investment viewpoints

Are strong earnings making equities more affordable?

In the latest instalment of Simply Put, where we make macro calls with a multi-asset perspective, we assess the case for P/E normalisation and consider how this can benefit investors in an environment of rising rates.

|

Need to know

|

|---|

Corporate earnings: the US and Europe lead the way

This latest earnings season leaves little room for doubt: economic growth may have weakened in the third quarter but remained very solid. Consistency across leading economic indicators, such as the US ISM or the German IFO, was almost perfect.

Overall, third-quarter corporate sales in developed markets rose by 17%, and earnings rose by just over 26% in quarter-on-quarter terms, as margins improved. Thanks to its more sectorial exposure, the European equity market led this rebound with a 50% surge in quarterly earnings. US equities were next, rising 37%. However, Asian equities exhibited signs of slowing corporate earnings growth with weaker earnings across several sectors. In general, almost 10% of companies in the US and Europe delivered positive earnings surprises, compared with almost none in Asia.

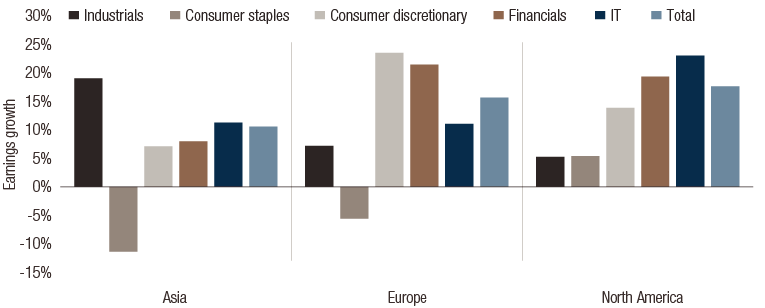

Earnings expanded by a substantial 16% in annual terms. Figure 1 provides some granularity for year-on-year expected earnings growth. North American equities clearly benefited from the combined growth of the information technology sector (+23%) and financials (+19%). Europe also benefited from the performance of financials (+21%), as well as strength from the consumer discretionary sector (+24%). Asia showed weaknesses: earnings in the utilities and consumer staples sectors contracted by 21% and 11% respectively, although industrials grew by 19%.

FIG. Chart 1. Expected annual earnings growth, year-on-year

Source : Bloomberg, LOIM as at November 2021. For illustrative purposes only.

Are Asia corporates really struggling?

China and Asia as a whole are experiencing more economic difficulties than the rest of the world at present. For those who follow their business-cycle indicators, this should not be surprising. However, this earnings season still contributed to our positive long-term outlook on the region. Economic growth increased during the quarter and few sectors suffered from higher input costs – indeed, overall margins even improved during the season.

This should help to dispel any lingering doubts that equities can be used to hedge inflation risk in multi-asset portfolios. Indeed, amid strong demand, companies generally had no issue in passing through their increased costs.

Normalisation is normal at this stage of the cycle

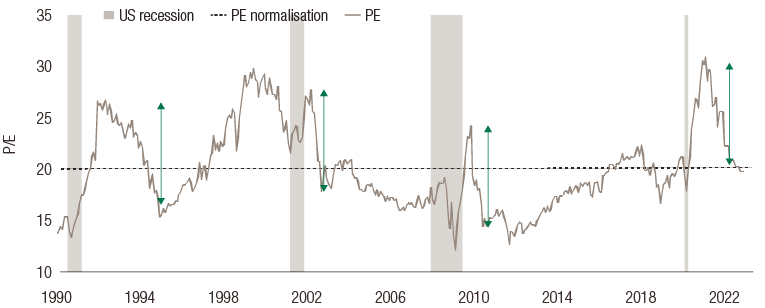

Because growth and corporate performance have remained strong despite market doubts, we do not expect earnings to contract in the fourth quarter. Figure 2 illustrates what, to us, is an obvious conclusion right now: if global equities are perceived as becoming expensive, it is because the classic dialectic of ‘multiple expansion’ and ’P/E contraction" has been forgotten.

It consists of two phases. The first begins when economies are exiting recession, animal spirits stir. Investors look through the wall of worry as governments and central banks commit stimulus. Even though corporate earnings tend to decrease at this point, hopes for a recovery drive expectations of a cyclical upswing. At such a time, the performance of equity markets is typically resurgent, re-rating strongly ahead of earnings, driving a P/E multiple expansion in which earnings are growing less than price, reflecting anticipated growth.

FIG. 2. US equities: P/E ratio and expected normalisation

Reading note: green arrows indicate periods of post-recession PE normalisation. They have historically accompanied been by a positive performance for world indices.

Source: Bloomberg, LOIM as at November 2021. For illustrative purposes only. Past performance is not a guarantee of future results.

In the second phase, P/E ratios deflate – not because of declining prices but because growing earnings are catching up with valuations. This causes multiples to contract and the market to climb at a slower pace. At this point, investors often scrutinise earnings releases for evidence of the hoped-for growth that is still embedded in their outlooks and are very sensitive to earnings surprises, guidance and company outlooks, as well as any macroeconomic data that may upset these expectations.

In our view, this is the phase we are currently experiencing – which is consistent with those of the last 25 years – and suggests earnings will continue to grow during the fourth quarter. Our estimates place the P/E valuations of global equities close to their long-term levels – at about 20 – by year-end.

Putting rising interest rates aside for a moment, equity valuations should become attractive as we enter 2022, in our view. Bringing inflation back into the picture, the recent performance of equities amid higher input costs means that cheaper stocks is good news for both equity and multi-asset investors.

|

Simply put, the improvement in corporate earnings in the third quarter means equities should gradually become cheaper, in our view. By the end of the year, the P/E ratio of global equities should return to long-term levels, which will be a good starting point for 2022. |

important information.

For professional investor use only

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA. ©2021 Lombard Odier IM. All rights reserved.