investment viewpoints

Improving convexity in credit

Fixed income as an asset class is inherently negative convexity. The investor receives a coupon payment, but stands to lose money in a negative situation such as a ratings cut. There is therefore high exposure to downside if ratings sour because the asset class provides little cushion generally from downgrade risk.

To reduce the impact, our fixed income team focuses on areas of the credit spectrum with less negative convexity. We believe that the crossover area of bonds – rated BBB to BB – could help investors improve their convexity exposure. Our way of building portfolios based on quality further enhances convexity.

The combination of these two factors better positions investors to withstand the risk of adverse outcomes.

Crossover for better ratings resilience

Firstly, given the higher yield targets in crossover, the asset class provides relatively more resilience to downside risks than lower-rated bonds. Key to the ratings resilience is the fact that crossover straddles the boundary between investment grade and high yield.

High yield bonds are very short convexity because their jump-to-default risk is usually pronounced, and the risk of loss to the investor is marked if the issuer were to default. This is because high yield sits lower on the ratings spectrum, exacerbating downside risk.

Investment grade bonds have less jump-to-default risk than high yield, because of their size, business profile and credit metrics. Still, issuers in this area tend to be more aligned with the equity holder at the cost of the debt holder. Increasing leverage, often through M&A activity, is an example of such behaviour. The reverse is true in the BBB and BB ratings buckets - where borrowers will be keen to either improve their credit rating towards investment grade, or avoid downgrade to high yield - and are thus more aligned with bondholders than shareholders.

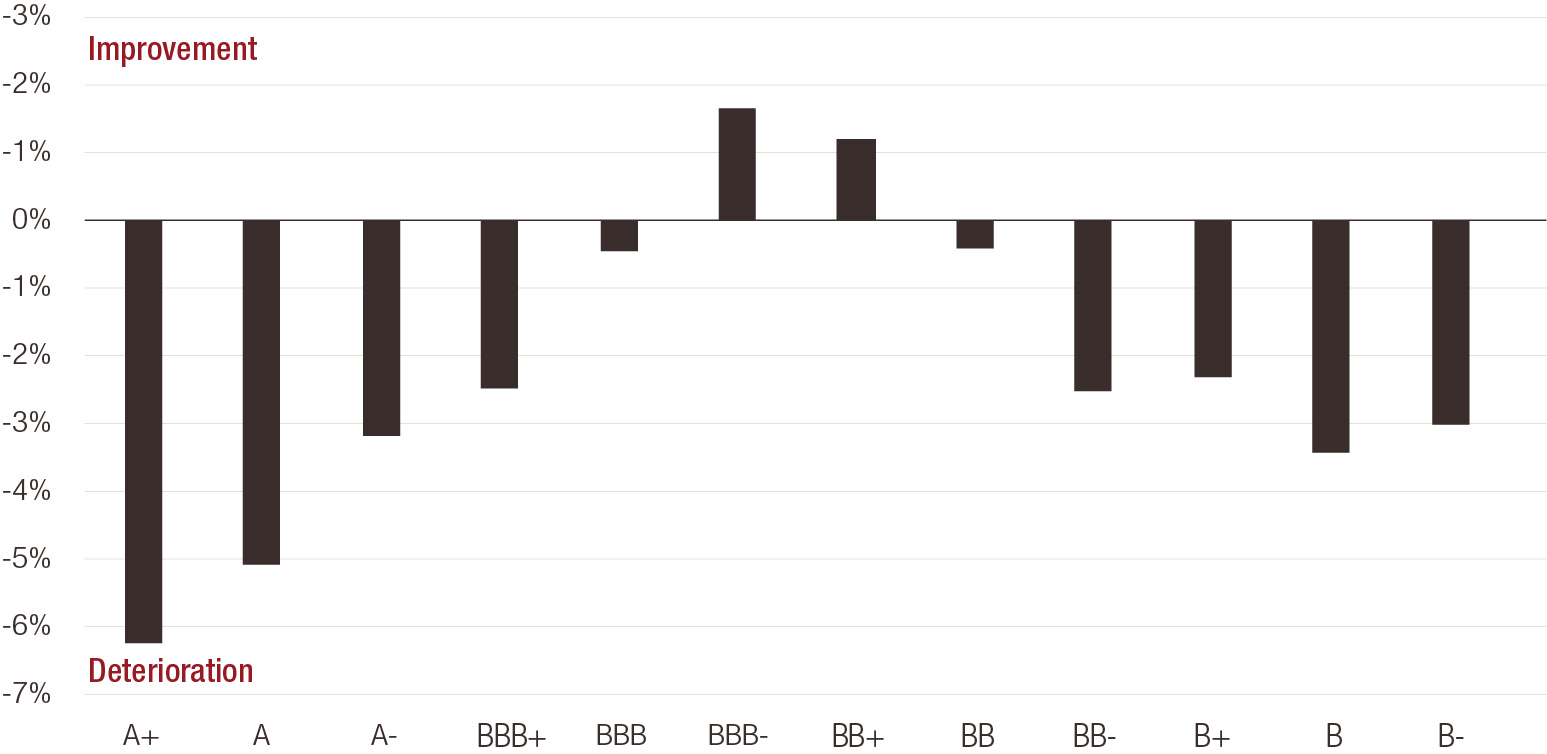

Because crossover encapsulates borrowers in the BB and BBB buckets, it increases ratings hardiness. Figure 1 shows the net rating (upgrades less downgrades annually) of crossover borrowers has been superior historically to other ratings buckets which show net deterioration over time.

Figure 1. Annual upgrade rate (%) less downgrade rate (%) from Moody’s

Source: LOIM calculations. Moody's Annual Default Study: Corporate Default and Recovery Rates, 1920-2017

Overall from an asset class perspective, crossover bonds could provide investors with yield enhancement comparable to lower-rated high yield, but do so with more resilience to downgrade risk. As such, from a risk standpoint, crossover will be more convex than other credit strategies with comparable yields.

Embedding convexity through a focus on quality

Secondly, the way we construct credit portfolios embeds convexity at a reasonable price. That means investors needn’t pay additionally for convexity when they invest – instead, it’s part of how we build portfolios. The main goal of our fundamental fixed income (FFI) strategy is to assemble portfolios based on quality in order to reduce risk but without reducing potential returns.

Credit ratios are key for us because we favour companies with good fundamentals from a credit perspective. That means building in risk reduction but without sacrificing potential returns. Our FFI approach combines: a systematic/rule-based construction to reflect issuer fundamentals, and a credit monitoring overlay to further mitigate default risk. Our low-turnover approach of less frequent portfolio rebalancing (every 6 months) helps buffer exposure to liquidity risks.

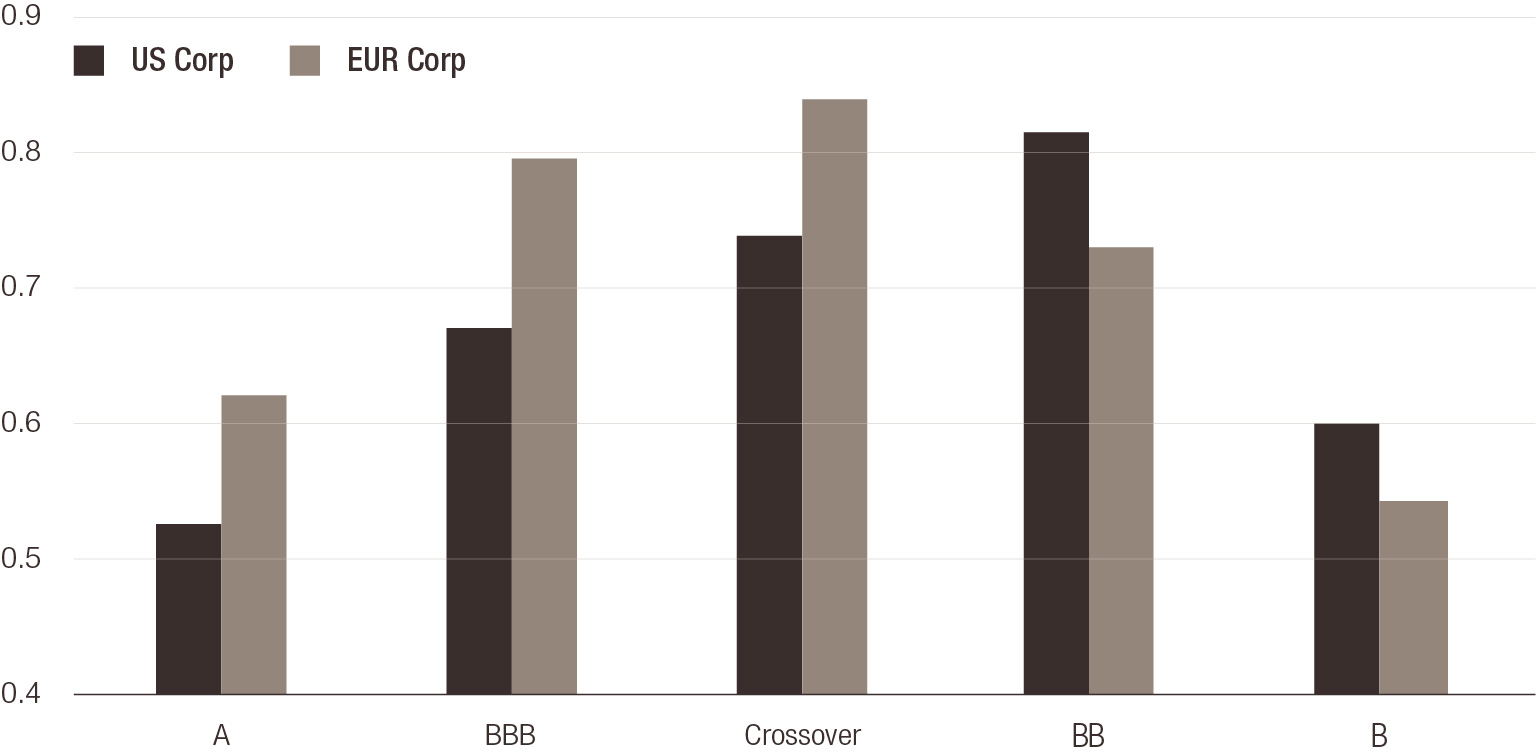

This approach helps reduce volatility in the asset class and improve Sharpe ratios. It means our version of quality mitigates risk without being detrimental to returns. This is in contrast to credit ratings provided by ratings agencies which offer convexity at a higher price. Over more than a decade, EUR and USD crossover debt has shown a favourable Sharpe ratio profile relative to neighbouring buckets, as illustrated in Figure 2.

Figure 2. Sharpe ratio (2004-2019)

Source: Boomberg Barclays indices, LOIM Calculations, LOIM Calculations.

For investors looking to achieve yield targets while limiting negative convexity, crossover offers compelling arguments. The combination of quality-focused portfolio construction and the asset class’s inherently convex-friendly properties takes the edge off the negative convexity of credit.

Please find key terms in the glossary.