investment viewpoints

Biodiversity vaults onto the G7 agenda

From vaccines and climate change to global corporate tax, the recent G7 summit examined crucial global short and long-term socio-economic issues – including an unprecedented call to action on biodiversity preservation.

The G7 nations – the US, Canada, Japan, UK, France, Germany and Italy – see biodiversity loss and climate change as intrinsically linked , mutually reinforcing and equally important existential threats to people and the planet. Acknowledging their contributions to the decline of biodiversity, they pledged to play key roles in its restoration and conservation. While climate change has been a fixture of G7 action plans, this is the first time the topic has made it to the G7, highlighting the increased momentum around natural capital and biodiversity loss on the global agenda overall in 2021.

TNFD and the G7 Nature Compact

Alongside its call for companies to report on climate risk in accordance with the Taskforce on Climate-related Financial Disclosures (TCFD), launched in 2015, the G7 urged that a similar transparency framework for nature is needed and endorsed the Taskforce on Nature-related Financial Disclosures (TNFD).

The TNFD is a global initiative that began in 2020 and aims to provide the finance sector with a complete view of environmental risks. The TNFD will deliver guidance for companies to report and act on evolving nature-related risks.1

In addition, to support strong outcomes for nature at the upcoming Convention on Biological Diversity (COP15 in) Kunming and COP26 in Glasgow later this year, the group launched the ‘G7 2030 Nature Compact’ to help reverse biodiversity loss by 2030. It directs action across four pillars (see figure 1).

We look forward to COP15, where some or all of these commitments may be further defined and discussed with a broader audience. We hope this leads to a global pact on biodiversity preservation similar to the Paris Agreement on combating climate change.

FIG 1. The four pillars of the G7 2030 Nature Compact

Nature: an economic pillar

At LOIM, we support the rise of biodiversity preservation on the policy agenda and are encouraged that leaders of major developed economies have committed to take action. With more than 50% of the world’s GDP moderately to heavily dependent on ecosystem services provided by natural capital2, our prosperity and wellbeing depend on a sustainable relationship with nature. For example, every year:

• Trees and other land vegetation convert 11 billion tonnes of carbon dioxide into plant matter and oxygen through photosynthesis – removing and storing the equivalent of 27% of human carbon emissions3

• Bees pollinate crops worth up to USD 577 BN, free of charge4

• We extract nearly 100 billion tonnes of resources – more than half the height of Mt Everest – which is one indication of our physical impact on earth5

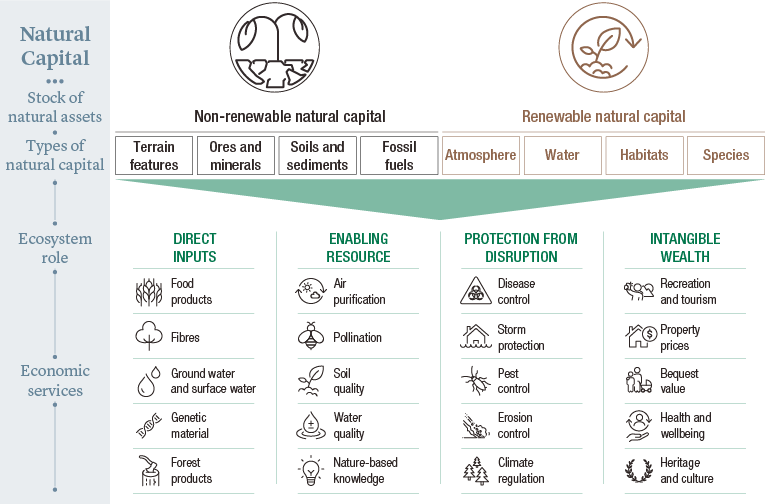

Free and vast carbon storage and crop pollination are two of the many services that healthy ecosystems provide to human societies (see figure 2).

FIG 2. Our economic activity depends on nature

Source: LOIM. For illustrative purposes only.

Source: LOIM. For illustrative purposes only.

Investing in nature for our future

We have identified a universe of about 500 small- and mid-cap companies whose products and services help to preserve nature and harness its regenerative power. They are typically aligned with the following themes:

- The circular bioeconomy unlocked by emerging technologies

- Leaner forms of production achieved through resource efficiency

- An outcome-oriented approach to consumption

- The move towards a zero-waste world

Investors targeting opportunities among these companies are supporting pillar two of the G7 2030 Nature Compact, in our view. Investing in natural capital is vital for mobilising some of the capital required to decarbonise the economy, restore biodiversity and underpin sustainable growth.

The key aims of natural capital investment are to generate positive impact, embed sustainability and align growth with the future viability of the world’s ecosystems. As policymakers and society at large recognise that biodiversity loss threatens the health of humanity, the planet and the economy, we believe that companies with businesses aligned to a sustainable future present the greatest long-term opportunities.

5 Circle Economy at 2017

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2021 Lombard Odier IM. All rights reserved.