investment viewpoints

Swiss outlook as negative rates bed in

Swiss FX focus amid Eurozone concerns

Generally speaking, macroeconomic indicators have softened this year in Switzerland, echoing the slowdown seen in the Eurozone across key areas such as manufacturing and inflation. Any remaining pressure on prices in Switzerland is being driven by domestic demand, while imported inflation has all but evaporated.

A notable firming of the Swiss franc between early May and August of this year helped fuel the decrease in imported inflation. On a trade-weighted basis, the currency appreciated by some 6% in this period. Inflation has essentially collapsed, as evidenced by the October headline CPI reading at -0.3% YoY.

Other Swiss indicators similarly felt the slowdown of Switzerland’s largest trading partner, the Eurozone. Economic activity indicators such as Swiss PMI and the KOF business survey have both softened notably and are showing below-trend growth.

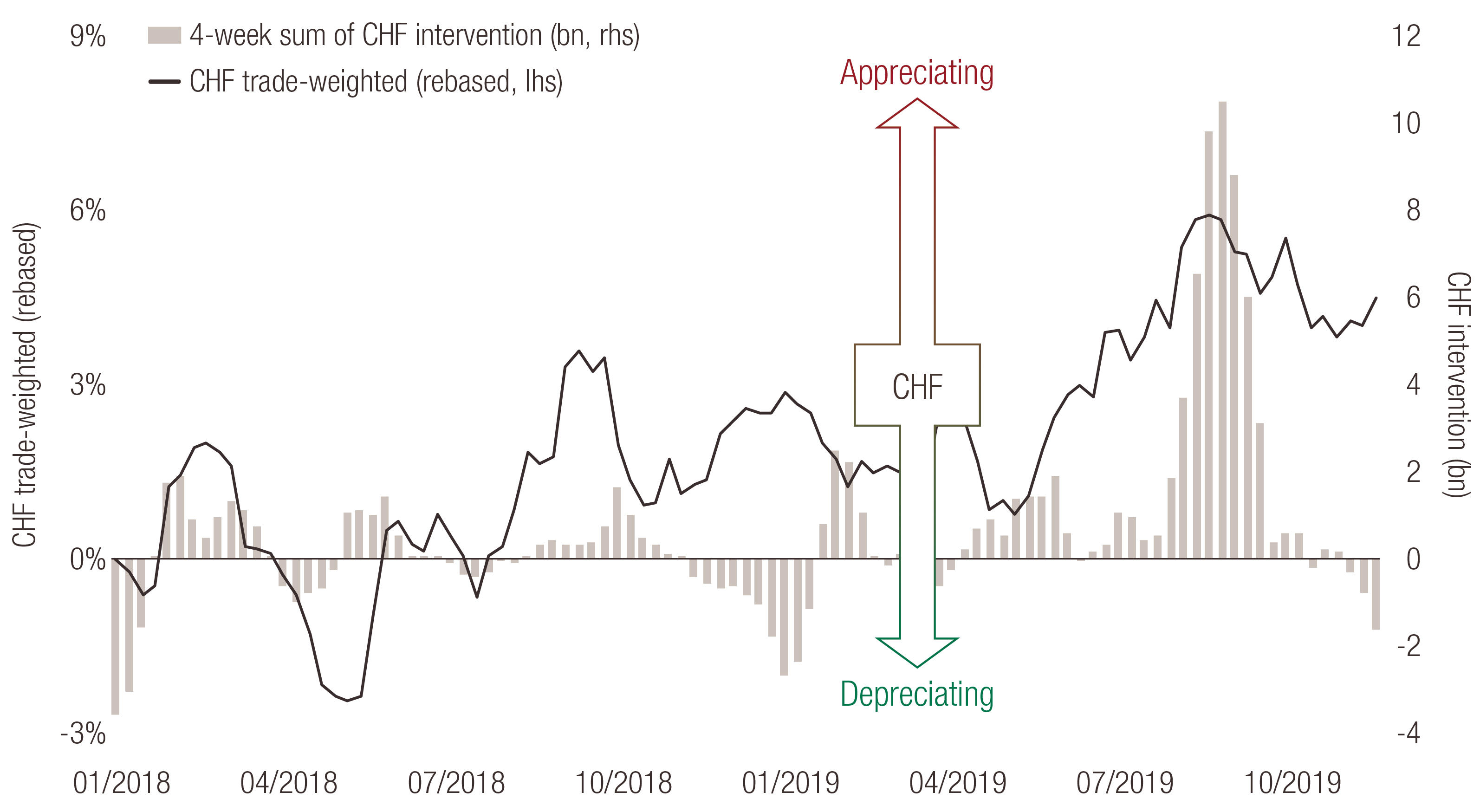

The Swiss National Bank (SNB) reacted to the appreciation of the franc by stepping up interventions in foreign exchange markets in August 2019. Interventions are a key area of SNB monetary policy, and the franc moves since August show the SNB was successful in curtailing further strengthening, as shown in Figure 1.

Figure 1. Swiss franc trade-weighted index and SNB currency intervention

Source: LOIM calculations, SNB, Deutsche Bank and Bloomberg. Period covered: Jan 2018-Nov 2019.

In 2020, we expect the bank to closely follow global developments, especially in the Eurozone where our house view is for renewed easing by the European Central Bank (ECB) next year. Should changes there prompt further SNB action, we believe the SNB could continue to focus first on FX interventions to maintain its accommodative stance. That said, we would not rule out a Swiss rate cut, either.

SNB: walking a thin line

While we see the SNB remaining on hold and letting the ECB move first on monetary policy, we also highlight that SNB policy is being carefully calibrated at various levels to respond to different interests. As such, we believe the bank is walking a thin line and moving rates only as a last resort.

At its meeting in September, the SNB addressed the reality that negative rates are here to stay. In a sense, the meeting was as notable for what it did as much as for what it did not do. We highlight three key areas where the SNB was forced to address the unintended consequences of negative rates and navigate between competing interests:

- What it did: The SNB adjusted the basis for calculating negative interest on sight deposits at the SNB and raised the exemption threshold. The move takes account of the fact that the low/negative rate environment has become entrenched and could persist for some time. This should provide relief for banks and appears to be a reaction to concerns about the impact of negative rates on bank balance sheets. It was also a clear signal that the SNB is trying to address offshoots of deeply negative rates, in our opinion.

- What it didn’t do: The SNB did not cut rates but stressed that its expansionary policy remains necessary and unchanged. We believe this reflects the mounting unpopularity of negative rates from the general public, from institutions feeling the pinch of negative yields, and political pressure. In such an environment, another cut would have exacerbated opposition from all of these areas, as was arguably seen in the Eurozone after the ECB’s September rate cut.

- What it reiterated: The SNB will continue to intervene in foreign exchange markets as necessary to dampen the impact of a “highly valued” franc on the Swiss economy. Here, we see the bank staking its stance on currency interventions and reaffirming this resolve in its communication.

Our view: The SNB’s emphasis on FX interventions could indicate this is where it continues to have policy scope, especially in the face of macroeconomic deterioration and global uncertainty. Broadly speaking, we see rate hikes being off the table for now. Conversely, should the ECB step up its quantitative easing programme, we note the use of this FX channel could become more complex, and indeed complicate the SNB’s task. In sum, the SNB walked a thin line between various interests in September, and is likely to continue doing so in 2020, in our opinion.

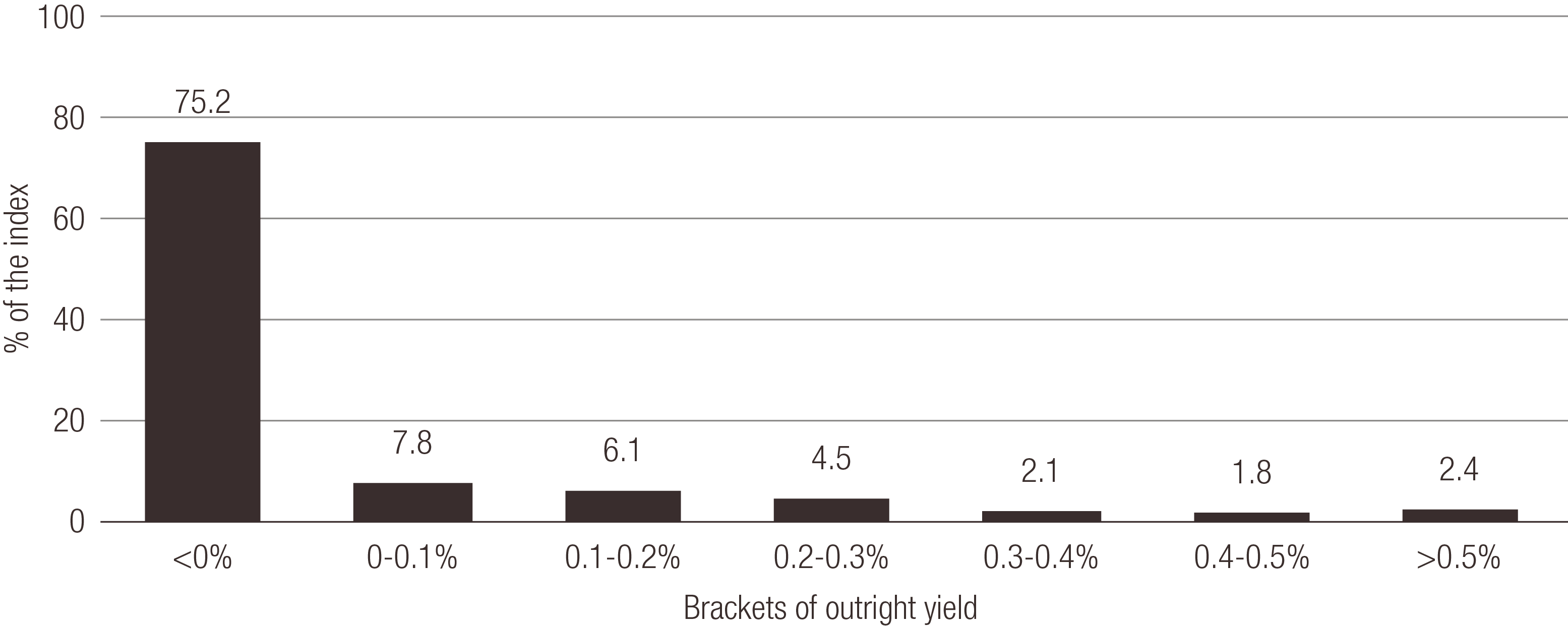

A wall of negative CHF yields

Reflecting the fact that negative rates are entrenched at the SNB, the Swiss investment universe now presents a wall of negative-yielding debt to investors. Negative-yielding debt accounted for 75% of the SBI AAA-BBB index at the end of October, as shown in Figure 2.

Figure 2. Market share per yield bucket within the SBI AAA-BBB index

As of 31 October 2019. Source: LOIM calculations, SBI, Bloomberg. Yields are subject to change and can vary over time.

Such firmly-entrenched negative yields are a game changer for investors as the search for yield enhancement becomes a search for positive yield, full stop.

We believe CHF-denominated corporate bonds provide opportunities, but caution that not all approaches are created equal. For instance, indices are exposed to an inherent lengthening of duration. For passive investors who mechanically track indices, this could mean an unintentional mirroring of such duration risk. We favour instead an active approach focused on yield enhancement from corporate bonds. In an environment where systematic risks offer diminishing rewards, we believe it takes specialists to navigate the intricacies of Swiss credit. We seek to optimise outcomes for investors through bespoke credit selection, which instead incurs idiosyncratic risks and where the rewards offer better prospects relative to the risks, in our view.

Recent market developments include ratings methodology changes by SIX that have slightly re-shaped the investment universe. The benchmark administrator of the SBI index will now use the median of all eligible credit ratings for a single bond/issuer, instead of the previous method of using the worst credit rating. The change makes roughly CHF2bn more bonds eligible for the index, with four borrowers affected, and made a minor impact on the market.

We favour a bespoke and specialised approach in corporate bonds denominated in CHF. Our approach looks to enhance yield by moving selectively down the ratings spectrum and buying Swiss corporate credit with shorter-dated exposure. Our expertise aims to exploit market inefficiencies and take advantage of opportunities efficiently, while also catering to specific client requirements.

As the consequences of negative yields reverberate, we believe a dedicated and disciplined investment approach is crucial to taking advantage of the potential in Swiss corporate bonds.

Please find key terms in the glossary.

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

LOIM does not provide accounting, tax or legal advice.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

For more information on Lombard Odier’s data protection policy, please refer to www.lombardodier.com/privacy-policy

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent.

©2019 Lombard Odier IM. All rights reserved.