global perspectives

Lombard Odier publishes an open letter to the TCFD and its Portfolio Alignment Team

Our detailed letter offers a commentary supporting the work of the Task Force on Climate-Related Financial Disclosures (TCFD) on forward-looking metrics, and analyses responses by the Transition Pathway Initiative (TPI) and the 2° Investing Initiative that, we believe, risk misrepresenting the nature of these metrics.

In November 2020, the TCFD-affiliated Portfolio Alignment Team (PAT) published an initial report exploring forward-looking metrics aimed at assessing the alignment of portfolios to the climate transition. In June 2021, the TCFD published two further reports, providing guidance on climate metrics and offering technical recommendations surrounding the adoption of so-called Implied Temperature Rise (ITR) metrics.

ITR metrics, or temperature alignment metrics, seek to assess whether investments align to the emission reductions needed to meet decarbonisation goals. For example, ITR metrics might classify an investment as “1.5°C aligned” if it meets objectives to keep global warming to the level pursued by the Paris Agreement. It follows that investments aligned to 3°C, 4°C, or 5°C would be lagging behind in their climate ambition.

At Lombard Odier, we have been an early advocate of more forward-looking metrics. Recognising the rapid evolution of forward-looking methodologies, our team undertook a review of early efforts in this space prior to developing an internal temperature alignment methodology. This review led us to similar conclusions as the TCFD and our own metric closely aligns with the TCFD’s recommendations.

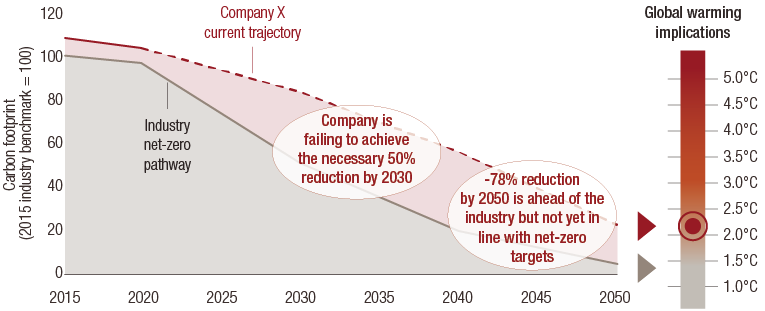

Temperature alignment metrics, as opposed to traditional carbon footprint analysis, evaluate not only the emissions of a company today, but also whether the company’s emissions are falling in line with sector-specific benchmarks. These ITR metrics recognise that a company in high-emitting, climate-relevant sectors such as steel, cement, or chemicals may absolutely form part of the solution, provided it is rapidly decarbonising or has set credible targets to reduce emissions. Conversely, companies in lower carbon sectors may be more poorly aligned if their emissions are increasing and their management is taking inadequate further action.

Figure 1: Schematic illustration of Lombard Odier’s implied temperature rise (ITR) metric

The reports of the TCFD provide practical guidance as to the development of these metrics, and encourage their adoption by financial institutions. However, two responses published by selected supporters of the Transition Pathway Initiative (TPI) and the 2° Investing Initiative (2DII, the lead developer of alternative PACTA methodology) called into question the reports’ conclusions.

The TPI response – signed by a selection of the TPI’s supporters – raises as its most fundamental concern that “[i]t would become increasingly difficult to hold a portfolio of transitioning assets in high carbon intensive sectors, even if those very same companies had been responsive to investor engagement and made credible and independently verified net zero aligned targets that were consistent with the transition.”

We believe that the above statement is an incorrect representation of nature and objective of ITR metrics. ITR metrics first define sector-specific benchmarks detailing the specific rate of decarbonisation that companies in the sector need to achieve, before comparing a company’s own historical and projected emissions to that benchmark. For example, a company in a sector such as steel might have a higher carbon footprint than a manufacturer of furniture. Well-designed ITR metrics, however, would compare the steel company against a benchmark specific to the steel industry. As opposed to what the TPI’s response implies, a company in this industry with credible net zero targets would indeed be assessed to be very well aligned to the transition, at least by ITR metrics aligned to the TCFD’s recommendations, such as our own.

TPI also argues that adoption of portfolio alignment metrics “will have a series of undesirable consequences for asset owners potentially forcing them to breach their fiduciary duties, imposing significant additional costs on asset owners.” In contrast, at Lombard Odier we believe that, given how the climate transition creates significant market and regulatory shifts, it is very much the fiduciary duty of asset managers and asset owners to identify how well their portfolios align to the transition. It agrees with the TCFD that ITR metrics, used alongside other tools, are an essential starting point for investors to understand that alignment.

In similar fashion, our open letter addresses a number of misconceptions in the response from 2DII. 2DII is the lead developer of PACTA, which offers sector-by-sector assessments of investments in key sectors such as real estate, power, and transport. 2DII argues that such sectoral analysis offers more actionable insights, but they provide only the most basic ITR metrics. This sector based analysis does not offer sufficient granularity, with the TCFD specifically recommending the use of more granular approaches – with Lombard Odier’s being an example of these. These approaches offer similar ability to steer action, but – in contrast to the PACTA approach – also provide a common language, allowing a direct comparison between a “2°C aligned” company in one sector and a “1.5°C aligned” in a different sector. Crucially, we note,ITR approaches also allow for the aggregation of scores at a portfolio level.

As ITR metrics draw on various climate scenarios, the approach requires specific analytical capabilities. Our letter addresses key issues raised by 2DII on a variety of technical topics from the use of emission- and production-based metrics, to the analysis of indirect emissions, relationships between emissions and global warming, and approaches to portfolio-level analysis. We observe that ITR metrics specifically support the analysis of real emission reductions and, for this reason, should be welcomed by investors.

Our letter concludes by agreeing that different approaches to these forward-looking assessments can lead to divergent results, an issue that also applies to assessments by TPI and PACTA. It argues, that to promote convergence and standardisation, common guidelines are needed – which, it highlights, the TCFD reports specifically seek to provide – and therefore calls for the recommendations of these reports to be embraced by market participants.

To read the letter in full, please use the button provided.

Informazioni importanti.

Il presente documento è pubblicato da Lombard Odier Asset Management (Europe) Limited, una società autorizzata e regolamentata dalla Financial Conduct Authority (“FCA”), iscritta nel registro FCA con il numero 515393.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Asset Management (Europe) Limited . Nel Regno Unito, questo documento rappresenta materiale di marketing ed è stato approvato da Lombard Odier Asset Management (Europe) Limited, che è autorizzata e regolamentata dalla FCA. ©2021 Lombard Odier IM. Tutti i diritti riservati