investment viewpoints

Swiss equities: Does company size determine performance?

In our previous commentary, Johan Utterman's team showed how structural megatrends will have a strong impact on the sustainable success of Swiss companies in the future. There is also a second factor that is crucial for investors. Is it worth investing in large caps, or are small and medium-sized companies the ones that stand to generate higher returns over time compared with the wider market? We explain the advantages of SPI Extra over SMI and SPI and why small and medium-sized companies are a worthwhile core holding in a portfolio.

At CHF 1,183 billion, just 20 Swiss companies account for 74 percent of market capitalization. The 80 medium-sized companies still account for CHF 365 billion in market capitalization (23 percent), while the 115 small caps account for only 3% percent. But does the size of a company affect whether it is a good and safe investment for investors? (Source: Bloomberg as at 30 April 2019)

Let's take a first look at the performance of the past twenty years. There is a clear winner here: Swiss small and mid caps, measured by the SPI Extra, outperform the SMI and SPI by a clear margin:

Figure 1: Swiss small and mid caps better than the SMI for 20 years now

Cummulative returns since inception of the SPIEX: January 1996 – 30 April 2019 . Performance metrics in CHF. Source: Bloomberg. Past performance is not a guarantee of future results.

But what are the reasons for this? Swiss companies in particular score points with regard to key financial figures such as earnings growth, profit margin, return on capital and dividend yield (Yields are subject to change and can vary over time). Small and medium-sized companies in particular appear promising, as they often produce innovative products and are characterised by innovative business models.

In our opinion, this is particularly true in the fields of health, technology, automation and optimisation of logistics chains. Due to the smaller company size compared to large caps, it is generally easier for them to grow quickly. Another key reason for investing in this asset class is the quality of these companies. They often serve niche markets where they are world leaders and are well positioned to benefit from the solid fundamentals that support the development of the global economy. Tomorrow's winners will be determined primarily by structural trends. Climate change, demographics and inequality are among the megatrends that can contribute to new business dynamism. Thanks to their specialisation, Swiss small and mid caps have an advantage over large caps, which are involved in many business cases.

The long-term figures speak for themselves: small and medium-sized Swiss companies outperform the SMI.

Higher earnings momentum offsets lower dividends

The average dividend yield of the Swiss Market Index (SMI), which measures the performance of the 20 largest Swiss blue chips, is 3.5%, while the Swiss Performance Extra Index, SPIEX, is 2.8%. Both are attractive yield levels, especially when yields are assessed against the background of central banks' low-interest policy.

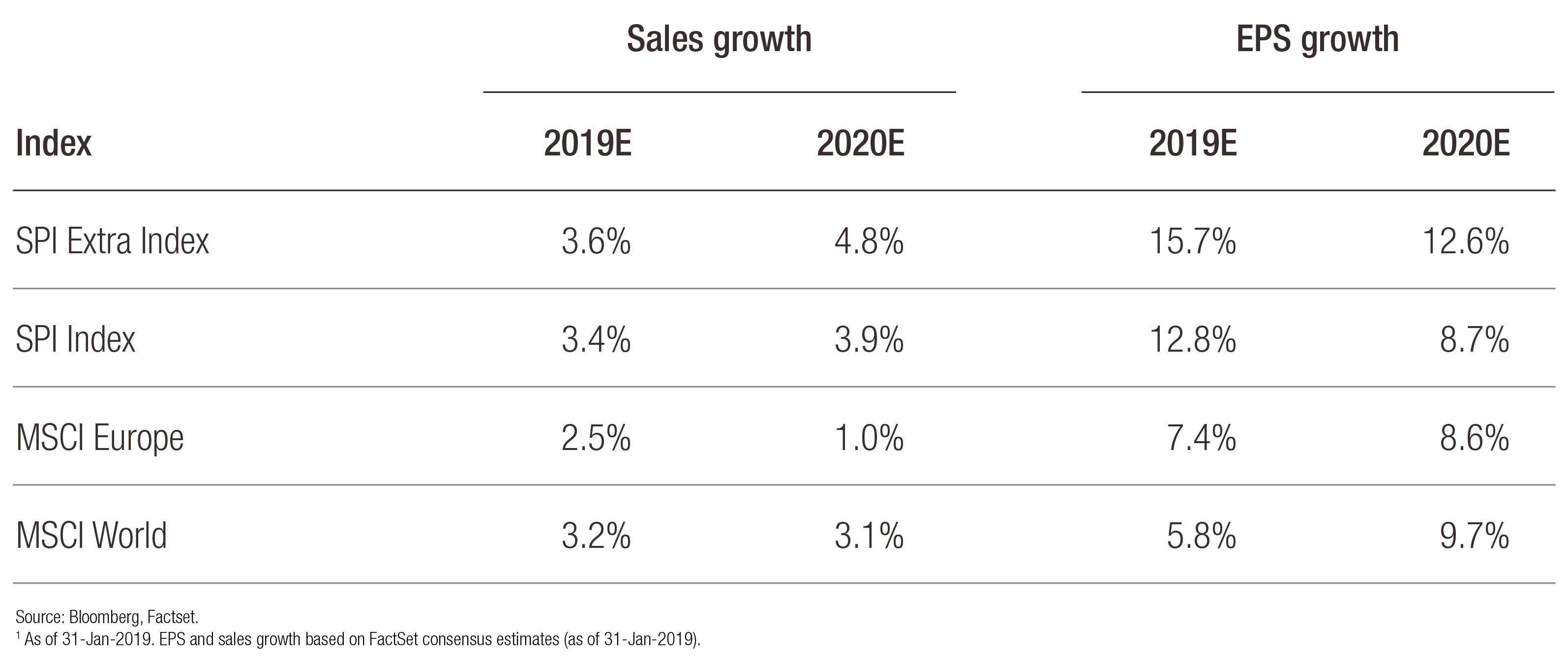

However, the slight disadvantage in the dividend yield is mitigated by the higher growth dynamics of the more flexible and agile small and medium-sized caps.: The consensus of earnings estimates for the SPI Extra index members for 2020 is 12.6% on average - compared with 8.7% for the broader SPI Index. Even in comparison with their counterparts in the MSCI Europe and the MSCI World, we see significant advantages for Swiss small and mid caps (chart 2).

Chart 2: SPI Extra Index at the top of profit and revenue forecasts

Many professional investors nevertheless focus strongly on the SMI or SPI. In addition to higher profit and sales growth, the SPI Extra Index also offers considerable diversification advantages:

- Compared to the SMI and SPI, the exposure to healthcare and consumer goods is lower. On the other hand, the industrial, information technology and real estate sectors are weighted higher.

- The SPI Extra Index also focuses more on cyclical sectors, while the three global corporations Nestlé, Novartis and Roche are active in non-cyclical sectors and account for almost 50% of the total capitalisation of the SMI Index.

The higher profit and sales growth and significant diversification benefits speak in favour of the SPI Extra Index.

However, the average beta in cyclical sectors such as consumer staples, finance or industry is on average 10% lower than the SMI or SPI. This should be taken into account in active portfolio management. Sector allocation is an important tool for managing volatility and risk. Active stock selection within a given sector is the key factor for risk-adjusted returns.

Appropriate valuation returns

Looking at the valuations, the situation has eased again. While in January last year they appeared to be still too high compared with the Swiss Market Index, they have since returned to normal. Against the backdrop of better growth conditions and the solid fundamental data of Swiss SMEs, the current valuation appears appropriate compared with the SMI. In our view, in a world in which economic development is currently slowing, high-growth equities should be rewarded with a valuation premium. This will close the valuation gap with the SMI.

It could prove expensive not to be invested. Because equity investments should be worthwhile at the moment, preferably in small and medium-sized Swiss companies.

Portfolio complementation with well selected small and medium-sized firms can significantly improve the risk-return ratio. First-class companies can still be found in all segments, and the creation of added value begins with a comprehensive analysis. When assessing whether a company can grow sustainably, the first question is whether the business model can sustainably play a leading role in one of the megatrends. Here, the smaller and medium-sized companies have an advantage over multiplayers due to their lean orientation.

important information.

FOR QUALIFIED INVESTOR USE ONLY

This document is issued by Lombard Odier Asset Management (Switzerland) SA, a Swiss based management company, having its registered office at 6, av. des Morgines, 1213 Petit-Lancy, authorized and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This material is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This material is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this material nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Switzerland) SA prior consent. In Switzerland, this material is a financial promotion and has been approved by Lombard Odier Asset Management (Switzerland) SA which is authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

©2019 Lombard Odier IM. All rights reserved