investment viewpoints

A crisis like no other - where to now?

Key Points:

-

Equity markets have moved from a near-term focus to a forward-looking one, assuming that a resolution to the pandemic crisis is not a matter of if, but rather when

-

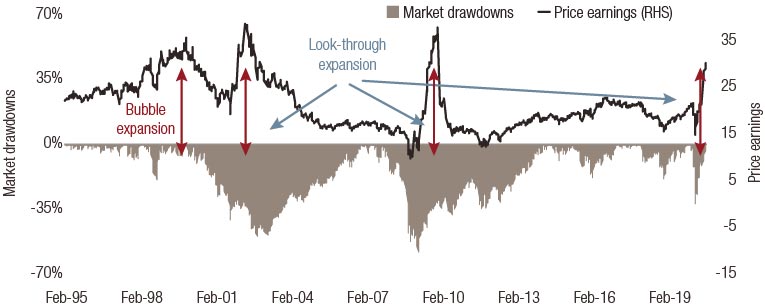

Equity markets have therefore gone through a massive re-rating on near-term multiple +37% - typical for a crisis - look-through exercise, and we believe there is still some potential for expansion

-

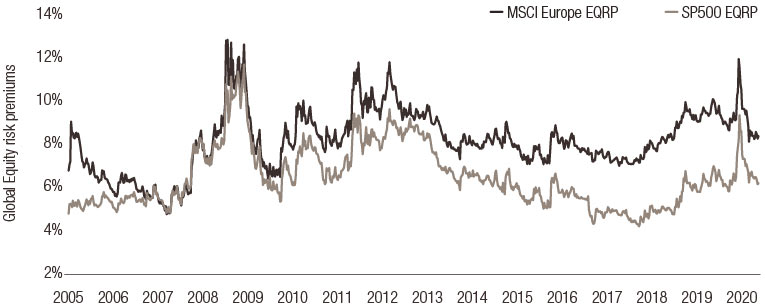

Forward Equity risk premiums are at least as attractive today as they were between 2014 and 2018 (6% in the US, 8% in Europe)

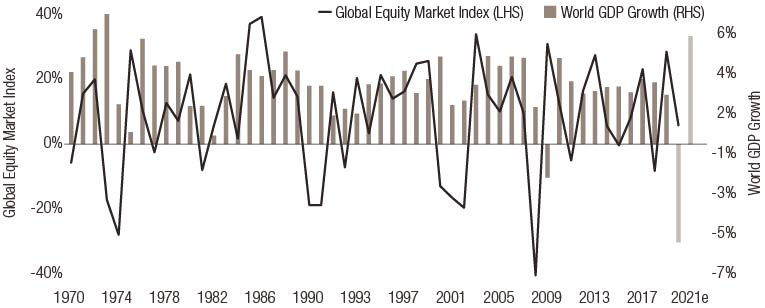

GDP growth is not necessarily correlated with global equity market performance, but big economic slowdowns or crises tend to leave a visible print for investors. So far, this is not proving to be the case in 2020 (chart 1). After a major drawdown of almost 35% in March, the market’s rebound was rapid and such that the global equity index is now up, year-to-date, despite the major economic blow caused by the pandemic. This leaves us with a very simple question: where to now?

Chart 1: Global GDP Growth and Global Equity Market Index

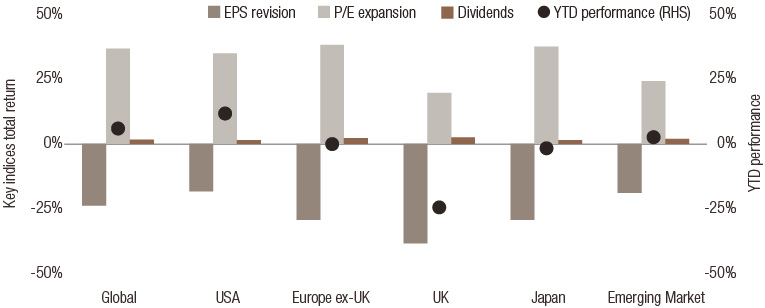

A breakdown of year-to-date performance between earnings, dividends and valuations (chart 2) illustrates ongoing market dynamics. On average, earnings per share have been revised downward by ca 20%, ranging from UK equities being the worst hit, to US equities being the most resilient. Everything else being equal, such downward revisions should have driven equity prices lower to the same extent. However, a massive valuation expansion has occurred with global equities being now almost 37% more expensive than they were at the beginning of the year.

Chart 2: Key indices total return decomposition

Chart 3: Multiple expansion and crisis

The implied market view is that the unlocking of the economy from its pandemic linked-constraints is not a matter of if but rather when, and that the final tab is going to be put on the shoulders of central banks and governments with ‘minimal’ disruption to the listed corporate world. Therefore, we believe it is fair to use forward earnings to analyse global equity risk premiums, which capture both the valuation of the market and risk free rates adjusted for inflation. In our view, this analysis reveals three key points:

-

Equities are at least as attractive today as they were between 2014 and 2018

-

In absolute terms, European equity risk premiums remain more attractive than the US

-

Relative to pre-pandemic, US equities are marginally more attractive thanks to the collapse in risk free rate which has not happened to the same extent in Europe. Indeed, US 10y bond yields dropped from 1.9% in late 2019 to 0.7% by the end of August 2020

Chart 4: Global Equity risk premiums