investment viewpoints

Will China’s middle class save luxury demand from wealth taxes?

The potential for new redistributive policies in China, in the form of heavier taxes on higher income earners and hikes in capital gains or property taxes, may hit high-net-worth individual (HNWI) consumers. However, in our view, this should not overshadow growing demand for luxury goods from the increasingly wealthy Chinese middle class – enabling sales for high-end brands to remain resilient.

Tech, tutoring – are luxury goods next?

At a finance meeting on 17 August Chinese President Xi Jinping called for a “reasonable adjustment of excessive incomes” and encouraged wealthy groups and businesses to give more to society, according to a Jing Daily report.

This year, Xi has also alluded to the importance of ‘’common prosperity,’’ loosely defined as the creation of more fair and inclusive conditions to expand the middle class and address the nation’s rising income disparities.

Disposable income of people in top fifth of Chinese households is more than 10 times higher than those in the bottom fifth, while disposable incomes in cities are two and a half times those of the countryside, according to The Economist, citing official figures.

The Chinese Communist Party’s (CCP’s) aim of achieving common prosperity can be seen as part of the motivation for the authorities’ regulatory action this year – especially lifting pay and improving conditions for gig-economy workers1. Lowering the income gap between the urban and rural Chinese is also part of the CCP’s current five-year plan.

This focus on the ultra-rich follows the recent regulatory crackdown on the technology and tutoring sectors, which triggered a stock-market sell-off and underscored increasing efforts by the Chinese Government to reimagine the nation’s quality of economic growth in accordance with its own blueprint.

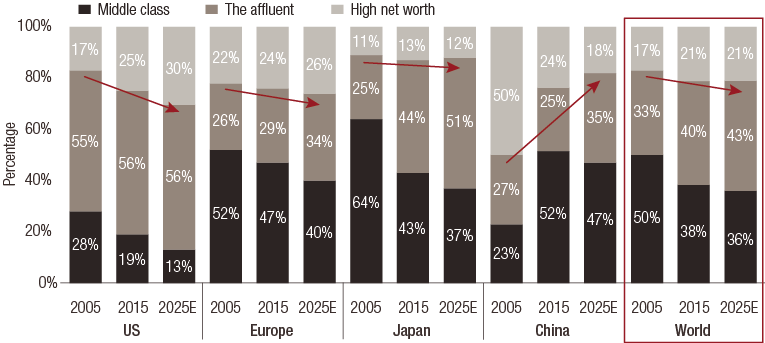

But we believe this short-term volatility should not cloud China’s underlying investment strengths in the long-term. Especially at a time when Chinese stocks have materially underperformed against the global benchmark since their recent peak (see figure 1).

FIG 1. Window of opportunity? Chinese stocks have underperformed recently

China’s appetite for luxury

The Chinese consumer represents about 40% of global demand for luxury goods, according to estimates by Goldman Sachs2. Q2 earnings reports from high-end consumer brands also pointed to strong retail sales in China, given the reduced mobility of Chinese travellers due to the pandemic.

But some investors are reducing exposure amid the perceived risk of luxury-goods demand being undermined by the potential for new policies targeting wealth redistribution. The luxury sector, as indicated by the S&P Global Luxury Index, was down 6.8% in the week of 17 August compared to the -1.9% return of the MSCI World. European luxury brands have been particularly impacted given their broad exposure to China.

Luxury brands’ middle kingdom

The Chinese Government’s rhetoric may be somewhat reminiscent of the Xi-led crackdown on gifting and lavish consumption that started in 2013. That campaign severely impacted the luxury sector, which took three years to recover. But we expect further regulatory moves to be less impactful.

This is because elite brands are less reliant on HNWI demand. They increasingly generate sales from middle-class and affluent consumers, and have attracted more buyers from the millennial and Gen Z demographic cohorts. To broaden their market base, luxury brands have diversified product ranges and pricing structures accordingly, and complemented their presence in Pudong, central Beijing and other retail hotspots by expanding into lower tier cities and selected e-commerce channels.

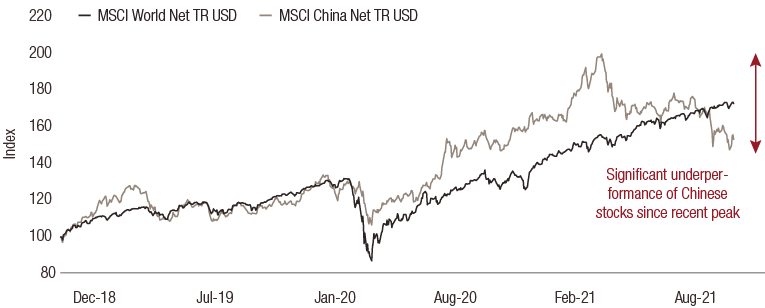

This has resulted in middle-class consumers providing the most demand for luxury goods in China, followed by the affluent and then the HNWIs – a trend that has persisted since 2015 (see figure 2).

An additional 400 million consumers are expected to transition from low-income to middle- class or higher over the next 10-15 years and domestic tourist, entertainment and duty-free zones like Hainan could bolster additional domestic luxury consumption when borders likely re-open in a year, according to another Jing Daily report.

This supports our view that any potential decline in HNWI demand as a result of any new redistributive policies should not diminish the dominant sources of growth for luxury brands in China: middle class and affluent consumers across the country’s cities.

FIG 2. Tectonic shifts in China’s luxury demand

Source: Goldman Sachs Equity Research. “Luxury outlook and strategy: Evolve or decline - Kering raised to Buy”. Published 26 September 2016.

LOIM’s luxury exposure through World Brands

As a global, high-conviction equity strategy focused on brands positioned to benefit from long-term consumer trends, our World Brands portfolio has an approximate 10% exposure to pure luxury companies (excluding cosmetics, apparel and sporting goods). This is one of the lowest weightings to the sector on a global basis relative to the portfolio’s history. Overall, the strategy is diversified across brands appealing to the appetite for greater sustainability, digitalisation and wellbeing among consumers.

sources

Sub-fund details

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.