investment viewpoints

Alphorum: the state of emerging-markets fixed income

In the emerging markets (EM) commentary for the Q4 2021 issue of Alphorum, we assess how different EM are responding to moderating global economic growth, the risk of inflation and strict regulatory measures in China.

It follows earlier insights from this issue:

- Our lead commentary, which examines the diverse financial, macro and sustainability risks and opportunities in markets

- Developed market and inflation-linked bonds, where policy-tightening narratives are building or interest rates are actually rising

- Sustainable fixed income, where record sustainability-bond issuance is being accompanied by accusations of greenwashing and real efforts to build knowledge in this space

- Corporate credit, and the importance of selectivity in an imperfect recovery.

In the final section of Alphorum, which will be published tomorrow, our systematic research team will explain findings from their analysis of investment opportunities among issuers whose credit ratings have descended to BB or lower – the so-called fallen angels of high yield.

Now, we focus on EMs and begin with the big-picture themes of growth, inflation, China and the current-account tailwind that has benefited the universe for some time.

Fundamentals and macro

With macro risks generally improving, the scenario for EM is quite positive. While growth is beginning to normalise, international trade remains strong. Developed-market demand is creating a clear tailwind for EM, and economic indicators have surprised positively across the EM universe. At the same time, developed-market monetary policy remains supportive for EM and geopolitical noise is relatively contained.

Although the Delta variant of Covid brought a degree of anxiety to the market, it appears to be causing less economic damage than feared. With the notable exceptions of China and some parts of Southeast Asia, mobility restrictions are mostly light and most EM economies have held up well. Vaccination is progressing (albeit not as strongly as in developed-market countries) and there seems to be a growing acceptance that the virus is something we must learn to live with.

Less positively, the consequences of the regulatory crackdown by the Chinese authorities are still playing out, with a possible China slowdown an undeniable threat to growth. Deleveraging in the real-estate sector could lead to a debt crisis and a bigger slowdown. However, while the Chinese Government wants to regain a greater level of control, it clearly doesn’t want the country’s economy to tank. The key question is whether Chinese growth, a significant tailwind for the global economy, will be affected: our own view is that while it may weaken a little, the effect won’t be too significant.

Inflationary risk remains a potential issue about which we remain vigilant. Current inflation is mostly due to supply shortages in the food and energy sectors and the aftereffects of reopening, so should be temporary. However, given that many EM countries have a history of high inflation, there is some risk of secondary effects. It is the role of central banks to stop that from happening, and many in EM have already started to take appropriate action.

Current accounts, which had been improving across the EM universe, are still in good shape. However, with private spending increasing and imports rising, current-account surpluses have probably peaked, and some are starting to return to previous levels of deficit. This is to be expected but means they are providing less of a tailwind than previously.

Sentiment

Overall, market sentiment in EM improved during the quarter. Given the importance of US monetary policy to emerging markets, potential tightening by the Federal Reserve (Fed) was a key concern. Chair Jerome Powell’s comments in his Jackson Hole speech and at the subsequent Fed meeting helped minimise uncertainties around the tapering process and allayed fears about an early lift-off for the federal funds rate. At the same time, actions by the Chinese government, including the state-backed bailout of Huarong Asset Management, fiscal stimulus measures and promises of an ‘appropriate’ (i.e. looser) monetary policy have gone some way to reassuring investors shaken by the regulatory crackdown and the unravelling of property company Evergrande1.

Inflows into EM bond funds, albeit volatile, rebounded through the quarter after a lacklustre Q2, reflecting an improvement in investor confidence.

Technicals

To some extent, there is less supply in EM than might have been expected. Local government bond issuance in China has improved the situation there after a very slow first half of the year. However, in the EM high-yield hard-currency market, supply is really not there. At USD 18 bn, EM corporate gross supply for August was the lowest in the year to date, although seasonality is a factor. Of this, Asia contributed 86%. Net supply remained negative at -$12bn, after accounting for scheduled cash flows of $19bn and elevated tender, buyback and calls of $11bn.

A significant allocation of funding from the International Monetary Fund (IMF) to most of the weaker EM countries is contributing to lower-than-expected levels of supply of government bonds. Central banks are issuing bonds to their governments and giving them the IMF money, obviating the need for governments to borrow on the bond markets.

Positioning on the local currency side is much lighter than it used to be, while EM hard currency sovereign positioning has also been reduced markedly this quarter. There is not too much risk being taken, which could support the market going forward.

Valuation

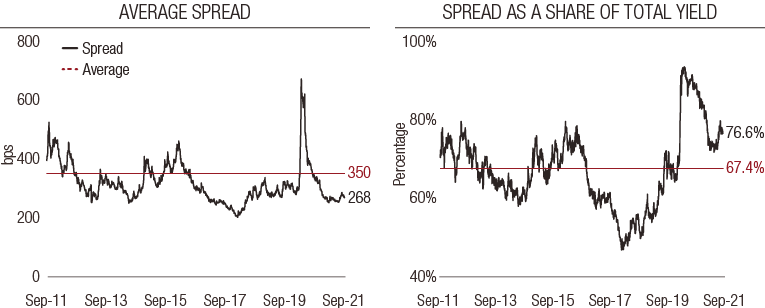

Nominal and real yields in EM continue to be attractive versus most of the main economies, while on the hard currency side spreads remain modest but are an important contributor to yield (see figure 1). Both sovereign and corporate indices are trading in a tight range not far from this year’s peak (in spread terms) reached at the beginning of this quarter, providing a potential 20bps of tightening and an attractive carry. We think that supportive EM fundamentals mean the Bloomberg Barclays EM Sovereign and Quasi-Sov Index should stabilise. In the China Local Currency segment, the favourable real yield differential over developed markets has diminished but remains important and offers diversification.

FIG. 1 In the current low-yield environment, the share of total yield from EM hard-currency bonds is high

|

Average spread: Bloomberg-Barclays EM HC Agg Index |

Spread as a share of total yield: Bloomberg-Barclays EM HC Agg Index |

Source: Bloomberg, Barclays, LOIM as at September 2021. For illustrative purposes only.

Outlook

As growth cools, EM monetary policy is generally adjusting to address the threat of inflation. For countries like Russia and Mexico, which have also shown commitment in terms of fiscal policy, the outlook is quite healthy. However, elsewhere much-needed fiscal consolidation is less in evidence, with governments either unwilling or unable to act due to social and political tensions. Growth has returned but it is not stellar, representing more of a catching up, while living conditions in many EM countries are challenging for much of the population. Events such as the riots in South Africa in July and Chile’s ongoing raids on its pension fund are two sides of the same coin in this respect. Similarly, in Brazil, responsive monetary policy from the central bank is being offset by a lack of fiscal responsibility from the government. These political risks are perhaps the biggest concern for EM going forward, in our view.

The other big ‘known unknown’ for emerging market bonds is US Treasury yields. EM bond markets are strongly correlated with US Treasury rates, with the US10-year yield curve serving as a bellwether in this respect. While the Fed is reassuring markets on the short end, rates are essentially too low and should edge higher. If the US curve normalises by another 50-75bps in the next few months, that would be reflected in local currency rates.

Sources

1Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

Informazioni importanti.

Il presente documento è pubblicato da Lombard Odier Asset Management (Europe) Limited, una società autorizzata e regolamentata dalla Financial Conduct Authority (“FCA”), iscritta nel registro FCA con il numero 515393.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Asset Management (Europe) Limited . Nel Regno Unito, questo documento rappresenta materiale di marketing ed è stato approvato da Lombard Odier Asset Management (Europe) Limited, che è autorizzata e regolamentata dalla FCA. ©2021 Lombard Odier IM. Tutti i diritti riservati.