sustainable investment

Why forward-looking decarbonisation is critical to achieving net zero

As the race to net-zero carbon emissions accelerates, is your decarbonisation strategy future-proof?

Achieving the Paris Agreement objective of net zero carbon emissions by 2050 is one of the greatest economic challenges of all time. To limit global warming to 1.5°C, net emissions must fall 50% by 2030 and be eliminated by 2050. Disrupting entire industries and impacting all sectors of the global economy, these targets pose a crucial investment question: Which companies will thrive and which ones will suffer as the global economy weans itself from carbon?

It is in investors’ interest to act urgently.

How existing solutions fall short

At Lombard Odier, the net zero challenge means investing in the transition, not merely investing in low-carbon companies. Our approach goes beyond methods such as simple exclusions, carbon offsets or tracking a climate benchmark. Other approaches focus solely on historic carbon footprints and therefore lack a forward-looking analysis of decarbonisation pathways. They miss fast-transitioning companies in vital economic sectors with credible plans to decarbonise. Excluding such companies can increase concentration risk in portfolios while missing out on transition opportunities.

Robust decarbonisation analysis necessarily begins with an accurate picture of all emissions. Many other approaches give investors an incomplete assessment of emissions because they focus only on a company’s direct (Scopes 1 and 2) emissions, ignoring the crucial indirect emissions from the supply chain and from sold products. By analysing Scope 1, 2 and 3 emissions1, we aim to assess more accurately a company’s carbon exposure, leading to a stronger, forward-looking assessment of climate impact.

How best to measure portfolio decarbonisation?

The goal of net-zero carbon emissions is clear, but the path to get there is far less tangible for investors. There is no common framework for asset managers to measure decarbonisation in their portfolios, and there are wide discrepancies in how climate-aligned assets are selected, managed, and reported on.

Look forward with LO Implied Temperature Rise analysis

At Lombard Odier, we combine custom benchmarks with forward-looking transition pathways consistent with different warming outcomes in our Implied Temperature Rise (ITR) methodology. ITR analysis allows us to derive warming scores by comparing the emissions trajectories that companies and portfolios are on against the paths they must take in order to meet the goals of Paris Agreement.

To us, genuine decarbonisation strategies should include investments in companies that are contributing to the greatest reductions in emissions, rather than focusing on low-carbon sectors, where less decarbonisation is occurring. High-emitting companies on credible reduction trajectories are too often neglected, but they offer long-term value opportunities, as the world transitions towards net zero.

Climate Value Impact for champions and casualties

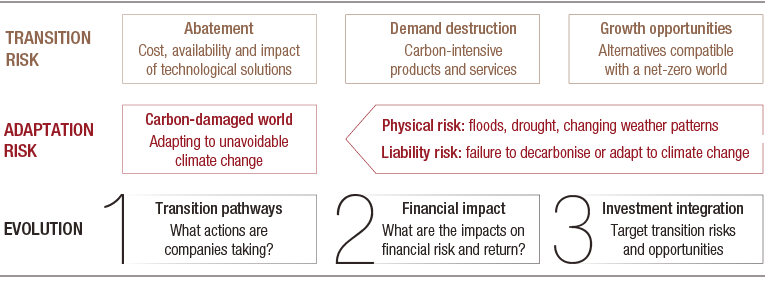

Complementing our Implied Temperature Rise methodology, we have also developed a proprietary approach that analyses the financial impact of climate change and the transition to net zero called Climate Value Impact (CVI). CVI captures both the preparedness of companies for the climate transition ahead, as well as the financial impact on risk and return. Considering transition risks, adaptation risks and the evolution of emissions, we use CVI to identify if a company is likely to be a transition champion or a casualty.

Figure 1. Climate Value Impact to analyse the financial impact of the transition

Source: LOIM analysis. For illustrative purposes only.

LOIM’s approach to carbon assessment and net zero has been developed in partnership with Oxford University and SystemIQ. The Portfolio Alignment Team of the TCFD cited LOIM’s process as one of seven leading methodologies, and one of only two developed by asset managers.

Future-proof strategies designed to step up decarbonisation

Driven by investment and sustainability expertise, our range of TargetNetZero solutions aims to decarbonise, diversify, and drive the transition. In both fixed income and equities, we adopt an economy-wide approach that:

- Offers a diversified portfolio with an implied temperature below 2 degrees (aligned with Paris Agreement objectives)

- maintains diversification

- reduces sector biases, and

- avoids excessive risk2

Our team of 20 sustainability experts works closely with experienced portfolio managers to apply science-based, academically verified and globally recognised carbon analysis to identify companies most able to contribute to a zero-carbon portfolio in the long term. The portfolio emissions of our strategies are at least 30% below their benchmarks’ carbon footprint at inception. They target a 50% reduction by 2030 and net zero emissions by 2050.

Aligned with both climate goals and investor interests, our strategies aim to equip portfolios for a net-zero future.

sources

1 The Greenhouse Gas Protocol defines Scope 1 emissions as direct emissions from company facilities and vehicles; Scope 2 emissions as indirect emissions related to purchased electricity, steam, heating and cooling used in company activities; and Scope 3 emissions as indirect emissions resulting from a company’s supply chain.

2 Target performance/risk represents a portfolio construction goal. It does not represent past performance/risk and may not be representative of actual future performance/risk

Find out more about our target net zero investment strategies:

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.