investment viewpoints

The butterfly economy and its investment potential

The importance of Natural Capital within the circular economy creates a ‘powerful force’. Portfolio Manager, Alina Donets, discusses this theme and why it is a long-term investment opportunity.

1. What is natural capital and why is it important to the global economy?

Nature is the most productive asset of our economy. More than 50% of global GDP currently depends on nature. Natural capital includes all the renewable and non-renewable resources in our biosphere, including clean air and water, fertile soils and sediments, biodiversity, and finite mineral resources. Nature also provides enabling and protective services (like pollination and air filtration) that support economic processes and prevent disruption from climate change, storms, erosion, and disease. We are extracting crazy amounts of material and overexploiting nature. At the same time we are not fully harnessing the regenerative power of nature. As a result, the value of nature is declining, threatening our economies and ability to sustain the same kind of returns in the future.

2. Why does natural capital sit at the heart of the supply chains of major global sectors, and how does the degradation of nature put some of these industries at risk?

We rely on nature directly and indirectly across multiple industries.

For instance, the USD 5 trillion agricultural industry depends as much on rapidly-degrading soils, just as the forestry industry depends on forests, which are shrinking. Within the pharmaceutical industry, two-thirds of newly-developed drugs are based on or inspired by natural products. Meanwhile, the non-material value of nature supports much of the USD 9 trillion tourism industry and can account for as much as 20% of local property prices.

Unfortunately, present levels of raw material usage and consequences of human and economic activity are unsustainable and contribute to ecosystem degradation. Resulting issues like water stress or chemical pollution create substantial economic, social and environmental damage across all levels of human life.

Nature is the most productive asset of our economy - more than 50% of global GDP currently depends on nature

3. How does natural capital fit into the circular economy, and why is it a standalone investment theme, rather than part of a broader sustainability investment strategy?

At Lombard Odier, we believe that the world is embarking on a necessary transition to a Circular, Lean, Inclusive and Clean (CLIC™) economy. While the CLIC™ economy encapsulates the move to a net zero emissions economy in a fair and inclusive manner, it is first and foremost built on natural capital. The transition to a more bio-friendly CLIC™ economy is happening now and it is accelerating. Natural capital will be its most vital foundation. Global businesses are already recognising the need for transformation toward Circular and Lean operating models. Such companies tackling the challenges linked to the circular bio-economy and leaner forms of industry can now be found in listed equity markets. And just as their privately owned peers, they are seeking capital to continue innovating and building solutions. The profound metamorphosis of our linear economic framework into a new circular model is first and foremost driven by value creation and superior economics

Our Natural Capital strategy is highly complementary with our existing Climate Transition strategy. The transition to the “butterfly”, circular bio-economy and net zero economy are mutually reinforcing. To achieve the net zero economy, we must first transition to a more bio-aligned economy.

Sources: 1 The current targets of the CBD (Convention on Biological Biodiversity) are the Aichi targets, which will end in 2020. 2 Task Force for Nature-related Financial disclosures. For illustrative purposes only. 3 Ellen Macarthur foundation, Towards the circular economy (2013). 4 2DS Smith (2019). 5 Nielsen. 6 PwC, Nature is to big to Fail (2020).

4. Lombard Odier’s Natural Capital investment strategy combines opportunities in the transition to a leaner form of industry and investment in the bio-circular economy. Can you just explain those two elements in more detail?

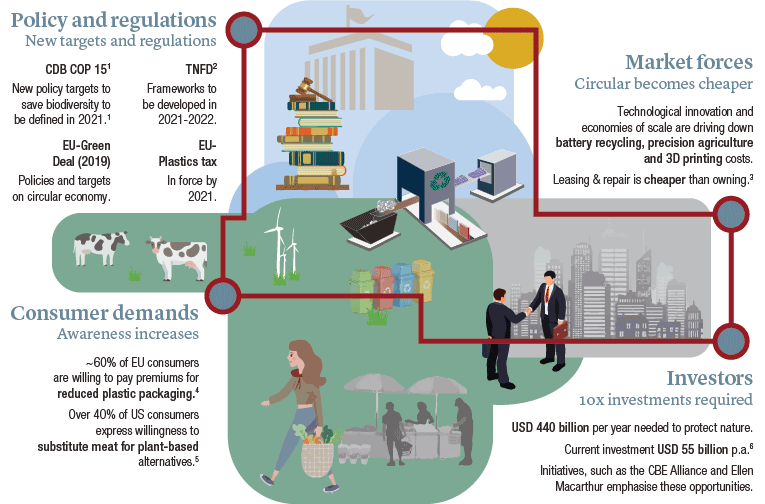

Powerful forces are now pushing for this outdated linear model to evolve into a new circular economy. Policy support for nature is accelerating globally, and technology costs are falling, enabling increased investment opportunities. Consumers are also pushing for natural preservation. These forces are propelling this new economic model that prospers in harmony with nature.

Harnessing the power of nature means shifting more of our economy into the bio-based economy which is more efficient and circular. This is about greater reliance on bio-materials and increase take-up of nature-based materials across many more industries. It is also about the using waste as resource, about bioenergy, and a variety of regenerative farming, forestry and fishery practices

Preserving nature also means shifting towards greater circularity in the areas of production and consumption where substitution with bio-economy is not yet possible, as well as eliminating waste in our industrial activities. This about creating a much leaner form of industry, or in other words about more efficient use of our resources, a shift in our consumption model and about zero waste strategies.

Preserving nature also means shifting towards greater circularity in the areas of production and consumption where substitution with bio-economy is not yet possible, as well as eliminating waste in our industrial activities

5. At the heart of this strategy there are 4 revolutions going on. What are the four and why are they important?

The Natural Capital Investment strategy is a global equity strategy, also inspired by His Royal Highness the Prince of Wales’ vision of the Circular Bioeconomy and developed in partnership with HRH’s Circular Bioeconomy Alliance. The Narrative of the strategy and the targeted key sectors are based on the 10-point action plan for a Circular Bioeconomy coordinated by Marc Palahí.

We have identified four key revolutions that also form the basis for investible themes: Circular bio-economy which unlocks innovation across water, food solutions and materials, harnessing the regenerative features of nature; Resources efficiency that targets leaner forms of production through dematerialization and materials performance; Outcome-oriented approach to consumption; and Zero waste world.

The strategy is focused on identifying companies that are already profitable and well positioned to take advantage of these four unstoppable growth opportunities.

6. Is it possible to create a truly global portfolio of companies which can benefit from these opportunities?

Natural Capital is equally important to people and business regardless of their geographic location, and unfortunately it has been equally indiscriminately endangered worldwide. Especially as global supply chains today are tightly interlinked, many companies globally are already taking steps to transition to leaner business models. This opens opportunities globally for the solution providers that would enable such transition.

Equally, technological advances now allow companies to leverage the self-regenerative features of nature to create new solutions that can build the foundation of the bio-economy, which has a potential to create positive externalities. Such innovation is also not constrained geographically, and often benefits from cross-border collaborations and information flows.

We have already identified over 550 companies globally that partake in this key revolution on both ends of the butterfly model: transition to lean industries and the bio-economy. And we expect this number to grow in the future.

Many companies globally are already taking steps to transition to leaner business models

7. How does the investment process work?

The four key revolutions across Circular Bio-economy, Resource Efficiency, Eco-Awareness and Zero Waste serve as the foundation for defining the scope of the strategy's focus. The Sustainability team has performed extensive work to identify the business activities that operate in, and enable these four revolutions. The Equity research platform then pinpointed the exact list of companies operating in these businesses that also have to constitute at least 30% of the economic activity for a company. The team uses a combination of algorithmic and fundamental research to come to the investable universe of over 550 companies, focused on small to mid-cap companies globally.

After this, the portfolio manager identify the companies with potential for superior growth profiles and excess economic returns, combined with solid ESG credentials including assessment of any controversies. The result is 40-50 stock high conviction portfolio, with good diversification and focus on high quality companies.

8. Why do you believe a focussed, high conviction strategy of 40-50 positions is appropriate; does this not create a higher risk approach?

We believe around 50 companies is an optimal size of a high conviction but well balanced portfolio. A concentrated strategy allows us to leverage the internal expertise around Natural Capital developed across the Sustainability team, and effectively reflect it in the long term financial performance of the strategy with the support of the fundamental Equity and portfolio management teams. All that while still maintaining a well-diversified portfolio.

The bio-economy is potentially a more important, and an under-explored part of the next economic revolution

9. How does this strategy correlate with other sustainable investment strategies?

There is an increasing attention on and appreciation of the importance of the circular economy, leading to launches of investment strategies focused on the circularity. However, we believe this focus is not recognising the full scope of the transition that is underway. Circularity only addresses the right wing of the “butterfly” model1, essentially helping to reduce the waste of resources to alleviate the pressure on natural capital. The bio-economy is potentially a more important, and an under-explored part of the next economic revolution. We believe that our strategy is the first of its kind, effectively capturing both sides of the butterfly model, and really investing across the full scope of the natural capital revolution.

10. Why is the ‘take-make waste model transition to a sustainable bio-based economy’ a multi-year investment opportunity rather than just a reaction to Covid-19?

The key aspects that are driving the revolution toward a bio-economy are not dependent on the pandemic behaviour and outcome. The environmental advantages and economic efficiency of the bio-economy and resource efficiency are proven and create a strong basis for evolution toward it. In fact, COVID-19 may serve as a reminder of the dangers of being misaligned with nature. The pandemic-related restriction on human and economic activity served as a good reminder just how severe our intrusion to nature is when the economy is left uncontrolled. Equally, the zoonotic nature of COVID-19 reminded us of the dangers of distorted ecosystems on human lives. The pandemic is thus a reminder of urgency, and just one supportive event along the way.

source.

important information.

FOR PROFESSIONAL INVESTOR USE ONLY

This marketing document is issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services

Lombard Odier Investment Managers (“LOIM”) is a trade name.

The Fund is authorised and regulated by the Luxembourg Supervisory Authority of the Financial Sector (CSSF) as a UCITS within the meaning of EU Directive 2009/65/EC, as amended. The management company of the Fund is Lombard Odier Funds (Europe) S.A. (hereinafter the “Management Company”), a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, L-1150 Luxembourg, authorized and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended. The Fund is only registered for public offering in certain jurisdictions. . The articles of association, the prospectus, the Key Investor Information Document, the subscription form and the most recent annual and semi-annual reports are the only official offering documents of the Fund’s shares (the “Offering Documents”). They are available on http//:www.loim.com or can be requested free of charge at the registered office of the Fund or of the Management Company, from the distributors of the Fund or from the local representatives as mentioned below.

Austria. Supervisory Authority: Finanzmarktaufsicht (FMA), Representative: Erste Bank der österreichischen Sparkassen AG, Am Belvedere 1, 1100 Vienna - Belgium. Financial services Provider: CACEIS Belgium S.A., Avenue du Port 86C, b320, 1000 Brussels - France. Supervisory Authority: Autorité des marchés financiers (AMF), Representative: CACEIS Bank, place Valhubert 1-3, F-75013 Paris - Germany. Supervisory Authority: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), Representative: DekaBank Deutsche Girozentrale, Mainzer Landstraße 16, D-60325 Frankfurt am Main - Gibraltar. Supervisory Authority: Gibraltar Financial Services Commission (GFSC), Information agent: Lombard Odier & Cie (Gibraltar) Limited, Suite 921 Europort - Greece. Supervisory Authority: Hellenic Capital Market Commission. Paying agent: PIRAEUS BANK S.A., 4, Amerikis Str., 105 64, Athens - Italy. Supervisory Authority: Banca d’Italia (BOI) / ConSob, Paying Agents: Société Générale Securities Services S.p.A., Via Benigno Crespi, 19/A - MAC 2, 20159 Milano, State Street Bank International GmbH - Succursale Italia, Via Ferrante Aporti, 10, 20125 Milano, Banca Sella Holding S.p.A., Piazza Gaudenzio Sella, 1, 13900 Biella, Allfunds Bank S.A.U., Milan Branch,Via Bocchetto 6, 20123 Milano, BNP Paribas Securities Services, With its registered office in Paris, rue d'Antin, 3, and operating via its Milan subsidiary at Piazza Lina Bo Bardi, 3, 20124 Milan - Liechtenstein. Supervisory Authority: Finanzmarktaufsicht Liechtenstein (“FMA”), Representative, LGT Bank AG Herrengasse 12, 9490 Vaduz - Netherlands. Supervisory Authority: Autoriteit Financiële Markten (AFM). Representative: Lombard Odier Funds (Europe) S.A. – Dutch Branch, Gustav Mahlerlaan, 1081 LA Amsterdam - Spain. Supervisory Authority: Comisión Nacional del Mercado de Valores (CNMV), Representative: Allfunds Bank, S.A.U. C/ de los Padres Dominicos, 7, 28050, Madrid – Sweden. Supervisory Authoriy: Finans Inspektionen (FI). Representative: SKANDINAVISKA ENSKILDA BANKEN AB (publ), Kungsträdgårdsgatan, SE-106 40 Stockholm – Switzerland. Supervisory Authority: FINMA (Autorité fédérale de surveillance des marchés financiers), Representative: Lombard Odier Asset Management (Switzerland) SA, 6 av. des Morgines, 1213 Petit-Lancy; Paying agent: Bank Lombard Odier & Co Ltd, 11 rue de la Corraterie, CH-1204 Geneva. UK. Supervisory Authority: Financial Conduct Authority (FCA), Representative: Lombard Odier Asset Management (Europe) Limited, Queensberry House, 3 Old Burlington Street, London W1S3AB,

NOTICE TO RESIDENTS OF THE UNITED KINGDOM The Fund is a Recognised Scheme in the United Kingdom under the Financial Services & Markets Act 2000. Potential investors in the United Kingdom are advised that none of the protections afforded by the United Kingdom regulatory system will apply to an investment in LO Funds and that compensation will not generally be available under the Financial Services Compensation Scheme. This document does not itself constitute an offer to provide discretionary or non-discretionary investment management or advisory services, otherwise than pursuant to an agreement in compliance with applicable laws, rules and regulations.

Singapore: This marketing communication has been approved for use by Lombard Odier (Singapore) Ltd for the general information of accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the Securities and Futures Act (Chapter 289). Recipients in Singapore should contact Lombard Odier (Singapore) Ltd, an exempt financial adviser under the Financial Advisers Act (Chapter 110) and a merchant bank regulated and supervised by the Monetary Authority of Singapore, in respect of any matters arising from, or in connection with this marketing communication. The recipients of this marketing communication represent and warrant that they are accredited investors and other persons as defined in the Securities and Futures Act (Chapter 289). This advertisement has not been reviewed by the Monetary Authority of Singapore.

Hong Kong: This marketing communication has been approved for use by Lombard Odier (Hong Kong) Limited, a licensed entity regulated and supervised by the Securities and Futures Commission in Hong Kong for the general information of professional investors and other persons in accordance with the Securities and Futures Ordinance (Chapter 571) of the laws of Hong Kong.

An investment in the Fund is not suitable for all investors. There can be no assurance that the Fund's investment objective will be achieved or that there will be a return on capital. Past or estimated performance is not necessarily indicative of future results and no assurance can be made that profits will be achieved or that substantial losses will not be incurred. Where the fund is denominated in a currency other than an investor's base currency, changes in the rate of exchange may have an adverse effect on price and income. All performance figures reflect the reinvestment of interest and dividends and do not take account the commissions and costs incurred on the issue and redemption of shares/units; performance figures are estimated and unaudited. Net performance shows the performance net of fees and expenses for the relevant fund/share class over the reference period. This document does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before making an investment in the Fund, an investor should read the entire Offering Documents, and in particular the risk factors pertaining to an investment in the Fund, consider carefully the suitability of such investment to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This document contains the opinions of LOIM, as at the date of issue. The information and analysis contained herein are based on sources believed to be reliable. However, LOIM does not guarantee the timeliness, accuracy, or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice.. Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Important information on portfolio composition

The portfolio information provided in this document is for illustrative purposes only and does not purport to be a recommendation of an investment in, or a comprehensive statement of all of the factors or considerations which may be relevant to an investment in, the referenced securities. They illustrate the investment process undertaken by the manager in respect of a certain type of investment, but may not be representative of the Fund's past or future portfolio of investments as a whole and it should be understood that they will not of themselves be sufficient to give a clear and balanced view of the investment process undertaken by the manager or of the composition of the investment portfolio of the Fund. As the case may be, further information regarding the calculation methodology and the contribution of each holding in the representative account to the overall account’s performance can be obtained by the Fund or the Management Company.

The strategy may include the use of derivatives. Derivatives often involve a high degree of financial risk because a relatively small movement in the price of the underlying security or benchmark may result in a disproportionately large movement in the price of the derivative and are not suitable for all investors. No representation regarding the suitability of these instruments and strategies for a particular investor is made.

Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks including, but not limited to, currency fluctuations and political instability.

Because of the smaller number of stocks held in the portfolio, the Fund may be subject to greater risks than a more diversified fund. A change in value of any single holding may affect the overall value of the portfolio more than it would affect a diversified fund that holds more investments.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

©2020 Lombard Odier IM. All rights reserved