investment viewpoints

How carbon-intensive industries can be brought into the fight against climate change

To meet the goals of the Paris Agreement, deep cuts in emissions will be required, over a short amount of time. To provide a reasonable chance of limiting global warming to 1.5°C, as per the highest ambition of the Paris Agreement, greenhouse gas (GHG) emissions would need to fall to 25 Gt CO2e by 2030, representing a 55% decrease from 2018 levels1. By 2050, carbon emissions would need to reach net zero, with GHG emissions reaching that same level no more than a decade later.

Albeit reducing emissions will be challenging to some industries, at Lombard Odier we believe that for the best-positioned companies within high-carbon, transitioning industries, the transition will create additional competitive opportunities and generate attractive investment returns.

Achieving this goal will require a monumental effort, and will depend on concerted action across all industries. All too often, the focus of decarbonisation has rested on the energy sector and efforts to transition from fossil fuel intensity to renewables. This is a vital effort as part of the transition, but risks obscuring the fact that a transition to cleaner forms of energy alone will not be sufficient to meet climate goals. Instead, the net zero economy will demand additional, deep investment in efficiency, abatement and carbon storage - across industrial, transport, agricultural, energy and other sectors.

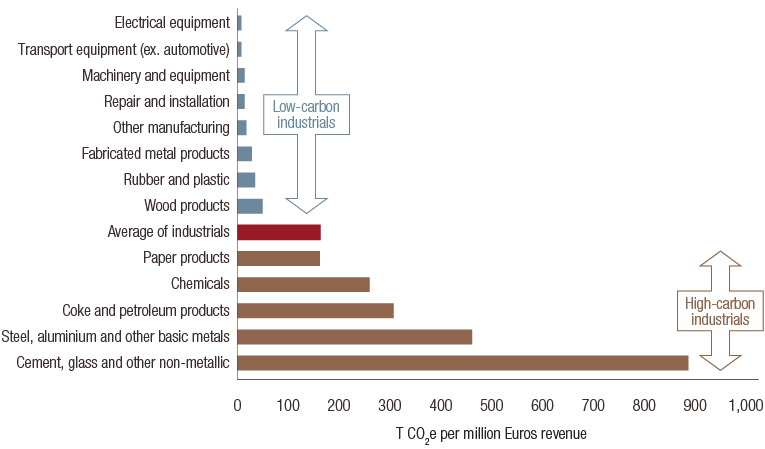

Today, sectors such as transport, iron & steel, cement and chemicals generate a large proportion of emissions. These industries are a mainstay of our economy and are essential as a driver of growth, providing the materials upon which our societies are built, and yet emissions in these industries are difficult to abate. By 2050, we will still need steel, cement, and chemicals. The need for high operating temperatures, unavoidable process emissions that result from physical and chemical reactions and the sunk costs of legacy assets represent difficult obstacles that increase the cost of reducing emissions.

Source: Lombard Odier calculations based on Eurostat (2019).

Industries with high and hard-to-abate emissions are of particular importance to the climate transition, yet they are often ignored by cleantech and low-carbon funds. These invest in poster-child technologies such as renewable energy and electric vehicles, or in low-impact sectors that offer the allure of guilt-free investment. Few of these funds, however, encapsulate the full extent of the climate transition required across all sectors, and fail to offer a satisfying solution to drive forward the revolutions required across these industries.

The Lombard Odier Climate Transition Strategy seeks to fill this gap, representing an investment philosophy that is aligned with a transition to a net-zero economy. This philosophy is in line with the latest recommendations across science, industry and policy, and is underscored by the EU Sustainable Finance Action Plan through the impending EU regulations on Taxonomy and Benchmarks. This taxonomy takes explicit account of some of the sectors most responsible for emissions today, and the activities needed for these sectors to transition to a more sustainable model.

Industries with high and hard-to-abate emissions are of particular importance to the climate transition, yet they are often ignored by cleantech and low-carbon funds.

Moving to a net-zero economy

A number of strategies and solutions may be identified that can support companies in their shift to a net-zero economy, creating energy and cost savings along the way for those that embrace the transition. Aside from the transition to alternative fuels and feedstocks, the International Energy Agency (IEA) estimates that modernising technologies to improve energy efficiency, better use of materials (including recycled materials), and related technologies may reduce emissions by roughly 46% over the coming decades.

Firstly, digitalisation is likely to be a key enabler of leaner forms of manufacturing. Following previous revolutions resulting from the invention of steam, the assembly line, and computing, current trends towards the digitalisation of value chains, products and business models is now often referred to as Industry 4.0. Driven by the advent of artificial intelligence, cloud computing, and big data analytics, a range of new applications is making manufacturing leaner and more efficient, with smaller environmental footprints. Computerised design and 3D printing, for instance, are driving dematerialisation and lightweighting of products, while predictive maintenance helps equipment last longer and the Internet of Things is being employed to reduce supply chain waste.

Secondly, when products do eventually reach the end of their life, increased attention must be paid to waste and recycling processes. The value of materials contained in electronic waste alone is estimated at nearly USD 63 billion, which will increase as the electronics industry continues to expand2. As raw material prices are more volatile today than at any point during the previous century3, such recycling not only decreases environmental footprints, but also serves to mitigate supply chain risks.

Thirdly, of particular importance to the industrial sector is the deployment of carbon capture, utilisation and storage (CCUS) technologies. Considered one of the most cost-effective solutions available to reduce emissions, the technology can also be retrofitted to existing plants, which is of particular relevance given the 50+ year lifespan of most industrial plants. CCUS plants are estimated by the IEA to have the potential to account for 24% of total emission reductions over the period to 2060, accounting for the capture of 28 GtCO2, and reducing overall emissions in the sector by a further 14%4.

Critically, these kind of solutions do not merely offer avenues towards reducing the environmental footprint of hard-to-abate industries, but also offer companies the means to increase their competitive edge, and grow their market share. In an increasingly carbon-constrained world, downstream businesses and consumers will be looking to reduce their carbon footprint. On average, emissions in a company’s supply chain outweigh those of its own operations by a factor of four5, creating strong incentives to switch to products offered by suppliers with smaller footprints and more forward-thinking environmental policies. Investing in abatement, thereby, provides market advantage.

For these reasons, when defining the universe of potential investment opportunities for our Climate Transition Strategy we do not shy away from these hard-to-abate sectors, as many others do. Instead, we set out to identify those players that can drive the transition and grow from it, due to their ability to thrive in a climate-constrained world.

Please click here to read the full report.

sources.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.