investment viewpoints

The case for convertible bonds in 2021

Global convertible bonds demonstrated their merits in 2020 as the asset class outperformed both global equities and global credit1. As the pandemic progressed, convertibles proved their defensive characteristics from the bond element while still giving exposure to equity risk. As such, we see growing appetite following renewed interest from traditional equity and fixed income investors.

Such demand is illustrated by the healthy liquidity of the asset class as well as the relative attractiveness of convertibles compared to both equity and fixed income. In our opinion, convertibles also stand to gain in 2021 from volatility valuations, as we believe volatility is cheaply valued.

Convertibles vs straight corporate credit

Convertible bonds could offer an additional engine of performance compared to conventional corporate bonds, both in terms of investing in potential growth companies, and providing a buffer against possible inflation.

The negative yield environment has increasingly driven fixed income investors down the credit spectrum in search of higher returns, risking the illiquidity and poorer quality typically associated with such lower-rated debt.

Investing in convertibles enables investors to access a broader and more diverse issuer base. Contrary to standard corporate debt, buying convertibles also gives investors an embedded equity call option, offering the possibility of capturing the growth offered by equities.

High-growth companies are using the asset class to raise capital amid an active primary market.

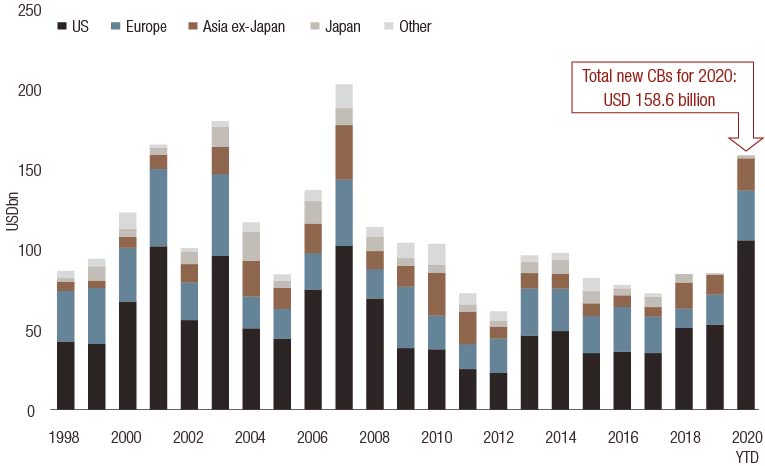

High-growth companies are using the asset class to raise capital amid an active primary market. Indeed, total new convertible bond borrowing in 2020 was USD 158.6 billion (Figure 1), the strongest issuance since the 2008 financial crisis.

Figure 1. Convertible bond primary market issuance 1998-2020

Sources: UBS until 2017, Bank of America Merrill Lynch starting from 2018.

We also believe more and more value companies will tap convertibles as their share prices begin to recover and they turn to the market to finance growth.

In addition, many of the companies issuing convertible debt could be well positioned to benefit from Covid-19-related themes and sustainability. The majority of 2020 new issuance fit into a theme we have dubbed “working and consuming from home.” And issuance from borrowers investing in renewable-energy firms was also notable.

In 2021, we also expect greater issuance driven by M&A activity and capital spending as the low-rate environment continues. Equity valuations are substantially higher now, making convertible bonds (and thus the issuance of equity call options) more palatable for issuers.

Inflation cushion

While the outlook is for global central banks to remain accommodative via both low interest rates and quantitative easing, the spectre of rising inflation has been a talking point. Convertibles could afford a measure of protection2 against potential inflation through their typically shorter duration, and the positive contribution of the optionality in inflationary environments.

In general, the asset class is less sensitive to interest rates than other types of bonds because of the embedded option, which usually gains value in times of rising interest rates. Secondly, the average duration of convertibles in our global strategy is 3.5years, enabling investors to lock in the shorter-term interest rate outlook without having to extend duration to ultra-long maturities where inflation risk is greater.

Convertibles vs equities

Convertibles could also look relatively attractive compared to straight equities. Current valuations in equities are historically high at a time when the outlook is clouded. Will equities continue to rally or might the market be in store for a correction? This could presage higher drawdowns in future.

With clear defensive properties, convertibles have in the past afforded higher risk-adjusted returns3 (Sharpe ratios) than conventional equities. The asset class gives continued exposure to highly valued equities through the optionality, while the bond element offers a measure of downside shelter should drawdowns rise.

Currently, convertibles provide a healthy mix of opportunities in growth, cyclical and recovery names, thereby giving investors the possibility of varied exposure to equities, should the optionality conditions be met and exercised.

Lastly, convertibles are a source of liquid, long-dated options that are not available through any other financial instrument. This gives investors exposure to volatility, at a time when we believe volatility is attractively valued.

We believe that volatility is cheaply valued at the moment.

A bet on greater volatility?

Convertibles could provide an interesting play on rising volatility, especially because current valuations in the asset class appear cheap, in our opinion.

There are good reasons to anticipate further spikes in volatility in the months to come: coronavirus vaccination programmes might not progress as smoothly as hoped, inflation could rise more than anticipated, while the geo-political backdrop (especially the US relationship with China) could raise uncertainty or instability.

While we do not foresee the market experiencing volatility similar to March 2020 levels, valuations could rise marginally, or even undergo a correction from highs and then a rally.

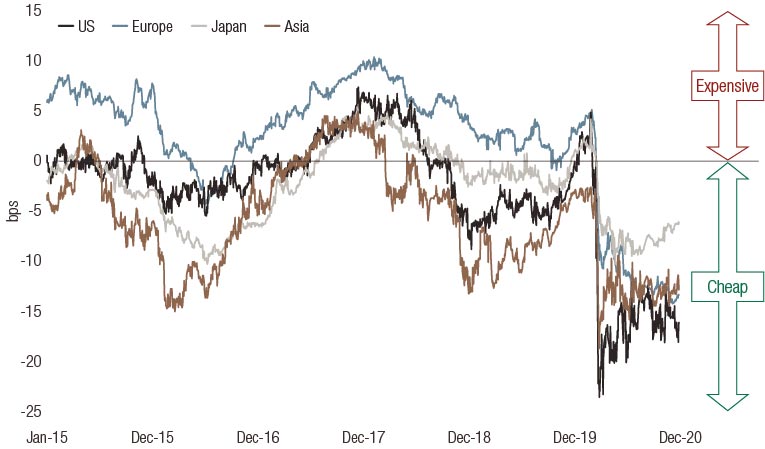

We believe that volatility – as measured by the difference between realised and implied volatility (Figure 2) – is cheaply valued at the moment. Looking at historical volatility prices, we find that realised

volatility has been substantially higher than implied volatility since 2015.

Figure 2. Valuation of volatility

Source: LOIM. Spread (difference in percentage points) by region between implied volatility and realised volatility (260 days realised volatility). Past performance is not a guarantee of future results.

Such prices mean that investors would benefit from just a slight rise in volatility, and of course gain even more should volatility rise markedly.

The distinctive characteristics of convertibles could serve investors well in light of the potential scenarios unfolding in 2021, in our opinion. In particular, we believe balanced, global convertible bond strategies focusing on asymmetric profiles are well-suited to the investment landscape.

sources.

1 Past performance is not a guarantee of future results. For illustrative purposes only. Source: LOIM. Refers to the 2020 performance of global convertible bond index (Refinitiv Global Focus index ) vs global equities (MSCI World) and vs global credit (Barclays Global Corporate Credit, and the Barclays Global Corporate High Yield). Any reference to a specific company or fund does not constitute a recommendation to buy, sell, hold or directly invest in the company or funds. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the funds discussed in this document.

2 Capital protection is a portfolio construction goal that cannot be guaranteed.

3 Refers to Sharpe ratio comparison of LOIM convertible bond benchmark compared to equity benchmarks and high yield from 2004 to end-2020. Past performance is not an indicator of future returns. For illustrative purposes only.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2021 Lombard Odier IM. All rights reserved.