investment viewpoints

7 questions on TargetNetZero convertible bonds

To reach net-zero greenhouse gas emissions by 2050, we have nine years left to reduce emissions by 50%. This urgent need to decarbonise is making sustainability a key driver of future returns.

In this Q&A, LOIM co-heads of convertible bonds, Arnaud Gernath and Natalia Bucci, discuss how our TargetNetZero global convertible strategy pairs economy-wide decarbonisation with growth potential. How do we determine if a company is aligned with the net-zero transition and why is the convertible bond market well suited to capture the opportunities?

To learn more about our approach, please click on the buttons below.

What is the idea of the TargetNetZero strategy?

The strategy invests in companies that are leaders in the climate transition to a net-zero economy. Our solution aims to decarbonise, diversify and drive the transition – and target climate growth opportunities. LOIM has developed dedicated carbon expertise to evaluate which companies have credible decarbonisation trajectories and stand to contribute to and benefit from the shift to an emissions-free future. We apply science-based, academically verified and globally recognised carbon analysis to identify companies most able to contribute to a zero-carbon portfolio in the long term.

Two key features of our decarbonisation approach are:

- We invest in all sectors across the economy, not merely today’s low-emitting companies, because only economy-wide decarbonisation will eliminate emissions in the future. Carbon-intensive industries – such as energy, transport and heavy industry - are often vital mainstays of our economy. Other approaches relying on simple exclusions miss transition opportunities, fail to solve the decarbonisation challenge, and increase concentration risk by reducing portfolio diversification.

- Our approach is forward-looking and analyses future decarbonisation pathways rather than relying on carbon-footprint analysis today. We have developed a proprietary implied temperature rise metric that indicates whether the emissions-reduction trajectory of a company is aligned with the net-zero transition, given the industries and regions it operates in, or an investment portfolio. To assess the potential for real decarbonisation, these calculations cover scope 1, 2 and 3 emissions1.

Our TargetNetZero convertible bonds strategy invests with high conviction in a portfolio of about 50 names. It applies a more flexible approach to credit risk than our flagship balanced convertible strategy in order to emphasise companies with better growth prospects linked to decarbonisation. Convertible issuers with large carbon footprints today, but clear emissions-reduction plans, could offer attractive but unrecognised return potential, in our opinion. The strategy has a higher equity sensitivity, and a flexible tolerance for portfolio credit quality, which is expected to remain between BB and BBB, overall.

As always with the asset class, convertible bonds could offer investors a lower volatility proxy to traditional equity exposure. Convertible investors benefit from upside participation with equities but with lower volatility due to the asymmetric return profile of the instruments and their characteristic bond floor, which offers elements of downside protection2.

Sources

1 The Greenhouse Gas Protocol defines Scope 1 emissions as direct emissions from company facilities and vehicles; Scope 2 emissions as indirect emissions related to purchased electricity, steam, heating and cooling used in company activities; and Scope 3 emissions as indirect emissions resulting from a company’s value chain, both upstream and downstream.

2 Capital protection is a portfolio construction goal that cannot be guaranteed.

Why do companies selected by the TargetNetZero strategy have better growth prospects?

The race to net zero is unavoidable and gathering increasing force. A powerful combination of technological innovation, market forces, shifting consumer preferences and regulatory change is already transforming the operating environment for companies. We believe change will only accelerate.

Companies that are on a viable pathway to achieve carbon neutrality and successfully manage transition risks stand to benefit from premium valuations versus their peers, and may enjoy cheaper and greater access to capital, in our opinion. We believe they will also successfully compete for business while attracting and retaining customers and talent. Overall, this translates into better growth prospects for those companies with credible plans to decarbonise.

How do you determine if a company is aligned with future net-zero goals?

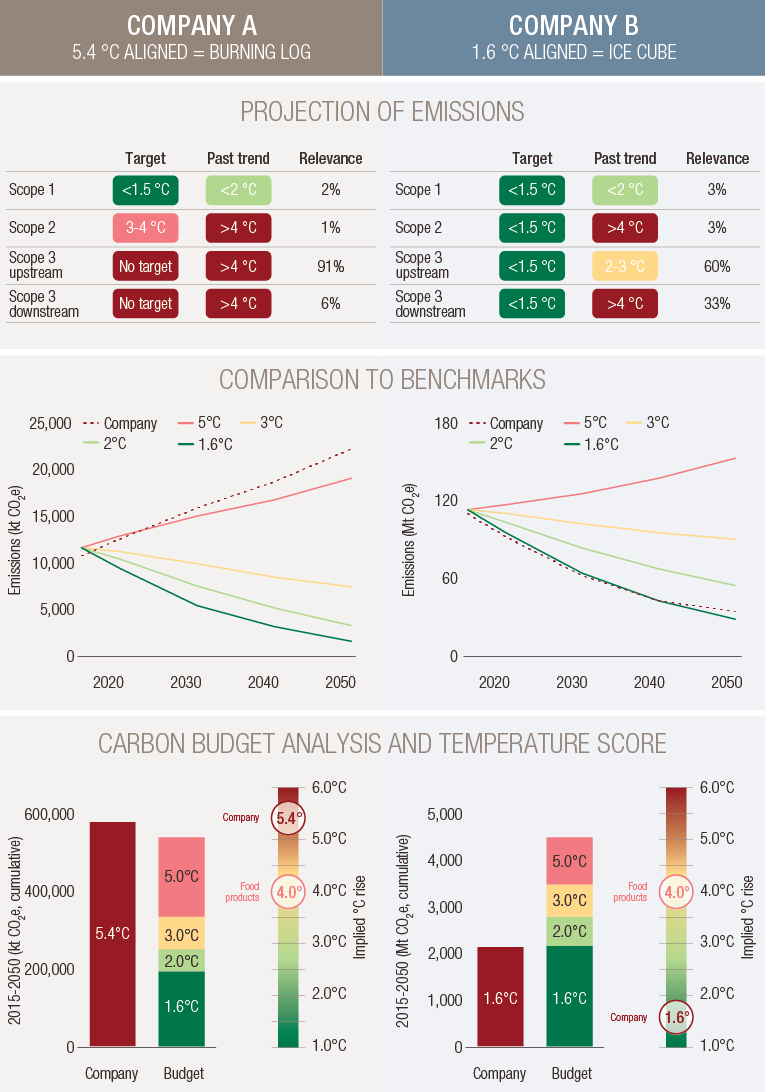

We use a science-based framework based on forward-looking metrics to determine if a company’s emissions trajectory is synchronised with net-zero targets. Our carbon expertise enables us to assess a portfolio or individual company’s temperature alignment with the Paris Agreement targets (figure 1).

A broad spectrum of emissions data – both historical and forward-looking – are analysed and quantified to gauge temperature alignment.

- First, we assess scope 1, 2 and 3 emissions to determine the company’s volume of emissions as of today as well as how those influence transitional risks.

- Second, we focus on how current emissions are expected to change across a range of industries. Here, we also assess companies’ recent progress made in cutting emissions and any reduction targets to understand whether companies are aligned with – and are likely to remain profitable in – a net-zero world. This enables us to calculate emission trajectories and see whether they reflect the carbon budget of an emissions pathway that implies net zero by 2050.

- Third, we track not only companies’ current targets and commitments, but also assess their exposure to external forces, including pressure from decarbonising competitors and regulators.

- Finally, we continuously seek new data on changes in emission levels, decarbonisation targets, policies and decarbonisation technologies in order to deliver dynamic and accurate assessments of companies’ progress in reducing emissions. Figure 1 illustrates how we measure the alignment of two companies in the food products industry.

Figure 1. Illustrative examples of company temperature alignment in food products industry

Source: LOIM analysis. For illustrative purposes only.

We believe forward-looking measures are vital for investors to understand the future transition pathways of their investments. Understanding the temperature alignment of a company can help avoid exposure to stranded assets and identify the most valuable investment opportunities. Active engagement with companies also plays a vital role in this process. Our stewardship framework integrates the Oxford Martin Principles to prioritise alignment with net zero. Our targeted and comprehensive approach has been recognised by the Financial Reporting Council (FRC): LOIM has been awarded signatory status of the FRC’s strengthened UK Stewardship Code.

How do you identify climate leaders and laggards?

We call climate leaders ‘ice cubes’ and climate laggards ‘burning logs’. Ice cubes are companies that face significant exposure to transition risks in relation to climate but understand the urgency of the transition and are decarbonising towards net-zero alignment: they disproportionately cool down the economy or a portfolio’s aligned temperature.

Conversely, burning logs are companies that generate huge emissions as of today and are not committed to net-zero alignment: they may be exposed to significant stranded assets or even lose their licence to operate in a net-zero regulated world. We do not invest in burning logs as they disproportionately raise the temperature of a portfolio.

How is the convertible bond market well suited to invest in a net-zero future?

The convertible bond universe offers myriad opportunities to achieve net-zero alignment through diversified exposure to a selection of value names and high-growth disruptors. The universe contains an appealing combination of growth, traditional value and new technology issuers that are active in sectors relevant to a carbon-free future, in our opinion.

Shifting supply patterns are creating compelling opportunities. Since January 2020, the convertible bond universe has expanded by over 70% to USD 600 bn. This busy primary market replenishes the list of investable names. More than 60% of the issues have come to the market over the past 18 months, providing fresh investment opportunities.

More specifically, more than USD 7.5 bn of issuance has been in the format of green bonds, a key way for borrowers to designate proceeds to promoting the climate transition. Our SIRSS3 team of 20 specialists carefully evaluates the sustainability credentials of all green-bond issuance and passes judgement to the investment teams to avoid greenwashers or potential weaknesses. We examine the strength and quality of the issuer’s framework and external review; the use of proceeds; alignment with best-practice guidelines published by the ICMA Green, Social, Sustainability Bond Principles; national and regional guidelines (such as the EU Green Bond Standard); and its overall environmental, social and governance (ESG) profile and sustainability characteristics through using our proprietary ESG and temperature alignment methodologies.

Source

3 SIRSS stands for Sustainable Investment Research, Strategy and Stewardship.

What are LOIM’s sustainability credentials?

Our transition mindset places us at the forefront of investing in decarbonisation, and is proof that sustainability is at the centre of our investment philosophy and partnerships. LOIM’s approach to carbon assessment and net-zero alignment was developed in partnership with Oxford University and SystemIQ. The Portfolio Alignment Team of the TCFD 4 cited LOIM’s process as one of seven leading methodologies, and one of only two developed by asset managers.

The ESG and sustainability approaches of our flagship convertible bond strategy have been externally validated by Febelfin and the Central Labelling Agency (CLA), which monitors the quality standard for sustainable and socially responsible financial products.

Having prioritised developing carbon expertise, our in-house capabilities have created pioneering methods to assess risk and opportunity in the climate transition. Our extensive sustainability and research capabilities include more than 80 equity, credit and sustainability analysts, and use of LOIM’s proprietary equity research platform (DEER).

Source

4 The TCFD is the Task Force on Climate-Related Financial Disclosures. It was established to develop recommendations for more effective climate-related disclosures that could promote more informed investment decisions and enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks.

Name 3 things that stand out about the TargetNetZero convertible bond strategy.

1. An innovative global convertible bond strategy with a defined net zero target: we target 50% emissions reductions by 2030 and 100% by 2050, in line with the Paris Agreement target of limiting global warming to 1.5°C.

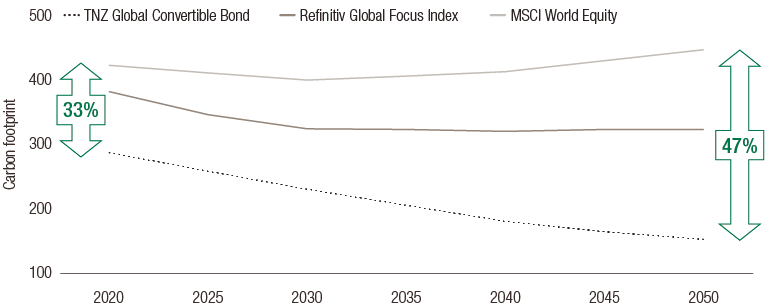

2. We seek to achieve a lower emissions trajectory than the benchmark Refinitiv Global Focus Index. By 2050, our strategy is projected to have reduced emissions by -47% versus -16% for the index (see figure 2)5. We do this by selecting companies that our analysis shows are aligned with and accelerate the climate transition to drive real decarbonisation across the entire economy.

3. Under the European Sustainable Finance Disclosure Regulation (SFDR), asset managers must classify their funds according to the level of sustainability integration and the objectives sought. This strategy will be classified as an Article 9, the highest sustainability classification, confirming that a very significant portion of its investments are sustainable.

Figure 2. Projected TargetNetZero convertible emissions trajectory (model portfolio) vs benchmark

Source: LOIM. For illustrative purposes only. As at July 2021. Carbon footprint refers to MtCO2e/MUSD invested. Allocations and holdings are subject to change. The strategy has not yet been launched.

Source

5 Targeted emissions reduction represents a portfolio construction goal and may not be guaranteed.

In a nutshell, how would you describe the TargetNetZero convertible strategy?

|

A pioneering way to combine economy-wide decarbonisation goals with a high-conviction focus on growth. The distinctive asymmetric return profile of convertible bonds remains in play, providing some downside mitigation from the bond floor as well as potential upside from the equity element. |

|---|

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.