investment viewpoints

Golden Age Q&A

Can you update us on the Golden Age fund’s performance? What are the latest market developments driving the silver economy?

The Golden Age fund has appreciated 12.1% over the last 12 months to 31 July 2018.1 Performance has been driven by organic sales growth, returns on equity, and free cash flow generation by silver economy companies.

Broadly, the silver economy can be defined as economic opportunities arising from consumer expenditure related to population ageing and the needs of seniors and baby boomers. It has been supported by rising equity markets over past years, which have allowed baby boomers and seniors to save more money towards retirement and bolstered consumer confidence.

What have been the individual stock or sector highlights over recent quarters? What is the investment thesis behind these investments?

Several sectors have benefitted from the ageing population trend over recent quarters, in our view.2 In wealth management, stocks like St. James’s Place in the UK or Charles Schwab in the US3 have catered for people saving towards retirement so they can retire financially secure.

In healthcare and consumer, we believe veterinary stocks have benefitted from growing pet ownership among the elderly and increasing spend per pet. These stocks range from Zoetis, which sells flea and tick medicines for dogs, to Blue Buffalo, which specialises in organic pet food.

In healthcare, life-science tools companies like Thermo Fisher Scientific, which sells reagents and instruments to biopharmaceutical companies pursuing innovative R&D, have rallied and the list goes on.

Looking ahead, what trends in the silver economy – particularly in terms of innovation – are especially interesting from an investment perspective?

There is a great deal of innovation in healthcare. We like Stryker, an orthopaedics company winning market share in knee implants thanks to the Mako robot, which makes procedures less error-prone and more easily reproducible.

In life sciences, a company like Illumina is at the forefront of nextgeneration sequencing of the human genome.

Customers like Verily, owned by Google’s parent Alphabet, use the technology to try to extend life expectancy. Others leverage it for personalised medicines using biomarkers.

In nutrition, companies like Royal DSM and Nestlé are trying to develop ingredients that help people live longer, healthier lives.

Thinking about the global economic picture, how do you see the macro outlook affecting the silver economy and, more specifically, the Golden Age Fund?

Playing the ageing population theme and the silver economy naturally lends itself to investing in high-quality, structural growth stories that can continue irrespective of shorter-term economic movements. We believe such companies may outperform as economic growth moderates.

Leading economic indicators like manufacturing purchasing managers’ indices (PMIs) peaked in December 2017 and have since rolled over.

In recent months, many market participants’ risk appetites seem to have moderated, which is favourable for investments driven by the inescapable demographic shift of ageing.

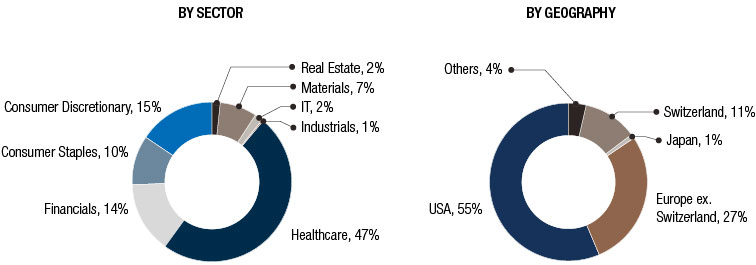

LO Funds– Golden Age portfolio breakdown

Chart source: LOIM, 31 July 2018. Holdings/allocation are subject to change.

sources.

1 Source: LOIM, 31 July 2018. Institutional N USD dividend-accumulated share class, performance net of fees. Past performance is not a guide to future performance. There can be no assurance that the Fund’s investment objective will be achieved or that there will be a return on capital.

2 Holdings/allocation subject to change.

3 Any reference to a specific company or security herein does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

important information.

Lombard Odier Funds (hereinafter the “Fund”) is a Luxembourg investment company with variable capital (SICAV). The Fund is authorised and regulated by the Luxembourg Supervisory Authority of the Financial Sector (CSSF) as an Undertaking for Collective Investments in Transferable Securities UCITS under Part I of the Luxembourg law of the 17 December 2010 implementing the European directive 2009/65/EC, as amended (“UCITS Directive”). The Management Company of the Fund is Lombard Odier Funds (Europe) S.A. (hereinafter the “Management Company”), a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, Grand Duchy of Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended. This marketing document relates to “Golden Age”, a Sub-Fund of Lombard Odier Funds (herein-after the “Sub-Fund”).

This marketing communication was prepared by Lombard Odier Asset Management (Europe) Limited. The prospectus, the articles of incorporation, the Key Investor Information Documents, the subscription form and the most recent annual and semi-annual reports are the only official offering documents of the Sub-Fund’s shares (the “Offering Documents”). The Offering Documents are available in English, French, German and Italian at www.loim.com and can be requested free of charge at the registered office of the Sub-Fund in Luxembourg: 291 route d’Arlon, 1150 Luxembourg, Grand Duchy of Luxembourg.

The information contained in this marketing communication does not take into account any individual’s specific circumstances, objectives or needs and does not constitute research or that any investment strategy is suitable or appropriate to individual circumstances or that any investment or strategy constitutes a personal investment advice to any investor. This marketing communication is not intended to substitute any professional advice on investment in financial products. Before making an investment in the Sub-Fund, an investor should read the entire Offering Documents, and in particular the risk factors pertaining to an investment in the Sub- Fund. We would like to draw the investor’s attention toward the long-term nature of delivering returns across the economic cycle and the use of financial derivative instruments as part of the investment strategy may result in a higher level of leverage and increase the overall risk exposure of the Sub-Fund and the volatility of its Net Asset Value. Investors should take care to assess the suitability of such investment to his/her particular risk profile and circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. There can be no assurance that the Sub-Fund’s investment objective will be achieved or that there will be a return on capital. Past performance is not a reliable indicator of future results. Where the Sub-Fund is denominated in a currency other than an investor’s base currency, changes in the rate of exchange may have an adverse effect on price and income. Please take note of the risk factors.

The information obtained from MSCI included in this marketing document may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used to create any financial instruments or products or any indices. The MSCI information and that of other data providers is provided on an ‘as is’ basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling or creating any MSCI information (collectively, the “MSCI Parties”) and other data providers, expressly disclaim all warranties (including, without limitation any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party or other data provider have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

Any benchmarks/indices cited herein are provided for information purposes only. No benchmark/index is directly comparable to the investment objectives, strategy or universe of a Sub-Fund. The performance of a benchmark shall not be indicative of past or future performance of any Sub-Fund. It should not be assumed that the relevant Sub-Fund will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between such Sub-Fund’s returns and any index returns. Target performance/risk represents a portfolio construction goal. It does not represent past performance/risk and may not be representative of actual future performance/risk.

The information and analysis contained herein are based on sources considered to be reliable. Lombard Odier makes its best efforts to ensure the timeliness, accuracy, and completeness of the information contained in this marketing communication.

Nevertheless, all information and opinions as well as the prices, market valuations and calculations indicated herein may change without notice. Source of the figures: Unless otherwise stated, figures are prepared by Lombard Odier Asset Management (Europe) Limited. The tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Lombard Odier does not provide tax advice and it is up to each investor to consult with its own tax advisors.

NOTICE TO RESIDENTS IN THE FOLLOWING COUNTRIES:

Austria – Paying agent: Erste Bank der österreichischen Sparkassen AG.

Belgium – Financial Services Provider: CACEIS Belgium S.A. – Please contact your tax advisor to identify the impacts of the Belgian tax “TOB” (“Taxe sur les Opérations Boursières”) on your transactions, as well as the impacts of the withholding tax (“Précomptes mobiliers”). Lombard Odier has an internal Complaints Management Service. You can lodge a claim via your Relationship Manager or directly to Lombard Odier (Europe) S.A. Luxembourg, Belgium Branch, Claim Management Service, Avenue Louise 81, Box 12, 1050 Brussels, Fax: (+32) 2 543 08. Alternatively you can address your complaint free of charge to the national complaint service in Belgium, OMBUDSMAN: North Gate II, Boulevard du Roi Albert II, n°8 Boîte 2 2, 1000 Brussels, Tel : (+32) 2 545 77 70, Fax : (+32) 2 545 77 79, Email: Ombudsman@Ombusfin.be.

France – Centralising agent: CACEIS Bank.

Germany – German Information and Paying agent: DekaBank Deutsche Girozentrale.

Italy – Paying agents: Société Générale Securities Services S.p.A., State Street Bank International GmbH – Succursale Italia, Banca Sella Holding S.p.A., Allfunds Bank S.A.U., Milan Branch, BNP Paribas Securities Services, CACEIS Bank Italy Branch.

Liechtenstein – Paying agent: LGT Bank AG.

Luxembourg – Depositary, central administration agent, registrar, transfer Agent, paying agent and listing agent: CACEIS Bank, Luxembourg Branch.

Netherlands – Paying agent: Lombard Odier Asset Management (Europe) Ltd, Netherlands Branch.

Spain – Paying agent: Allfunds Bank S.A.U. – CNMV Number: 498.

Sweden – Paying agent: Skandinaviska Enskilda Banken AB (publ).

Switzerland – The Sub-Fund is registered with the Swiss Federal Financial Market Supervisory Authority (FINMA). The Offering Documents together with the other Shareholders’ information are available free of charge at the Swiss Representative: Lombard Odier Asset Management (Switzerland) S.A., 6, avenue des Morgines, 1213 Petit-Lancy, Switzerland. Swiss Paying Agent: Banque Lombard Odier & Co Ltd 11, rue de la Corraterie 1204 Genève, Switzerland. Publications about the Sub-Fund: www.fundinfo.com. The issue and redemption prices and / or the net asset value (with the mention “excluding commissions”) of the Share classes distributed in Switzerland: www.swissfunddata.ch and www.fundinfo.com. Bank Lombard Odier & Co Ltd is a bank and securities dealer authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

United Kingdom – This document is a financial promotion and has been approved for the purposes of Section 21 of the Financial Services and Markets Act 2000, by Lombard Odier Asset Management (Europe) Limited. It is approved for distribution by Lombard Odier (Europe) S.A., London Branch for Retail Clients in the United Kingdom. The Sub-Fund is a Recognised scheme in the United Kingdom under the Financial Services and Markets Act 2000. UK regulation for the protection of retail clients in the UK and the compensation available under the UK Financial Services Compensation scheme does not apply in respect of any investment or services provided by an overseas person. UK facilities agent: Lombard Odier Asset Management (Europe) Limited. Lombard Odier (Europe) S.A. UK Branch is a credit institution regulated in the UK by the Prudential Regulation Authority (PRA) and subject to limited regulation by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). Details of the extent of our authorisation and regulation by the PRA and regulation by the FCA are available from us on request.

Chile – The Sub-Fund has been approved by the Comision Clasificadora de Riesgo (CCR) in Chile for distribution to Chilean Pension Funds under Agreement Nr 32 of the CCR.

Singapore – The Sub-Funds are not authorised or recognised by the Monetary Authority of Singapore (“MAS”) and the Shares are not allowed to be offered to the retail public in Singapore. Each Sub-Fund is a restricted scheme under the Sixth Schedule to the Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations of Singapore. This document can be transmitted only (i) to “institutional investors” pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “Act”), (ii) to “relevant persons” pursuant to Section 305(1) of the Act, (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the Act, or (iv) pursuant to, and in accordance with the conditions of, other applicable exemption provisions of the Act.

European Union Members: This marketing communication has been approved for issue by Lombard Odier (Europe) S.A. The entity is a credit institution authorised and regulated by the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. Lombard Odier (Europe) S.A. branches are operating in the following territories: France: Lombard Odier (Europe). S.A. Succursale en France, a credit institution under limited supervision in France by the Autorité de contrôle prudentiel et de résolution (ACPR) and by the Autorité des marchés financiers(AMF) in respect of its investment services activities; Spain: Lombard Odier (Europe) S.A. Sucursal en España, Lombard Odier Gestión (España) S.G.I.I.C., S.A.U., credit institutions under limited supervision in Spain by the Banco de España and the Comisión Nacional del Mercado de Valores (CNMV).

United States: Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States or given to any US person.This marketing communication may not be reproduced (in whole or in part), transmitted, modified, or used for any public or commercial purpose without the prior written permission of Lombard Odier.

© 2018 Lombard Odier Investment Managers – all rights reserved.