battery solutions to fulfil a contract with a tier 1 electricity provider, to refinancing a solar and biogas company whose renewable-energy output exceeds that of two coal power plants. The loans are predominantly senior secured, and are not exposed to risks associated with new technologies or other early-stage initiatives more suitable for private equity or venture capital investors.

As a sustainable private-asset manager, LOIM has an obligation to be more than capital providers to our partners: we help create mutual value by positively influencing corporate behaviours and actions. Our expert team can provide guidance and technical support to growing enterprises seeking to overcome various challenges, such as aligning with the United Nations Sustainable Development Goals, complying with regulatory frameworks, achieving transparency on key performance indicators and managing environmental, social and governance risks. We hold active stewardship and engagement conversations with our investee and investor partners.

important information.

RISERVATO AGLI INVESTITORI PROFESSIONISTI

Il presente documento è stato pubblicato da Lombard Odier Funds (Europe) S.A., una società per azioni di diritto lussemburghese avente sede legale a 291, route d’Arlon, 1150 Lussemburgo, autorizzata e regolamentata dalla CSSF quale Società di gestione ai sensi della direttiva europea 2009/65/CE e successive modifiche e della direttiva europea 2011/61/UE sui gestori di fondi di investimento alternativi (direttiva AIFM). Scopo della Società di gestione è la creazione, promozione, amministrazione, gestione e il marketing di OICVM lussemburghesi ed esteri, fondi d’investimento alternativi ("AIF") e altri fondi regolamentati, strumenti di investimento collettivo e altri strumenti di investimento, nonché l’offerta di servizi di gestione di portafoglio e consulenza per gli investimenti.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari. Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento. Non dovrebbero essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Funds (Europe) S.A. ©2022 Lombard Odier IM. Tutti i diritti riservati.