investment viewpoints

Outlook 2020 - Sustainable finance: Bridging the gap to decarbonisation

In 2019, the sustainable finance landscape continued to grow more diverse in terms of issuers and geographies, and more complex in terms of instruments.

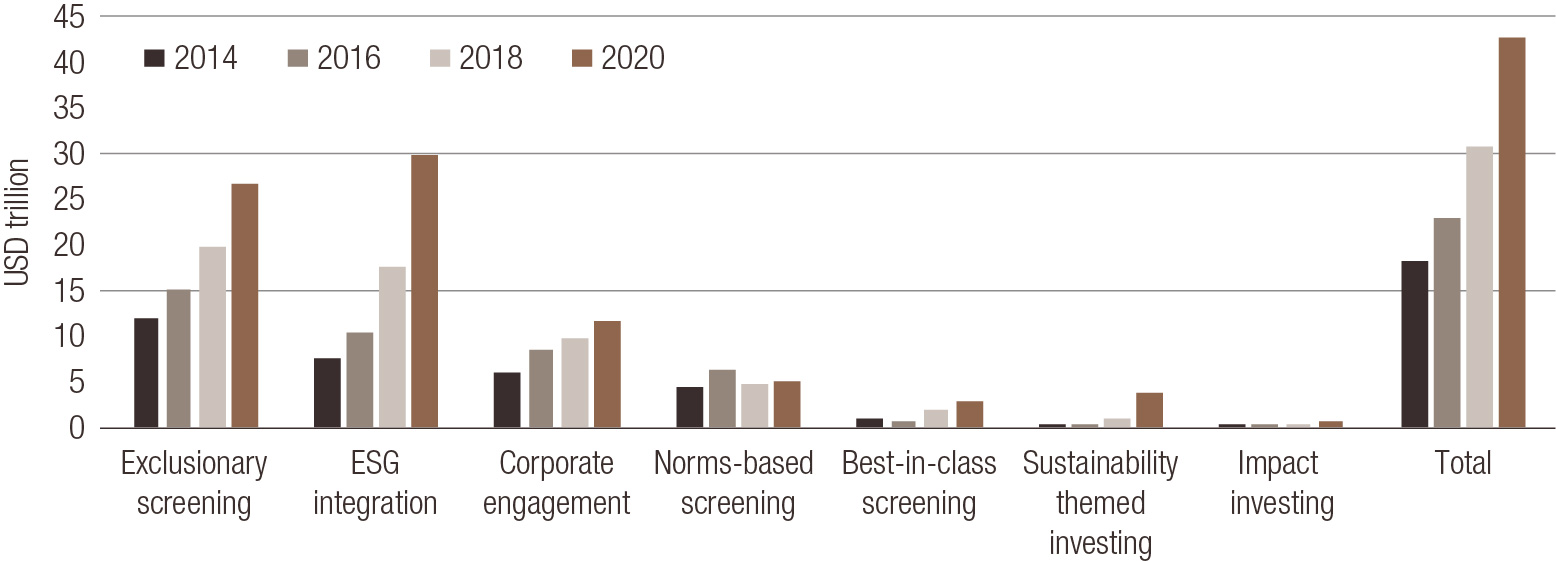

Last year, total assets under professional management invested according to responsible investment strategies exceeded USD 30 trillion for the first time.1 Issuance of sustainable debt in 2019 looks set to fall just short of USD 400 billion, with green bonds expected to account for around two-thirds of this or 250-265 billion (well above most market estimates from the beginning of the year).2

These trends are now accelerating. In July, nine Dutch pension funds managing EUR 800 billion in assets committed to reduce their carbon footprint, necessitating a more active management approach.3 By 2020, we see total assets invested according to responsible investment strategies exceeding USD 40 trillion.4 Sustainability and impact-focused investing can account for four to five trillion of this total, nearly tripling from 2018. Based on our analysis of the prospects for sustainable debt issuance, we see the potential for issuance to reach USD 560-620 billion in 2020 and USD 720-810 billion in 2021. We expect that green bonds could account for USD 320-360 billion of this total in 2020 and USD 400-450 billion in 2021.

Figure 1: Volume of assets under professional management invested according to responsible investment strategies, 2014-2020F (USD billion)

Source: Data from Global Sustainable Investment Review for 2014-20185; LOIM forecasts for 2020; note that as many forms of sustainable investment combine several of the strategies listed, the sum of the individual strategies exceeds the total figures shown

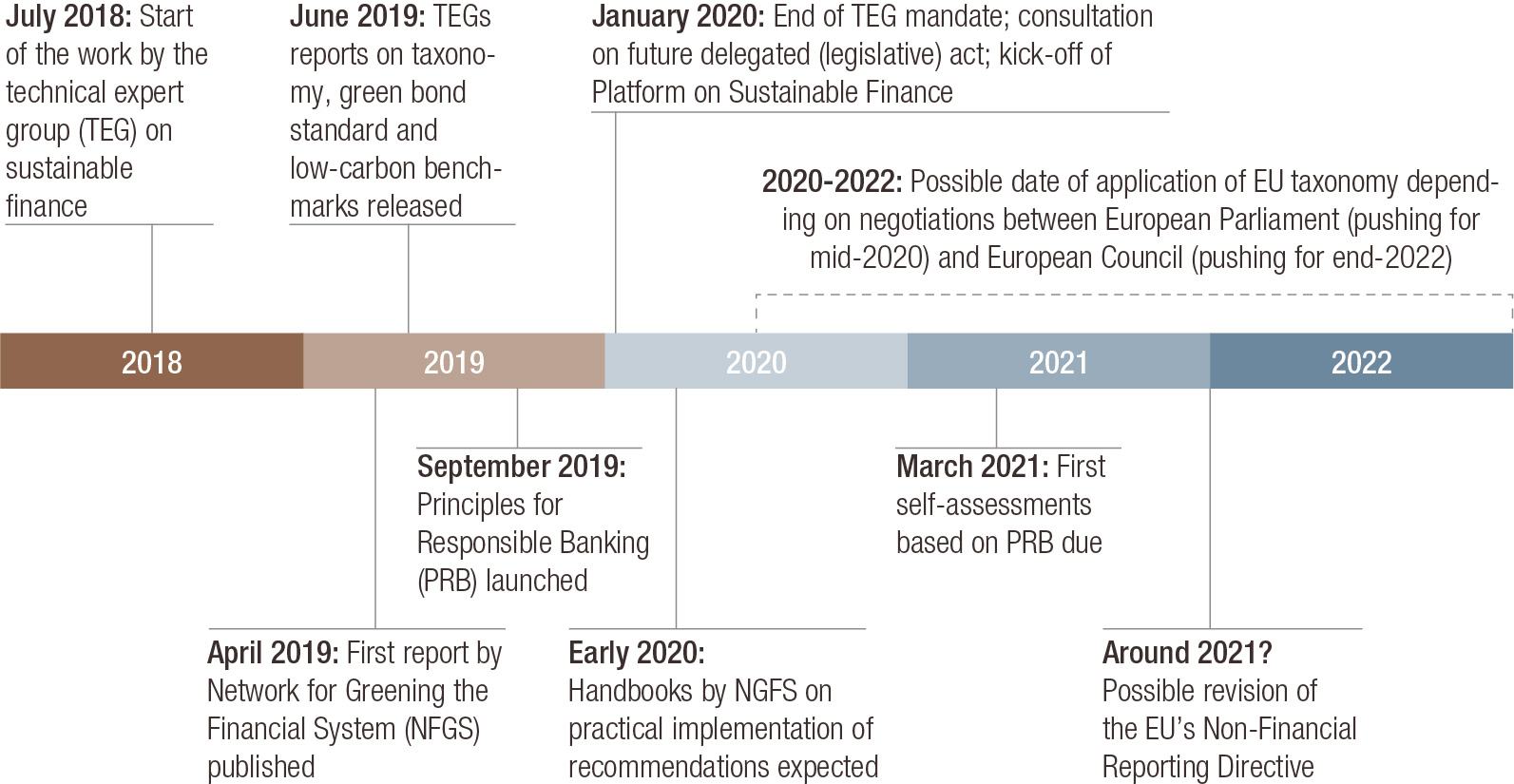

As the sustainable finance industry grows, regulators and voluntary initiatives are looking to bring welcome standards and transparency to the sector. The EU Commission’s action plan on sustainable finance is a case in point, comprising the establishment of a taxonomy to classify sustainable activities, an EU standard for green bonds, benchmarks related to decarbonisation, and disclosure requirements on ESG integration.6

Figure 2: Timeline of ongoing regulatory initiatives

Source: LOIM analysis

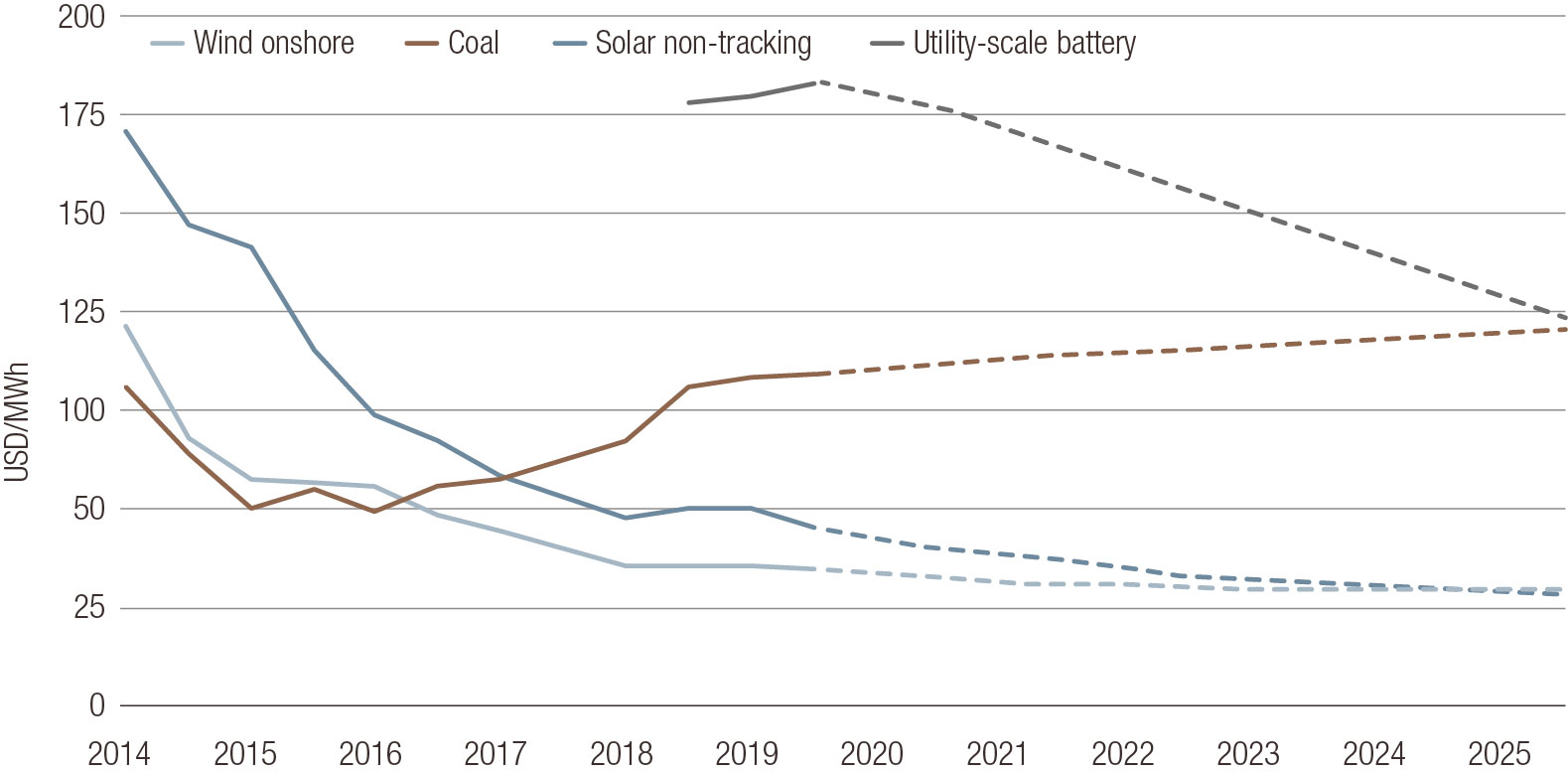

Market trends are supporting these regulatory and policy trends. Costs of wind and solar power are continuing to fall and IRENA forecasts that by 2020, auction prices of solar and wind power will fall below the operating cost of 700 GW and 900 GW, corresponding to 35%-45% of the coal industry’s current capacity.7 Nonetheless, up-front capital costs can be significant, creating a role for the finance industry in bridging the gap near term funding requirements and future returns.

Figure 3: Trends in levelised cost of electricity in the US (USD/MWh, 2018 real terms)

Source: LOIM analysis based on BloombergNEF8

A vast increase in investment levels is still required. Current policies place us on a pathway towards a 3-5°C increase this century.9 IRENA estimates that to meet the goals of the Paris Climate Agreement, additional funding in the range of USD 27 trillion (over and beyond present commitments) will be required to support energy, mobility and related transitions.10 The finance industry will be ready to support that increase in scale, but it is a pipeline of investable projects that is the missing part of the equation today. Policy ambition will have to significantly increase to create the magnitude of projects commensurate with the challenge, beyond what market forces and corporate action can deliver.

Sources.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent.

©2019 Lombard Odier IM. All rights reserved.