investment viewpoints

Debunking 7 misconceptions about scope 3 emissions

In our Roadmap to Net Zero series, ahead of the 2021 United Nations Climate Change Conference (COP26) in Glasgow, we investigate challenges that investors face in decarbonising their portfolios in line with the objectives of the Paris Agreement and the global goal of achieving net-zero emissions by 2050.

To launch the series, we explore the opaque domain of scope 3 emissions. For investors to comprehensively analyse risks in the transition to net zero and align their portfolios with the Paris Agreement, they must have clarity – not confusion – when assessing indirect greenhouse gas (GHG) emissions.

Specifically, we describe seven key misconceptions that we think may have deterred investors from fully integrating considerations linked to scope 3 emissions and lead to confusion in the market.

Scope 3: indirect emissions linked to supply chains and product use

In the same way that companies’ financial reports are subject to strict accounting rules and procedures, so too are companies’ greenhouse gas (GHG) emissions. Unlike accounting standards however, there is as of today only one global standard for GHG emissions reporting, and it is set out in the Greenhouse Gas Protocol.

Similar to financial accounting, accounting for one’s carbon emissions requires specific expertise and a detailed understanding of the intricacies of this GHG Protocol. In particular, understanding and appreciating the nuances of different parts of a company product’s lifecycle (known as the different scopes of emissions) is absolutely critical. Divided into scope 1, 2 and 3 emissions, these scopes define the different stages of a product’s or service’s lifecycle during which emissions are generated.

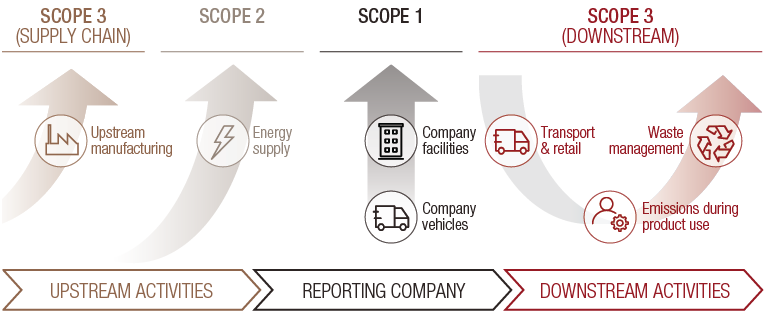

FIG 1. The three different scopes of greenhouse gas emissions

Source: Lombard Odier. For illustrative purposes only.

They are broadly defined as follows:

• Scope 1: comprises all emissions directly under the control of a company itself, and are typically linked to emissions from their own buildings, facilities and vehicles

• Scope 2: consists of emissions caused by the generation of power, heat, steam and cooling purchased by a company from third parties

• Scope 3: emissions linked to the wider supply chain and lifecycle of a company’s products and services.

By far, scope 3 emissions are often the most perplexing. Here we aim to improve understanding by correcting seven prevalent misconceptions. Read our full report, or an overview of each below.

Misconception 1

Scope 1 and 2 emissions are comprehensive enough

Many investors still focus primarily on scope 1 and 2 emissions, believing that this provides at least a reasonable insight into most companies’ carbon footprints. Our report shows that this is incorrect.

For key industries, such as the oil, gas and automotive sectors, almost all of companies’ emissions are categorised as scope 3 – particularly those linked to the downstream, or consumers’, use of products. And in all major sectors, with the exception of utilities, scope 3 are the dominant type of emissions. Therefore, if investors do not take scope 3 emissions into account, they fail to capture a company’s full GHG profile.

Misconception 2

Scope 1 and 2 emissions are more important due to corporate control

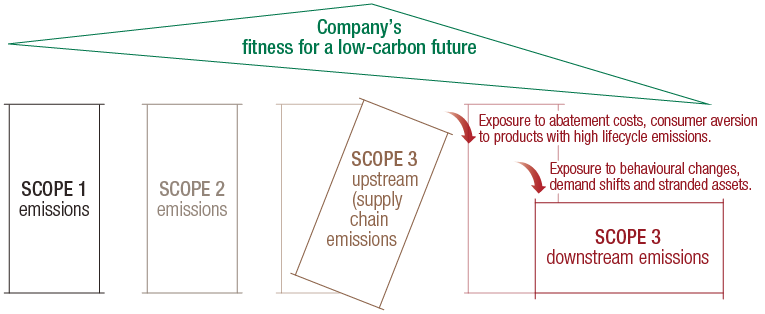

Even when investors recognise the significance of scope 3 emissions, they might argue that companies have more direct control over scope 1 and 2 emissions and are therefore more important to focus on. Our report challenges this view on three accounts:

• First, companies may have significant influence over their supply chains and can therefore engage suppliers to reduce emissions.

• Second, many companies can directly reduce their supply-chain emissions by transitioning to less carbon-intensive business models.

• Third, and perhaps most importantly, even where a company’s ability to influence scope 3 emissions may be limited, the company’s exposure to these emissions still creates significant transitional risks – driven by regulatory and market forces – that would be vital for an investor to understand.

FIG 2. Carbon exposure is not just a question of responsibility, but of transitional risk

Source: Lombard Odier. For illustrative purposes only.

Misconception 3

There is insufficient data to meaningfully assess scope 3 emissions.

The number of companies disclosing GHG emissions data has rapidly increased. In 2010, less than 3,000 companies disclosed information to the Carbon Disclosure Project, but as of 2020 this had grown to over 9,500. While a smaller number of these disclose scope 3 data, or do so comprehensively, this proportion has also grown. Furthermore, what is often overlooked is that scope 3 emissions can often be assessed even if they are not reported. For instance, estimates of emissions linked to product use can be calculated using data on the number of products sold, their average energy or fuel intensity, and information on the energy mix in the countries where the goods are distributed. Using the automotive sector as a case study, our report finds that such models can be more accurate than company-reported figures.

Misconception 4

Emissions double-counting occurs within portfolios

For investors who have begun to explore the realm of scope 3 emissions data, no issue arises more often than double-counting. If an investor holds an oil and gas and a transport company in the same portfolio, would the oil and gas company not be reporting emissions that are also already counted by the transport company? In our report, we explain how these issues are often misrepresented in overly stylised examples that fail to recognise that it would be unusual for more than a small share of a company’s suppliers to feature in the same portfolio. Double-counting of emissions should therefore be considered from an economy-wide, rather than portfolio, perspective.

Misconception 5

Double-counting is undesirable and should be adjusted for

In addressing misconception #4, we clarified some common misunderstandings about double-counting. But we recognise that a significant amount of double counting does occur. But, the question that is all too frequently forgotten is whether such double counting is in fact undesirable? In our report, we argue that although emissions are double-counted across a value chain, carbon risks also reverberate through supply chains. In our earlier example of a petrol company and a transport company (see misconception #5), a carbon tax on petrol would significantly disrupt the operations of both companies. While double-counting may recognise that companies share responsibility for emissions, it artificially deflates the true scale of a portfolio’s carbon exposure and the financial risks that it entails.

Misconception 6

As data are still improving, it makes sense to defer scope 3 analysis

Given the misunderstandings about scope 3 analysis – especially regarding data availability and the primacy of scope 1 and 2 emissions -- some investors are taking a cautious approach. At best, they are investigating indirect emissions in a handful of sectors only. In our report, we warn that this may have significant and unintentional investment consequences.

We believe that delaying scope 3 analysis across the economy will result in significant turnover in investors’ portfolios. In the process, this could lead to investors selling hidden, poorly aligned companies only after they have already depreciated due to scope 3 emissions disclosure, and equally drive appreciation among better-aligned companies before investors lagging on scope 3 analysis have identified them.

Misconception 7

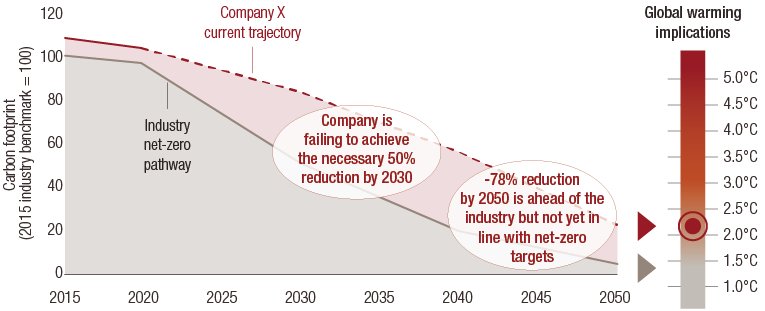

High scope 3 emissions disqualify companies from a climate-aligned portfolio

Including scope 3 emissions in investment analysis improves the accuracy of carbon-risk assessments in portfolios, but does not mean that high-emitting companies should necessarily be excluded. In our report, we recognise that carbon-intensive industrial sectors are often not only essential to the economy, but are also among the most important in the net-zero transition.

The right question is therefore not whether a company is emissions intensive today, but whether it is transitioning quickly enough to meet Paris Agreement-aligned decarbonisation objectives. This forward-looking assessment requires genuine carbon expertise, including new assessment capabilities such as implied temperature rise (ITR) metrics, which Lombard Odier already offers.

FIG 3. Lombard Odier’s implied temperature rise (ITR) metric

Source: Lombard Odier. For illustrative purposes only.

Investing for the long haul

The road to net zero is a long and challenging one. Investors need to understand how they can reduce emissions in their own operations and the portfolios they manage. For the latter, we believe they must rethink net zero to ensure they are fit for this profound economic change.

To do so, investors must first come to grips with the complex analytical field of emissions. Scope 3 emissions may appear confusing, but dispelling the seven common misconceptions above can help investors begin the process of understanding the true carbon risk of companies and determine whether their portfolios are aligned with the transition ahead.

To download the full report, please use the button provided.

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.