investment viewpoints

Are strong earnings making equities more affordable?

In the latest instalment of Simply Put, where we make macro calls with a multi-asset perspective, we assess the case for P/E normalisation and consider how this can benefit investors in an environment of rising rates.

|

Need to know

|

|---|

Corporate earnings: the US and Europe lead the way

This latest earnings season leaves little room for doubt: economic growth may have weakened in the third quarter but remained very solid. Consistency across leading economic indicators, such as the US ISM or the German IFO, was almost perfect.

Overall, third-quarter corporate sales in developed markets rose by 17%, and earnings rose by just over 26% in quarter-on-quarter terms, as margins improved. Thanks to its more sectorial exposure, the European equity market led this rebound with a 50% surge in quarterly earnings. US equities were next, rising 37%. However, Asian equities exhibited signs of slowing corporate earnings growth with weaker earnings across several sectors. In general, almost 10% of companies in the US and Europe delivered positive earnings surprises, compared with almost none in Asia.

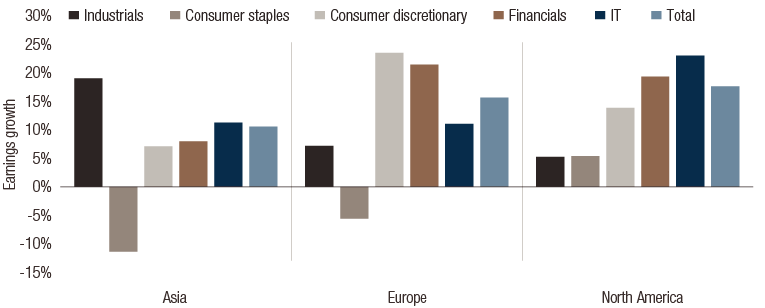

Earnings expanded by a substantial 16% in annual terms. Figure 1 provides some granularity for year-on-year expected earnings growth. North American equities clearly benefited from the combined growth of the information technology sector (+23%) and financials (+19%). Europe also benefited from the performance of financials (+21%), as well as strength from the consumer discretionary sector (+24%). Asia showed weaknesses: earnings in the utilities and consumer staples sectors contracted by 21% and 11% respectively, although industrials grew by 19%.

FIG. Chart 1. Expected annual earnings growth, year-on-year

Source : Bloomberg, LOIM as at November 2021. For illustrative purposes only.

Are Asia corporates really struggling?

China and Asia as a whole are experiencing more economic difficulties than the rest of the world at present. For those who follow their business-cycle indicators, this should not be surprising. However, this earnings season still contributed to our positive long-term outlook on the region. Economic growth increased during the quarter and few sectors suffered from higher input costs – indeed, overall margins even improved during the season.

This should help to dispel any lingering doubts that equities can be used to hedge inflation risk in multi-asset portfolios. Indeed, amid strong demand, companies generally had no issue in passing through their increased costs.

Normalisation is normal at this stage of the cycle

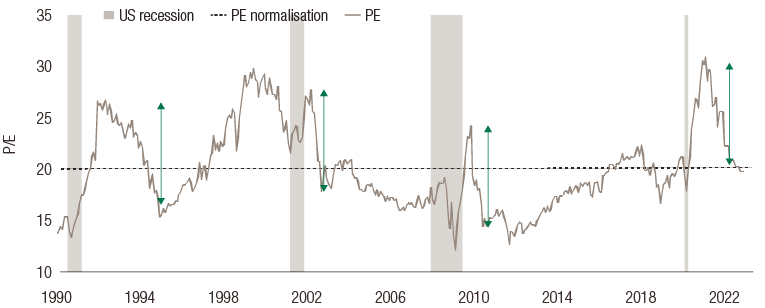

Because growth and corporate performance have remained strong despite market doubts, we do not expect earnings to contract in the fourth quarter. Figure 2 illustrates what, to us, is an obvious conclusion right now: if global equities are perceived as becoming expensive, it is because the classic dialectic of ‘multiple expansion’ and ’P/E contraction" has been forgotten.

It consists of two phases. The first begins when economies are exiting recession, animal spirits stir. Investors look through the wall of worry as governments and central banks commit stimulus. Even though corporate earnings tend to decrease at this point, hopes for a recovery drive expectations of a cyclical upswing. At such a time, the performance of equity markets is typically resurgent, re-rating strongly ahead of earnings, driving a P/E multiple expansion in which earnings are growing less than price, reflecting anticipated growth.

FIG. 2. US equities: P/E ratio and expected normalisation

Reading note: green arrows indicate periods of post-recession PE normalisation. They have historically accompanied been by a positive performance for world indices.

Source: Bloomberg, LOIM as at November 2021. For illustrative purposes only. Past performance is not a guarantee of future results.

In the second phase, P/E ratios deflate – not because of declining prices but because growing earnings are catching up with valuations. This causes multiples to contract and the market to climb at a slower pace. At this point, investors often scrutinise earnings releases for evidence of the hoped-for growth that is still embedded in their outlooks and are very sensitive to earnings surprises, guidance and company outlooks, as well as any macroeconomic data that may upset these expectations.

In our view, this is the phase we are currently experiencing – which is consistent with those of the last 25 years – and suggests earnings will continue to grow during the fourth quarter. Our estimates place the P/E valuations of global equities close to their long-term levels – at about 20 – by year-end.

Putting rising interest rates aside for a moment, equity valuations should become attractive as we enter 2022, in our view. Bringing inflation back into the picture, the recent performance of equities amid higher input costs means that cheaper stocks is good news for both equity and multi-asset investors.

|

Simply put, the improvement in corporate earnings in the third quarter means equities should gradually become cheaper, in our view. By the end of the year, the P/E ratio of global equities should return to long-term levels, which will be a good starting point for 2022. |

Informazioni importanti.

RISERVATO AGLI INVESTITORI PROFESSIONISTI

Il presente documento è stato pubblicato da Lombard Odier Funds (Europe) S.A., una società per azioni di diritto lussemburghese avente sede legale a 291, route d’Arlon, 1150 Lussemburgo, autorizzata e regolamentata dalla CSSF quale Società di gestione ai sensi della direttiva europea 2009/65/CE e successive modifiche e della direttiva europea 2011/61/UE sui gestori di fondi di investimento alternativi (direttiva AIFM). Scopo della Società di gestione è la creazione, promozione, amministrazione, gestione e il marketing di OICVM lussemburghesi ed esteri, fondi d’investimento alternativi ("AIF") e altri fondi regolamentati, strumenti di investimento collettivo e altri strumenti di investimento, nonché l’offerta di servizi di gestione di portafoglio e consulenza per gli investimenti.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari. Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento. Non dovrebbero essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Funds (Europe) S.A. ©2021 Lombard Odier IM. Tutti i diritti riservati.