global perspectives

Simply put: where are rates headed?

This article marks the first of a regular series chronicling our multi-asset team’s perspectives.

In a nutshell, we currently believe:

• The improvement in GDP growth could spur a partial normalisation in savings and a tapering phase by central banks

• Both elements could lead to roughly a 50bps rise in real rates in the US, in our opinion

• This is sufficient to spur negative performance in bonds by year-end, but small enough that it remains limited in total returns terms

With the Federal Reserve’s Jackson Hole meeting now past, it’s a good juncture to reflect on the level of rates in the medium term. Rates are low – that is a statement – and the temptation to see them mean-reverting to higher levels is common. We ask the essential questions: what factors explain the low level of rates, and what is their likely behaviour in the medium term?

Based on the work of Irving Fisher1, general academia sees three components comprising each tenor of the yield curve:

- the inflation premium: how much inflation compensation the market agrees on for holding bonds

- a term structure premium: how much compensation the market requires to offset duration risk

- what remains: “real rates”, what the buy-and-hold investor will retain at the maturity of the bond in real terms – that is to say net of inflation impact

The term structure impact is usually small. We believe the current inflation shock is likelier to be transient than persistent, meaning inflation compensation should remain low. Should inflation mean-revert to where it was prior to the pandemic, markets are unlikely to seek much more protection than what they already have, in our opinion.

The drivers of real rates

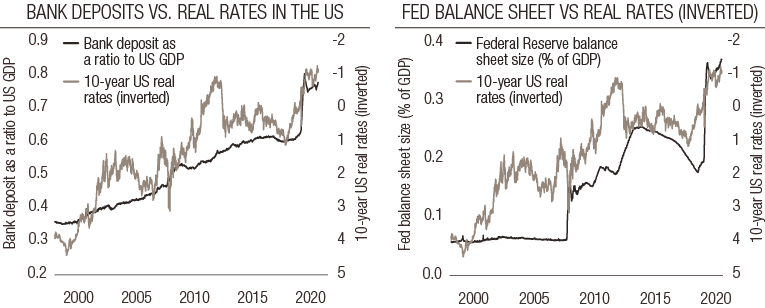

Focusing on real rates, figure 1 highlights two key drivers of real rates: savings and monetary policy.

First, economic theory clearly states that real rates bring balance between capital owners (households and corporates savings) and those in need of it (investors). A high level of savings in a context of low investment means naturally lower real rates. Today, consumer survey data2 clearly shows pessimism, while investment intent surveys3 lay on the lower end of their historical evolution. This means that the level of accumulated savings will keep bearing lower on real rates for probably longer than expected.

The level of savings is approximated by looking at US bank deposits as a ratio of GDP, and are illustrated in figure 1: some USD 2 trillion remains in excess of the pre-pandemic period. These savings will normalise as macro conditions do, but the process stands a good chance of lasting a long time.

Second, current accommodative monetary policy explains the remainder: as central banks have purchased bonds they have compressed real rates, pushing investors to exit the bond market to buy equities – also known as the “risk appetite” monetary policy channel.

Figure 1. US bank deposits vs real rates and the Fed’s balance sheet vs rates

Source : Bloomberg, LOIM. For illustrative purposes only.

Figure 1 shows a clear illustration of this phenomenon. The Jackson Hole meeting was slightly more dovish than expected, but also set out the Fed’s medium term goal: exiting its current accommodative stance. There is no precise calendar for that, but current expectations are for the Fed’s balance sheet to fully stabilise by the end of 2022/beginning of 2023. From the figure, a stabilisation of the Fed’s balance sheet in GDP terms is not enough to see real rates rise. For that, we need to see the world economy’s growth rate outpace the growth rate of central banks’ holdings.

One common denominator of both factors is therefore GDP growth: should it surprise to the upside in coming quarters, then real rates stand a chance of rising. This would create confidence for consumers and corporates, pushing them to reduce their savings (for consumption and investment). It would reduce the Fed’s balance sheet size relative to GDP, pushing rates higher. In the 1930s and after World War II, a similar process was instrumental to exiting a period of sharply negative real rates.

How high could rates go?

The final question is: if rates increase as real-rates factors improve, how high can they go? Let’s do the maths. If savings normalise fully (which is unrealistic) and bank deposits move back to 60% of the US GDP (their pre-pandemic level, from roughly 75% now), a historical regression would restore real rates to a positive 1%. This would bring nominal rates to about 3%, which means a price return of about -15%.

We believe this is an unrealistic scenario for the following reasons:

- the carry on bonds is positive and would increase as rates rise

- the beginning of quantitative easing was orderly across the world – the exit will not be the same

- in 2008, risk aversion savings normalised by roughly 25%; in the current scenario that would mean a 50bps increase in real rates

With that 2008 scenario in mind, we believe it is reasonable to expect the US 10-year nominal rate to reach 1.8% by year-end – perhaps with some volatility. Accounting for carry, a-synchronicity and normalising inflation, we do not expect major losses on our bond investments4. Quite the contrary, with continued pandemic uncertainty, we remain happy with bonds’ diversification potential.

Medium-term outlook

Simply put: rates could rise as real rates increase in the quarters to come. Yet we believe this rise should be limited, as savings and monetary policy are in the driving seat and unlikely to dramatically normalise.

Sources

important information.

For professional investor use only

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA. ©2021 Lombard Odier IM. All rights reserved.