investment viewpoints

Quality focus as pandemic distorts CHF credit

The COVID-19 pandemic has prompted unprecedented central bank response, and distorted global bond markets. In this insight, we update investors on our expectations for the Swiss National Bank, and key issues in CHF-denominated corporate bond markets. How is the Swiss National Bank fostering lending conditions and handling the strong franc? And why do investors need an active approach focused on liquidity and credit quality to steer through highly-testing times?

SNB view: to support lending conditions, sell francs

Due to significant shocks from the COVID-19 pandemic, we believe the Swiss National Bank (SNB) will continue to support bank lending conditions and intervene in foreign exchange markets in the short term.

The SNB’s March assessment clearly communicated a reluctance to reduce interest rates further into negative territory. At -0.75%, base rates are already at the lower bound, and a rate cut would probably hurt bank profitability more than it would benefit the economy. As such, the hurdle seems very high to cuts here.

We believe the central bank will continue to support lending conditions and intervene in foreign exchange markets in the short term.

Swiss credit institutions play a central role in stimulating the economy, especially now. The SNB policy fosters this role. On the one hand, credit institutions are liquidity providers and sustain businesses with required cash. On the other hand, lenders are expected to be flexible with businesses encountering difficulties due to the current climate.

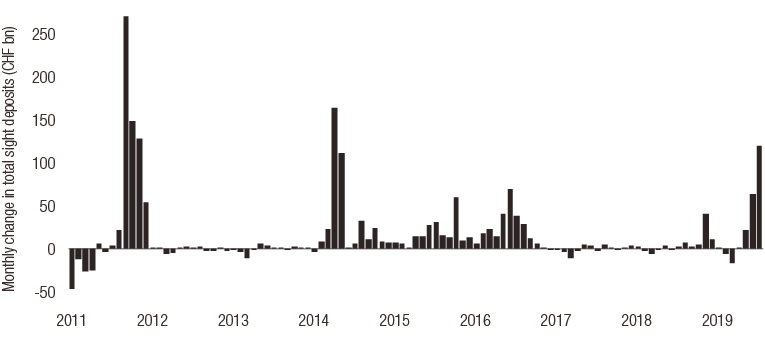

In this respect, the appreciation of the franc is clearly problematic for the Swiss economy, and the SNB has intervened in the foreign exchange market to sell the currency. It is doubtful the SNB can continue this intervention in the long term, however, as its balance sheet balloons from increasing sight deposits. Figure 1 shows the marked increase in sight deposits, which are a good indicator of FX intervention.

Figure 1. Swiss sight deposits

Source: Swiss National Bank.

We believe the SNB's aversion to foreign-exchange intervention will increase as its balance sheet expands accordingly. Safe haven buying of the franc has typically accompanied turbulent markets, and as such, we expect the franc to remain strong.

If the franc strength persists, we do not entirely exclude further measures. For instance, targeted lending measures are very possible to support specific sectors, as done by the European Central Bank. Such measures would further discount base rates, like in the Eurozone. Alternatively, if liquidity conditions deteriorate substantially in CHF corporate bond markets, the SNB could be incentivised to follow the lead of other central banks and intervene in its domestic market.

Recovering CHF bond market eyes distortions

The Swiss franc capital market continues to recover from its most distressed levels as the primary market shows signs of life and buyers gradually return to the secondary market. This has helped narrow bid-ask spreads on CHF-denominated corporate bonds.

Nonetheless, sentiment remains fragile and we do not expect resumption of standard conditions until there is greater clarity about the coronavirus and what the ‘new normal’ means for the global economy.

Many CHF bonds continue to be priced at levels that reflect a lack of market liquidity rather than the borrower’s fundamentals. For instance, different bonds from the same issuer are pricing different credit risk premiums, indicating that illiquid conditions can significantly distort prices. We believe our active approach focused on quality and discipline can help fixed income investors navigate such conditions.

Monitoring for liquidity to ensure credit quality

We put fundamental credit analysis at the heart of portfolios, which in the current context means monitoring issuers for company liquidity, as well as sector exposure.

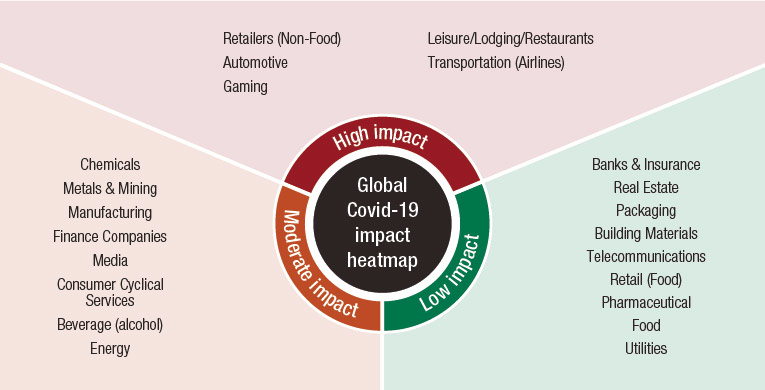

We also assess the impact of COVID-19 at a sector level because certain sectors of the economy are clearly more affected. For instance, non-essential consumer sectors are likely to be most negatively impacted, including non-basic consumer goods and their suppliers. Sectors producing vital goods and services are likely to be less affected. Lastly, monetary and fiscal measures are likely to support defensive sectors in the near term, but it is unclear how long such support will last.

Figure 2. COVID-19 will disproportionately disrupt some industry sectors more than others

Source: LOIM. For illustrative purposes only.

Sufficient liquidity is critical for businesses to operate, as companies scramble to ensure they have enough cash and credit lines to survive this period. Our fundamental analysis focuses on a company’s liquidity situation and pays particular attention to corporate balance sheet quality.

Close monitoring of credit risks is essential, in our opinion. Our analysts use their expertise to evaluate current credit ratings (the lowest first), and complement their analysis with bespoke liquidity tools that are developed in-house to optimise assessments. Such liquidity tools enable us to review entire portfolios using several data points (Bloomberg, CAPIQ etc.) to estimate how long a company can continue operations with no income or without needing to enact measures to limit damage.

Our fundamental analysis focuses on a company’s liquidity situation and pays particular attention to corporate balance sheet quality.

In addition, we add other balance sheet indices - such as loan-to-value or other debt:asset ratios – because traditional metrics – such as income and cash flow ratios – are not reliable predictors in current conditions.

To gauge a company’s ability to reduce its cost base quickly, we consider both variable costs, the ratio of labour to total costs, as well as the ability to dismiss employees or obtain state resources to cover wages. Where necessary, our analysts contact companies directly to discuss liquidity and crisis management measures.

Our approach puts quality first, and helps build portfolios comprised of robust companies that are more resilient to the challenges of today’s highly-testing environment.