investment viewpoints

Alphorum: new interest-rate regimes dawn in developed markets

In the global government and inflation-linked bonds commentary for the Q4 2021 issue of Alphorum, our quarterly assessment of global fixed-income markets, we cover the rhetoric for interest-rate rises central banks across the developed world.

This report follows our lead commentary, which focused on the interplay of current financial, macro and sustainability risks and opportunities in markets. In the coming days, we will turn our attention to corporate credit, sustainable fixed income, emerging markets and systematic research.

Fundamentals and macro

The reversal of a largely technical summer rally in sovereign developed markets accelerated in September. The Bloomberg Global Treasury index (euro hedged), went into negative territory by the end of quarter, with a modest drop of -0.14% over Q3 2021. The incrementally less accommodative tone of the Federal Reserve (Fed) in particular weighed on the market in Q3 2021, adding to the negative returns of sovereign bond markets since the start of the year. Further upside surprises in monthly Consumer Price Index (CPI) prints and ongoing supply-side constraints fuelled concerns that inflation pressures may persist for longer than had been anticipated earlier in the year.

Recent macroeconomic data remain consistent with a robust growth outlook for developed markets. Economic activity in the US surpassed its pre-pandemic high in June, and while the labour market recovery remains incomplete, rapidly improving conditions saw an average of 600,000 jobs per month created across the quarter. Eurozone growth momentum is actually more dynamic than in the US (where growth peaked earlier in the year) although the output gap is larger. The stronger-than-expected rebound in economic activity has led the European Central Bank (ECB) to repeatedly revise its GDP growth estimate for 2021, from 4% in March to 4.6% in June, and again to 5% in September.

The thesis that rising price pressures are likely to be transitory is largely endorsed by market participants. The 5-year-5-year (5y5y) US breakeven inflation rate was trading at about 2.44%, which, after accounting for the basis between CPI and Personal Consumption Expenditures (PCE) inflation, is reasonably close to the Fed’s 2% target. In some regions, particularly the UK and Eurozone, breakeven inflation rates continued to move higher, supported by higher-than-expected monthly CPI prints. The supply side of the economy struggles to catch up with the rapid normalisation in demand, with record job vacancies and supply bottlenecks in specific sectors hampering a swift return to market equilibrium.

Sentiment

In the context of a robust global growth outlook and elevated inflation pressures, further details on the Fed’s tapering of asset purchases were highly anticipated by investors. The September Federal Open Market Committee statement confirmed that: “a moderation in the pace of asset purchases may soon be warranted”. Chair Jerome Powell signalled that tapering is set to start in November if the labour market continues to improve as expected, adding that ending net asset purchases in mid-2022 might be appropriate. This is consistent with a relatively swift slowdown in the pace of asset purchases of $15bn per month for mid-November. The median Fed Fund projections were also raised and pulled forward, with half the Committee now expecting an initial rate hike by the end of 2022, followed by three hikes in 2023 and 2024.

Following its strategic review, the ECB adopted an adjusted inflation target of 2% with a symmetric aim, replacing the close-to-but-below 2% target in place since 2003. At its July meeting the bank updated its forward guidance on its policy rate, which it now expects to remain at current levels or lower until inflation reaches 2% on a sustained basis over the projection horizon. While this falls short of the fully fledged average inflation targeting (AIT) the Federal Open Markets Committee adopted last year, the policy implications are similar, and the ECB will be patient in removing policy accommodation.

Across regions some differentiation is evident, with a few central banks starting to tighten their monetary policy stance quite decisively. The Bank of Korea and the Norges Bank began to raise their respective policy rates in Q3 2021, while the Reserve Bank of New Zealand signalled it will announce a rate hike at its next meeting in October. The Bank of England (BoE) turned decisively hawkish; its Monetary Policy Committee acknowledged in the minutes of its September meeting that there were “some signs that cost pressures might prove more persistent” and signalled a first rate hike as early as February 20221. In contrast to the Fed and the ECB, the BoE has not shifted its policy framework, maintaining its more traditional inflation targeting focus.

Technicals

We expect that the apparent outsized impact on sovereign bond markets of market positioning and technical factors seen in the first half of Q3 2021 will continue to fade by the end of the year. Commodity Futures Trading Commission reports indicate net speculative positions in the US are now less short than earlier in the year for various maturity segments. In addition, net supply after QE will become less favourable, with central banks following the Fed’s lead to gradually reduce their asset purchases in 2022. The ECB has announced a reduction in Pandemic Emergency Purchase Programme purchases in Q4 2021, while the Bank of Canada and the Bank of England are well-advanced in tapering their asset purchases. Meanwhile, the Reserve Bank of New Zealand already ended its asset purchases program in July.

Valuation

Nominal yields in the US and the Eurozone were virtually unchanged over the quarter, while rising further in some markets, including the UK and New Zealand. Real yields slid further into negative territory, hitting fresh historical lows in several markets. In most regions breakeven inflation expectations advanced further. With supply constraints continuing we expect ongoing support for inflation expectations in the near term, with the major central banks signalling a slow removal of policy accommodation. However, we expect a consolidation in inflation expectations as we edge closer to a wider reduction in asset purchases, as real yields gradually rebound from the current historically low levels.

Outlook

Policy stimulus remains a powerful tailwind for the global growth outlook. Around a third of the potential USD 2-3trn cost for two major bills before the House in the US will be added to fiscal deficits over a 10-year time span. Similarly, in the Eurozone the fiscal stance remains expansionary. The German federal election result is unlikely to prompt major policy change, as all parties recognise the need to invest in the energy transition. At the same time, global monetary policy remains extremely accommodative; the major central banks have reviewed their reaction function in the context of the average inflation targeting framework and will be slow in dialling down monetary policy stimulus.

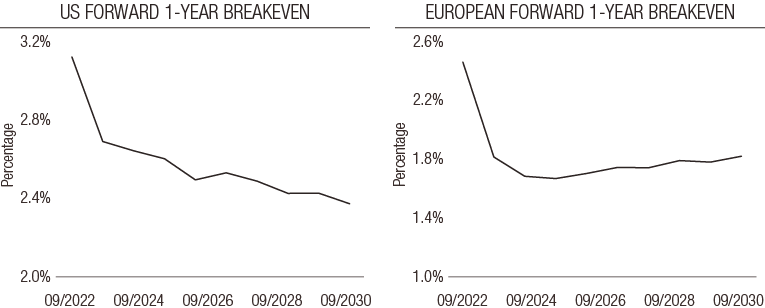

Given broadly solid growth momentum and firm inflation expectations, we see room for a gradual rise in nominal yields led by a rebound in real yields from record-low levels. Following the dramatic repricing of breakeven inflation expectations this year, we expect some consolidation. Forward 5y5y breakeven rates trade relatively close to respective central bank targets, although short-term breakeven rates are priced for inflation to remain elevated in the near term. However, considering the risk of further upside surprises in future monthly CPI prints, current breakeven inflation market pricing is reasonably well aligned with our views.

Source: Bloomberg, LOIM as at 30 September 2021. For illustrative purposes only.

A clean read of the economic situation remains difficult, but existing supply-side constraints and labour shortages could potentially become more persistent, leading to ongoing inflation. Market participants should therefore continue to pay close attention to inflationary indicators such as the US NFIB hard-to-fill job index and the Job Opening and Labor Turnover Survey.

To read the full Q4 2021 issue of Alphorum, please use the download button provided.

Sources

1 “Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 22 September 2021,” published by the Bank of England.

informations importantes.

Ce document est publié par Lombard Odier Asset Management (Europe) Limited, autorisée et supervisée par l'autorité de surveillance des services financiers (Financial Conduct Authority ou FCA) et enregistrée sous le numéro 515393 dans le registre de la FCA.

Lombard Odier Investment Managers (“LOIM”) est un nom commercial.

Ce document est fourni exclusivement à des fins d’information et ne constitue pas une offre ou une recommandation d’achat ou de vente d’une valeur mobilière ou d’un service. Il n’est pas destiné à être distribué, publié ou utilisé dans une juridiction où une telle distribution, publication ou utilisation serait illégale. Ce document ne contient pas de recommandations ou de conseils personnalisés et n'est pas destiné à remplacer des conseils professionnels au sujet d’investissements dans des produits financiers. Avant de conclure une transaction, l’investisseur doit examiner avec soin si celle-ci est adaptée à sa situation personnelle et, si besoin, obtenir des conseils professionnels indépendants au sujet des risques, ainsi que des conséquences juridiques, réglementaires, financières, fiscales ou comptables. Ce document est la propriété de LOIM et est adressé à son destinataire pour son usage personnel exclusivement. Il ne peut être reproduit (en partie ou dans son intégralité), transmis, modifié ou utilisé dans un autre but sans l’accord écrit préalable de LOIM. Ce document contient les opinions de LOIM à la date de publication.

Ni le présent document, ni une copie de celui-ci ne peuvent être envoyés, amenés ou distribués aux États-Unis d’Amérique, dans l’un de leurs territoires, possessions ou zones soumis à leur juridiction, ou à l’attention ou dans l’intérêt d’un ressortissant américain (US Person). À cet effet, le terme « ressortissant » désigne tout citoyen, ressortissant ou résident des États-Unis d’Amérique, tout partenariat organisé ou existant dans un État, territoire ou possession des États-Unis d’Amérique, toute société de capitaux soumise au droit des États-Unis d’Amérique ou d’un État, territoire ou possession des États-Unis d’Amérique, ou toute propriété ou tout trust soumis à l’impôt fédéral des États-Unis d’Amérique, quelle que soit la source de ses revenus.

Source des chiffres : sauf mention contraire, les chiffres sont fournis par LOIM.

Bien que certaines informations proviennent de sources publiques réputées fiables, en l’absence de vérification indépendante, nous ne pouvons garantir leur exactitude et leur exhaustivité.

Les avis et opinons sont exprimés à titre informatif uniquement et ne constituent pas une recommandation de LOIM pour l'achat, la vente ou la détention de quelque titre que ce soit. Les avis et opinions sont exprimés en date de cette présentation et sont susceptibles de changer. Ils ne doivent pas être interprétés comme des conseils en investissement.

Aucune partie de ce document ne saurait être (i) copiée, photocopiée ou reproduite sous quelque forme que ce soit ou (ii) distribuée à toute personne autre qu’un employé, cadre, administrateur ou agent autorisé du destinataire sans l’accord préalable de Lombard Odier Asset Management (Europe) Limited . Au Royaume-Uni, ce document constitue une promotion financière et a été approuvé par Lombard Odier Asset Management (Europe) Limited , qui est autorisée et supervisée par la FCA. © 2021 Lombard Odier IM. Tous droits réservés.