loim tube

Brighter outlook for China consumer sector

Consumer spending in China appears to have stalled in recent months, due to a number of unforeseen factors. However, the outlook for the next six months and beyond is far more positive.

At the macro-level, the recovery of the consumer sector appeared to lag the recovery of the industrial sector, for the three months ending June. In July, retail sales fell by 1.1%, but we believe this is a reflection of temporary headwinds such as the flooding in Southern China, a resurgence of COVID-19 cases in certain hotspots, a lower pent up demand following the June shopping festival. Our analysis of the consumer universe has presented four specific trends which we believe indicate the consumer sector will stage a recovery in the coming months.

Firstly, numerous companies in our consumer universe are forecasting double digit revenue growth for the third quarter and second half of 2020. Most consumer segments appear optimistic about the future including food staples, beverages, food delivery, jewellery, small white good appliances, and restaurants. Travel companies – which were notably impacted by the consequences of the pandemic – report that growth in domestic flights has almost completely offset the contraction in foreign. Flight bookings in the first two weeks of August were down just 2%, year on year. The hotel industry is taking longer to return to normalcy, however, as occupancy was still around 65% in mid-August.

The premiumisation effect continues to deliver a boost to select brands. In the second quarter, sports brand Li Ning reported that new products in stores were selling well, despite significant promotions designed to clear out old inventory, Budweiser’s super premium beers saw strong growth in over the same period. Delivery services company SF Holdings reported that revenue for its express business was up 80% in the second quarter, compared to a 20% spike for its standard business. High-end cosmetics brands in China, including LGHH and Estee Lauder, and Proya’s new higher-end lines, reported growth spanning 20 to 50%. Additionally, in July, luxury car sales outstripped overall car sales, up 20% versus 13%.

Online penetration has also increased, along with the willingness of sellers to pay for the privilege. Online retail sales of goods year-to-date have risen in clear double digits – up 25% in July – in contrast to overall retail sales which remain negative. Alibaba’s gross merchandise volume (GMV) was up by 27% in the second quarter, and interactive e-commerce platform Pinduoduo’s grew by 48% over the same period. In the three months ending June, online accounted for more than 30% of total sales for traditionally-offline companies including restaurant company Yum China, cosmetics company LGHH, and education group TAL. The pandemic has accelerated consumers’ switch to online, and now includes goods with lower price-points. Retailers have reacted to this trend by investing more in online marketing, in a bid to both capture traffic and enhance brand recognition.

Finally, lower-tier cities are providing extra growth. Well-established national brands have recognised the potential here and are working on their penetration of lower-tier cities. Dairy company Mengniu is in the process of growing new points of sales by 10% per year and is expected to add 1 million points over the next five years, to build on the 2 million already in existence. Sauce and flavourings manufacturer Foshan Haitian increased its number of distributors by 20% in the second quarter. Education companies including TAL and GSX also reportedly see significant growth avenues in lower-tier cities. Bookings company Tongcheng e-Long reported a 15% rise in second quarter hotels bookings in lower-tier cities, and anticipates a meaningfully higher figure in the third quarter of the year. Although higher exposure to lower-tier cities can mean lower prices initially, this is part of China’s premiumisation curve and we believe it will provide several years of additional growth.

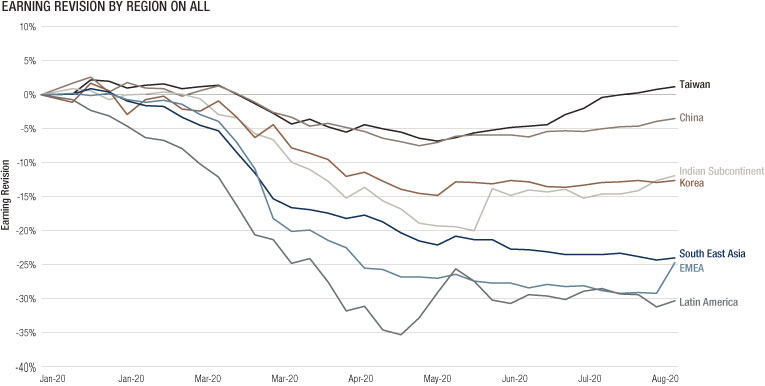

Domestic consumption already account for more than 60% of GDP growth in China and we believe it will remain a key driving force. These four trends in particular signal a positive outlook for the consumer sector, which would help China sustain a faster growing economy than any other major developed region in the coming years. We aim to capture these dynamics through our Asia High Conviction and China High Conviction strategies.

Informazioni importanti.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.