global perspectives

Recovery disrupted: as inventories stabilise, wages surge

Welcome to Simply put, where we make macro calls with a multi-asset perspective. This week, we focus on two disruptive forces in the pandemic recovery – inventory shortfalls and rising wages.

Need to know

|

|---|

Disruption: all the rage

‘Disruption’ has been appeared frequently in news reports recently, often accompanied by references to a ‘paradigm shift’. Together, they reflect the pandemic’s deleterious impact on the global production system. The rate of productive capacity utilisation has declined for several months, eroding the productive capacity of the world's major economies. For example, the capacity utilisation rate in the US dropped from 76% to 64% in 2020, but has recently returned to around 75%. Europe experienced a similar decline and rebound, running at 65% capacity at the bottom of the downturn only to return to its pre-crisis level of 80% in the second quarter of 2020. In a world of low inventories, this rapid and prolonged decline in production, followed by a rapid restart, was bound to generate tremors: the so-called ‘disruptions’ we have read about.

In order to avoid the worst enemy of economic analysis – the anecdote – it is essential to classify and then measure such disruptions The press is reporting on surging wages amid severe labour shortages, a lack of raw materials affecting the production of durable goods, and the consequent effects on consumer prices. These disruptions are mainly a reflection of two phenomena: low stock and full order books.

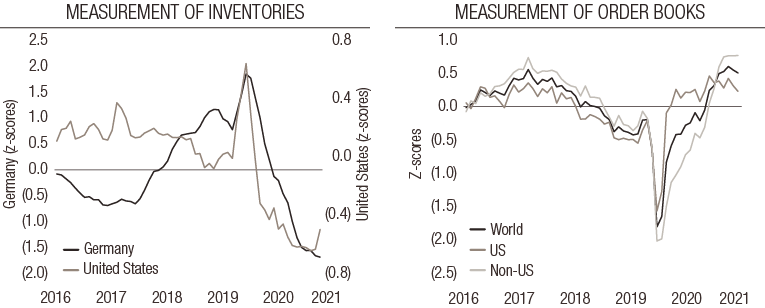

Many business surveys contain questions that accurately measure the state of these two elements around the world. Figure 1 aggregates this data in the form of z-scores: these series are centred and divided by their standard deviation in order to make them comparable and to allow their aggregation. Z-scores mostly oscillate between -2 and +2, with any outliers indicating a score well above/below the long-term average. We use them to provide evidence of ‘disruption’: inventory surveys are abnormally low, while order books are unusually full. This is not isolated to any one country: both the US and Germany exhibit the same trend.

FIG. 1. Measurements of inventories (left) and order books (right) (adjusted to z-scores) for the period 2016-2021

Source: Bloomberg, LOIM as at November 2021.

If we are going to use this scenario to explain how the underlying components of both the consumer and producer price indices are rising, it is essential to look ahead rather than backwards. Both inventories and orders are losing momentum, bringing welcome stabilisation. Of the 36 inventory indicators, 45% are now increasing compared to just 21% in May. Of the 36 order book indicators, only 39% were up in September, compared to 63% in March. If this normalisation continues, prices should gradually adjust.

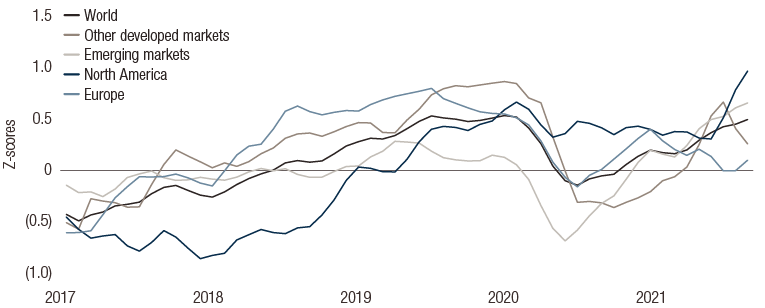

However, another pandemic-related ‘disruption’ does not appear to be weakening: rising labour costs. Figure 2 shows the result of z-score calculations across a wide range of wage-growth measurements1. In 2018-2019, wages generally showed signs of strong growth, but the pandemic brought this to a halt. This year’s recovery drove demand for labour to grow faster than supply. While wages are gradually adjusting, the inertia of wage growth suggests this could be a key feature of the current business cycle. This does not necessarily mean out-of-control wage inflation, but, as central banks have been cautioning for several quarters, inflation could rise above their targets for some time. From a debt perspective, it is essential to keep the spectre of deflation at bay during this stage of the cycle.

FIG. 2. Wage-growth rates (adjusted to z-scores) across the world, 2016-2021

Source : Bloomberg, LOIM as at November 2021.

|

Simply put, the greatest impacts of the pandemic-driven disruptions should now be over and we expect company results to gradually reflect this. However, global wage growth should not be underestimated. Economic theory holds that workers’ pay drives inflation over time, and therefore influences long rates. Investors should closely watch central banks’ reactions to increases in both wages and the cost of capital. |

important information.

For professional investor use only

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA. ©2021 Lombard Odier IM. All rights reserved.