multi-asset

The start of the ECB’s long journey to counter inflation

In the latest instalment of Simply put, we reflect on the ECB’s recent hawkish shift and consider whether this will clear up some of the economic uncertainty in the Eurozone, as well as how markets may react.

|

Need to know:

|

|---|

It is now official: the European Central Bank (ECB) is fighting inflation. It is joining the side already occupied by the US Federal Reserve (Fed) and several other Anglo-Saxon central banks by saying goodbye to the hypothesis of uncontrollable energy-led inflation and hello to the one of inflation being rooted in strong demand. This latter form of inflation is now a concern for the ECB and on 9 June it started a "hawkish" pivot that we have not seen since Jean-Claude Trichet's failed hike in 2011. Why has the ECB changed its tone now and how does its stance differ from the Fed’s? The following are elements that we believe are key to understanding this turnaround and its consequences in terms of the market.

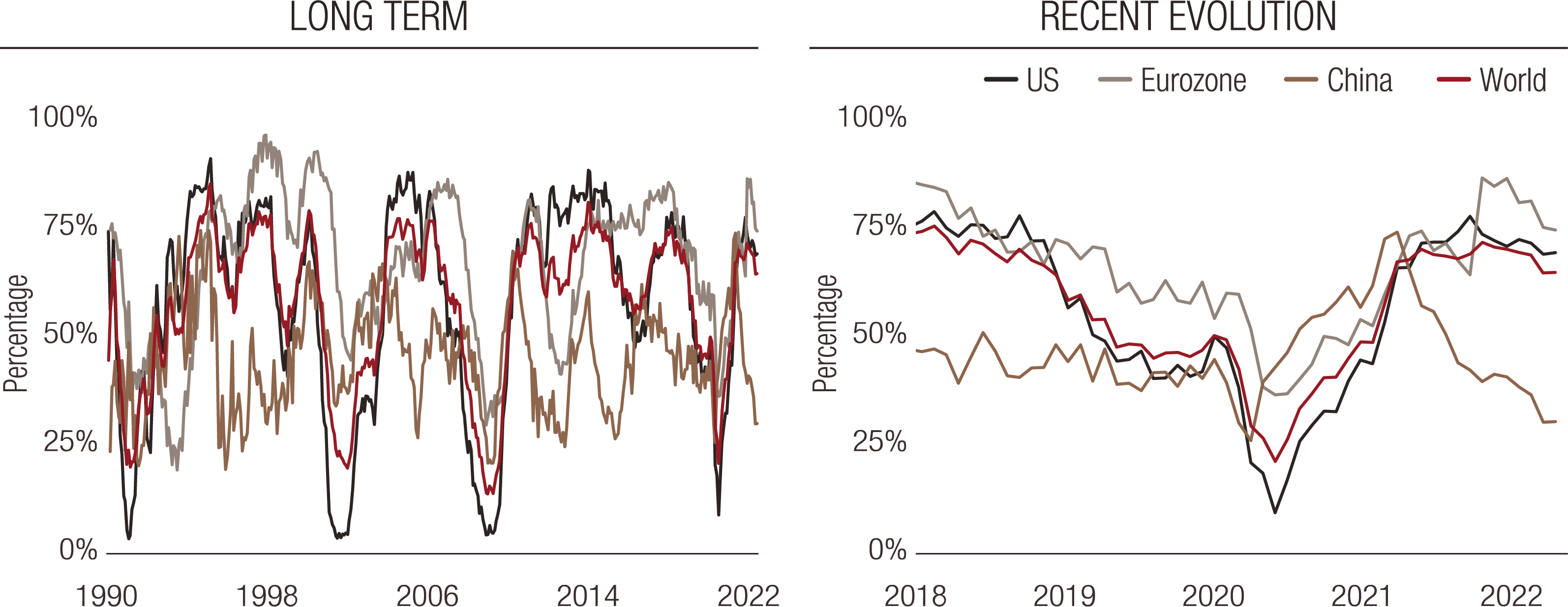

Our nowcasting indicators leave little room for doubt: inflationary pressures in Europe have gradually become very strong (chart 1). Our inflation nowcaster is currently at 72.5%, a historically high level that echoes the major European inflationary shocks of 2000 and 2011. The difference today is the intensity of growth, a powerful accelerator of inflation. Our European growth nowcaster is at 73% (an equivalent level to our inflation indicator) despite the inflation, interest rate and geopolitical shocks being faced by the Eurozone. Among the world's major economic powers, the Euro area is in an exceptional situation:

- China is experiencing a strong slowdown and therefore inflation is low; its central bank and central government have recently adopted measures to support the economy.

- The US is starting to feel the effects of the Fed’s policy, with inflationary pressures stabilising. Our US inflation nowcaster has fallen below 50%, a sign that the country's inflation peak is probably behind us.

- Europe is the exception: growth momentum remains similar to that of the US, but inflationary pressures remain very strong and, until its last meeting, the ECB appeared hesitant to fight against this.

Chart 1. LOIM Inflation nowcaster 2018-2022

Source: Bloomberg, LOIM

Reading note: LOIM’s nowcasting indicator gathers economic indicators in a point-in-time manner in order to measure the likelihood of a given macro risk – in this instance inflation surprises. The nowcaster varies between 0% (low inflation surprises) and 100% (high inflation surprises).

The page is now being turned and questions are being asked about the consequences of the ECB’s shift to normalisation. What most worries markets is the apparent inconsistency between the need to fight inflation through rate hikes and the perceived financial fragility of peripheral European countries. In simple terms: if the ECB raises short-term rates, peripheral spreads could widen and place southern European economies in an unsustainable fiscal situation. In our view, this is probably a misunderstanding of the fundamental functioning of monetary policy in the 21st century. By exiting quantitative easing for good and raising short-term interest rates, the main channel to weakening inflationary pressures is to raise long-term real interest rates.

We have already seen this in the United States at the beginning of 2022 –Europe is simply following in the Fed's footsteps. European real rates rose by a spectacular 100 basis points in May, from -2% to -1%. While they are still far from positive real rates, unlike in the United States, this development shows a clear change in direction. While the cost of living has risen recently, it is now being joined by the rising cost of capital. So what impact will this backdrop of tightening financial conditions have on peripheral spreads? Italian spreads (the difference between the rates associated with Italian 10-year debt and the equivalent German debt) have risen just 30 bps; in other words, spreads have hardly moved at all, as shown by Chart 2. Our calculations suggest a complete normalisation of European real rates (i.e. a return to positive real rates) could lead to a total spread increase of 1%, bringing Italian spreads to 400 bps. This high level calls for the consideration of two elements:

- First, these higher rates will need to be considered in the context of nominal growth remaining high. In its latest projections, the ECB sees nominal Eurozone growth approaching 10% in 2022. This figure remains well above the cost of debt for southern economies, resulting in a fiscal dynamic that should remain sustainable.

- Second, normalised real rates will only be necessary as long as inflation remains persistent. When inflation recedes, real rates should subside, reducing peripheral spreads too. We believe markets are probably discounting a temporary situation.

Chart 2. 10-year Italian spreads vs. Germany compared to European real rates evolution

Source: Bloomberg, LOIM

The ECB has chosen to stop worrying about decelerating growth and officially fight inflation. Mrs. Lagarde is unlike to be the “Mrs. Volcker” of the 21st century – she is not as dogmatic and that is probably for the best – but the Mario Draghi era is now well and truly over.

| Simply put, the ECB is tackling inflation and clearing up some of the economic uncertainty in the Eurozone. This should be good news for markets. |

|---|

Macro/Nowcasting Corner

The most recent evolution of our proprietary nowcasting indicators for world growth, world inflation surprises and world monetary policy surprises are designed to keep track of the latest macro drivers making markets tick. Along with it, we wrap up the macro news of the week.

In terms of economic data, it was not a particularly busy week in terms of quantity, but it was still decisive. Two key events were the US inflation report and the ECB meeting. The core message was that the peak for US inflation is getting closer and closer, albeit it is still heavily dependent on energy prices, and that the ECB has begun a hawkish shift.

These two elements should help to dispel some of the uncertainty weighing on markets this year, but investors remain unconvinced.

US inflation remained high in May. Inflation was expected to be 8.3% year-on-year, but reached 8.6%. The monthly variation reached 1%, versus expectations of 0.7%. The main element behind this evolution was the increase in energy prices. This contributed 0.16% over the month, or almost one fifth of the monthly growth. Its contribution over the last 12 months is now 2.58% or 30% of total realised inflation. Within the inflation data, some moderation can be seen in services inflation and the shelter component showed a more stable growth rate than previously. This may not be the peak of inflation yet, but there are some encouraging signs in the underlying report.

The ECB meeting was accompanied by a complete revision of the central bank's economic forecasts. The key message was to be found in the revised inflation figures. The ECB now expects 3.5% headline inflation in 2023: European inflation now looks more sustained than expected, settling permanently above the 2% target. For 2022, the central bank expects inflation to reach 6.8%, a figure well above its target: the two combined figures leave little room for doubt that the ECB must make a significant turnaround in its rate policy. Unsurprisingly, the ECB's communication moved in this direction, in the words of Christine Lagarde, opening the door to "a long journey" in the fight against inflation.

In China, leading indicators continued to show the benefits of its economic reopening as the pandemic recedes. The Caixin survey showed a clear rebound, which nevertheless remains below expectations: the "services" survey was expected to be at 46 but came in at 41.4, up from 36.2. The need for monetary and fiscal stimulus to support the country's economy is starting to show in the figures. Last week’s investment figures showed that money supply that is taking off. The growth of M0 rose from 11.4% to 13.5% (versus an expectation of 10%). Supporting the economy is necessary and the weakness of inflation in China is further proof of this: the CPI was only up by 2.1% annually and PPI was up 6.4% (compared to 8% last month). China is therefore making a marked reversal from a period of structural reform to one of increased support for its economy. This should be good news for markets.

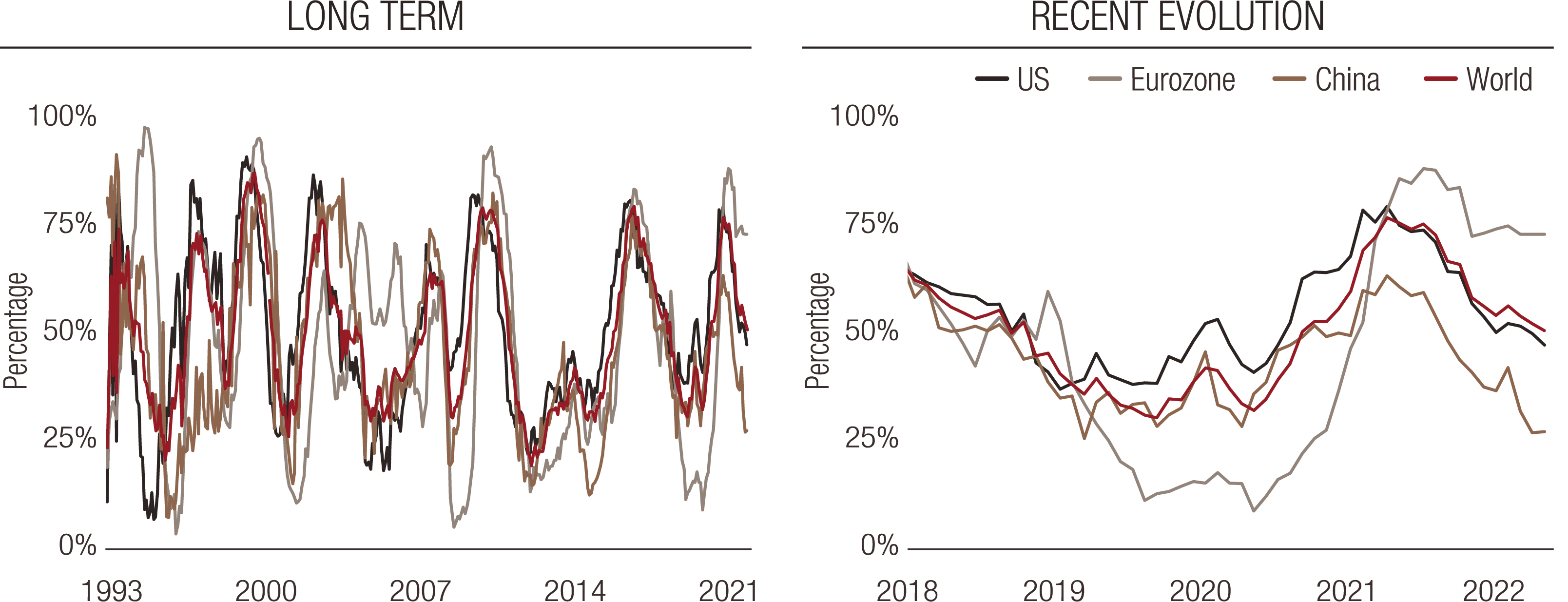

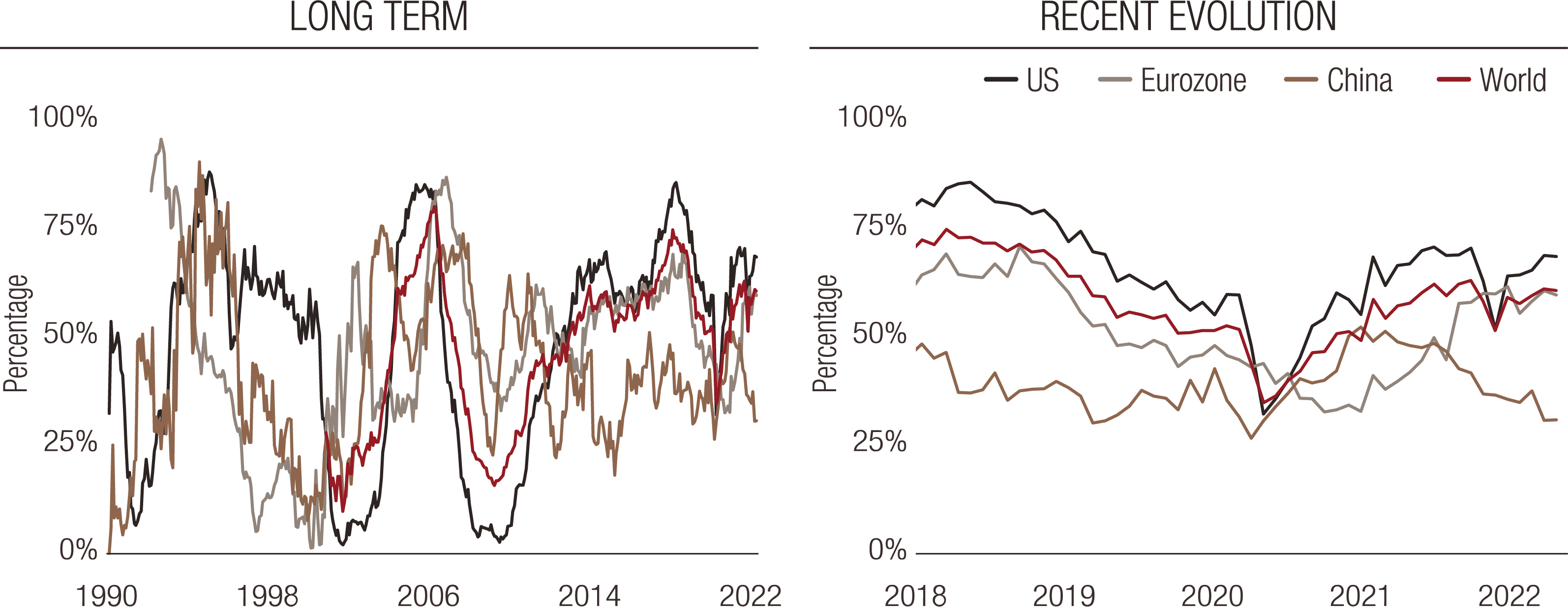

Factoring in these new data points, our nowcasting indicators currently point to:

- Worldwide growth remaining solid. The US and the Eurozone are still showing high numbers, but growth is now clearly declining in the Eurozone.

- Inflation surprises should remain positive, but our signals have shown a recent decline. In the US, this has brought the indicator below the 50% line. Only European inflation should keep surprising us on the upside.

- Monetary policy is set to remain on the hawkish side, mirroring the strength of economic activity. The ECB’s reaction was consistent with our indicators.

World Growth Nowcaster: Long-Term (left) and Recent Evolution (right)

World Inflation Nowcaster: Long-Term (left) and Recent Evolution (right)

World Monetary Policy Nowcaster: Long-Term (left) and Recent Evolution (right)

Reading note: LOIM’s nowcasting indicator gather economic indicators in a point-in-time manner in order to measure the likelihood of a given macro risk – growth, inflation surprises and monetary policy surprises. The Nowcaster varies between 0% (low growth, low inflation surprises and dovish monetary policy) and 100% (the high growth, high inflation surprises and hawkish monetary policy).

important information.

For professional investor use only.

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name. This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Any benchmarks/indices cited herein are provided for information purposes only. No benchmark/index is directly comparable to the investment objectives, strategy or universe of a fund. The performance of a benchmark shall not be indicative of past or future performance of any fund. It should not be assumed that the relevant fund will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between such fund’s returns and any index returns.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term “United States Person” shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA.

©2022 Lombard Odier IM. All rights reserved.