investment viewpoints

The transformation from the WILD to the CLIC economy

At Lombard Odier, we believe that the transition to decarbonisation and the net-zero economy forms part of a larger economic transformation.

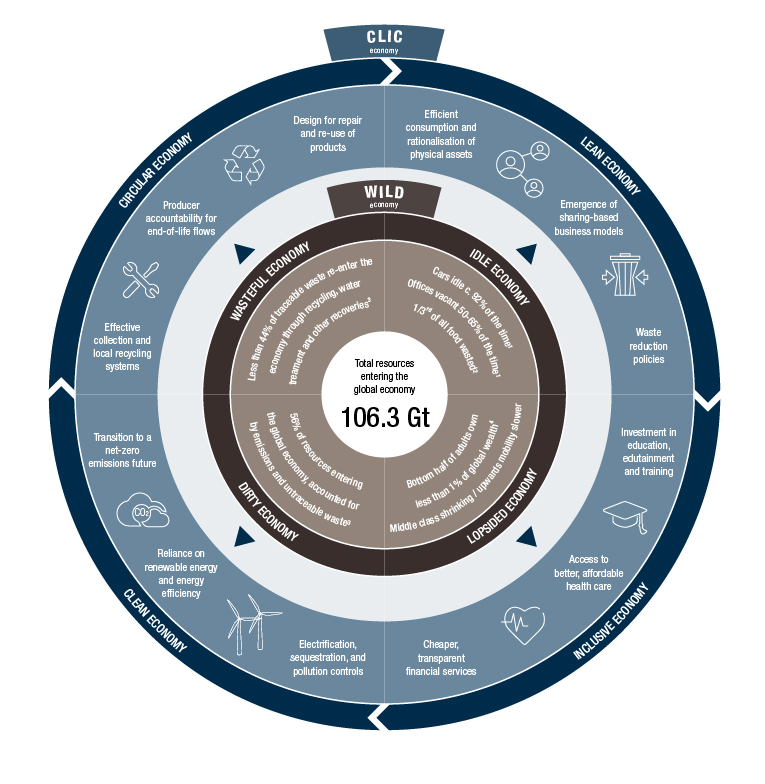

Today, we believe our economy is wildly out of control. Our present system has a severe impact on our natural environment and climate change. It is one where economic growth comes hand-in-hand with unpriced negative externalities. In addition, our economy is enormously wasteful.

We extract nearly 97 gigatonnes of material from the planet every year1, equivalent to over 265 thousand times the weight of the Empire State Building. A small fraction of this material is recycled.

Meanwhile, even the products that we produce from this material sit idle much of the time. Passenger cars, for instance, sit unused 92% of the time2. And on top of all this, increasing inequalities are leaving large swathes of the population behind. The bottom half of all adults in the world collectively own less than 1% of global wealth3.

We call this Wasteful, Idle, Lopsided and Dirty economy, the WILD economy, and it is completely unsustainable. To ensure the continued viability of our society and future economic growth, we believe we must fundamentally rethink the way we live, produce and act. To do this, we must decouple our economic growth from its underlying, adverse environmental footprint, and ensure our economy delivers broad and inclusive benefits for all stakeholders in society.

The end goal of this transformation is an economy that is Circular, Lean, Inclusive and Clean. We call this the CLIC™ economy. The CLIC™ economy leverages efficient production and consumption, and the sharing economy; reducing the wasteful accumulation of idle assets. By focusing on the four R’s: Re-use, Repair, Re-manufacturing and eventual Recycling of products, the CLIC™ economy reduces the dependence on ever greater extraction of mineral resources and leverages the substantial value of the materials and components that constitute the products that we so readily discard today.

The transformation from the WILD to the CLIC™ economy

Source: LOIM analysis 2020 based on 1 Ellen MacArthur Foundation; 2 FAO; 3 Circularity Gap Report; 4 Credit Suisse; 106.3Gt based on LOIM estimate of extraction of raw materials in 2019 plus recycled materials.

Please click here to read the full report.

sources.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.