world in transition

Investing in zero-waste

We live in an economy today that is wildly unsustainable in terms of the way we consume, produce, and organise our lives.

Presently, we live in a linear, take-make-waste economy, reliant on vast extraction of natural resources. This is putting huge pressure on natural capital, and not only failing to harness the regenerative power of nature but also failing to protect nature’s precious biodiversity. This means we miss out on many opportunities, including the residual value that the re-use of finished products might deliver, and the value of components and materials contained in discarded waste. At Lombard Odier, we believe analysing the challenge of zero waste, as part of the transition required to a CLIC™ (Circular, Lean, Inclusive and Clean) economy, can help us identify investable opportunities across multiple industries.

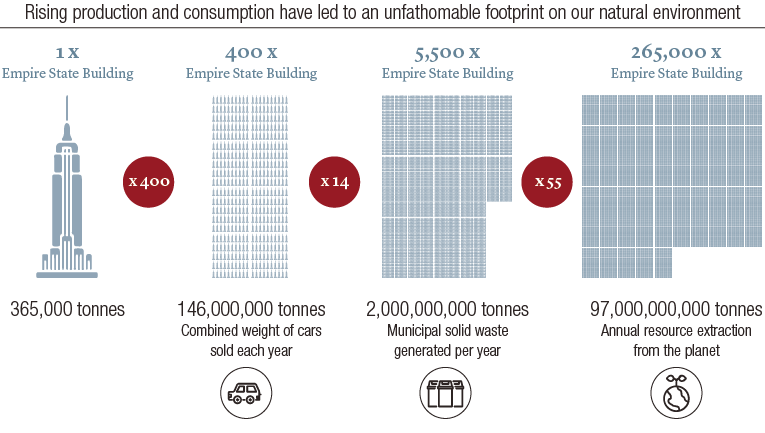

While many industries vitally depend on nature, they also have a propensity to destroy it. We must invest in a leaner form of industry to do more with less and also recognise the untapped potential of the circular bio-economy. Our cities and industries today are wasteful. Every year, we produce over 2 billion tonnes of municipal waste alone, the equivalent of more than 7,500 Empire State Buildings. In some countries, we generate as much as 4.5 kilograms of waste per person every single day1. Around 33% of the waste we produce is openly dumped, outside of landfills, contributing to pollution, health risks and biodiversity losses2. Moreover, greenhouse gas emissions generated during decomposition and disposal account for as much as 5% of global emissions3. Yet, aside from being an environmental hazard, these waste flows also represent a missed economic and investment opportunity.

Materials and waste – Our economic model requires a vast amount of raw materials

Source: LOIM estimates and calculations based on OICA, the World Bank and the Global Resources Outlook

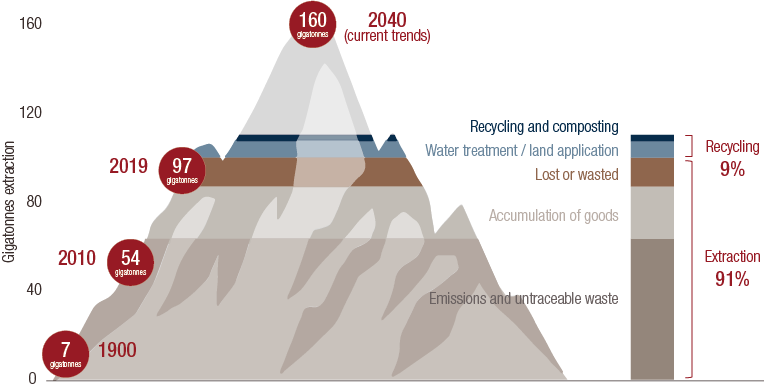

Under current projections, 160 billion tonnes of material will be extracted from the planet by 2040. Only 9% of this material is currently recycled, composted or treated for re-use, with the remaining 91% contributing to the gradual depletion of our natural resources4. Global waste is therefore set to increase to 3.4 billion tonnes by 2050, meaning it is growing at double the rate of population growth5. The increase in waste is driven by demographic changes, as well as rising incomes and changing patterns of consumption. The regions accounting for most of the expected increase in waste, such as South Asia and parts of Africa, are also among the regions with the least developed waste management systems, adding additional urgency to waste reduction efforts.

Our habits related to produced assets are wildly unsustainable

We will soon extract the weight of Mount Everest every year, while recycling only 9% of the material we extract

Source: LOIM estimates and projections based on Global Resources Outlook 2019, Circulatory Gap Report 2019, European Commission

Much of this waste retains substantial economic potential. One entire garbage truck of clothes is burned or added to a landfill every second, even though most of these clothes have been little worn before being discarded6. Similarly, some 54 million tonnes of electronic and electrical waste is generated every year, only 17% of which is recycled7. The value of raw materials in this unprocessed waste flow is in excess of USD 63 billion and growing yearly8.

Materials and waste – a lost opportunity

Recycling offers an environmental and economic opportunity that challenges conventional models of production

Source: LOIM estimates, Global e-Sustainability Initiative, Dell, The Verge

While improvements in waste management are often thought of as a net cost, taking full account of the negative externalities of pollution, including carbon pricing, radically shifts the economics of waste management.

Investable opportunities

The transition to zero waste requires action across every stage of a product’s value chain. This ranges from the re-thinking of the way we consume, by replacing products with superior alternatives or a service; limiting the use of raw materials; extending a product’s economic life; to the provision of appropriate collection and recycling systems at the end of a product lifecycle. In our view, there are multiple investable opportunities as a result of the transition to zero waste including:

-

E-commerce and online marketplaces are mainstreaming the ability to re-sell items, promoting the ability to re-use products and extend their useful economic life. Re-use of products is an important element in the hierarchy of strategies aimed at reducing waste and is preferable to recycling.

-

Off-price retailers offer out-of-season, surplus or second-hand goods, generally at discount prices. In the fashion industry, known for high inventory turnover and wastage of surplus stock, such retailers can increase the percentage of manufactured products that are sold or re-sold.

-

Repair services are emerging as calls for more modular, repairable forms of consumer products have resulted in the “right-to-repair” becoming legally recognised in some areas, such as the EU. Services range from domestic repairs, to companies specialising in the repair and maintenance of industrial equipment or the servicing of equipment produced by allied manufacturers.

-

Best-in-class warranties are being offered by some leading providers of consumer products that are intended to be more durable. Such longer-lived products offer brand recognition for higher-value, higher-quality products and stand in contrast to business strategies built around “planned obsolescence” and the rapid turnover of consumer goods.

-

“Waste and recycling” covers the collection, recycling and recovery stages at the end of a product’s life to process whichever forms of waste, that cannot be avoided, through smarter products or their re-use and repair. Recycling ensures a second economic life for individual components or the materials they are comprised off and maximises value addition of these natural resources.

Our economy must transition to a more Circular, Lean, Inclusive and Clean (CLIC™) model. Transitioning to a more circular bio-economy could unlock trillions in untapped value. Natural capital is an extraordinarily productive asset and we must harness its power and preserve its regenerative capacity. By analysing the exposure of business models to an economy transitioning to zero waste, we believe we can identify those companies best able to outperform and unlock the potential of the CLIC™ economy, as well as supporting the drive for a more sustainable world.

sources.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.