investment viewpoints

Physical risks in the finance sector

The current manifestations of climate change, such as in the severity of the ongoing hurricane and wildfire season in the US, are drawing attention to the scale, scope and urgency of understanding physical risks and assessing the impacts and opportunities for the finance sector.

Climate models reinforce the importance of these assessments, predicting that at current emission pathways, the frequency and intensity of weather-related hazards will continue to increase. It is precisely the evolving nature of these risks that highlights the importance of analysing current and future business models in terms of the financial materiality of these risks. Investments can promote adaptation and generate a return through improved resilience and avoided damage.

As an example, 90% of urban areas are located along coastlines and will face increased damage from storm surges and sea level rises. These costs are expected to rise to more than USD 1 trillion each year for coastal cities by 2050, if governments do not strengthen climate policy ambition1. As a solution, making coastal infrastructure more climate-resilient could add about 3 percent to the upfront costs but has cost-benefit ratios of about 1:4, as confirmed by the World Bank and other research institutions2.

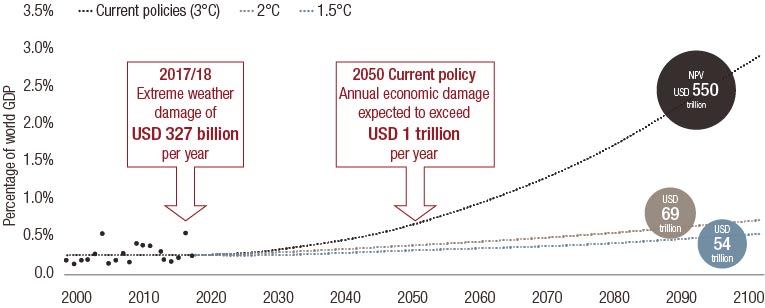

Based on current policies, the cost of climate change could reach a net present value (NPV) of US$550 trillion by the end of the century and, even on a 1.5 degree trajectory, costs could still soar to US$54 trillion.

Cost of climate change will skyrocket and may act as a drag on economic growth

Source: Lombard Odier analysis based on Watson and Le Quéré (2018); Aon Benfield (2019).

The Network for Greening the Financial System (NGFS) has published a technical document in September 2020 highlighting the importance for financial institutions of accurately assessing the climate and environmental risks to which they are exposed. The report argues that underestimating these risks leads to excessive allocation of financial resources to polluting or high carbon sectors, which not only exacerbates pollution and climate change, but threatens financial institutions’ own balance sheets and financial stability. Physical risks can arise from the impact of extreme climatic events (such as exacerbated extreme weather events), rises in sea levels, losses of ecosystem services (e.g. desertification, water shortage, degradation of soil quality or marine ecology), as well as environmental incidents (e.g., major chemical leakages or oil spills to air, soil and water/ocean). The NGFS argues that it is vital to use accurate tools and methodologies (such as Environmental Risk Analysis or ERA) to measure environmental and climate exposure by analysing both physical risks and transition risks.

At Lombard Odier we believe forward-looking, judgemental analysis of a company’s exposure to climate damage, via in depth analysis of physical risks, can help us identify those sectors, industries and businesses that are most likely to outperform as physical climate affects accelerate and avoid those companies that are not able to transition and face “stranded asset” risk.

Investments can promote adaptation and generate a return through improved resilience and avoided damage

Assessing the risks- 2020 Atlantic Hurricane Season

Earth Observation (EO) and Geographic Information Science (GIS) technologies are a rapidly growing sector and enable us to monitor and analyse planetary-scale change on a daily basis.

Using these technologies, climate models are being enhanced with the ability to predict weather-related hazards on different time-scales. As an example, the National Oceanic and Atmospheric Administration (NOAA) released a statement in May 2020 saying that an above-normal Atlantic Hurricane season could occur with a 60% chance1. This was due to warmer-than average sea surface temperatures and weaker winds detected.

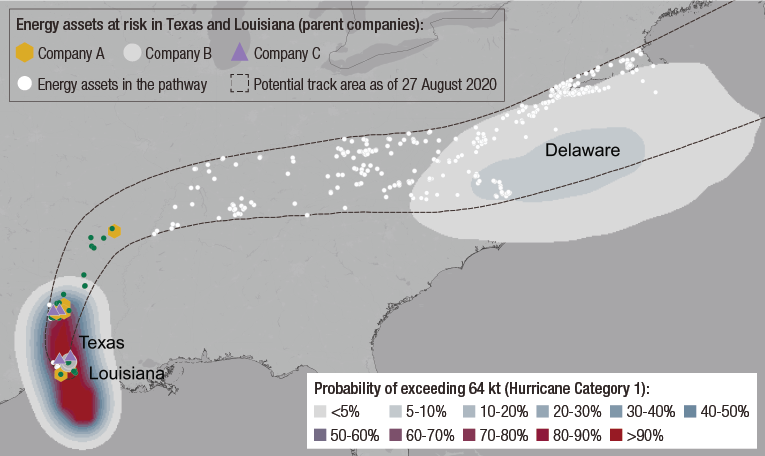

When a hurricane alert is released, different meteorological agencies provide data on its consolidation, and predicted pathways as shown in the image below for Hurricane Laura on September 27. It is possible to retrieve satellite captions and predicted pathways on average every 10 minutes. Infrared sensors on board satellite systems allow us to capture temperatures of storms, which are “visible” during the day and at night. These temperatures can be associated with wind speeds, and therefore potential economic damages, depending on the location and preparedness of people and assets in relation to the hurricane.

This data allows us to evaluate the physical risk for specific companies in the pathway using relational databases containing information on asset locations. We combine this exposure analysis with bottom up analysis by our investment teams on the preparedness of a company to confront these hazards.

Source: National Hurricane Center (NOAA), various asset data providers

This example illustrates the concept of ‘spatial finance’, which is the integration of geospatial data and analysis into financial theory and practice. As predicted, this season has broken many records, including twenty storms over three months, compared with a historical average of twelve over six months4.

Spatial finance is essential to assess these risks on a near-real time basis, but also in the longer term to enable investment institutions to analyse the effects of climate damage and preparedness of current business models to confront this challenges.

Conclusion

Our approach to climate transition is built on the dual concept of identifying companies that will outperform in an increasingly carbon-constrained world and those that will deliver value in a carbon-damaged world. Via an in-depth review of physical risk we endeavour to add a further layer of analysis to our investment processes and even portfolio construction. We are building out systems to monitor and alert our investment teams to climate-related hazards and other physical risks, and are also focusing on those companies able to increase resilience, monitor risk and manage impact. These range from companies focused on infrastructure solutions to help cities adapt to rising sea levels and technology providers of early-warning systems.

sources.

important information.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.