investment viewpoints

Convertibles build in convexity for ups and downs

As a hybrid asset class, convertible bonds do a remarkably simple thing: they provide natural, long-term convexity1 at a reasonable price. In fact, convexity is built into convertibles the way cupboards are built into kitchens: it is integral to the proposition.

In our view, any investor seeking convexity should find space in their portfolio for convertible bonds.

Convertibles contain a corporate bond with a fixed coupon and a set maturity date. Embedded in the bond is an equity call option that allows the holder to convert the bond into common stock (that of the issuing company or of another company in the case of exchangeable convertible bonds). This optional conversion occurs at some point in the future (if certain conditions are met) and the details of the conversion are set at the time of issuance.

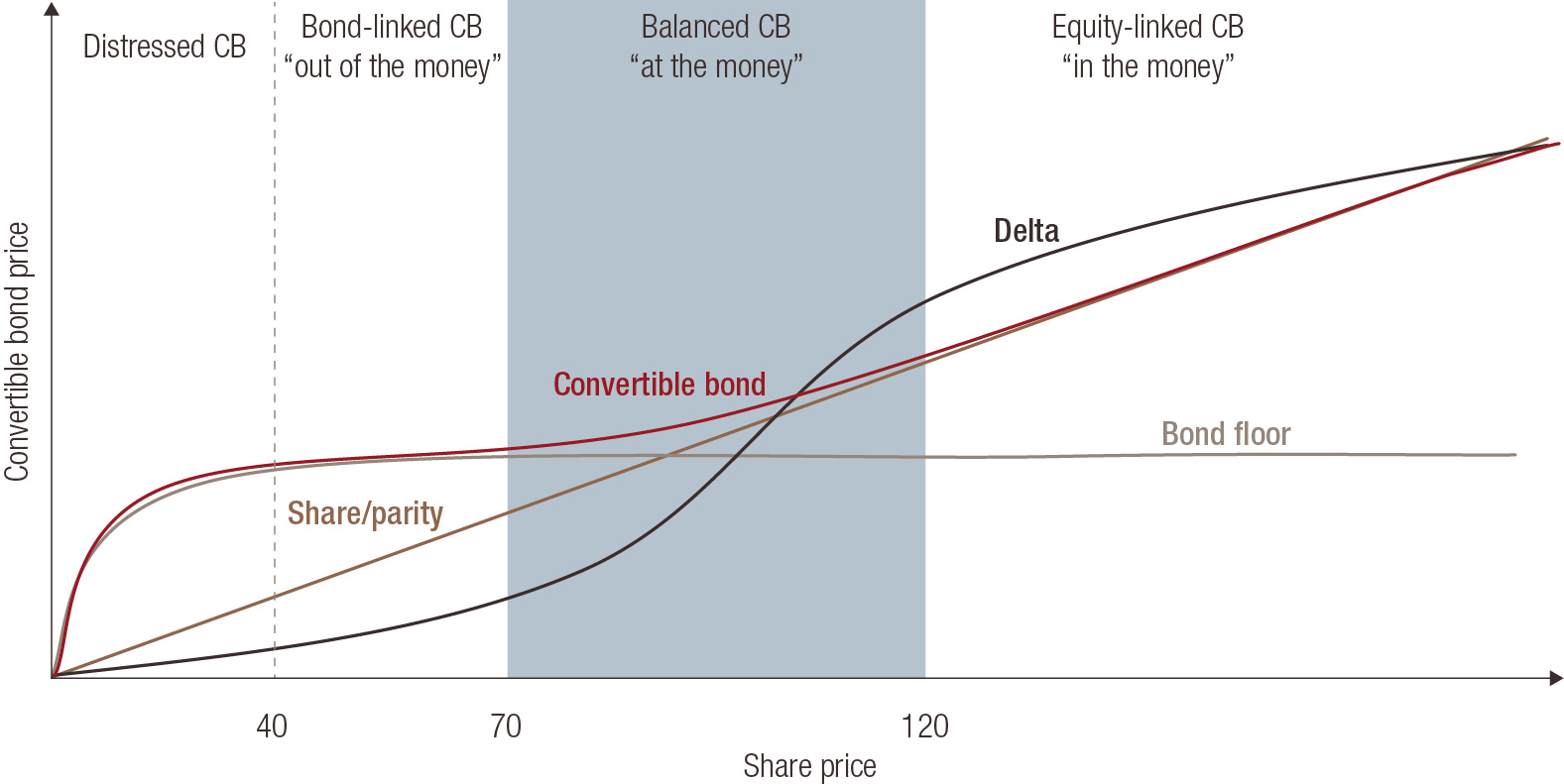

Depending on technical features and market conditions, a convertible bond may act more like a stock or more like a corporate bond at any given time. The dual structure means convertibles are more resilient to different outcomes because the bond or equity elements react differently depending on valuations and market conditions.

Convexity is built into convertibles the way cupboards are built into kitchens: it is integral to the proposition.

On the one hand, convertibles provide upside potential from the equity element. Since convertible bonds are correlated to the underlying share through the embedded call option, they offer investors the potential to participate in the upside of the underlying stock. The upside potential is not restricted - the owner of the convertible has the choice to convert into shares when the strike price is met.

On the other hand, convertibles also feature downside protection2 from the bond element. If the underlying equity fails to increase in value, the convertible bond maintains the investment value of the bond floor (or the theoretical value at which a straight bond with the same coupon, maturity and credit quality would trade). The downside as such, assuming the credit remains solid, is limited to the value of the embedded option3.

The outcome of this asymmetric return profile is that convertible bondholders can be far less exposed to falls in share prices than ordinary equity holders because the bond element enables them to effectively limit the equity downturn. Simultaneously, convertible bondholders participate in the upside of equities but with less volatility than simply investing in the underlying shares.

This unique structure has led to very attractive risk-adjusted returns for convertible bonds over the long-term. Over the past 15 years, convertible bond strategies have generated similar returns to equities but have done so with lower volatility, resulting in much higher Sharpe ratios4.

Time matters for convexity-driven investors, who tend to seek long-term coverage due the nature of their liabilities. Convertible bonds are a unique way to gain exposure to liquid and long-term optionality, typically 5 years at issue. This coverage contrasts with the purchase of independent optionality, which can be costly, often requires onerous governance and has much shorter exposure to the underlying share (typically 1 year maximum).

Balanced bonds for convexity

Our approach to investing in convertibles aims to optimise the convexity of the asset class and leverage its full potential. We tilt our selection towards issuers that provide the best asymmetric profiles because we recognise the intrinsic value of convexity for investors.

As such, we narrow down the convertible bond universe to bonds that we believe offer the most attractive balanced profiles and high risk-adjusted return potential. Figure 1 shows what we look for in a balanced bond.

Figure 1. Balanced convertible bonds with a high bond floor

Source: LOIM.

On the equity side, the extent to which the price of the convertible bond is expected to change for any given change in stock price is known as the equity sensitivity (or delta). We aim for an equity sensitivity between 30% and 60%. On the bond side, we look for a strong (and relatively high) bond floor. This is the value of the bond element of the convertible. Our selection of issuers is therefore tilted towards those that provide higher convexity.

The selection process is structured as follows. From a filtered convertible bond universe, the team analyses instruments in depth (from both fundamental and technical points of view) in order to build a portfolio of conviction with the best possible asymmetric return profiles.

The portfolio management team continuously screens the convertible bond universe to find the most liquid and most technically-attractive convertible bonds.

This filtering of the universe triggers the fundamental analysis of each issuer and the underlying share that fit our technical criteria. It enables us to focus our credit and equity analysis on the most liquid and technically-attractive instruments in the universe.

The screening process results in a focus list of instruments, which is continually updated by the convertible bond portfolio management team.

The selection of instruments which enter the portfolio is made after in-depth research of both the issuer and the underlying share. This fundamental analysis is undertaken by the team’s own analysts. It focuses on both the credit quality and remuneration of risk (from a fixed income point of view) as well as the potential of the underlying share.

The team’s portfolio managers and analysts apply a top-down view based on their strongest convictions with regard to regions, sectors and style.

The sector and regional biases of the management team guide the weighting of individual positions, which have been subject to technical review (aiming for convertible bonds with best risk/reward profile) and in-depth fundamental work (equity and credit analysis done by the team’s own analysts).

Combining participation in rising equities but defence when equity markets are declining, convertibles are a natural fit for investors seeking convexity.

Please find key terms in the glossary.

Sources

1 We define convexity as an asymmetric return profile whereby gains are typically larger than losses.

2 Capital protection is a portfolio construction goal that cannot be guaranteed.

3 There are, of course, risks also associated with convertible bonds. These include the typical risks associated with corporate debt (eg default risk or interest rate risk), as well as risks associated with equity call options (eg an equity correction leading to the devaluation of the option).

4 Analysis period 31 December 2004 to 31 July 2018. Sources: Equities: MSCI World TR (EUR-hedged); LOIM Convertible Bonds Strategy (gross); TR Global Focus Index: Thomson Reuters index (EUR-hedged); TR Global Focus IG Index: Thomson Reuters index (EUR-hedged). Past performance is not a guarantee of future results.