investment viewpoints

Alphorum: credit selection in an imperfect recovery

In the credit section of the Q4 2021 issue of Alphorum, our quarterly analysis of global fixed-income themes and dynamics, we canvass the opportunities generated by the combination of generally positive business performance among issuers, the likelihood of US tapering beginning before year-end, and the pricing-in of imperfections in the recovery from the pandemic.

It follows earlier insights from this issue:

- Our lead commentary, which charts the diverse financial, macro and sustainability risks and opportunities in markets

- Developed market and inflation-linked bonds, where narratives for raising interest rates are gaining momentum or policy tightening is already underway

- Sustainable fixed income, where it is vital for investors to continue to build knowledge and apply new and established metrics to understand how deep economic change, such as the net-zero transition, will affect companies

In the coming days, we will turn our attention to the state of play in the emerging-market sovereign bonds and share findings from our research into opportunities among investment-grade companies whose ratings have descended to BB or lower, making them the so-called fallen angels in the high-yield market.

For now, we focus on the credit space, where the market is becoming more discerning as investors price risks with greater specificity, resulting in pockets of wider spreads among high-yield issuers.

Fundamentals and macro

The macro environment continues to look generally positive for corporate credit. Growth is slowing somewhat in the US and China, but Europe’s economy has room left to grow and continues to perform strongly. With the global economy looking quite healthy, potential inflation and the tapering of monetary support have become the market’s main concerns. The Federal Reserve’s indication that it would probably announce a reduction in asset purchases at its November meeting brings forward the timeline for tapering somewhat, but the fact that this has been well signalled means the market’s reaction should be controlled.

The threat of renewed Covid-related disruption is diminishing. Marginal risk from possible variants remains, especially for emerging markets where vaccination levels are lower (as highlighted in our lead commentary, vaccination levels are closely aligned with the GDP per capita of nations). However, vaccine production is scaling up rapidly, while the initial success of Merck’s anti-viral drug Molnupiravir in reducing the effects of the disease makes us more confident in humanity’s ability to live with Covid as a long-term, endemic disease1.

Supply-chain issues and labour shortages are arguably more of a concern in terms of constraining markets. Aside from the ongoing chip shortage and its impact on car and consumer electronics manufacturing, supply-demand mismatches are sending the price of commodities, such as aluminium, soaring. Meanwhile, a perfect storm has been created by the rebound in energy demand from pandemic-era lows, ongoing OPEC supply restrictions and global transport bottlenecks. The unexpected consequences are laying bare the highly interlinked nature of the global economy; for example, coal shortages in China have heavily impacted industrial activity, while a shortage of natural gas in Europe has affected the food and beverage industry in the UK and led to gaps on supermarket shelves. The speed of the recovery has been a factor, while the economy is also still adapting to new spending habits due to changes in the way we live.

With everything having been priced for a perfect recovery, the existence of imperfections in supply chains means we are seeing spreads widening. However, our overriding view is that this is a healthy correction. Central banks are still managing the situation and acting as a backstop for the economy; if the labour market fails to improve, there remains the option to delay tapering, while if the correction goes too far in other ways, they can defer interest-rate hikes.

Sentiment

Spreads for lower-rated bonds have tightened, compressing relative to higher-rated ones. However, given the prospect of tapering and the risk of interest-rate volatility rising again in the future, we remain constructive on high-yield credit and it continues to be our preference over investment grade. Investor consensus is somewhat one-sided, ‘hoping’ for continued low volatility and a range-bound spread environment ahead. So far, the spill-over from events in China is limited in terms of the wider market, however, this is something we will be monitoring closely.

Technicals

In general, technicals remain highly supportive, with central bank and government policy continuing to be accommodative. Even for September, which is traditionally a strong month for issuance, supply was strong in both the investment-grade and high-yield markets, yet it was matched by demand. However, many deals have featured little-to-no new issue premium, while some higher rated deals have had very low absolute levels. With this in mind, we prefer to await more interesting opportunities.

Valuations

The market continues to be as tight as ever. Investment-grade credit spreads are below pre-Covid levels with little dispersion, while better index quality is driving high-yield valuations back to where they were before the pandemic. Improving fundamentals are translating into more rising-star candidates, supporting high-yield valuations even further. We are keeping our exposure to high yield for its relatively stronger carry, while standing ready to seize opportunities when they arise.

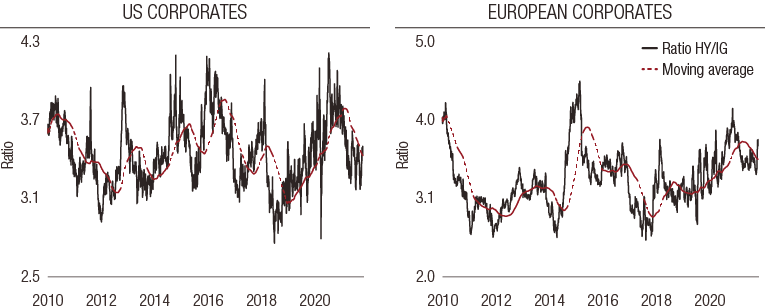

FIG 1. Relative value in corporate bonds: spread ratio of high yield over investment grade

Source: Source: Bloomberg, Barclays as at September 2021. For illustrative purposes only.

Outlook

Q3 results tend to be seen as important indicators of whether businesses will hit yearly performance targets. Overall, the year so far has been quite positive for most sectors, and expectations have increased as a consequence. Most companies are likely to outperform their initial targets from the start of 2021, but equally the market will already expect that. Given the relatively positive environment, companies that fail to meet targets are likely to be punished, although supply issues will inevitably be invoked as an excuse.

With many corporates benefiting from a surplus of liquidity, a key question is what companies will decide to do with all their cash. Will businesses invest in capex, distribute dividends, engage in M&A, or pay down debt?

In our view, the answer to some extent depends on which sector they are in. Some companies may remain cautious at this point, waiting until the end of the year to be sure increased travel and social mixing don’t result in further lockdowns. Others will be keen to repay the expensive debt they issued immediately after Covid hit; we note that firms in challenged sectors such as cruise lines are already carrying out liability management exercises on the debt they issued. Some M&A activity is in evidence, although not all of it successful; for example, the property sector has seen several failed take-over attempts, with insiders seemingly keen to buy but reluctant to sell. M&A could also be favoured in the media sector, where size is becoming key and there is a trend towards concentration, however, valuations are high so deals will not come cheap and companies could become over-leveraged.

In telecoms, the need for continuing investment in the rollout of 5G and fibre means capex will be a key focus, while the historic underperformance of telecoms as a sector pre-Covid means dividends may also be a preferred option. Tech is likely to have a similar focus on dividends and share buybacks. Meanwhile, now that prices have gone up, energy companies are likely to satisfy credit investors by reducing debt, as well as trimming businesses to be more profitable and decreasing the breakeven cost of extracting oil.

To read the full Q4 2021 issue of Alphorum, please use the download button provided.

Sources

1 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document

informations importantes.

Ce document est publié par Lombard Odier Asset Management (Europe) Limited, autorisée et supervisée par l'autorité de surveillance des services financiers (Financial Conduct Authority ou FCA) et enregistrée sous le numéro 515393 dans le registre de la FCA.

Lombard Odier Investment Managers (“LOIM”) est un nom commercial.

Ce document est fourni exclusivement à des fins d’information et ne constitue pas une offre ou une recommandation d’achat ou de vente d’une valeur mobilière ou d’un service. Il n’est pas destiné à être distribué, publié ou utilisé dans une juridiction où une telle distribution, publication ou utilisation serait illégale. Ce document ne contient pas de recommandations ou de conseils personnalisés et n'est pas destiné à remplacer des conseils professionnels au sujet d’investissements dans des produits financiers. Avant de conclure une transaction, l’investisseur doit examiner avec soin si celle-ci est adaptée à sa situation personnelle et, si besoin, obtenir des conseils professionnels indépendants au sujet des risques, ainsi que des conséquences juridiques, réglementaires, financières, fiscales ou comptables. Ce document est la propriété de LOIM et est adressé à son destinataire pour son usage personnel exclusivement. Il ne peut être reproduit (en partie ou dans son intégralité), transmis, modifié ou utilisé dans un autre but sans l’accord écrit préalable de LOIM. Ce document contient les opinions de LOIM à la date de publication.

Ni le présent document, ni une copie de celui-ci ne peuvent être envoyés, amenés ou distribués aux États-Unis d’Amérique, dans l’un de leurs territoires, possessions ou zones soumis à leur juridiction, ou à l’attention ou dans l’intérêt d’un ressortissant américain (US Person). À cet effet, le terme « ressortissant » désigne tout citoyen, ressortissant ou résident des États-Unis d’Amérique, tout partenariat organisé ou existant dans un État, territoire ou possession des États-Unis d’Amérique, toute société de capitaux soumise au droit des États-Unis d’Amérique ou d’un État, territoire ou possession des États-Unis d’Amérique, ou toute propriété ou tout trust soumis à l’impôt fédéral des États-Unis d’Amérique, quelle que soit la source de ses revenus.

Source des chiffres : sauf mention contraire, les chiffres sont fournis par LOIM.

Bien que certaines informations proviennent de sources publiques réputées fiables, en l’absence de vérification indépendante, nous ne pouvons garantir leur exactitude et leur exhaustivité.

Les avis et opinons sont exprimés à titre informatif uniquement et ne constituent pas une recommandation de LOIM pour l'achat, la vente ou la détention de quelque titre que ce soit. Les avis et opinions sont exprimés en date de cette présentation et sont susceptibles de changer. Ils ne doivent pas être interprétés comme des conseils en investissement.

Aucune partie de ce document ne saurait être (i) copiée, photocopiée ou reproduite sous quelque forme que ce soit ou (ii) distribuée à toute personne autre qu’un employé, cadre, administrateur ou agent autorisé du destinataire sans l’accord préalable de Lombard Odier Asset Management (Europe) Limited . Au Royaume-Uni, ce document constitue une promotion financière et a été approuvé par Lombard Odier Asset Management (Europe) Limited , qui est autorisée et supervisée par la FCA. © 2021 Lombard Odier IM. Tous droits réservés.