investment viewpoints

China's crackdown: a credit perspective

An overarching regulatory crackdown across various sectors in China reflects the authorities and China Communist Party (CCP) promoting two long-term goals, in our view. These social and demographic objectives seek to:

- Reduce social inequality and curtail some of the extreme wealth disparities accumulated over the last two decades of growth

- Expand the labour force demographic over the coming decades

We frame these two aims in the context of the country’s ageing population, and explore how developments in education, property and technology could impact fixed income investments. Rather than reflecting an uncoordinated series of crackdowns, we see the latest measures as being fully aligned with the 14th Five-Year Plan. While causing severe turmoil in the near-term, the measures have the potential to entrench longer-term stability in society, and create what the CCP deems a fairer society that is more sustainable. We believe that it is important to acknowledge that China’s version of capitalism and opening up of capital markets will look very different to the models in the West.

What are the authorities’ focus?

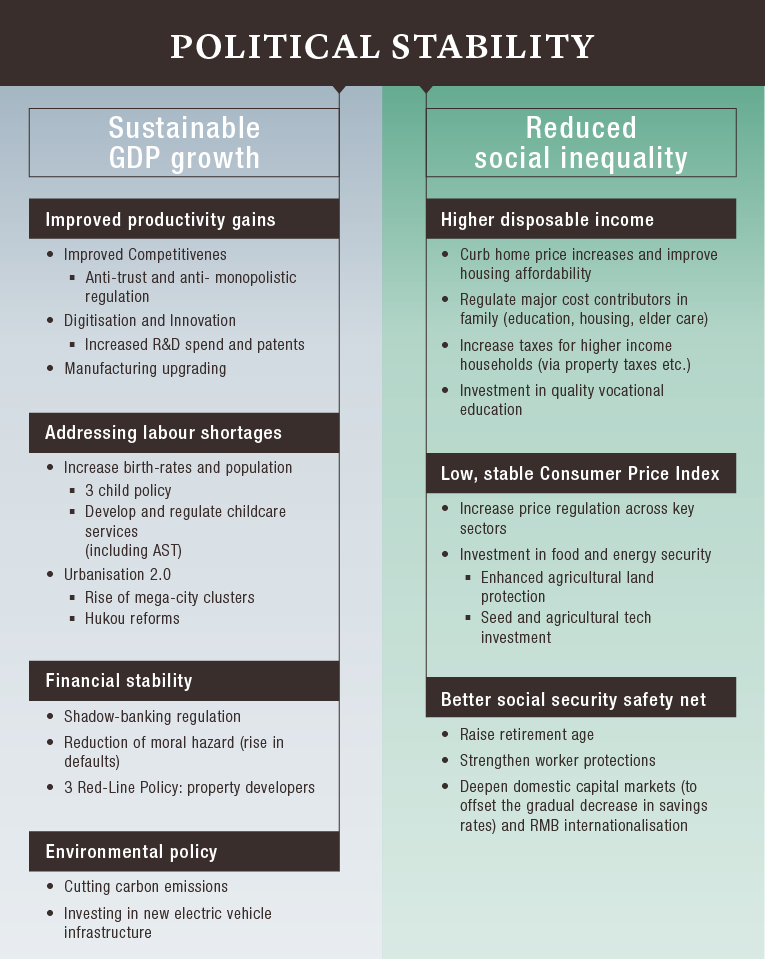

Much has been made of the recent changes in regulation due to their scope and breadth. What are the Chinese authorities’ priorities, and how do they fit into the regulatory environment this year? We illustrate our understanding in figure 1.

Figure 1: LOIM’s understanding of the Chinese authorities’ priorities

Source: LOIM. AST stands for after school tutoring. Hukou refers to China’s system of household registration.

These priorities continue to be addressed by recent regulations covering the education, technology and property sectors. We consider the impact for fixed income investors.

Education: little debt means no credit upset

In the education sector, the State Council has taken a range of measures that include: requiring after school tutoring to be registered as a non-profit institution and banning foreign firms from acquiring or holding shares in ASTs using variable interest entities, M&A franchising or custodians. We expect the largest players in this sector to bear substantial negative impact, and while they may re-orient their activities, we see them operating from a much-reduced revenue base.

The greatest impact will be on equity investors. There is little outstanding debt in this sector, therefore we do not see the measures de-stabilising Asia fixed income markets.

Technology: large cap companies could emerge as winners

Heightened regulatory focus in technology has included greater adherence to anti-monopoly law, protection of users and data safeguarding, and regulation of FinTech. We believe China intends to regulate so-called “new economy” businesses more appropriately, rather than force companies out of business or into bankruptcy. Ultimately, these clampdowns will challenge high valuations from an equity perspective by dimming growth prospects and potentially stunting earnings growth. That said, leading technology firms will undoubtedly continue to benefit from the long-term trend of top-line revenue and increasing market size.

From a credit perspective, such developments can actually be positive as technology leaders lower their growth trajectories and become more cash-flow generating with lower capex needs. Still, the impact may vary on a case-by-case basis.

We believe well-established, large cap companies will emerge as winners of the current downtrend and there should be no credit or ratings impact. We advocate adopting a more differentiated approach in this sector. For instance, technology companies with significant exposure to hardware will be minimally impacted and face less regulatory risk, whereas companies with substantial exposure to software and consumer-related sectors face greater regulatory scrutiny.

Benchmark technology companies with large issuance in USD bond markets generally have low leverage or are in a net cash position. Despite greater regulatory scrutiny, including anti-monopolistic curbs, we believe the companies will continue to maintain their sound fundamentals over the coming years. This is especially the case given their strong, cash flow positive position in previous years for most of the benchmark credits.

Property: transition to sustainable growth

China’s property market has gone through periods of rapid growth over the past 5-8 years, and the authorities have attempted to cool the red-hot market by trying to dampen demand.

We believe 2021 will be a pivotal year for the sector as it transitions from two decades of rapid expansion to a period of sustainable growth. As such, the nationwide contracted sales growth is likely to slow down, even though the first five months of data still showed strong growth. This strong growth was largely due to lower base evident in 2020, as well as front-loaded activity by developers, as they fear a potential slowdown in the market in the later part of the year.

In the tightening credit environment, China property developers are likely to focus on improving their balance sheets. As a result, we expect balance sheets to improve through debt reduction in an environment where operating margins are likely to gradually contract.

In general, we expect most property developers under our coverage will likely:

- Slow down land acquisition (especially through public land auctions)

- Accelerate cash collection through fast turnover (maybe with some discount in order to facilitate fast sales)

- Actively manage their liquidity needs and reduce debt (or stabilise their borrowing at the current level)

However, on the flipside, we would expect margin contraction to continue in the next 12-18 months (given higher land and commodity prices, and labour costs, among other rising expenses).

Given this backdrop, the risk of an ‘accident’ in the property sector is reasonably high and therefore market jitters persist. Ultimately, it is difficult to overstate the importance of China’s real-estate sector: it has directly contributed between 8-10% of GDP over the past few years. However, together with upstream industries, such as steel and cement, and downstream businesses, such as furniture, renovations and buildings maintenance, the total contribution to GDP is estimated to be as high as 30%. We think it is highly unlikely for the sector to be de-stabilised by policy moves on the whole, given the crucial role property plays in China’s social and economic stability1.

For a complete analysis and to read the full paper, please click on the download button above.

sources

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved