investment viewpoints

Steering through China’s property sector

As defaults escalate among China’s high yield property developers, our Asia fixed income specialists break down the key factors driving debt markets including the sector’s fundamental problems and potential future government policy response. After presenting several prospective scenarios for the future – including the higher risk of a hard landing - we map the investment implications for investors.

|

Need to know

|

|---|

Real estate defaults mount

A raft of defaults in high yield (HY) real estate has caused seismic shifts in China’s property sector during the second half of 2021 and continues to strongly disrupt the market. Eight developers have defaulted on USD17.5bn worth of debt in the period so far. Including the likely defaults of Evergrande and potentially Kaisa1, we believe total defaults this year could rise to USD50bn, or approximately 30% of China’s high yield property universe.

Such spectacular dislocations have prompted a 41% decline in the Iboxx China HY Real Estate index since 1 June 2021. The average cash price of Chinese HY property bonds is now well below USD60 (compared to USD96 on 1 June 2021). More than 60% of property developer bonds are trading at yields greater than 30%, signalling that debt restructuring is now more than priced into debt instruments.

Local government regulators tightened restrictions to limit the second order effects of this ripple of defaults. Some measures - including restricting the access property developers have to their cash - precipitated the second wave of defaults and sell-off seen last week. A significant amount of cash is typically held at the escrow and project level: we now understand that many companies are unable to use their cash, despite having high cash balances and a short-term cash to debt cover ratio of over 1x. This inability to tap cash has alarmed the market and further fuelled the downward spiral over the past week.

Higher risk of a hard landing

That said, we believe policy response thus far is only marginal, and not significant enough to solve the fundamental issues and restore confidence. The sector’s fundamental problems are an unprecedented squeeze on liquidity, and the inability of central and local government regulators to act together. As such, we see a higher risk of a hard landing for China’s property sector, and in turn, higher systemic risk to China’s economy in the next 3-6 months should policy stance not change materially.

The table below outlines possible scenarios that might arise going forward, and their implications. It is hard to pinpoint one as the central scenario since a lot rests on the nature and timing of the policy path chosen by the authorities. Scenario 1 represents the read-through for the sector if there is no response, and we believe this is an unstable equilibrium since the ultimate consequences are likely unpalatable to China as a whole. Once this is recognized, we are left with two scenarios, one that is a ‘half-measure’ muddle through (scenario 2) and another that is a more forceful, holistic response (scenario 3). We would expect that scenario 3 becomes that ultimate equilibrium point but the risks are still finely balanced.

# |

Scenario |

Implication |

Probability |

|

1 |

Status quo – No significant response or very delayed response by the authorities |

Implications for China Property market

Global macro implications – hard landing for China

|

Medium – not a stable equilibrium |

|

2 |

Back-channel or stealth easing onshore with selective rescues |

Implications for China Property market

Global macro implications

|

Low/Medium |

|

3 |

Strong, quick response from authorities involving measures to meaningfully ease the liquidity pressure onshore and offshore [bullish case] |

Implications for China Property market

Global macro implications Limited |

Medium |

Next steps: more defaults, policy uncertainty, maximising recovery

Given the evolution of events, we believe that further HY defaults will be inevitable given the drastic sales declines in September-October and mainly onshore cash restrictions. These are currently being sparked by liquidity considerations rather than solvency constraints. However, a permanently weaker buyer base for the physical market going forward could impact solvency in the medium term.

Sticking with the status quo would be politically and economically untenable for China, especially with the start of a third term for President Xi next year. As a result, we would expect some form of a policy response for the sector, although the risk of it being too little too late is definitely rising.

Current valuations in the offshore market for China are severely dislocated and many HY developers are trading at or below their recovery values. To maximise recovery, investors should be prepared to ring-fence exposure to weak credits and pursue an orderly resolution for those credits that are forced into selective default due to liquidity pressures.

For the remainder of property names able to survive until a forceful policy response is forthcoming, we would recommend staying invested in the sector and would expect their yield curves to normalise over time. These names potentially offer strong upside from current levels, including for state-owned and quasi-sovereign real estate firms, in our view.

Overall uncertainty and lack of clarity around China’s policy response is high. As such, we are maintaining our exposure to the property sector but not increasing it until a clear policy response emerges. High quality developers should have ample room to rally once there is greater precision, in our view.

Sources

1 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

RECENT DEBT MARKET COLLAPSE

China’s property sector has undergone a spectacular dislocation in the second half of 2021, with ~41% decline in the Iboxx China HY Real Estate index since 1 June 2021. Eight developers have already defaulted, namely Fantasia, Modern Land, Fanhai, Yango, China Fortune, Sinic, Languang, Xin2, totalling USD17.5bn worth of debt. Including the likely defaults of Evergrande and potentially Kaisa, the total defaults this year will rise to USD50bn (which is ~30% of the total China HY property universe).

The average cash price of bonds is now well below USD60 (and was USD96 as at 1 June 2021). JP Morgan3 estimates that the full year 2021 Asia HY default rate will come to 9% (total defaults amounting to USD 34bn), with a further 6.5% default rate in 2022 (totalling USD25bn in defaults). Nevertheless, markets have already gone into free-fall and over 60% of the property developer bonds are trading at yields greater than 30%: hence, this has already been largely priced in.

The second order effects from the Evergrande and Fantasia defaults have resulted in another round of tightening by local government regulators. They have now begun to restrict the cash of property developers, which has precipitated the second wave of defaults and sell-off last week. A significant amount of cash is typically at the escrow and project level, and we now understand that many companies are unable to use their cash balances despite having high cash balances and short-term cash to debt cover of over 1x. This has alarmed the market and has fueled the spiral downward over the past week.

In Figure 1, we present a timeline of key events that have resulted in this extreme price action.

Figure 1. Key timeline of events

Time |

News |

Remarks |

|---|---|---|

|

September 2021 |

Imminent restructuring of Evergrande |

Evergrande’s imminent default was precipitated by policy tightening but was primarily caused by its aggressive expansion into non-core business activities and sheer unwillingness to sell assets. |

|

4 October 2021 |

Fantasia default |

Sparked wider panic in the offshore bond market as investors were instructed that the bonds would be repaid a few weeks prior, but the company failed to make the payment on time, in effect triggering a 'willful' default |

|

18 October 2021 |

Modern land defaults |

Default on principal and interest payments under USD$250m 12.85% notes maturing Oct. 25 after surprise termination of proposed consent solicitation due to withdrawal of credit lines from onshore banks. This was despite the unrestricted cash balance reaching an all-time high of RMB 13.62bn (USD$2.13bn) in June. |

|

22 October 2021 |

Agile private placement disclosure |

Agile claimed to have repaid a previously undisclosed private placement bond, and claimed it did not have any more private placements. This further dented the confidence in disclosures of property developers |

|

25 October 2021 |

Small developer Sinic defaults |

Sinic, a small developer with USD$710m in public bonds defaulted on its USD$250mn bonds due in October, triggering cross default |

|

19-28 October 2021 |

Chinese estates sale of Kaisa bonds

|

Chinese Estates, a HK property developer controlled by Joseph Lau, sold an aggregate principal amount of USD255m notes for USD77.7m from Oct. 19 and Oct. 28, including USD75m of the 9.375% due 2024s, USD30 million of the 10.875% perpetuals and USD150m of the 11.7% due 2025s |

|

Mid October 2021 to now |

Moody’s/S&P/Fitch downgraded group single B developers |

Rating agencies started to downgrade most single B developers to lower ratings, citing concern on the market condition and refinancing pressure for such developers in the next 6-12 months; Names include Kaisa/Yuzhou/Aoyuan/R&F/CCRE/Ronshine4 etc. |

|

October 2021 |

Evergrande chairman pledges HK apartment to make bond payments |

Overdue coupon payments were made within the grace period, and market suggestions are that the authorities have required the chairman to make bond payments using his personal wealth |

|

3 November 2021 |

Yango group exchange offer |

Yango said it has initiated extension talks with all creditors of its near-term onshore and offshore debt maturities. The Chinese residential and commercial property developer told bondholders on the calls that its available cash and funding channels have been severely restricted due to regulatory policies and deteriorating market conditions since July. Has become evident to the market that cash levels disclosed are not fully available to make offshore payments |

|

4 November 2021 |

Kaisa WMP default |

Post from Weixin channel alleged that Kaisa missed payment in some wealth management products (WMP) due by 30 October. Debtwire news indicated that Kaisa president Mai Fan told some WMP investors at an office in Shenzhen that it is unable to pay their WMPs due beginning this month. In addition, he admitted that Kaisa was the end user of the funds raised by the WMPs and thus is the obligor. In one of the meetings, a WMP holder questioned the veracity of Kaisa’s “approximately CNY 24bn cash” as of 30 June 2021, prompting a company official to say the level remains about the same, but that most of the cash is restricted. Kaisa had about RMB 40bn cash equivalent as of end June |

|

4h November 2021 |

Shimao rumours of extension of trust loan maturity |

Management denied the rumour on an investor call on Nov. 5, saying that Shimao still has about RMB 3 billion outstanding loans with Lujiazui Trust and the earliest maturity is not due until 2022. Management guided a cash balance of RMB 80 billion as of June but part of that is restricted by regulators. The company has a USD700m offshore bond due around April next year and it is in talks with its sole holder GIC for a one-year extension. Management also assured investors that Shimao has limited exposure to wealth management products, with most of them issued by its regional subsidiaries. |

Sources

2 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

3 Source: JP Morgan “EM Corporate Default Monitor” dated 8 November 2021

4 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document

STRUCTURAL CONTEXT FOR CHINA PROPERTY

Real estate is a large part of the Chinese economy – China’s property market is believed to have grown to USD 60trn in notional value, making it the largest asset class in the world5. It is estimated that the housing sector contributes to nearly 30% of GDP via direct and indirect channels such as property FAI, property construction supply chain, consumption, and wealth effect. Property-related loans (developer loans, mortgages, shadow banking) represent 35% of banks’ loan books and developer bonds represent 23% of the outstanding balance of the offshore USD credit (IG + HY) market.

Figure 2. Links between China’s property market and Chinese macroeconomics

Source: Goldman Sachs September 2021

Structural demand side support is likely weakening in China. It is well understood that property is used more as a store of value rather than as a ‘productive asset’. As a broadly closed economy with a still developing capital market, there are limited avenues for the population to invest their excess savings, resulting in savings being channeled into the property sector. Over 60% of total urban household wealth is estimated to be invested in the property sector. According to China Household Finance Survey (CHFS), housing ownership in China is ~93% on a nationwide basis, which is arguably high. While replacement/upgrading demand can certainly drive price increases, we believe the marginal demand for property has been driven by speculative demand rather that true underlying demand for a few years, pushing property affordability even lower for urban cities. This has been the driving force for authorities’ tightening efforts and the oft-stated “housing is for living and not for speculation”. It is becoming increasingly clear that the willingness to allow property prices to rise is extremely limited this time around. Structural factors such as ageing demographics should also drive a peak in property price growth. However, the key risk has now evolved into whether a dent in confidence will lead to downward pressure on prices, and whether the authorities will be able to control prices on the way down.

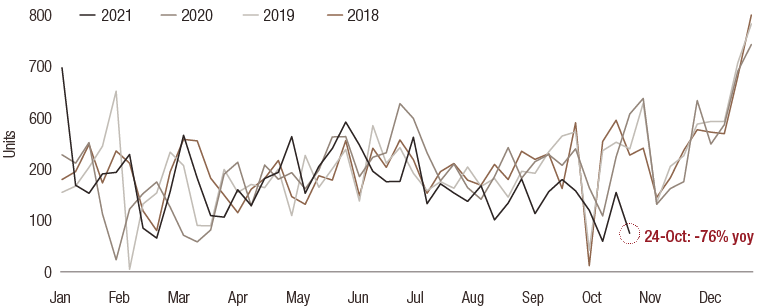

Even without a steep demand drop, there are several channels of contagion that could result in a hard landing for China if policy action is not forthcoming soon. For example, property sales already represent an important financing channel for local governments. Local government fiscal reports show that ~35% of their consolidated fiscal revenue comes predominantly from land sales. Recent data has shown a 76% yoy drop in weekly land transaction volumes in the top 100 cities. Barring a sharp rebound in the last two months of the year, which we think is unlikely given the state of developer finances, there will be further pressure on the fiscal balances at the local level, hindering potential infrastructure spend at the local level, further curtailing growth.

Figure 3. Weekly land transaction volume in 100 Chinese cities

Source: Goldman Sachs Global Investment Research, October 2021

Against this backdrop, we move onto the epicentre of the struggle on the supply side with property developers. Historical debt growth for the top 30 developers from 2016-2019 stood at 22% CAGR whilst assets owned by them have gone up by similar or greater levels. The business model for property developers during this time hinged on fast turnover with land banks, largely ranging from 2-5 years for most developers. Therefore, there is a large focus on in-year contracted sales and execution capability, with the proceeds from the sales and cash collection getting ploughed back into further land acquisition. This has since resulted in a large build-up of leverage across the sector, both via operating, financial and cooperation channels as shown below in figure 4. Authorities began to curtail on-balance sheet lending from banks, and this perversely led to an increase in off balance sheet financing via trust financing and WMPs. As a result, the opacity of developer balance sheets increased significantly. This also occurred during a time when regulation was focused on cooling the demand side via increased mortgage downpayment ratios, home purchase restrictions and tightened market supervision around ASP (average selling prices).

Figure 4. Various types of leverage used by property developers

Source: Citi Research, April 2021

Figure 5. Estimated total property-related borrowing breakdown

Source: Citi Research, April 2021

Regulators then began to clampdown on the supply side toward the end of 2019 with measures cracking down on off-balance sheet financing and quotas on developers’ offshore bond issuances.

Measures prior to last year included:

|

Policy Action |

Details |

Time framework |

|---|---|---|

|

Interest Rate Hike/cutting |

PBoC occasionally provided guidance on interest rates for mortgage/construction loan applications |

From time to time |

|

Home Purchase Restriction |

To be eligible for an additional unit, either newly built or second-hand, a household registered in the Hukou system – which officially identifies a family as residents of an area – cannot already own more than one unit.

A non-Hukou household, provided that it does not already own a unit, must also present proof of over one or three years of income tax or social security payments within the last two or five years. The actual number of years depends on the city of registration of the non-Hukou household. Details also vary about the scope of implementation: some cities impose city-wide restrictions while others confine them to inner-city areas. |

Since 2010 |

|

Down payment Requirement |

Depending on the stage of the market cycle and policy guidance, down payments range from 25%-60% for a second unit. For example, in Beijing the down-payment ratio for an ordinary second home was raised to a record high of 60% (and for a luxury second home, to even 80%) in March 2017. |

From time to time |

|

Pre-sale price cap |

To sell property, developers need to obtain a pre-sale permit from the local government, which usually sets the pre-sale price limits in order to property control prices in the local market. |

Since 2015 |

The second half of 2020 and 2021 has seen further policy tightening, including the three red lines policy, that has severely cramped developers’ ability to refinance their borrowings and has since precipitated a forced deleveraging in the sector. A summary of all the recent regulation is listed below:

|

date |

Policy action |

Details |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

August 2020 |

Three red lines policy |

Restrictions from the central government aiming to control the growth of new debt from property developers, a way of managing leverage in the sector.

1. Liability to asset ratio (debt leverage) <=70%; 2. Net debt to equity ratio (capital structure) <=100% 3. Cash to short-term debt ratio (liquidity) >=1 On top of these parameters, two additional factors are closely monitored: land acquisition to contracted sales ratio, which must be < 40%; and operating cash flow, which must have been negative for the three preceding years. |

|||||||||||||||||||||

|

January 2021 |

Real estate loan exposure guidance |

The PBoC and China Banking and Insurance Regulatory Commission (CBIRC) jointly announced and specified the ceiling for real-estate loan exposure and mortgage loan exposure for banks (as a percentage of RMB loans):

The regulator used to give guidance on capping real-estate loan exposure of new loans/existing loans in the past, but this is the first time it has provided an explicit cap for a different tier of banks. |

|||||||||||||||||||||

|

February 2021 |

Centralised land supply policy |

Requiring 22 cities in China to implement a centralised residential land-supply system via three batches in 2021. |

|||||||||||||||||||||

|

March 2021 |

NPC meeting communication |

Key messages from the National People’s Congress (NPC) & Chinese People's Political Consultative Conference (CPPCC): 1. Reiterated the policy of 'housing for living, not for speculation’ 2. Focused on stabilising land prices, housing prices and market expectations 3. Aiming to solve housing difficulties in big cities, especially for new urban residents and young people, by: increasing the supply of affordable rental and shared-ownership housing by increasing land supply, allocating special funds, and concentrating on affordable-housing construction |

|||||||||||||||||||||

|

July 2021 |

Regulation towards property management companies |

On 23 July, the Ministry of Housing and Urban-Rural Development and seven other government departments jointly issued a statement, which announced their aim to “improve the order in real estate sector in the next three years”.

Under the “property management” section, there are five company practices which the government intends to combat:

|

|||||||||||||||||||||

|

ongoing |

National Development and Reform Commission (NDRC) quota requirement |

China property developers issuing offshore bonds denominated in USD or other foreign currencies need to apply for NDRC quota. The use of the proceeds are largely for refinancing only the next one-year maturity. |

|||||||||||||||||||||

|

OCTOBER 2021 |

Property tax announcement |

|

While the introduction of the three red lines policy was expected to be positive from a long-term sector development and evolution perspective, the default of Evergrande and subsequent ‘stealth’ tightening by the government in recent months have resulted in a severe funding squeeze within the offshore channels.

Sources

5 Source: Goldman Sachs Portfolio Strategy Research note, 23 September 2021

POLICY RESPONSE SO FAR

Policy easing so far in response to this funding crunch has been very slow. Since October 2021, we have started to see some positive developments on the policy side, such as:

Figure 6. Summary of recent policies and comments on China’s property industry

|

Date |

Officials/Authorities |

Summary |

|

|---|---|---|---|

|

28 October 2021 |

NDRC |

NDRC meeting held with different developers to address their difficulties in funding/ operation:

|

|

|

21 October 2021 |

China Banking and Insurance Regulatory Commission (CBIRC) |

CBIRC mentioned five focuses on real estate market at 3Q news briefing:

|

|

|

20 October 2021 |

Liu He, Vice Premier |

Vice-Premier Liu He said at a financial forum that:

|

|

|

20 October 2021 |

Yi Gang, PBoC Governor |

PBoC Governor Yi Gang commented that Evergrande issue is a stand-alone case and should:

He said overall spill-over impact appears manageable. |

|

|

20 October 2021 |

Pan Gongsheng, PBoC Deputy Governer |

PBoC deputy governor Pan Gongsheng delivered a speech at a forum where he said that financial activities by property sector and financial market prices are gradually becoming normal. |

|

|

15 October 2021 |

PBoC |

PBoC mentioned at 3Q news briefing

|

|

|

15 October 2021 |

China Real Estate Association |

The China Real Estate Association hosted a seminar with 10 property names and (MOHURD) to assess industry situation and needs. |

|

|

First 2 weeks of October |

N/A |

Improvement has been seen on first-home mortgage in cities, including Guangzhou, Foshan, Suzhou etc. , with faster approval as banks may deploy part of ‘22’s loan quota in 2H21. |

|

Source: PBoC, State Council, CBIRC, The Paper, Citi Research

However, so far, the policy easing is only marginal and not significant enough to solve the fundamental issues and restore the confidence in the property market.

In our view, the fundamental problem facing China’s property sector is an unprecedented liquidity squeeze which is being caused by both central government, as well as by local government regulators who do not seem to be acting together. These are perhaps driven by one or more of the below factors:

- Reluctance to communicate the real state of affairs up the chain of command for political reasons ahead of the start of President Xi’s third term

- Misalignment of incentives between the local government and central government. Structurally, the centre does not benefit from income from the property sector owing to the lack of property taxes, creating a degree of separation between central policy making and local execution. In the more near term, local governments appear to have begun to restrict cash at the project level by tightening escrow rules. In the face of increased risk aversion and potential default, local government regulators are likely daunted by the prospect of needing to take over and complete the projects of defaulted developers, and so appear to be preemptively preparing for the outcome of default although it is not necessary (and unwittingly precipitating the same).

There is anecdotal evidence that the Evergrande default has caused demand to soften in Tier 3 and Tier 4 cities and people have become nervous about project completions. A few more relatively high profile defaults in Tier 1/Tier 2 cities could upset the equilibrium and trigger a sector-wide meltdown (not just in the USD market, but also in the physical market). With policy remaining tight, more and more developers will face refinancing/liquidity squeeze, going forward.

POTENTIAL POLICY ACTIONS AND THEIR EXPECTED EFFECTIVENESS

As such, there is higher risk of a hard landing for China’s property sector and as such, higher systemic risk to China’s economy in the next 3-6 months should the policy stance have no material change. This would not be the case if there is a policy shift of easing, although it is difficult for investors to call this, and even then, the swiftness of the easing will become key and there is a rising risk that it comes too little too late.

We outline a few potential key policy actions and their expected impact on the USD offshore market in Figure 7.

Figure 7. Potential key policy actions and their expected impact on the USD offshore market

|

# |

Policy Response |

What will it solve? |

Effectiveness |

Where the line is drawn for offshore USD issuers? |

Probability |

|---|---|---|---|---|---|

|

A |

Statement by top officials (Liu He for example) on front page of Global Times or China Daily, augmented by directed lending from state-owned banks |

|

|

|

Imminent – Low

Delayed – Medium |

|

B |

Removal of loan concentration caps and three red lines |

|

|

Same as above |

Low, politically unpalatable |

|

C |

National Team buys USD distressed bonds similar to 2015 China equity scenario |

|

|

|

Low, for fear of setting moral hazard issues |

|

D |

Relaxation of escrow curbs at local government level |

|

|

|

High |

|

E |

PBOC-funded special bond or liquidity facility (onshore) to provide more concrete reassurance that funds will be available for developers to complete unfinished houses and pay contractors, suppliers, and creditors. |

|

|

|

Medium |

|

F |

Statement assuring that offshore creditors would be treated similarly to those onshore

|

|

|

|

Medium |

|

G |

Merger of large SOE developers to create a large national champion |

|

|

|

Very low |

|

H |

Reserve Requirement Ratio (RRR) Cut |

|

|

|

Less likely unless authorities realized the hard landing problem |

|

I |

Relending facility |

|

|

|

Highly likely but less supportive to overall property market |

Depending on when any or some of the above policies will be enacted and announced, we would still expect that some of the China property sector names will be forced into default and will subsequently need to be ring-fenced and worked out. We suspect the pace of policy action will be determined by what the authorities’ pain threshold is, and their chosen policy path will determine the path ahead for the sector.

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.