investment viewpoints

How we approach convertibles

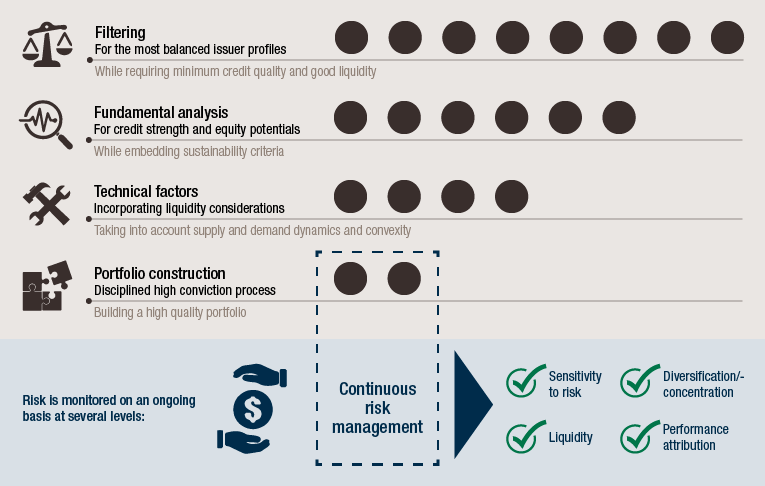

Our way of investing in convertible bonds aims to optimise the asymmetry of the asset class and leverage its full potential for investors. Our process begins by filtering for the most balanced issuer profiles, while also requiring a minimum credit quality and good liquidity. We then add fundamental and technical analysis. Once the portfolio is constructed, we continue with on-going risk management. We have been investing in convertible bonds for more than 30 years, and our well-established team has experts globally.

Before we begin building our portfolio, we take into account the macroeconomic environment as a larger context for risk and return. In this area, we bear in mind sector-specific data, monetary policies, the political and social context, other markets (such as equities, bonds, commodities and foreign exchange) and fund flows.

We then begin building a portfolio by narrowing down the convertible bond universe to bonds that we believe offer the most attractive technical features (such as a balanced profile and high risk-adjusted return potential). On the equity side, the extent to which the price of the convertible bond is expected to change for any given change in stock price is known as the equity sensitivity. We aim for an equity sensitivity between 30% and 60%1. On the bond side, we look for a strong (and relatively high) bond floor. This is the value of the bond element of the convertible.

Our selection of issuers is therefore tilted towards those that provide higher convexity, or the greatest bond-equity resilience to different outcomes. We focus on high quality credit and large, liquid instruments. As such, we screen for the most liquid and the most asymmetric issues on a continuous basis to exclude any instrument that is smaller than USD150m in size, and all instruments with a credit rating below B-. We also tailor our screening to the needs of the portfolio, using multiple factors to help our portfolio management team meet the fund’s stated objective of superior risk-adjusted returns.

This filtering process results in a long-list of companies that is, in turn, analysed on a fundamental basis and technical basis. Our fundamental analysis is undertaken by the team’s own analysts, in both credit and equity. This analysis focuses on credit quality and remuneration of risk from a fixed income perspective, as well as the potential of the underlying share from an equity perspective.

The portfolio managers also analyse the technical features of the convertible bond closely and assess its suitability for the portfolio. This includes identifying how equity-sensitive the bonds are and estimating the theoretical valuation (value of optionality, yield level). When looking at multiple issues from the same issuer, all things being equal, the most suitable technical profile from the same issuer will be chosen for our portfolio.

Next, we take into account sector and country weightings, aim to steer the fund’s equity sensitivity and its bond floor, and allow for currency hedging. Reflecting the belief that currency moves should not affect performance, our strategies are minimum 90% currency hedged, with an average of 97% hedged.

There are, of course, risks also associated with convertible bonds. These include the typical risks of corporate debt (eg default risk or interest rate risk), as well as risks related to equity call options (eg an equity correction leading to the devaluation of the option).

In addition to addressing risks when the portfolio is constructed, we also undertake on-going risk management. Our portfolio managers monitor the sensitivity of investments to various risks (equity, rates, default), look for diversification or concentration in the portfolio, scrutinise liquidity and attribute performance metrics. Dedicated risk mangers apply proprietary tools for deep analysis of all our convertible bond portfolios– this includes monitoring for risk limits and liquidity, applying stress tests and producing risk reports.

"Dedicated risk managers apply proprietary tools for deep analysis of all our convertible bond portfolios."

We also review potential investments according to sustainability criteria. Applying what we call the three pillars of sustainability, we evaluate issuers based on their financial models, their business practices and their business models. In the second pillar, we use a proprietary ESG (environmental, social and governance) scoring framework, evaluate an issuer’s exposure to controversies and look at what impact measures the company is undertaking in its business practices2.

Our offering and team

Lombard Odier Investment Managers has a long-standing franchise in convertible bonds. We have been investing in convertible bonds since 1987, building up more than three decades of convertible bond experience across both bull and bear markets.

Our goal has remained steadfast over the decades: to capture the risk-return asymmetry inherent in convertible bonds. We search globally for opportunities, while seeking to lower risks through market cycles. As of March 2019, we managed roughly €3.2bn in our global convertible bond fund. In addition to this flagship strategy, we also offer a range of high conviction convertible strategies focusing on high yield, defensive delta and emerging Asia.

Our 11-member investment team performs broad and extensive research, leveraging the research and risk management capabilities of LOIM’s global platforms. We seek out the highest quality investments across different regions, sectors and styles through a global group of dedicated experts spread between London, Geneva and Singapore. This team has its own credit analysts, equity analysts and convertible bond analysts. In place since 2004, there have been very few changes in our team over the past 15 years.

With a track record spanning three decades that focuses on optimising risk-adjusted returns, we aim to maximise the benefits for investors.

Please find key terms in the glossary.