multi-asset

When will a recession come to our shores?

In the latest instalment of Simply put, we break down the signals from our nowcasting indicators in a bid to determine whether a recession is forthcoming and what the timing of this might be.

|

Need to know

|

|---|

Regular readers of this column will surely have noticed the evolution of our nowcasting indicators: growth is high and flat, while inflation remains high but has declined significantly, primarily in the US. This means that apart from in Europe, the burning question no longer centres inflation but the potential for an upcoming recession. Central banks, such as the Federal Reserve (Fed), have never previously been in the position of having to slow down inflation without creating a period of recession and it is hard to imagine that today could be any different. Therefore, if central banks are serious about taming inflation, they should expect to trigger a mild recession at the very least. The market has recently shown signs of having this conviction. So we return the question of when this recession could happen? Our nowcasting indicators are providing the following three hints on this topic.

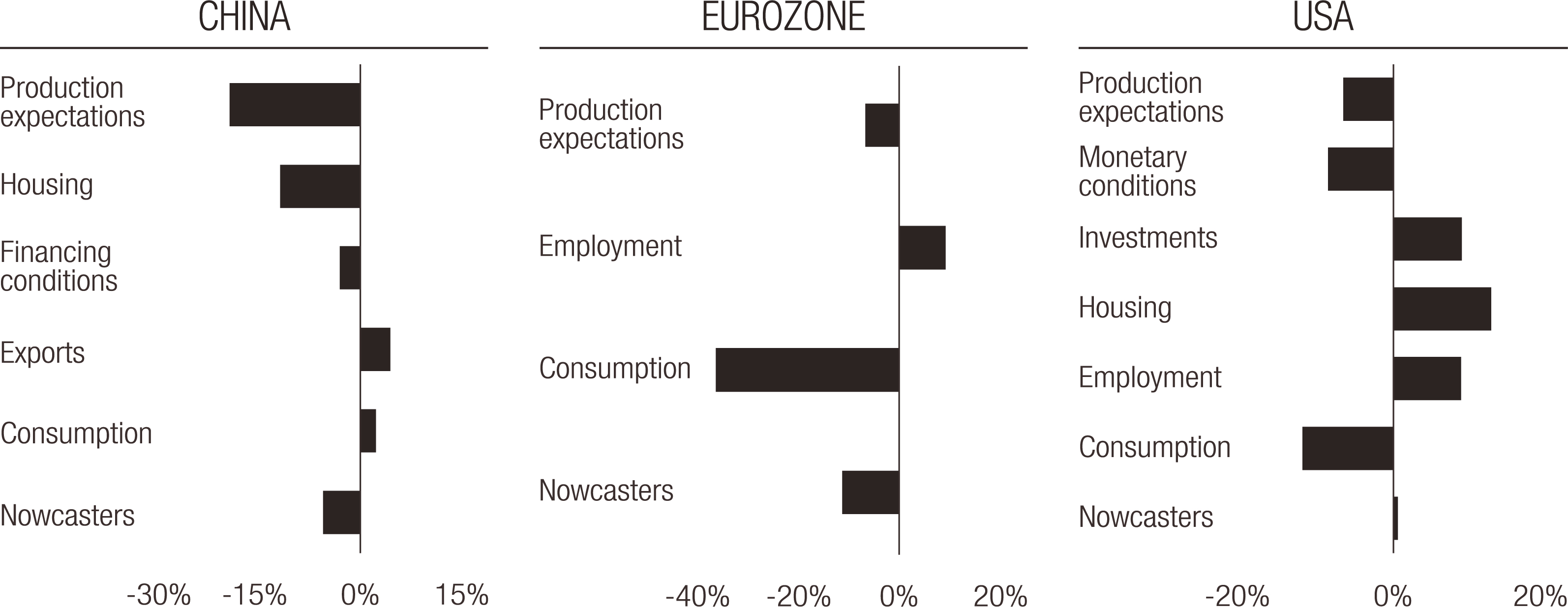

1: Nowcaster components. Our growth nowcasters have declined across the board. Looking at the detail of this decline helps us better understand the nature of this dynamic and whether the drop poses a genuine threat to growth. Chart 1 shows the year-to-date variation across all the components that comprise our China, US and Eurozone growth nowcasters. Focusing on commonalities, consumption in the US and the Eurozone shows the largest decline across all components. This is bad news. Additionally, monetary conditions have deteriorated in the US – not a surprise given the Fed’s current policy. Finally, production expectations have declined in the US, Eurozone and China. That “animal spirit” element of our macro indicators can highlight a deterioration in the sentiment of purchasing managers, which has already happened among consumers. In contrast to these negative indicators, both in the US and in the Eurozone, employment data has been improving in recent months. This is an important message that markets need to hear: the job market is far from emitting recession-consistent signals and we would need to see a decline in this dynamic before we can really expect a recession to commence. In a nutshell: our growth nowcasters have deteriorated, but this is essentially at the consumption end, while the dynamism of the job market rules out an imminent recession.

Chart 1. Year-to-date change in the LOIM Nowcasting indicators

Source: Bloomberg, LOIM

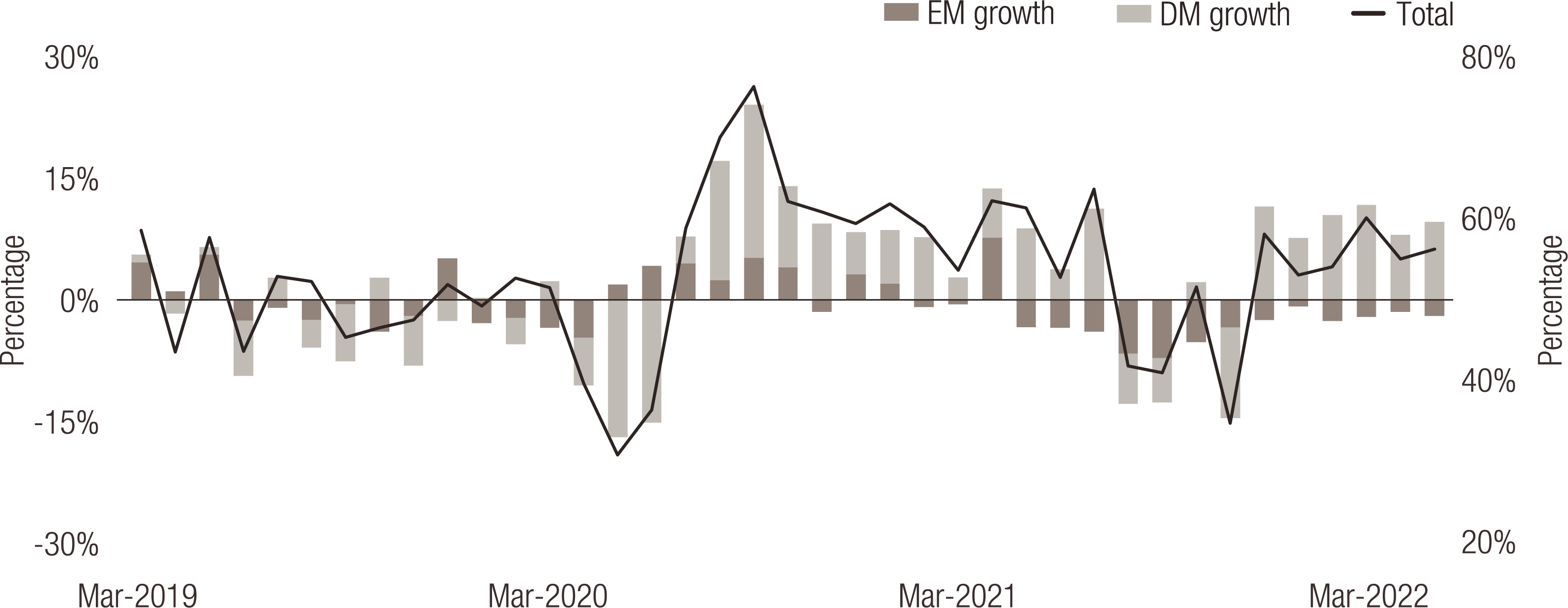

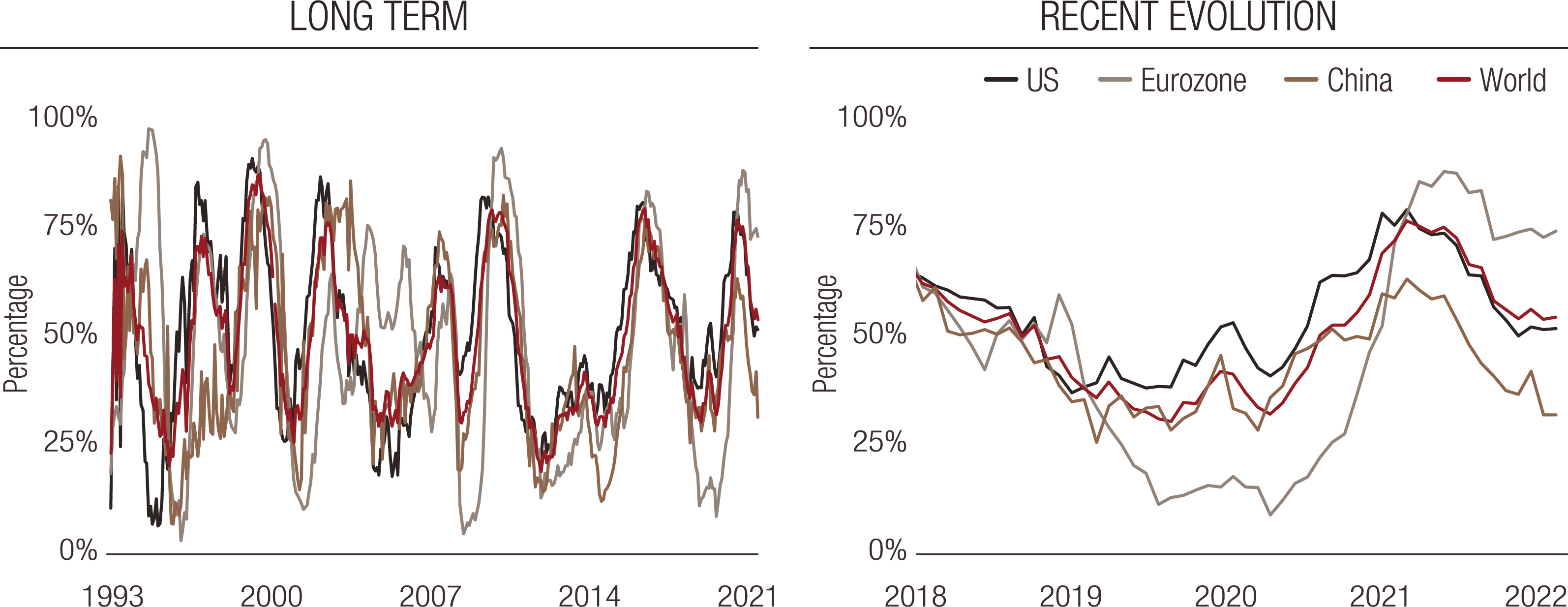

2: Diffusion indices. An important signal when tracking a turn in the macro cycle is the cross-sectional evolution of a large number of growth-related time series. Our “diffusion index” is calculated from the average number of improving time series in the time used to compute our nowcasting indicators. Chart 2 shows the recent evolution of this number, splitting the signal between EM (China) and DM (US and the Eurozone). Since December 2021, the DM diffusion index has steadily remained above the 50% neckline. Notably, the US economy has seen a steady improvement in economic conditions throughout H1 – which is precisely what has given the Fed the confidence to operate its shift in monetary policy despite the commodity shock tied to the Ukraine invasion. From that perspective, a genuine slowdown has not started yet: growth conditions continue to give positive signals and we would need to see a turn in growth’s first derivative before we can start calling a recession.

Chart 2. Recent evolution of the LOIM Growth nowcaster diffusion index

Source: Bloomberg, LOIM

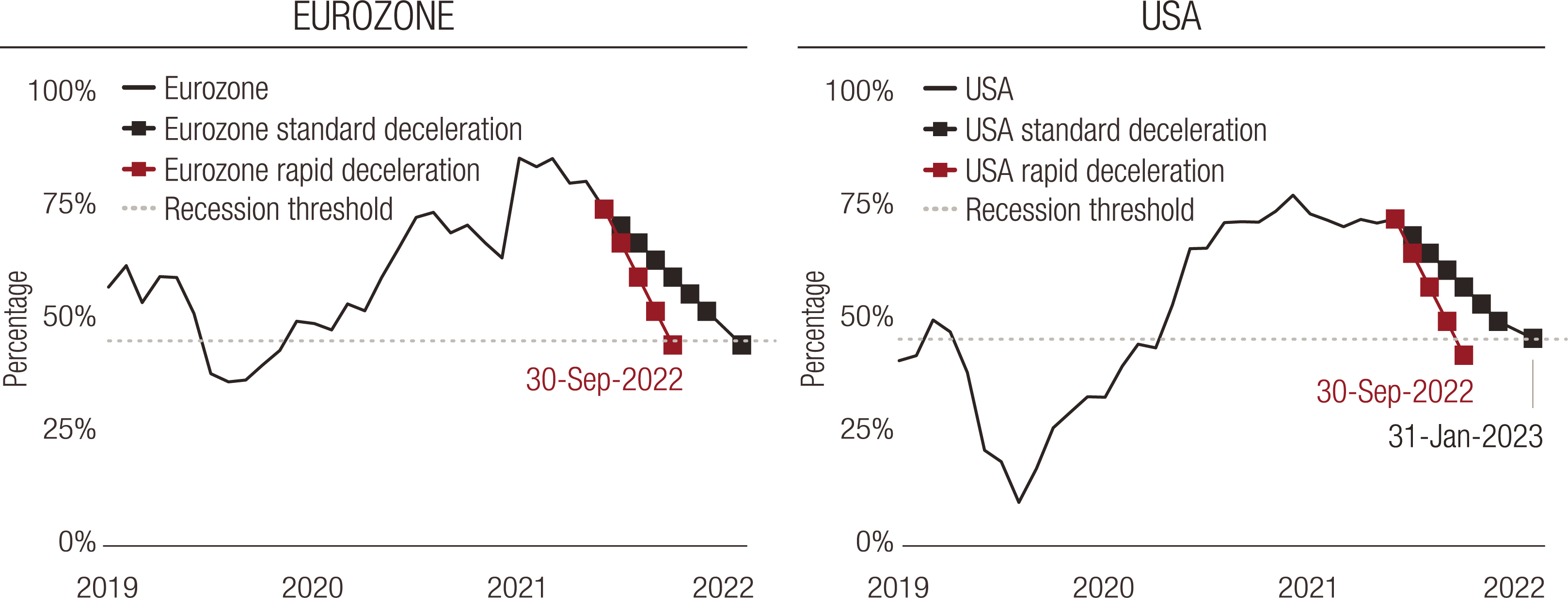

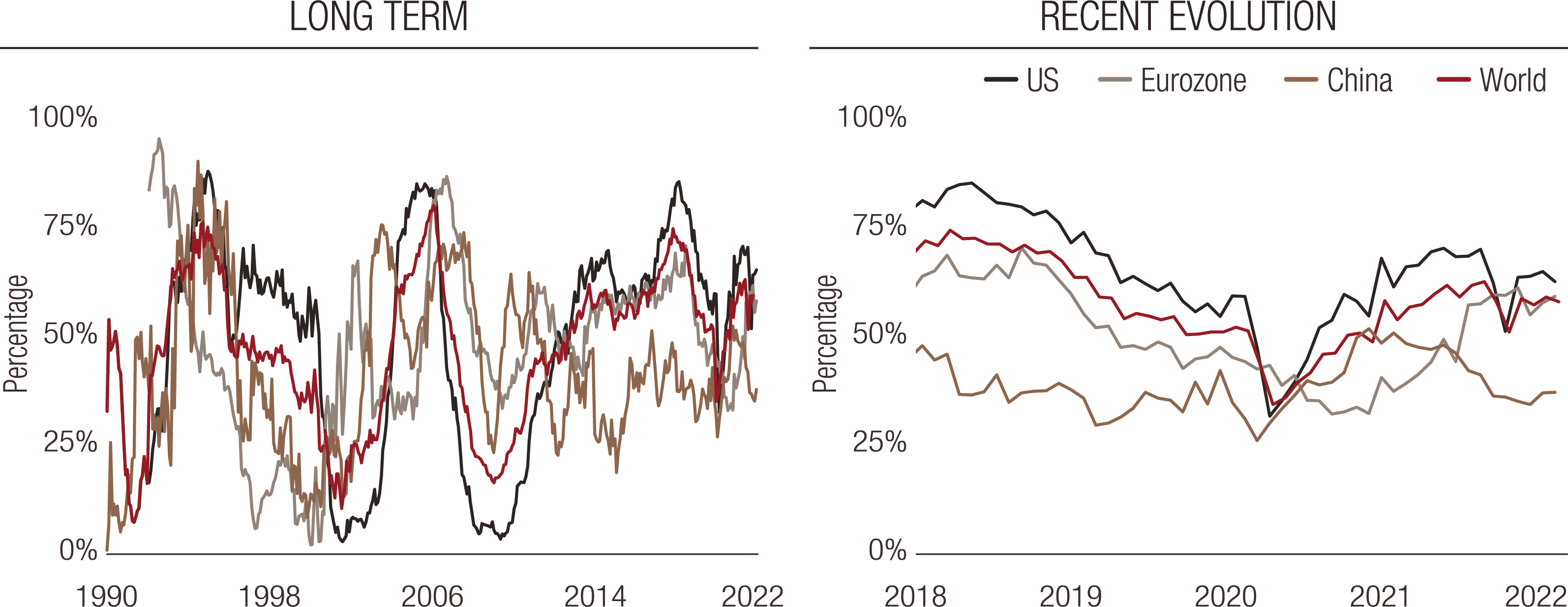

3: Scenario analysis. A final indication comes from examining the pace at which growth indicators decline when a slowdown hits an economy. Such scenario-based analysis provides an intuitive answer regarding how much time the economy has before it enters a recession. Our indicator ranges between 0% (very low growth) and 100% (very high growth). Our calculations show that, on average, it declines by -3.8% per month during a slowdown. Starting from the most recent readings of our Eurozone and US indicators and subtracting the monthly decline usually observed yields the “standard deceleration” scenario presented in Chart 3. Considering the acceleration of the present cycle, we have added a “rapid deceleration” scenario to this analysis during which our indicators decline twice as quickly as the historical pace observed in our sample. Given these scenarios, the question switches to how long will it take for both zones to enter a recession? The answer is presented in chart 3. The earliest point is in September and the latest Q1 2023. This eliminates Q2 and lowers the probability of Q3 being the starting point for a potential recession.

Chart 3.LOIM Growth nowcasters evolution scenario

Source: Bloomberg, LOIM

Our analysis shows that while it is true that markets can look through short-term episodes, it is probably too soon for them to start discounting a recession just yet.

Simply put, a slowdown maybe upon us but it is not yet a recession. This should come later, although its timing will be difficult to ascertain given the ongoing positive macro data.

Macro/Nowcasting Corner

The most recent evolution of our proprietary nowcasting indicators for world growth, world inflation surprises and world monetary policy surprises are designed to keep track of the latest macro drivers making markets tick. Along with it, we wrap up the macro news of the week.

In terms of macro data, the week has seen a handful of publications return a mixed message. In the US, consumption data remains strong. Personal spending notably rose by 0.9% in April (versus 1.1% the month before), with its real component progressing by 0.7% (versus 0.2% the month before, which was finally revised to 0.5%). Spending is roaring in the US. The CFNAI index also points to strong economic activity, with another solidly positive reading for April (0.47, versus 0.44 the month before). On the flip side of the coin, the Richmond Fed survey points to slower economic activity and is at odds with the other Fed surveys. The decline in this survey is consistent with a rapid upcoming economic deceleration. New homes sales have also moderated: 748K new homes were forecast in April, but initial estimates point to 591K, a much lower number. In the Eurozone, the IFO survey – that has declined significantly already – has shown its first signs of a recovery, albeit remaining at very low levels especially in its expectation component. Once again this week has delivered a broadly mixed set of messages from macro indicators.

Factoring in these new data points, our nowcasting indicators currently point to:

- Worldwide growth remaining solid. The US and the Eurozone are still showing high numbers, but these numbers are now clearly declining in the Eurozone.

- Inflation surprises should remain positive, but our signals have shown a recent decline. In the US, this has brought the indicator closer to its neutral zone, as costs and housing data should now translate into lower inflation pressure.

- Monetary policy is set to remain on the hawkish side, mirroring the strength of economic activity. The Fed has again confirmed its hawkish stance – the European Central Bank should be next.

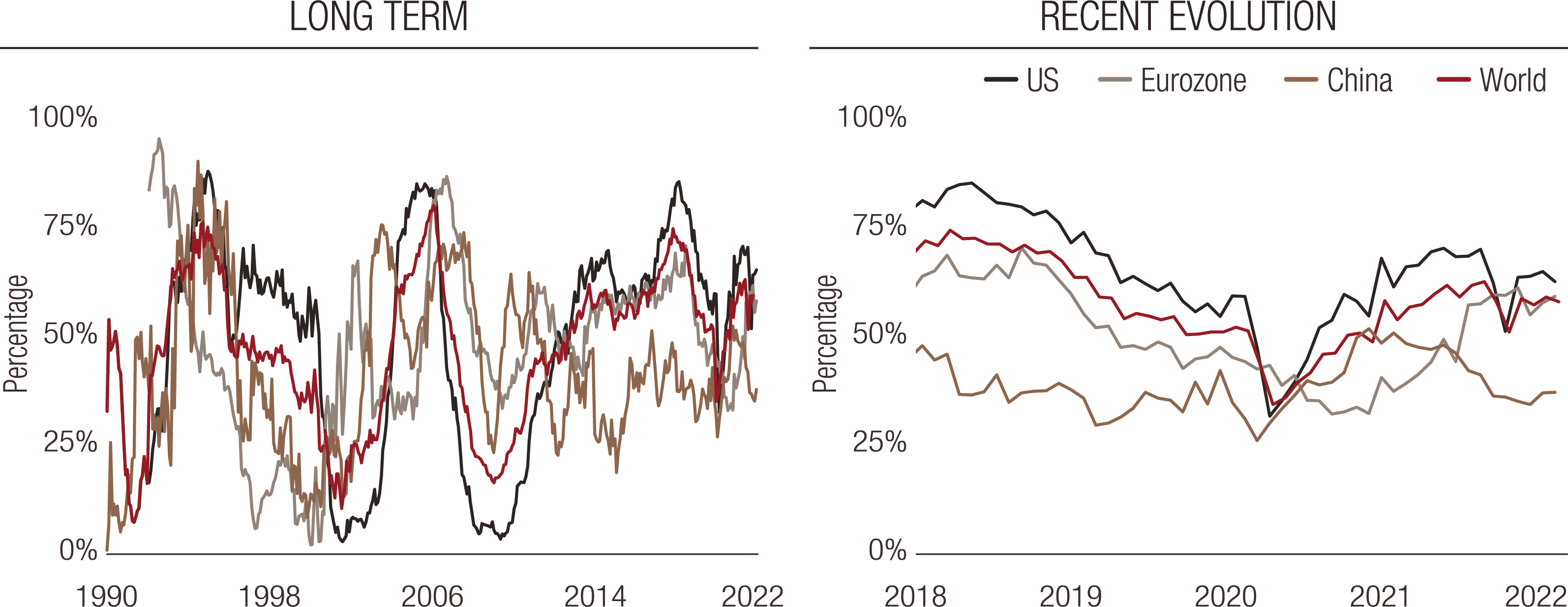

World Growth Nowcaster: Long-Term (left) and Recent Evolution (right)

World Inflation Nowcaster: Long-Term (left) and Recent Evolution (right)

World Monetary Policy Nowcaster: Long-Term (left) and Recent Evolution (right)

Reading note: LOIM’s nowcasting indicator gather economic indicators in a point-in-time manner in order to measure the likelihood of a given macro risk – growth, inflation surprises and monetary policy surprises. The Nowcaster varies between 0% (low growth, low inflation surprises and dovish monetary policy) and 100% (the high growth, high inflation surprises and hawkish monetary policy).

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2022 Lombard Odier IM. All rights reserved.