investment viewpoints

The case for Asian markets

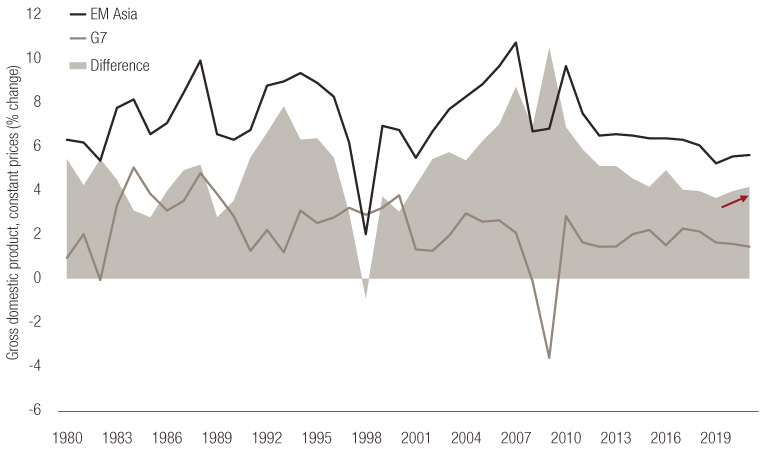

The growth differential between emerging market (EM) Asia and developed markets (DM) has been narrowing over the past few years, hampered by the tightening in US monetary policy, higher US asset prices and a recovery in DM growth prospects. However, during this time, EM Asian countries have strengthened their fundamentals significantly.

China has deleveraged to a good extent, India and Indonesia have both embarked on structural reforms that have increased potential growth, improved the fiscal health of the sovereign balance sheets and decreased the external vulnerabilities faced by these economies. Armed with these substantial improvements, we believe 2020 will represent important milestone for the region. According to the World Economic Forum (WEF), 2020 will mark the first time since the 19th century that Asia will be larger than the rest of the world combined in terms of purchasing power parity.

Asia DM growth differential

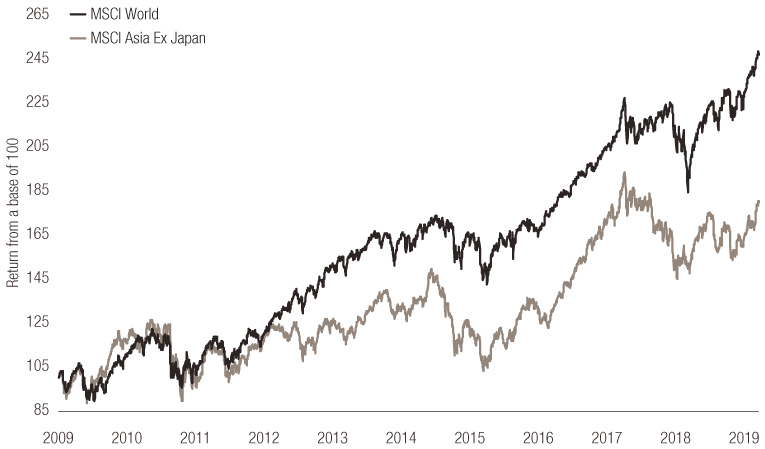

MSCI World vs. MSCI Asia

A number of supportive trends will aid the resurgence of Asia

1. Foreign investment and homegrown R&D

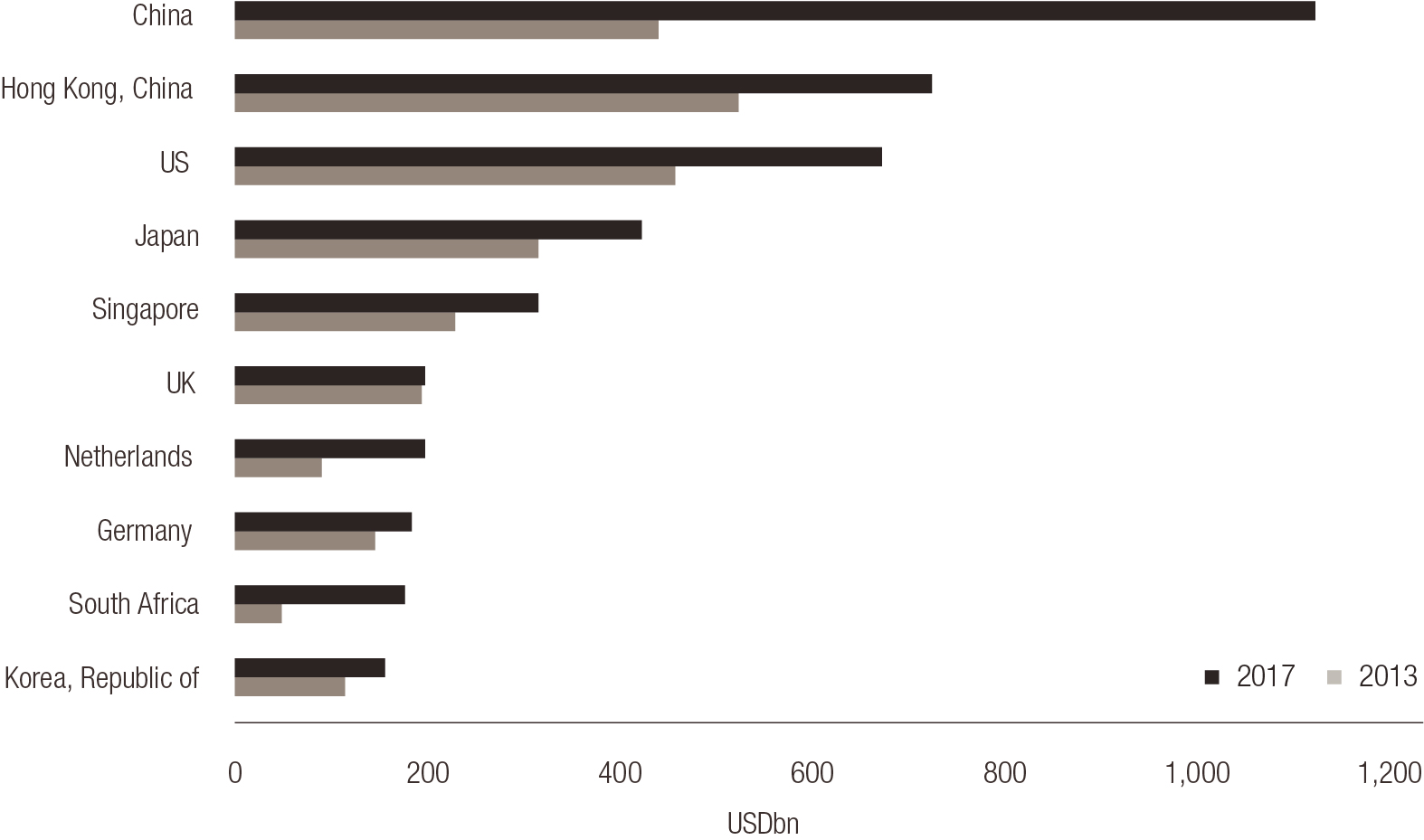

A benefit of the structural reform undertaken by emerging Asian countries has been an increase in the foreign investment into these economies. Asia is the world’s largest recipient of foreign direct investment (FDI), with flows to the region accounting for 39% of global FDI in 2018 – up from 33% in 2017. Asia is now also the top destination for venture capital in relation to exciting frontier technologies such as robotics, 3D printing, and artificial intelligence.

Top 10 investor economies by FDI stock, 2013 and 2017 ($ billions)

At the same time, Asia has also taken a lead when it comes to homegrown research and development spending. For example, South Korea has doubled the amount it invests in R&D – from 2.2% of GDP in 2000 to 4.6% by 2015. Over the same period, the number of researchers in the country rose from a little over 2000 per million inhabitants to more than 70001. China spends around 2% of GDP on R&D – up from 0.9% in 2000. There is considerable room to grow this allocation, particularly given the ‘Made in China 2025 strategy’ where Chinese authorities have now made a conscious decision to build on their intellectual property in the face of increasing trade tensions.

2. Favorable demographics and growing skill levels

Asia is now home to half the people on the planet, with the working age population expected to grow by 10% between 2015 and 2030. This is largely concentrated in India and China, and India’s population growth is not expected to peak until 2050. A larger working population comes with a number of benefits such as increasing competition for jobs, low labour costs, and potential for greater margins for businesses.

While research conducted by the UN suggests China’s working age population peaked in 2015, it has an increasingly better educated workforce now. Whereas just 3% of university-age people in China were enrolled in tertiary education 30 years ago, it is now at more than 50%. The same trend applies for the rest of Asia as well. For example, a larger proportion of university-age South Koreans enroll in colleges and universities than in the US. In the 2000s, just 10% of university-age inhabitants were enrolled. By 2014, this had nearly quadrupled to just short of 40%. This increase in skill level is a key precursor to productivity gains, which further boost Asia’s potential growth.

3. Strong and improving consumption trends from a growing middle class

Asia has a fast-growing middle class that continues to underpin rising consumption trends in the region. An estimated 93 million people have joined the middle class in Asia over the past 8 years, and the region boasts the fastest wealth creation on a household basis. The OECD anticipates that the global middle class will have risen to 4.9 billion by 2030, with Asia accounting for 66% of the total.

Along with the fast growth comes higher spending power. Asia will account for 59% of the global middle class consumption by 2030. China’s middle class spending power alone expected to double over the next decade to $14.5 trillion, which is the equivalent to middle classes of North America and Western Europe combined.

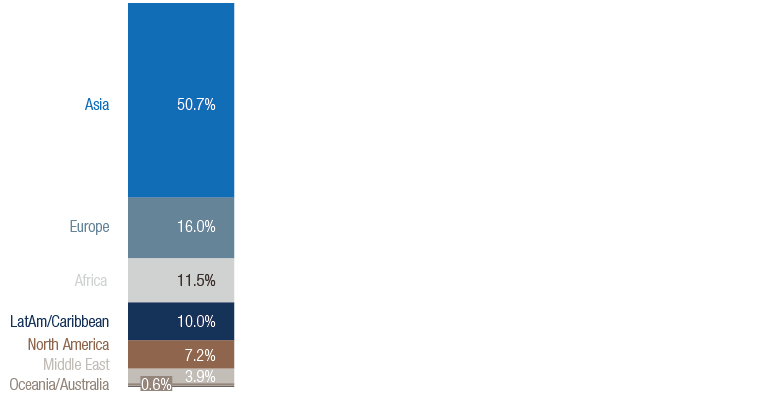

This larger middle class is set to boost Asia’s share of global consumption to 40% by 2040 in a trend facilitated by the ongoing integration of technology. Asia already accounts for half of all 2.2 billion internet users worldwide, while China and India together make up one-third. This continues to open up significant new markets for online retailers. China’s online retail market is now larger than the United States and the United Kingdom combined. McKinsey estimates that China’s online retail sales volume hit USD 1.5 trillion in 2019, representing a quarter of the country’s total retail-sales volume. In India, e-commerce retailing is the second largest and fastest-growing segment of the economy.

Percentage of internet users (2019 mid-year estimates)

Source: Internet World Stats

The middle class in Asia has powered the rise of new Asian corporate titans such Alibaba and Tencent displacing corporate giants in the oil and gas, and financial sectors as the most valuable companies in Asia. This change has been very rapid and Asia now boosts some of the most valuable “unicorns” such Bytedance (developer of the TikTok app), Go-jek and Grab2 (ride share companies) in the world.

By any measure - from economic expansion to capital flows to people power - Asia is already an economic powerhouse. We believe it is poised to take an even greater role on the world stage.

This economic expansion is reflected in the commercial and corporate sectors. More than a third of the Fortune 500 World’s largest companies are now based in Asia, and three of the top five are based in China alone.

Asia is also increasingly home to ‘superstar’ companies – which post annual revenues in excess of $1 billion. McKinsey research shows that Asia accounts for 30% of all global superstar companies, concentrated in China, India, Japan and South Korea.

These trends have room to play out as they are now supported by significant macro improvements in Asian economies

China has made decisive steps to slow runaway credit growth by streamlining regulation through the setup of a Financial Stability and Development Committee who have moved to reduce the financial instabilities in the system. For example, the Chinese government announced a new round of tightening policy to regulate the property sector in June 2019 that is aimed at controlling the property price, land cost, and to prevent excessive liquidity flow into property sector. Real estate financing has been tightened across all channels including mortgages, trust financing as well as domestic and offshore bonds. These have in turn de-risked the Chinese economy to a large extent, in our opinion.

Indonesia and India made significant progress with structural and fiscal reform that have dramatically improved their stability. Fuel subsidies were cut in both India and Indonesia in 2013 and 2014, providing much-needed fiscal room. Indonesia ran one of the most successful tax amnesty programs in the world, with over $330bn of declared assets. India made important steps on tax reform with the introduction of the Goods and Services tax (GST) in 2017.

External vulnerability has also sharply declined for emerging Asian economies that ran current account deficits since 2013. Both India and Indonesia have contained their current account deficits to ~2% of GDP. They have also shored up their foreign exchange reserves in order to insulate themselves better against external volatility – India has nearly $440bn in reserves and Indonesia is at $130bn. Asian current account surplus countries remain wary of sharp depreciations too, and this stability is important for long-term investors.

These efforts further bolster the high growth potential of Asian economies. Potential growth estimates for China, India, and Indonesia stand comfortably above 5%, a rarity in the developed world. Inflation has also been far more subdued than non-Asian EM counterparts, and this provides an important anchor for debt investors for a long-term sustainability perspective. The opening up of the onshore China bond market through Bond Connect reduces the friction for international investors significantly and there are already encouraging early signs. Compared to 2018, the number of approved investors in 2019 grew 218% YoY and the total volume grew 198% YoY (from c.$0.9tn to c.$2.6tn).

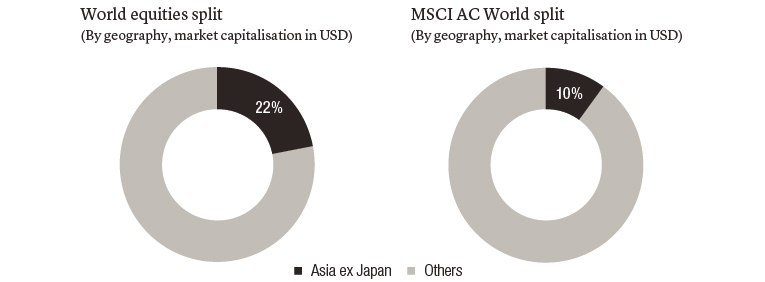

In the coming decade, Asian equity markets will be increasingly important for global investors as the region's weight in global equity indices catch up with its economic weight. Asia ex Japan equities are very underrepresented in global equity indices with about 10% weight in MSCI World when the region accounts for 22% of global market capitalization.

For illustrative purposes only. Source: Bloomberg, MSCI as of March 29, 2019.

The catch up is also happening faster than expected with MSCI increasing the weight of Chinese domestic A shares (listed in Shanghai and Shenzhen Stock Exchanges) in its indices in November 2019 by increasing the number of companies and lifting the inclusion factor from 5% to 20%. This trend will continue as Asia's equity weights catch up with the region's economic and financial importance.

The attractiveness of Asia to foreign investors has been steadily improving over the years and will only grow stronger in the coming years in our view. We believe this is the right time for investors to increase allocations into the region from a multi-year viewpoint for debt and equity markets.