investment viewpoints

Portfolio diversification: bonds and beyond

Bonds have been a highly attractive asset class for the past 30 years, providing consistent income and protecting1 portfolios when recessions hit.

Yet this dynamic has now seemingly reversed, with bond yields low, or even negative - around USD13trillion of bonds have a negative yield.

Central banks are still following an easing monetary policy and governments have embarked on vast fiscal stimulus programs, raising hopes for a rebound in economic growth but stoking fears of a return of inflation. Hence, ‘risk-free interest’ as highly rated sovereign bonds have been known, has become ‘interest-free risk’ as some have coined it.

The role of bonds amid shifting dynamics

Against this backdrop, two questions have risen to the top of investors’ mind: Firstly, are bonds still useful in portfolios, continuing to provide protection and if not, where else can investors turn? And secondly, how do shifting bond market dynamics affect other asset classes, in particular relative to equities?

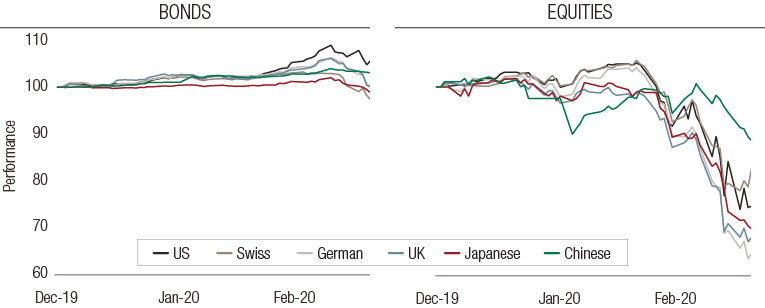

First off, let us remember that 12 months ago, yields were about where they are today. During the Covid shock of February/March 2020, bonds did protect portfolios, albeit unevenly and to a lesser extent than in the past, eg in the financial crisis of 2008 – see Figure 1. For example, Swiss or Japanese government bonds provided no protection at the height of the pandemic shock. They displayed ‘positive correlation’ -their returns were correlated or moved in the same direction as equities- and negative performance that did not offset the negative return of equities.

On the other hand, US bonds, despite a short initial sell-off, did offer some protection, providing negative correlation to equities and positive performance. So, an outright removal of sovereign bonds from portfolios seems too extreme, in our view. What is clear, though, is that the breadth and depth of the protection have diminished.

Figure 1. Performance of bonds and equities Q1 2020

Source: Bloomberg. Indices used: US Bonds: MLT1US10 Index; US Equities: SPXT Index; Swiss Bonds: SBR12T Index; Swiss Equities: SPI Index; German Bonds: RX1 Comdty; German Equities: DAX Index; UK Bonds: G 1 Comdty; UK Equities: UKX Index; Japan Bonds: JB1 Comdty; Japan Equities: NKY Index; Chinese Bonds: I08273CN Index; Chinese Equities: SHCOMP Index.

Identifying diversifiers

So where can investors turn for diversification? There are fortunately a few answers.

Within traditional sovereign bonds to begin with, looking further afield may prove useful. Chinese sovereign bonds for example, had both positive performance and negative correlation to equities during the Covid shock.

Inflation-linked bonds may have a more important role to play going forward, mixing a sensitivity to ‘duration’, or interest rate risk, with some inflation protection.

Another example is foreign exchange as an asset class, with the Japanese yen or the Swiss franc traditionally seen as safe havens, which can be gained through direct exposure to short-dated foreign bonds.

Gold is a popular safe haven and a traditional inflation hedge, too, although its performance during last year’s shock failed both in terms of correlation to equities (positive) and overall performance (negative).

This frantic search for diversification has also led to the development of a number of so-called ‘defensive strategies’, some using systematic trading designed to protect against equity shocks or other events, for instance a rise in bond yields.

Examples include buying the VIX index, known as the ‘fear index’, or capitalising on the tendency of markets to move in trends. This can be on a long-term basis, or in an increasingly popular format, short-term (intra-day) basis. These types of strategies performed very well last year, with performance ranging from the mid-teens to 40-50% over the Covid shock.

Finally, cash as a protective asset, used tactically, remains an underutilised option, even though it obviously fits the bill with the additional advantage of it simplicity. However, it must be noted that most of these options will themselves lose small amounts of money. For example, with cash rates so low, the value of money on deposit is being eroded by inflation.

Perhaps combining a comfortable yield and a solid diversification potential in a single asset is a thing of the past!

Diversification within equity sectors

With the US Federal Reserve now expecting interest rates to start rising in 2023- investors have started to analyse the sensitivity of their portfolio to rising rates, in particular their equity portfolio.

Historically, the sensitivity of equities to interest rates has varied through time, but recently growth stocks have become increasingly negatively sensitive to rates, with tech stocks selling off on fears of rates rising. At the same time, ‘value’ stocks’ display the opposite behaviour, as shown in Figure 2.

Figure 2. Rate sensitivity for growth and value stocks

Source: Bloomberg, LOIM calculations, Data from 1998-2021.

So the rate sensitivity of an equity portfolio overall may largely depend on its specific exposure to the value and growth sectors.

More generally, if we look at a broader set of equity factors or styles, a similar analysis shows that quality and size currently have a positive rates sensitivity, similar to value above, whereas momentum has a negative sensitivity, like growth.

A finer analysis at sector level sheds an interesting light, with financials, industrials, materials or energy having positive sensitivity to rates. These could potentially be able to offset the negative sensitivity of utilities, telecommunication services, IT and consumer sectors.

In short, it does appear that the sensitivity of equity portfolios to rate movements has accelerated since early 2020. A rotation towards value might be explained in part by a desire to position favourably against a rise in bond yields.

More generally, in our view, allocation to individual sectors can potentially reduce this exposure, but this requires an active, rather than passive, approach, and as a whole, the S&P 500 index has negative sensitivity currently due to its growth bias.

Sources

1 Capital protection represents a portfolio construction goal and cannot be guaranteed.

Informazioni importanti.

RISERVATO AGLI INVESTITORI PROFESSIONISTI

Il presente documento è stato pubblicato da Lombard Odier Funds (Europe) S.A., una società per azioni di diritto lussemburghese avente sede legale a 291, route d’Arlon, 1150 Lussemburgo, autorizzata e regolamentata dalla CSSF quale Società di gestione ai sensi della direttiva europea 2009/65/CE e successive modifiche e della direttiva europea 2011/61/UE sui gestori di fondi di investimento alternativi (direttiva AIFM). Scopo della Società di gestione è la creazione, promozione, amministrazione, gestione e il marketing di OICVM lussemburghesi ed esteri, fondi d’investimento alternativi ("AIF") e altri fondi regolamentati, strumenti di investimento collettivo e altri strumenti di investimento, nonché l’offerta di servizi di gestione di portafoglio e consulenza per gli investimenti.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari. Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento. Non dovrebbero essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Funds (Europe) S.A. ©2021 Lombard Odier IM. Tutti i diritti riservati.