investment viewpoints

Weathering cycles in Emerging Markets

Emerging Markets (EM) now offer a more complete range of investment opportunities.

EM assets have evolved over the space of a few decades. From what was once a concentrated, narrow and volatile space, now represents an increasingly deep and diverse investment universe. This provides investors with an attractive playground for capturing a large range of growth opportunities.

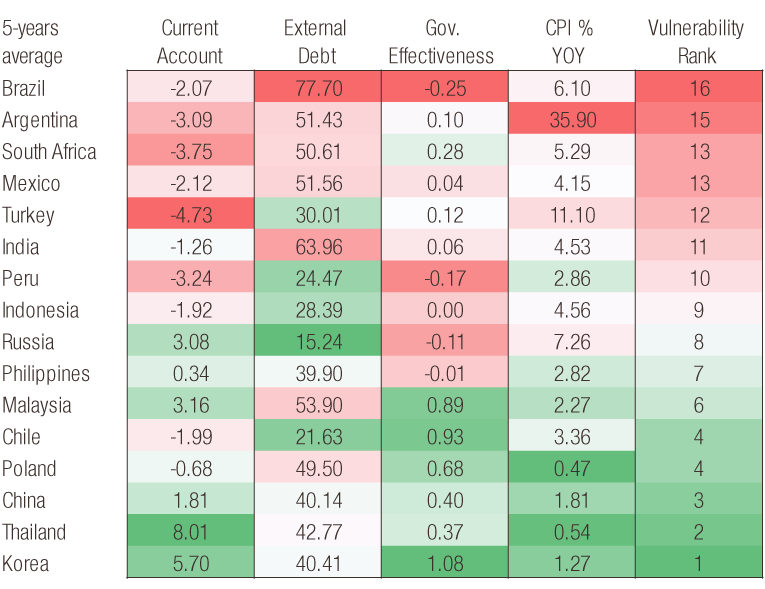

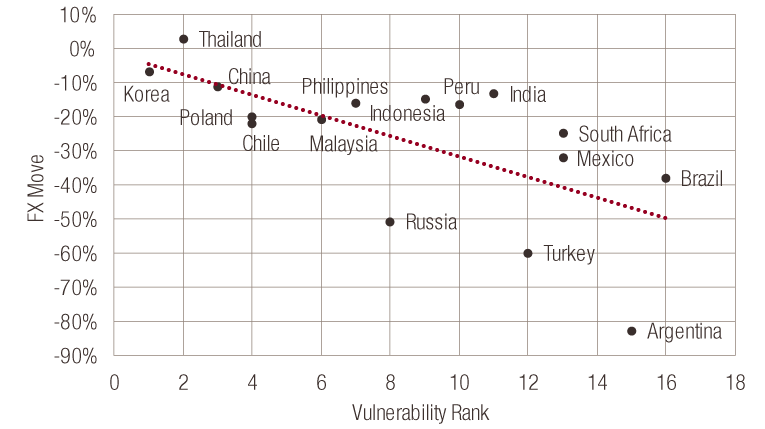

Currency is one EM aspect that many investors may have suffered with in the past. For example, equity or debt investments could increase in value, while the currency depreciates, eating away at returns in hard currency. It is therefore imperative to carefully dissociate between assets in stronger currencies, and to hedge exposure to weaker currencies. Our research shows that countries with strong fundamentals, and limited external dependencies, will typically boast a stronger currency.

Currency comparison

FX move versus vulnerability

Source: LOIM calculations, Bloomberg Economics, World Bank. FX change measured from 31.12.2014 until 31.12.2018. The vulnerability rank scale is higher the more vulnerable or the lower the more reliable).

Many investors have typically invested in EM in a momentum-driven way, with limited structure in their convictions. In our view, to enhance returns and mitigate risk, investors should allocate within each emerging country across equity, debt (hard currency and local currency), and commodity-linked assets with strong attention paid to currency exposure and country’s weight. Such a structured allocation can provide a solution with better risk-adjusted returns and less drawdowns. This structured allocation can in turn allow investors to build a structural allocation to EM assets and be less tactically driven.