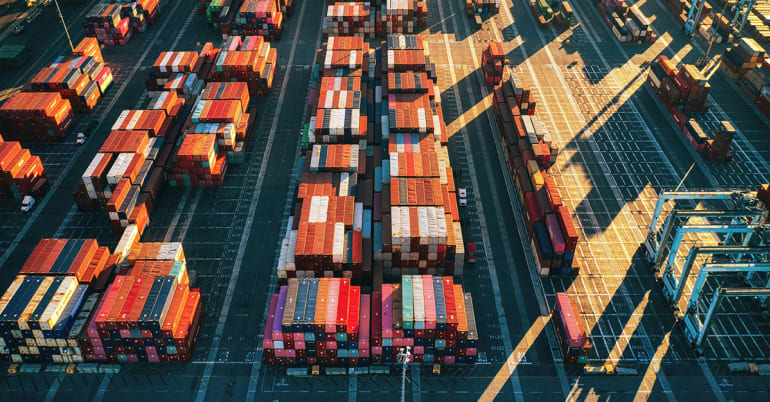

Global trade relationships are undergoing seismic change, culminating in the so-called Liberation Day announcement of reciprocal tariffs by the Trump administration. Across asset classes, LOIM’s CIOs respond to the ramifications of the global trade war and consider the investment implications for unpredictable times. In summary:

- In equities, we ignore the noise and seek opportunities for bottom-up stock selection

- In fixed income, we prefer duration over credit, while staying flexible

- In multi asset, we use history as a guide, initially favouring safer assets for uncertain times

- In Asian markets, we see five ways that tariffs could hasten the progression of Asian economies and companies

- In response to risks, we emphasise diversification, downside protection and keeping portfolios resilient

- In convertible bonds, we highlight why an asymmetric return profile can help investors get the timing right.

Please explore the sections below to discover our views.

Sustainable equities: single stock selection for opportunities in the noise

Markets always knew tariffs would be a part of President Trump’s second term. The negative surprise has been the speed with which tariffs have been implemented and the breadth of the coverage being considered. As the scale and the speed of tariffs has increased, so has the fear that they will develop into more than a negotiation tool and, in fact, become significant enough to curtail economic growth, challenging not just underlying forecasts but also the multiples applied to them.

Liberation Day has the potential to also clear the air by giving the market specific numbers to embed in its analysis and by replacing uncertainty with clarity. However, the Trump administration appears comfortable with uncertainty, and this, combined with concern around the size and additive nature (or stackability) of tariffs, has kept us defensive for now.

The volatility surrounding significant events such as Liberation Day creates opportunities for us as bottom-up stock pickers: as the picture remains unclear, our decisions are being made stock by stock rather than sector by sector. We believe the market will both over- and under-react.

Our job is to find the opportunities in the noise.

Fixed income: preferring duration over credit while staying flexible

Reciprocal tariffs announced on Liberation Day imply a rise of the US average tariff rate in the range of 20% to 30%, which was higher than general expectations. The announced tariffs are likely to be renegotiated downwards in some cases and to cause retaliation in others. Uncertainty and volatility will remain high in coming weeks, with flexibility in positioning being key. We have adapted our positioning for greater economic uncertainty and market volatility, and generally favour an increase in duration exposure and lightening of credit positions.

Markets have started pricing rising recession risks in the past weeks: US Treasury yields fell to their lows of the year and credit spreads widened from historically tight levels. US high yield (HY) and emerging market (EM) sovereign debt have been the main underperformers. President Trump’s 02 April announcement increases the recession odds, and with the Federal Reserve saying it will look through goods inflation, the tariff news is lowering the resulting terminal rate expectation of this cutting cycle.

Within our global fixed income strategy:

- We continue to see greater value in duration risk than in credit risk. We favour investment grade bonds, which offer a good combination of both

- In credit, we tactically prefer to focus more on domestic names than on global ones, with a preference for financials over corporates

- We like US Treasury Inflation-Protected Securities (TIPS) over US nominal Treasuries in the context of higher stagflation risks

- We remain cautious on EM sovereign debt.

Multi asset: initially favouring safer assets for uncertain times

The roll-out of US economic policies is a scenario with uncertain outcomes. We may have a reasonably clear understanding of the Trump administration’s political agenda, but its broader impact and how other parties react are unknown. The US economy could either strengthen or weaken; and the implications for company earnings and creditworthiness, and rate fluctuations are challenging to assess.

Using history as a guide, tariffs typically tend to accompany an initial (measured) increase in inflation, up until the impact on growth becomes so negative that it eventually reduces inflation pressures. At first, uncertainty surges and investors’ scenarios and potential outcomes proliferate. Only months from now will data be sufficient to help us understand the true impact. In the meantime, market nervousness increases, reflecting lower visibility and a renewed dispersion of investors’ perceptions.

“At this stage, the balance of exposure in our All Roads strategy shifts towards holding somewhat safer assets at the expense of cyclical assets. ”

In such a market environment, our multi-asset strategy naturally trims exposures across assets as a first response to the increased risk of losses, then cross-asset indicators progressively capture changes in leadership through our valuation, momentum and carry signals, as well as macro Nowcaster signals.

At this stage, the balance of exposure in our All Roads strategy shifts towards holding somewhat safer assets (eg government bonds, long volatility and inflation swaps), at the expense of cyclical assets (eg credit, equities and commodities).

Asian markets: how tariffs could catalyse expansion and inter-regional trade

US trade policy could provide a large catalyst for Asian economies to progress, building on the region’s record of using strong infrastructure development, education, industrial policies and, most significantly, manufacturing to make rapid advances. We see five trends underlying this shift:

- Led by north Asian companies with manufacturing prowess in robotics, AI and green technologies, the region could move to dominating global supply chains

- A rise in greater inter-regional trade within Asia, as well as increased trade with the ‘global south’ sets the stage for Asia to cover 60% of global GDP by 20301

- Higher tariffs are encouraging Asian companies to expand globally more quickly rather than relying purely on exporting

- Marked Asian domestic savings and Asian policy shifts could underpin greater domestic consumption, especially via digital services growth

- As it increases renewable or self-sourced energy, the region also reduces the drag on its current account from energy imports and its reliance on the dollar.

Read also: Asia fixed income: a promising outlook for 2025

These trends lead us to believe that changes in global trading practices are likely to hasten Asia’s economic advance. Investment opportunities are multiplying in public equities with newer and stronger business models, while a growing pool of Asian capital remains keen to invest domestically in Asian fixed income and public equities. To us, this signals a shift in valuations that will occur over multiple years.

Risk: diversification and downside protection to create resilient portfolios

Tariff developments portend a range of investment risks that investors must navigate carefully. From market volatility and rising consumer prices to sector-specific challenges and recession fears, the implications are wide-reaching.

We believe investors need to prioritise diversification, downside protection and nimbleness to create resilient portfolios in this ever-evolving economic backdrop.

Read also: Investment and risk implications of Trump’s Liberation Day

Convertible bonds: asymmetric exposure for better timing

Navigating the complexities of current tariff policy requires a balanced assessment of the multi-faceted impact on the global economy and markets. It also requires an acute ability to time investment decisions, which can be difficult when policy changes quickly. The attributes of convertible bonds are particularly well-suited to the current context.

Bridging bonds and equities. Acting as a bridge between bonds and equities while offering exposure to both, convertibles can help investors get the timing right. To tackle limited visibility, investors could adopt investment strategies with the ability to offer both upside participation and downside protection.

Dual exposure. Investors are currently paid through positive yield to participate in potential equity market gains. Concurrently, they own downside protection if things do not evolve as expected. This dual exposure is particularly valuable for those questioning whether to trim positions after the recent rally in European equities.

click here to explore our convertible bonds strategy Valuations and quality. Compelling valuations and high-quality issuers enhance the appeal of convertible bonds.

Asymmetry. The inherent asymmetry, or convexity, of the instrument means it typically captures a greater share of equity market upside than the downside. Convertible bonds, in the prevailing turbulent environment, are doing what they are designed to do.

Diversification. Convertible bonds offer diversification opportunities, especially in Asia.

While the current tariff environment introduces significant challenges, it also presents potential for strategic investment approaches that balance risk and reward. Convertible bonds stand out as the all-weather investment vehicle for navigating these uncertain times.

Read also: An asset class for all seasons: 20 years of investing in convertible bonds