investment viewpoints

The long and short of it

Fixed income investors in USD face a few, unappealing risk trade-offs of late.

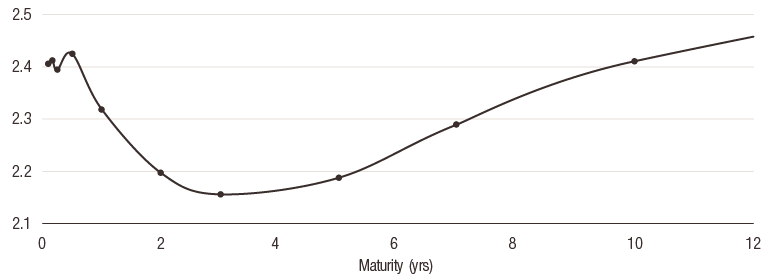

Firstly, the belly of the US Treasury yield curve—the intermediate portion between 2 and 7 years—is inverted. This means that yields on this part of the curve are below the overnight Fed Funds rate, as shown in Figure 1.1

Secondly, the longer end of the yield curve at the 10 year point has been anchored near the Fed Funds rate due to modest growth and low inflation expectations. Yet this longer part of the curve exposes investors to much more duration risk should higher economic activity and inflation materialise and push interest rates higher.

Figure 1. US Treasury actives yield curve

Source: Bloomberg, LOIM. Snapshot of the yield curve as of 14 May 2019. For illustrative purposes. Yields are subject to change.

Credit investors also face heightened risks. Not only has interest rate risk increased due to the lengthening of bond maturities in the main indices, credit spread risk has also risen as more and more companies in the investment grade universe have lower, BBB ratings. Concerns about liquidity are prominent in a world where debt loads have ballooned, but market-makers have reduced capacity due to regulatory and capital constraints.

For these reasons, we believe an attractive allocation for USD fixed income investors could be a fund with extremely low duration. An ultra-low duration strategy could generate better returns than a longer-duration strategy, with more subdued volatility, while being structured to maintain average credit risk around A2. We believe this profile could represent a better risk-reward trade-off than many other fixed income strategies because it can partly insulate investors from duration and credit spread risks, while generating competitive returns, in our view.

Finally, an ultra low duration strategy could be a good place to park structural cash. For instance, it could provide a war chest that is used when the market presents attractive opportunities. The strategy is also useful for liquidity horizons spanning a few months or more, when investors seek improved performance over short-term money market funds, while maintaining a similar flexibility around redemption timing.