investment viewpoints

China’s crackdown: closed door or window of equities opportunity?

Will China’s cybersecurity crackdown help its internet sector grow more sustainably? In this commentary, we present our response to the current sell-off and look further ahead. Aware of the critical role of technological innovation in the nation’s economic plans, we believe investment opportunities should arise as companies adapt to the new rules and compete on a similar regulatory footing as their Western counterparts.

Key points:

- Perceptions of regulatory crackdowns on the internet, food-delivery and after-school tutoring sectors have triggered a drawdown in China equities. In many cases, we argue that China is modernising its regulatory oversight to standards similar to those in traditional Western economies

- In recent months, we have become cautious on China and our stock picking reflected this view. We are not surprised that investors are selling now and asking questions later

- But we already seek a long-term perspective. Rather than being discouraged from the market, we believe opportunities will arise as companies adapt to new cybersecurity requirements that support China’s digital ambitions and new regulations aiming at fostering more inclusive and harmonious growth

- Drawing on the history of Tencent, we argue that stricter regulation in China has historically led to attractive entry points for investors willing to look at China’s long-term prospects – Such as those for the digital economy included in the 14th plan Five-Year Plan

What has happened?

Regulatory risk in the China internet sector escalated in early July following the initial public offering (IPO) of DiDi, a ride-hailing firm, in the US1. The listing was understood to have gone ahead despite the concerns of China’s authorities about the data security and privacy of the company’s customers. Just two days after appearing on the New York Stock Exchange, the Cyberspace Administration of China (CAC) began investigating the firm. After another two days, DiDi was removed from China’s app stores, barring new users and generating a wave of perceived regulatory risk for China internet stocks.

As July progressed, the sell-off was intensified by further regulations: after-school tutoring (AST) providers in core subjects must now run on a not-for-profit basis, making them essentially non-investable; food-delivery platforms must pay above the minimum wage and provide insurance for workers; and tech firms with more than 1mn customers which seek an overseas IPO must first pass a cybersecurity review. China and Hong Kong indices fell to their lowest levels this year, and US-listed China companies suffered. In general, investors are de-risking their China exposures.

How is LOIM positioned?

We have sought to mitigate this risk in our high-conviction China, Asia and emerging-market equity strategies. First, we did not participate in DiDi’s IPO despite it being highly anticipated and over-subscribed. Since the incident, we have trimmed our exposure to the China internet sector to mitigate any fallout and are now underweight. As for the AST sector, our funds only had small positions and we have since exited them.

We believe some clarity is needed before investors can become comfortable once again in the China internet sector. We remain invested in companies that benefit from long-term structural trends such as the consumer, technology-hardware and clean-energy industries. Our exposure is biased towards Chinese-listed companies, which we believe are subject to less regulatory risk, as the cybersecurity crackdowns associated with US listings are likely triggered by stricter American regulations on protecting consumer data. We continue to monitor the situation.

In our World Brands strategy, we have reduced our China allocation from 20% at the end of 2020 to 5.8% by the end of July. Sports and electric-vehicle firms are our focus, with 1% of the portfolio exposed to video-game brands2.

Will a stronger internet sector emerge?

As experienced investors in China, this is not the first time we have witnessed state interventionism in the market. Often, the impact of such actions is softened by subsequent policy moves that are more measured. However, given the unprecedented move to force companies to change their business models – as in the case of the AST sector – we are not surprised that investors are selling now and asking questions later. But this is only a short-term response.

In time, a rewired China internet sector will emerge as companies adapt to stronger state oversight. The winners will be those firms that can demonstrate strong cybersecurity infrastructure and data-privacy governance and infrastructure, and which provide the most appealing content for their targeted audiences. China’s crackdown, while severe in the short term, might spur an innovation cycle that drives long-term growth. Valuations will be reset after the sell-off, making it important for investors to approach the sector with a forward-looking mindset.

Interventionist precedents: Tencent and Alibaba

Tencent’s QQ messaging platform and multi-purpose app Wechat have made the company, a holding in our portfolios, the dominant Chinese internet player.3 Launched in 1999, five years before Facebook, QQ has now about 600mn users; WeChat, the Chinese peoples’ ‘app for everything’ has 1.2bn. Thanks to its vast, connected network, Tencent has also been applying its clout in gaming. It owns of Riot Games, vendor of League of Legends, and has a majority stake into the Finnish firm Supercell, creator of Clash of Clan. With about 45% market share in online gaming in China, Tencent is the clear global leader in this sector.

In 2018, the Chinese gaming industry came under increased scrutiny as some officials believed the increased popularity of video games negatively impacted children – distracting them from school, becoming a source of addiction and exposing them to violent content. The regulator stopped approving new games and in August 2018 the Ministry of Education released a plan to combat eyesight problems among young people amid greater use of electronic devices and less outdoor activity and exercise. This led to an age-based ratings system for online games, restrictions on the amount of time spent playing them and also controlling the number of approvals for new games.

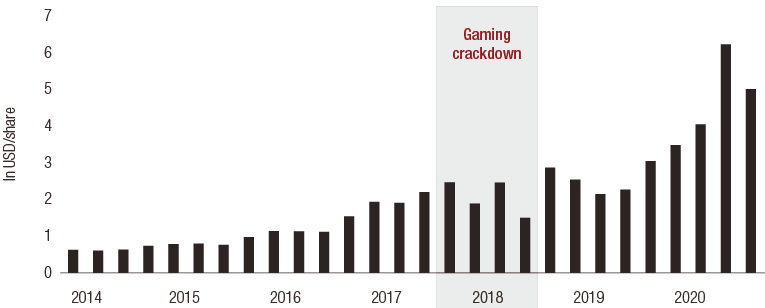

With the freeze in game approvals in force until December 2018, revenues and profit margins for Chinese gaming companies were under significant pressure. In 2018, Tencent delivered its slowest annual earnings per share growth on record (see figure 1). Throughout the year, its share price suffered an almost nine-month drawdown down to -50%, with the low reached in October 2018 amid a 30% fall in the Chinese market. But this negative predicament proved to be an attractive entry point: by June 2020, Tencent’s share price had doubled to recover fully.

FIG 1. How Tencent’s earnings per share was impacted by China’s 2018 online-gaming crackdown

Source: Bloomberg as at July 2021. Past performance is not a guarantee of future results.

The dominance of Tencent and other big Chinese tech firms has spurred regulators to focus on controlling for any monopolistic effects and to ensure competition and quality of services to users. We do not think that anti-trust regulators in other jurisdictions would act differently. For instance, the merger of Huya and Douyu, two video game live-streaming services businesses partially owned by Tencent, was blocked as it could have further cemented Tencent’s dominance in online gaming. Such intervention creates volatility and may generate attractive entry points to a business generating attractive free-cash flow and exposed to growth opportunities.

In early 2021, Alibaba was charged a USD 2.8bn fine – equivalent to 4% of 2019 domestic revenue – after being found to have abused its dominant market position. The regulator’s main concern was that Alibaba prevented merchants on its platform from doing business or running promotions on rival platforms. This fine was imposed by the recently created State Administration for Market Regulation (SAMR), a regulatory body established in 2018. In contrast, the US Federal Trade Commission was created in 1914 to prohibit “unfair and deceptive acts or practices” and gained greater scope through Congress in 1938. It could be argued that China is catching up to normal practices in developed markets.

Cybersecurity crackdown: providing the discipline needed for growth?

Cybersecurity is currently a major source of regulation-driven volatility in the Chinese market. From 10-25 July, the CAC undertook a consultation with a view to publishing revised measures that would come into force on 1 September. This resulted in the rule that companies holding data of more than 1m users will now be subject to a cybersecurity review before they are permitted to list overseas. The regulator’s concern is that poor controls could result in core national data or personal information being leaked. DiDi’s efforts to stage an IPO during this consultation period, and before the expected announcement of the new measure, drew the ire of the Chinese regulators. They have made an example of the firm, preventing it from attracting new users while ensuring it complies with the new rules. This signals a new development in Chinese tech – one which we believe offers opportunities.

Rather than interpreting the DiDi affair as a cautionary tale, we see stricter cybersecurity rules as indicative of rich investment potential. According to the 2019 UNCTAD Digital Economy Report, the digital economy, in the broadest sense, represents 30% of China’s GDP – above the 21.6% share in the US and 15.5% in the rest of the world. The Chinese Government’s 14th Five-Year Plan placed technological innovation at the forefront of its agenda: annual R&D spending in the digital economy will grow by more than 7%, 5G customer penetration will ramp up to 56% by 2025 and productivity growth will outpace GDP growth, according to the government. Authorities are also focused on advancing new technologies: 6G, smart-city development, the formation of a national data-centre system and high-tech industrialisation through robotics, automation and digitalisation. Given these ambitious plans, greater cybersecurity is essential, in our view. Investors should not allow short-term volatility driven by necessary regulations and data-control concerns to obscure the long-term opportunities offered by the growth of China’s digital economy.

Cynics might argue that the Chinese Government’s focus on national security is a response to the host of issues the US Government has raised against foreign companies listed in America. Under the Holding Foreign Companies Accountable Act passed in the US in December 2020, there is a significant increase in audit requirements for Chinese companies. We would argue, however, that increased focus on cybersecurity is a worldwide phenomenon. In Europe, a data-protection package applied in 2018 – the EU General Data Protection Regulation – aims to make data governance in Europe fit for the digital age. In the US, regulation is more state-driven, as usual. In 2019, New York expanded its data-breach notification law to tighten requirements for the security, confidentiality and integrity of the private information of New York residents. California has enacted the California Consumer Privacy Act, which became effective on 1 January 2020.

Further reform: food delivery and tutoring

Some other activities have also attracted increased regulation. From 26-27 July, the share price of Meituan, China’s largest food-delivery company and a holding in our portfolios4, dropped 30% when the government announced that employees must be paid above the minimum wage and be given insurance, among other worker-protection measures. Uber and Deliveroo have been subject to these issues in the West, too. We believe such businesses need to adjust to deliver sustainable growth for all stakeholders.

China's tutoring reforms deliberately seek better health for schoolchildren. The authorities have charted a decisive timeline for reform:

- March: the government suspended offline tutoring until providers had passed regulatory checks on licenses, capital supervision, teacher certification and content

- May: the Central Commission for Comprehensively Deepening Reform passed measures to “reduce students’ homework and after-school tutoring burden”

- June: the Ministry of Education established a standalone department to oversee the AST sector

- July: the “double reduction” policy was instituted whereby so-called K12 firms – those offering tutoring from kindergarten to year 12 – must become non-profit organisations, enforce limitations on foreign capital, be restricted in advertising activity and be banned from providing tuition during holidays and weekends for all students from primary to high school

This regulation aims to strictly implement the new Law on the Protection of Minors, due to come in to force on 1 September, which aims to reduce homework levels and protect pupils’ health. Some argue that that it could also contribute to a more inclusive education system. In addition, this measure would work in favor of increasing affordability of education for kids in a country that is looking to improve its fertility rate.

sources

- “Data standards for main fields coming,” by Ouyang Shijia. Published by the Chinese Government on 17 July 2021.

- “Regulations on the protection of schools for minors,” published by the Ministry of Education of the Chinese Government on 1 June 2021.

- “Digital Economy Report 2019,” published by UNCTAD in September 2019.

- “Progress of Research & Development of E-CNY in China,” published by the People’s Bank of China in July 2021.

- “Spurring ahead with 6G places China in driver’s seat,” by Tom Pauken. Published in China Today on 25 June 2021.

important information.

FOR PROFESSIONAL INVESTOR USE ONLY

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA. ©2021 Lombard Odier IM. All rights reserved.