investment viewpoints

CIO views: looking beyond China's crackdown

China has unveiled significant policy changes recently, including a regulatory crackdown as well as redistributive and demographic policies. How are such developments impacting Asian assets and where do our CIOs see risks and opportunities?

In the sections below, we consider how to best position our Asian strategies by asset class.

China policy: making sense of the crackdown

Over the past year, Chinese authorities have increased regulatory scrutiny across technology, fintech, payments and media sectors while tightening policy on real estate. The most unexpected was turning a significant part of the after-school tutoring (AST) sector into non-profit. More recently, Macau has started to tighten control over its private sector gaming companies, and there are signs that Hong Kong property developers may be forced to contribute towards social housing. In total, over 100 regulatory actions, directives and policy changes have been made in the past few quarters.

We see this is as a coordinated effort for China to reduce wealth and income inequality and improve the standard of living of the middle class. There are also efforts to orient demographics towards a younger median age, due to an aging population, by promoting the conditions to support family formation.

Given the pace of these policy changes, could this be the start of a long-term regime shift away from Western-style, market based reforms and capitalism back towards socialism? Chinese President, Xi Jinping, said in January that “China has entered a new stage of development” and that his goal is to build China into a “modern socialist power”. Strong emphasis is now being placed on a new campaign of common prosperity which calls for a more equal distribution of wealth.

We do not believe that the country will move down a path towards extreme socialism. Theoretically speaking, the potential adoption of a modern socialist approach would undoubtedly lead to structurally lower growth in the long term. Yet populist approaches rarely succeed in advancing their societies, raising economic output or improving standards of living.

Indeed, China is still seeking to advance its manufacturing capability, lead advances in global internet technology and computing, raise the standard of living, and, most importantly, ensure social harmony. Over the last three decades of liberalisation and economic growth, the Chinese Communist Party has been eager to ensure citizen loyalty in exchange for economic freedom and prosperity: this is unlikely to be rolled back.

It is in China’s interest to keep capital markets open and functioning, to continue liberalising financial markets and to attract capital, in our view. Only 5-years ago, China pushed for its equities to be included in the MSCI index, and achieved strong uptake of its offshore bond markets by global investors.

Ultimately, we believe that the pace of the regulatory crackdown will slow down from here now that the official strategy has been communicated. The message was loud and clear: China is seeking to reduce the long-term imbalances that have accompanied its rapid growth. This led to aggressive and volatile re-pricing in the market where recent bearish sentiment was compounded by investor emotions running high, and pushed some valuations to historic lows.

Going forward, should China ease back on its rhetoric and reverse the most extreme investor pessimism, we believe the case for contrarian investors today could appear compelling.

Asian fixed income: grappling with change and finding value

This year is notable for marking the time when complacency was thrown out of Asian credit markets. In past years, strong performance was paired with low overall credit volatility and defaults. This stemmed from a variety of factors such as strong sovereign fiscal balances, the presence of large capitalised corporates benefitting from a high growth and low inflation regime, and growing domestic wealth.

Everything changed this year as investors were forced to grapple with:

- China’s regulatory crackdown

- Massive volatility and a state-led bailout of Huarong1, one of the largest emerging market (EM), investment grade (IG) issuers with USD 20bn in outstanding bonds

- The impending and likely debt restructuring of Evergrande Real Estate1, the largest Asian high yield (HY) issuer with USD 20bn in outstanding bonds

The ensuing market contagion has been pronounced – especially in Chinese real estate due to macro policy tightening in the sector – and soured sentiment to unprecedented levels. As many investors suffered the consequences, we note nascent areas of value in the markets have been left untapped, marking a stark shift from previously when investors seized every bond opportunity.

Even more remarkable, however, has been the robust overall reaction of Asian diversified bond indices: the popular JPM Asia Credit Index (JACI) has managed to remain flat year-to-date while the JPM Asia Credit Index Investment Grade Sub Index has returned close to 1% year-to-date. This is a testament to the strength in regional diversity, high carry relative to developed markets and continued strong flow into the Asia fixed income asset class2 that has now grown close to USD 1.5 trn.

The widening of credit spreads in Asian IG and HY issuers currently offers investors a fresh starting point for potentially attractive valuations3, in our opinion. The opportunities range from low-beta names in IG, to spread pick-up prospects in the crossover segment (rated BB to BBB), and ample special situations openings in HY.

Going forward, we see returns being driven by appealing coupon rates and yields3, as well as the potential for the Asian universe to outperform non-Asian EM as well as developed markets. We expect the strong rebound in growth to continue in Asian economies into 2022. The post-pandemic re-opening of the economy had been slow thus far, with weaker than expected vaccination drives. This is now reversing, and we believe cyclical sectors should perform well into 2022. For HY, we believe China’s macro policy will be a key driver, and any easing of real estate and financing markets onshore could lead to strong upside.

Sources

Asian equities: assessing risk and valuations for long-term prospects

The Chinese government’s regulatory crackdown on the technology, tutoring and other sectors was accompanied by hints of greater taxes that impacted overall sentiment on Chinese equities. We believe more time and greater clarity are needed before investors become comfortable investing in the Chinese market again. Generally speaking, however, we continue to see consumer demand acting as an engine for growth on a longer-term basis alongside the ambitions of the recently presented 14th Five-Year Plan.

It is not the first time we have witnessed state interventionism in China. We believe it is modernising its regulatory oversight to standards similar to those in Western economies, and is also looking to increase inclusivity and affordability. New redistributive policies were alluded to last month when President Xi Jinping called for a “reasonable adjustment of excessive incomes,” providing a blow to stocks of luxury focused brands. In the near term, we have sought to mitigate this risk in our high-conviction China, Asia and emerging-market equity strategies.

For instance, we did not participate in DiDi’s IPO4, despite it being highly anticipated and over-subscribed. Regulatory risk escalated after the ride-hailing firm floated in the US. The company swiftly found itself under investigation from the Cyberspace Administration of China and removed from China’s app stores.

Further regulatory interventions followed. After-school tutoring (AST) providers in core subjects have been forced to switch to a not-for-profit basis, rendering them essentially uninvestable. Food-delivery platforms are now required to pay above minimum wages and provide worker insurance; gaming time for under 18s has been restricted; and tech firms with over 1 million customers must pass a cybersecurity review before they can be floated overseas. We have since been cautious regarding our exposure to the China internet sector to mitigate any fallout. We held only marginal positions in ASTs and have since exited them.

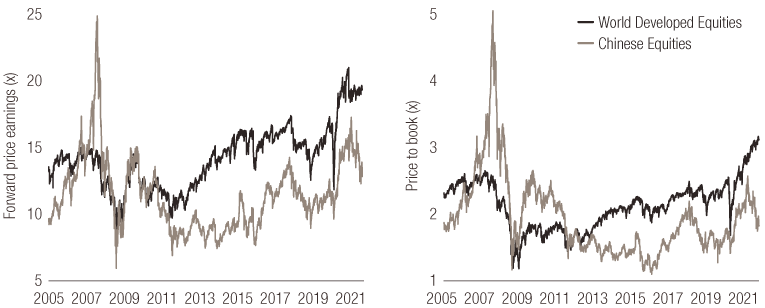

Factoring in the recent increase in risk, Chinese equity valuations may have reached potentially appealing levels relative to developed markets and historically, in our opinion. Using next year forward price-to-earnings (PE) multiples to account for the full earnings cyclical recovery in developed markets, Chinese equities are currently priced at 12.5x, a 35% discount to developed market equities (ca. 19x), compared to a -18% average discount over a 15-year period (Figure 1). Using a price to book measure, which is less cyclical, Chinese equities are priced at 1.9x versus 3.2x for developed market equities (Figure 2). This is not far off the historic lows of a 40-50% discount last seen in late 2015.

Investors should seek a long-term perspective, in our view. We believe opportunities will arise as companies adapt to new cybersecurity requirements that support China’s digital ambitions, and new regulations aimed at fostering more inclusive growth. Drawing on the history of Tencent4, we argue that stricter regulation in China has led to attractive entry points for investors willing to consider China’s long-term prospects, such as those for the digital economy included in the 14th Five-Year Plan. Investors should note that an additional 400 million consumers are expected to become middle class, or wealthier, over the next 10-15 years. New redistributive policies should not diminish the dominant sources of growth for premium brands in China: middle class and affluent consumers.

|

Figure 1. Forward price-to-earnings ratio |

Figure 2. Price-to-book ratio |

Source: LOIM, Bloomberg. Data until 16 September 2021. For illustrative purposes only.

Sources

4 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

Asian convertible bonds: constructive on China’s growth potential

Chinese equities have corrected sharply since Chinese policy shifted to focus on social issues and the long-term stability of the country and its population. Despite the volatility seen this summer, we remain constructive about exposure to China. We believe the correction could be an opportunity to invest in what will soon be the world’s largest economy. Asian consumers are expected to account for half of global consumption growth in the next decade5, driven by a growing middle class, changing business models and consumer demand trends. The region has undergone tremendous structural reforms in recent decades: beyond export-oriented growth, Asia has seen increased economic diversification and the rapid development of its capital markets, which offer a growing diversity of opportunities as well as improving credit quality, in our opinion.

The economic growth and development of the region have given rise to investment opportunities in new sectors for convertible bond investors. Issuance is coming from sectors which did not exist just 5-10 years ago: electric vehicle manufacturers, online payment platforms and plant-based protein food producers. Over the past decade, Asian corporates have prioritised profitable growth over debt-funded expansion and the Chinese authorities have been clamping down on sectors, such as real estate, perceived to be leverage-hungry.

We do not believe that China has entered a monetary tightening cycle following the People’s Bank of China’s (PBoC) recent decision to lower the Reserve Requirement Ratio (RRR) to boost credit liquidity. As a result, we expect risky assets to remain supported by low rates for longer than expected.

We expect the markets in China and Hong Kong to stabilise as focus returns to some of China’s undoubtedly attractive macro fundamentals such as:

- continued dovish monetary policy

- growth expectations exceeding those of developed markets

- a substantial rebound forecast for GDP in Q4 after an easing of mobility restrictions

- an expected increase in government bond issuance to finance project investment, and

- improved public health dynamics, with a strong focus on controlling any new Covid-19 outbreaks

We have every reason to believe that convertible bond investors will continue to find opportunities to gain exposure to the growth sectors prevalent in the region’s equity indices, with the benefit of the asset class’s typically lower volatility than a direct equity investment.

Uncertainty surrounding the near-term outlook for some sectors is likely to remain and could lead investors to adopt a conservative stance when valuing assets in the region. That conservative approach could lead to a prolonged valuation discount for Chinese names that are most exposed to potential shifts in regulation. On a more positive note, however, we also see opportunities in areas less affected by regulatory pressure, where the success of the sector corresponds more closely to current government policy, such as semiconductors, consumer discretionary and sportswear.

Given the record levels of primary issuance over the past 18 months, the global convertible bond universe now offers broad exposure to themes supported by China’s current Five-Year Plan, including technology independence through semiconductor and renewable-energy production, electric vehicle production, communications and healthtech innovation. Following the recent pull-back in Chinese equities, many convertible bonds could also now offer compelling valuations, in our view, while providing upside participation with the equity market.

Source

5 McKinsey & Co discussion paper “Beyond income: Redrawing Asia’s consumer map.” September 2021.

Sustainability: looking ahead to COP26 and climate action in Asia

With a month-and-a-half to go until the COP26 climate conference in Glasgow, Scotland, what changes could be in store for investors and the private sector in Asian assets?

Over the last two years, climate action has rapidly accelerated. Right now we estimate that close to 80% of GDP is covered by a net-zero goal, compared to just 16% two years ago. In Asia, this now includes pledges by China (which is seeking to reach a peak in CO2 emissions before 2030 and carbon neutrality by 2060), as well as South Korea and Japan (both having pledged to reach net zero by 2050).

We expect COP26 will build on existing momentum, intensifying progress on carbon pricing mechanisms and the development of credible markets for carbon offsets. This should lead to accelerated action on the phaseout of coal and deforestation and more detailed policy guidance on the specific roadmaps governments will seek to follow on the route to net zero.

For companies, this is raising the stakes, and increasing the urgency of developing clear, credible and commercially-viable strategies for the transition to net zero. In terms of the private sector, over 1,600 companies have already committed to set science-based targets. Of these, 373 are based in Asia and the number is rapidly increasing. As economies, downstream customers and end-markets transition to net zero, these climate leaders are well-positioned for the transition, at the expense of those companies failing to take action.

A significant investment opportunity is taking shape. China has been at the forefront of the electric vehicle and wind energy revolution, albeit it has now been overtaken by Europe and North America. It still dominates the manufacturing of batteries and solar panels. Now, new opportunities are arising in nature-based solutions (including in Southeast Asia), the hydrogen economy (where South Korea is placing its bets) and other decarbonisation solutions.

For investors, managing this transition this will require new carbon expertise. At Lombard Odier, we have developed proprietary assessment capabilities that do not merely consider a company’s carbon footprint today, but a company’s emission trajectory. This enables us to determine whether a company’s strategy is aligned, or misaligned, to the objectives of the Paris Agreement.

We have also developed capabilities to assess not only the journey a company is on and the challenges it will face, but the financial relevance of those. Through the concept of Climate Value Impact, we assess exposure to transitional risks and opportunities, and are expanding this with an additional focus on physical and liability risks, and the ability to stress-test our clients’ portfolios under different scenarios.

Our differentiated approach seeks to help investors identify the carbon risks and opportunities, across both equity and fixed income portfolios. The use of more forward-looking assessments is likely to be a topic of interest for investors and regulators participating at COP26, and one for which we are already well-prepared.

Wichtige Informationen.

NUR FÜR PROFESSIONELLE INVESTOREN

Dieses Dokument wurde von Lombard Odier Funds (Europe) S.A. herausgegeben, einer in Luxemburg ansässigen Aktiengesellschaft mit Sitz an der Route d’Arlon 291 in 1150 Luxemburg, die von der Luxemburger Finanzmarktaufsichtsbehörde, („CSSF“), als Verwaltungsgesellschaft im Sinne der EU-Richtlinie 2009/65/EG in der jeweils geltenden Fassung und der EU-Richtlinie 2011/61/EU über die Verwalter alternativer Investmentfonds (AIFMD-Richtlinie) zugelassen wurde und deren Aufsicht unterstellt ist. Geschäftszweck der Verwaltungsgesellschaft ist die Errichtung, Vermarktung, Administration, Verwaltung und der Vertrieb von luxemburgischen und ausländischen OGAW, alternativen Investmentfonds („AIF“) sowie anderen regulierten Fonds, kollektiven und sonstigen Anlagevehikeln sowie das Angebot von Portfolioverwaltungs- und Anlageberatungsdiensten.

Lombard Odier Investment Managers („LOIM“) ist ein Markenzeichen.

Dieses Dokument wird ausschließlich zu Informationszwecken bereitgestellt und stellt weder ein Angebot noch eine Empfehlung zum Kauf oder Verkauf eines Wertpapiers oder einer Dienstleistung dar. Es darf nicht in Rechtsordnungen verbreitet, veröffentlicht oder genutzt werden, in denen eine solche Verbreitung, Veröffentlichung oder Nutzung rechtswidrig wäre. Dieses Dokument enthält keine personalisierte Empfehlung oder Beratung und ersetzt keinesfalls eine professionelle Beratung zu Anlagen in Finanzprodukten. Anleger sollten vor Abschluss eines Geschäfts die Angemessenheit der Investition unter Berücksichtigung ihrer persönlichen Umstände sorgfältig prüfen und gegebenenfalls einen unabhängigen Fachberater hinsichtlich der Risiken und etwaiger rechtlicher, regulatorischer, finanzieller, steuerlicher und buchhalterischer Auswirkungen konsultieren. Dieses Dokument ist Eigentum von LOIM und wird den Empfängern ausschließlich zum persönlichen Gebrauch überlassen. Es darf ohne vorherige schriftliche Genehmigung von LOIM weder ganz noch auszugsweise vervielfältigt, übermittelt, abgeändert oder für einen anderen Zweck verwendet werden. Dieses Dokument gibt die Meinungen von LOIM zum Datum seiner Veröffentlichung wieder.

Weder das vorliegende Dokument noch Kopien davon dürfen in die USA, in die Gebiete unter der Hoheitsgewalt der USA oder in die der Rechtsprechung der USA unterstehenden Gebiete versandt, dorthin mitgenommen, dort verteilt oder an US-Personen bzw. zu deren Gunsten abgegeben werden. Als US-Person gelten zu diesem Zweck alle Personen, die US-Bürger oder Staatsangehörige sind oder ihren Wohnsitz in den USA haben, alle Personengesellschaften, die in einem Bundesstaat oder Gebiet unter der Hoheitsgewalt der USA organisiert sind oder bestehen, alle Kapitalgesellschaften, die nach US-amerikanischem Recht oder dem Recht eines Bundesstaates oder Gebiets, das unter der Hoheitsgewalt der USA steht, organisiert sind, sowie alle in den USA ertragssteuerpflichtigen Vermögensmassen oder Trusts, ungeachtet des Ursprungs ihrer Erträge.

Datenquelle: Sofern nicht anders angegeben, wurden die Daten von LOIM aufbereitet.

Obwohl gewisse Informationen aus als verlässlich geltenden öffentlichen Quellen stammen, können wir ohne eine unabhängige Prüfung die Genauigkeit oder Vollständigkeit aller aus öffentlichen Quellen stammenden Informationen nicht garantieren.

Die in diesem Dokument geäußerten Ansichten und Einschätzungen dienen ausschließlich Informationszwecken und stellen keine Empfehlung von LOIM zum Kauf, Verkauf oder Halten von Wertpapieren dar. Die Ansichten und Einschätzungen entsprechen dem Stand zum Zeitpunkt dieses Dokuments und können sich ändern. Sie sind nicht als Anlageberatung zu verstehen.

Dieses Material darf ohne vorherige Genehmigung von Lombard Odier Funds (Europe) S.A. weder vollständig noch auszugsweise (i) in irgendeiner Form oder mit irgendwelchen Mitteln kopiert, fotokopiert oder vervielfältigt oder (ii) an Personen abgegeben werden, die nicht Mitarbeiter, leitende Angestellte, Verwaltungsratsmitglieder oder bevollmächtigte Vertreter des Empfängers sind. ©2021 Lombard Odier IM. Alle Rechte vorbehalten.