investment viewpoints

The CLIC Transport Transition – electric vehicle penetration is underestimated

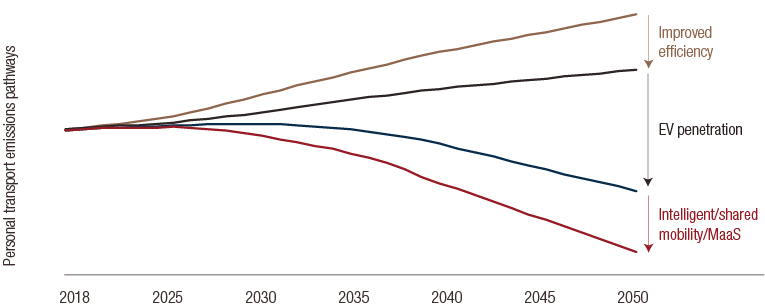

In order to meet the commitments of the Paris Accord, we need to see transport emissions, including long-distance, heavy-duty transport, almost halve by 20501. This requires a decoupling of emissions from economic growth, while still meeting the increasing demands for the movement of goods and people. We call this transition to a net-zero aligned, digitally-enabled Circular, Lean, Inclusive and Clean model the CLIC Transport Transition and we expect it to drive a USD2 trillion annual investment opportunity. This Transport Transition must be inclusive to all, cost-effective and suited to the shifting demands for mobility in a post-COVID-19 world.

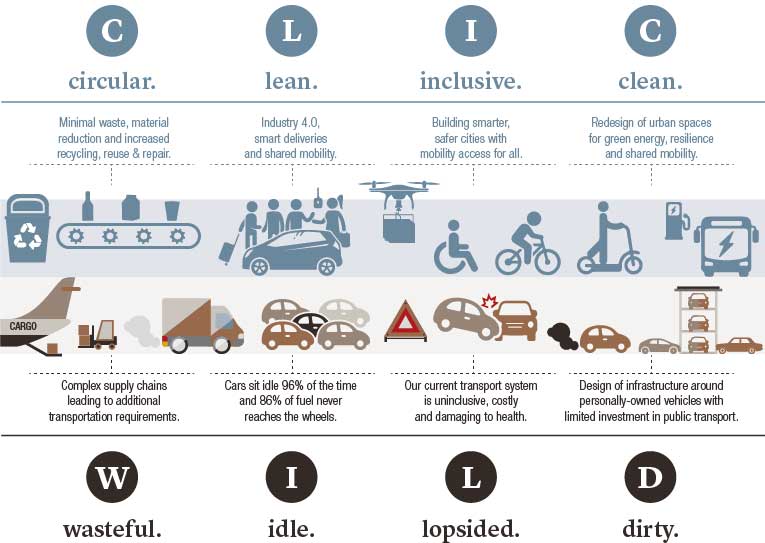

Figure 1: Our current mobility model is WILD and urgently needs to transition to a CLIC model

Source: LOIM

The human and economic cost of COVID-19 has not only highlighted inefficiencies in our current mobility model2 but has also shown the interconnectedness between air-borne viruses3 and the devastating health implications of air pollution4. The Organisation for Economic Co-operation and Development (OECD) estimates that road transport contributes up to 30% of Particulate Matter (PM) in European cities and up to 50% of PM across OECD countries5. Global lockdowns provided a brief respite in many urban areas, with congestion falling by up to 85%6 in some regions and air pollution more than 50%7. In our view, although some mobility habits will slowly normalise as lockdowns continue to ease, there is an established trend towards electric vehicles which will continue unabated, as local regulation increasingly penalises the current, combustion-centric mobility model. We believe it is important to focus on investment opportunities in this newly emerging mobility model.

Electrification is a relatively easy way to decarbonise light-duty and short-distance transport. Recent step-changes in battery technology are enabling longer distance e-mobility at significantly reduced costs. The total cost of ownership proposition of an e-vehicle is now generally more attractive than its combustion engine equivalent. The average battery electric car (BEV) costs EUR 0.65/mile, at parity with an equivalent, internal combustion engine (ICE). However, upfront BEV purchase incentives and localised regulatory support (such as exemption from congestion zones, or reduced parking costs) are bringing electric mobility costs down even further. The total cost of ownership (TCO) proposition of a BEV is even more attractive for fleets (freight, delivery vehicles, taxis etc.), as running costs fall the higher the mileage of the vehicle. At-home chargers are increasingly economical and investment in public charging infrastructure is increasing at a rapid rate. With electric vehicles now capable of distances above 300 miles on a single charge, range-anxiety is also decreasing.

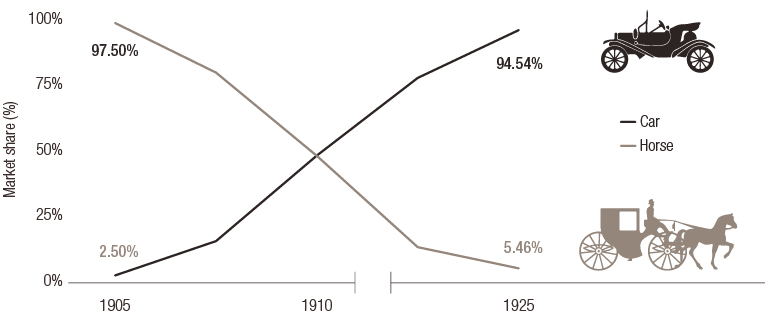

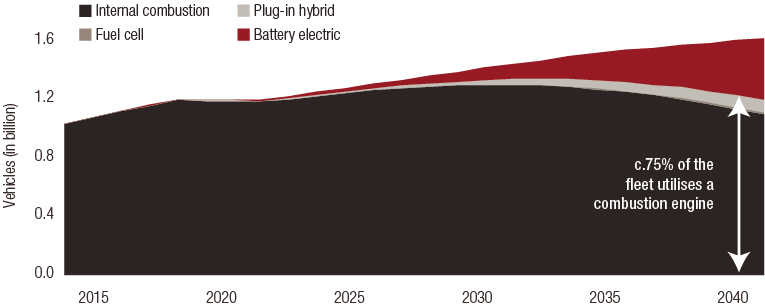

We think third party forecasters are missing the inflection point to electric vehicles (EV) and underestimating penetration rates. In key European markets, such as Germany and the UK, EV demand was up triple digits, even at the peak of lockdowns in March whilst ICE sales collapsed by 50%. Bloomberg New Energy Finance (BNEF) forecasts that EV sales will fall 18% globally in 2020, as Chinese demand has suffered, but that long-term prospects remain undimmed8. We acknowledge current battery capacity constraints but expect these will be overcome as demand accelerates. In our view, national and increasingly localised regulations and incentives will encourage faster consumer uptake. Once battery costs reach a “tipping point” of $100/KWh in 2023, car manufacturers can make BEVs as profitably as ICEs. At this point, current EV forecasts will prove too pessimistic. It took just two decades for the car to take 95% share from the horse; we expect a similar speed of revolution to electric mobility.

Source: LOIM

Source: LOIM

However, e-mobility is just one solution to decarbonise transport. It must come in combination with efficiency savings, to optimise routes and decrease unnecessary journeys. Modal shift is also key to changing consumer habits away from the car-centric model and towards more active, and smaller forms of mobility, such as bikes, two-wheelers or micro-vehicles. Electric, micro-vehicles are increasingly suitable even for relatively long distances. This may require a regulatory push to discourage dirtier transport modes and incentivise micro-mobility and shared mobility but we also believe consumer tastes are also pushing more conscious consumption.

We expect to see strong investment opportunities in all types of e-mobility, including micro-mobility, electric delivery vehicles and short-haul freight transport. Many cities (such as Paris, London9 and Rome) are implementing schemes to discourage car usage post-lockdown and encourage active mobility and zero-emission food and retail delivery. This has driven a recent surge in e-bike sales as well as shared micro-mobility solutions10. We expect this trend to continue as more cities focus recovery budgets on e-mobility and shared mobility. Next, we expect to see an increased regulatory focus on the decarbonisation of harder-to-abate, heavy-duty, long-distance transport. For heavier-duty, long-distance transport, hydrogen fuel-cells may over-time provide the most efficient low-carbon solution, although this will require significant investment to reduce technology costs, install infrastructure and ensure the “greenness” of the hydrogen production.

sources.

Download whitepaper

This could be a pivotal moment for transportation, not least due to the impact of the COVID-19 pandemic. We believe our transport system is currently WILD (Wasteful, Idle, Lopsided and Dirty). Transport needs to shift to a CLIC (Circular, Lean, Inclusive and Clean) model, whilst still enabling, and even driving, a recovery in economic growth and mobility.