investment viewpoints

Alphorum: credit selection in an imperfect recovery

In the credit section of the Q4 2021 issue of Alphorum, our quarterly analysis of global fixed-income themes and dynamics, we canvass the opportunities generated by the combination of generally positive business performance among issuers, the likelihood of US tapering beginning before year-end, and the pricing-in of imperfections in the recovery from the pandemic.

It follows earlier insights from this issue:

- Our lead commentary, which charts the diverse financial, macro and sustainability risks and opportunities in markets

- Developed market and inflation-linked bonds, where narratives for raising interest rates are gaining momentum or policy tightening is already underway

- Sustainable fixed income, where it is vital for investors to continue to build knowledge and apply new and established metrics to understand how deep economic change, such as the net-zero transition, will affect companies

In the coming days, we will turn our attention to the state of play in the emerging-market sovereign bonds and share findings from our research into opportunities among investment-grade companies whose ratings have descended to BB or lower, making them the so-called fallen angels in the high-yield market.

For now, we focus on the credit space, where the market is becoming more discerning as investors price risks with greater specificity, resulting in pockets of wider spreads among high-yield issuers.

Fundamentals and macro

The macro environment continues to look generally positive for corporate credit. Growth is slowing somewhat in the US and China, but Europe’s economy has room left to grow and continues to perform strongly. With the global economy looking quite healthy, potential inflation and the tapering of monetary support have become the market’s main concerns. The Federal Reserve’s indication that it would probably announce a reduction in asset purchases at its November meeting brings forward the timeline for tapering somewhat, but the fact that this has been well signalled means the market’s reaction should be controlled.

The threat of renewed Covid-related disruption is diminishing. Marginal risk from possible variants remains, especially for emerging markets where vaccination levels are lower (as highlighted in our lead commentary, vaccination levels are closely aligned with the GDP per capita of nations). However, vaccine production is scaling up rapidly, while the initial success of Merck’s anti-viral drug Molnupiravir in reducing the effects of the disease makes us more confident in humanity’s ability to live with Covid as a long-term, endemic disease1.

Supply-chain issues and labour shortages are arguably more of a concern in terms of constraining markets. Aside from the ongoing chip shortage and its impact on car and consumer electronics manufacturing, supply-demand mismatches are sending the price of commodities, such as aluminium, soaring. Meanwhile, a perfect storm has been created by the rebound in energy demand from pandemic-era lows, ongoing OPEC supply restrictions and global transport bottlenecks. The unexpected consequences are laying bare the highly interlinked nature of the global economy; for example, coal shortages in China have heavily impacted industrial activity, while a shortage of natural gas in Europe has affected the food and beverage industry in the UK and led to gaps on supermarket shelves. The speed of the recovery has been a factor, while the economy is also still adapting to new spending habits due to changes in the way we live.

With everything having been priced for a perfect recovery, the existence of imperfections in supply chains means we are seeing spreads widening. However, our overriding view is that this is a healthy correction. Central banks are still managing the situation and acting as a backstop for the economy; if the labour market fails to improve, there remains the option to delay tapering, while if the correction goes too far in other ways, they can defer interest-rate hikes.

Sentiment

Spreads for lower-rated bonds have tightened, compressing relative to higher-rated ones. However, given the prospect of tapering and the risk of interest-rate volatility rising again in the future, we remain constructive on high-yield credit and it continues to be our preference over investment grade. Investor consensus is somewhat one-sided, ‘hoping’ for continued low volatility and a range-bound spread environment ahead. So far, the spill-over from events in China is limited in terms of the wider market, however, this is something we will be monitoring closely.

Technicals

In general, technicals remain highly supportive, with central bank and government policy continuing to be accommodative. Even for September, which is traditionally a strong month for issuance, supply was strong in both the investment-grade and high-yield markets, yet it was matched by demand. However, many deals have featured little-to-no new issue premium, while some higher rated deals have had very low absolute levels. With this in mind, we prefer to await more interesting opportunities.

Valuations

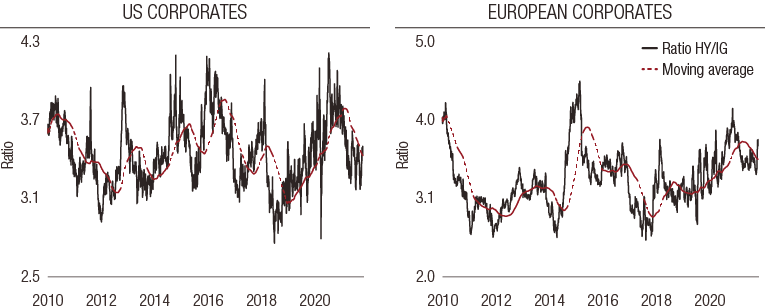

The market continues to be as tight as ever. Investment-grade credit spreads are below pre-Covid levels with little dispersion, while better index quality is driving high-yield valuations back to where they were before the pandemic. Improving fundamentals are translating into more rising-star candidates, supporting high-yield valuations even further. We are keeping our exposure to high yield for its relatively stronger carry, while standing ready to seize opportunities when they arise.

FIG 1. Relative value in corporate bonds: spread ratio of high yield over investment grade

Source: Source: Bloomberg, Barclays as at September 2021. For illustrative purposes only.

Outlook

Q3 results tend to be seen as important indicators of whether businesses will hit yearly performance targets. Overall, the year so far has been quite positive for most sectors, and expectations have increased as a consequence. Most companies are likely to outperform their initial targets from the start of 2021, but equally the market will already expect that. Given the relatively positive environment, companies that fail to meet targets are likely to be punished, although supply issues will inevitably be invoked as an excuse.

With many corporates benefiting from a surplus of liquidity, a key question is what companies will decide to do with all their cash. Will businesses invest in capex, distribute dividends, engage in M&A, or pay down debt?

In our view, the answer to some extent depends on which sector they are in. Some companies may remain cautious at this point, waiting until the end of the year to be sure increased travel and social mixing don’t result in further lockdowns. Others will be keen to repay the expensive debt they issued immediately after Covid hit; we note that firms in challenged sectors such as cruise lines are already carrying out liability management exercises on the debt they issued. Some M&A activity is in evidence, although not all of it successful; for example, the property sector has seen several failed take-over attempts, with insiders seemingly keen to buy but reluctant to sell. M&A could also be favoured in the media sector, where size is becoming key and there is a trend towards concentration, however, valuations are high so deals will not come cheap and companies could become over-leveraged.

In telecoms, the need for continuing investment in the rollout of 5G and fibre means capex will be a key focus, while the historic underperformance of telecoms as a sector pre-Covid means dividends may also be a preferred option. Tech is likely to have a similar focus on dividends and share buybacks. Meanwhile, now that prices have gone up, energy companies are likely to satisfy credit investors by reducing debt, as well as trimming businesses to be more profitable and decreasing the breakeven cost of extracting oil.

To read the full Q4 2021 issue of Alphorum, please use the download button provided.

Sources

1 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document

important information.

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA. ©2021 Lombard Odier IM. All rights reserved