Fixed Income Market overview

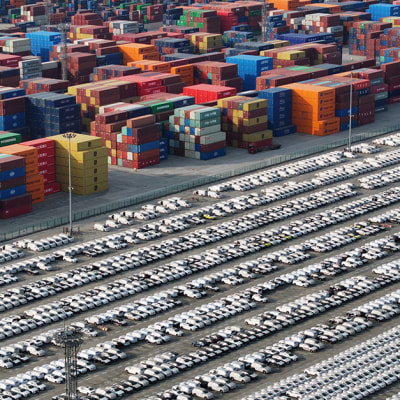

March brought heightened geopolitical turmoil with landmark developments in both the US and Europe seeing Fixed Income post its first negative month of the year, culminating in the unveiling of an enormous tariff program in early April which sent vast risk off waves across markets. Focusing just on March moves, prior to the April announcements, European treasuries were the sizable underperformer, whilst spreads in high yield also suffered. US Treasuries were the only positive for the month, also supporting US IG corporate total returns to near flat for the month. Sectoral spread moves were broadly in line, with the only notable underperformance coming in the final week of the month from Autos as the crosshairs of tariff action fell upon them.The month began with a sharp U-turn on fiscal spending rules in Europe, as the new German administration drew up plans to remove fiscal spending limits and push through an unprecedented fiscal package of infrastructure and defense spending. The market reaction was equally unprecedented, with bunds delivering the largest 1 day move in over 30 years, rising ~30bps on the day. The move comes to compensate for the loss of reliance upon US military support under the new Trump administration, with their shift in stance on the Russia-Ukraine situation causing a sudden shock to international allegiances. In a quite remarkable move, the plan was passed through the incumbent Bundestag, before the first sitting of the newly elected government, to ensure its passing, underlining the urgency deemed necessary by European powers to get it over the line. Not to be outdone, the political action on the other side of the Atlantic was equally as drastic. The Trump administration ramped up tariff talk and action, with targeted measures on several close trading allies, ranging from Candain Lumbar to European wines. The largest of which came towards month end, with a 25% tariff on autos globally, with a warning that tariffs plans were real and not just for negotiation purposes. The start date of these measures was added to an agenda for April 2nd, which was increased in prominence and dubbed 'Liberation day', with promises of unveiling a full tariff program. The unveiling of the April 2nd tariffs was a monumental event, with the levies coming in much higher and broader than anticipated. A minimum level of 10% globally was implemented (with the notable exclusions of Canada and Mexico) with what was described as a reciprocal tariff regime applied to others. However, the numbers showed little resemblance to actual tariffs levied on the US, being more closely linked to trade balances as a percent of US exports. This left Emerging economies particularly hit, with the EU and Japan also heavily hit. Fall out is ongoing but the market reaction has been heavily risk off, with spreads spiking higher and yields falling, as negative growth concerns heavily outweighs the upside inflation impact.Central bank meetings in the month were largely as expected, with the Fed holding and ECB cutting, but both unwilling to commit to their next moves with such uncertainty around the impact of fiscal events. The Fed in particular now faces a stagflationary mix which will be particularly complex to navigate, particularly as clarity on trade policy's impact likely won't be seen in hard data fully for a few months at least. Macro data itself continued to look weak growth wise in US soft data, but hard data still painted a more robust picture. Elsewhere, advancement on solutions on global conflicts saw a lot of noise, but ultimately little concrete improvement. In fact, the middle east conflict moved in the opposite direction, with a breakdown in the Israel-Gaza ceasefire seeing military strikes resume. Finding a resolution in Ukraine - Russia also hit a wall, with highly conflicting demands for a truce making for very little common ground.The tariff upheaval has accelerated the re writing of the geopolitical status quo, global trade relations being completely rewritten. The market has clearly chosen the side of recession fears over inflation concerns, which should continue to favour duration even after these sharp moves lower in yields. The risk off episode has been blanket and hit credit hard at a blanket level, but with such repricing comes the chance the pickup fundamentally robust names that have been caught in the crossfire and offer alpha potential. In risk off epsiodes, remaining nimble and ready to act is vital, as such times usually offer the best opportunities for alpha, but selectivity remains key.

Portfolio activity

There were no new Fallen Angels in March.Nordic retail real estate company Citycon left the Fallen Angel universe in somewhat unusual circumstances. At the beginning of the month it was rated Ba1 NW/BBB- NO having become a Fallen Angel in 2020. On 10th March Moody's withdrew the rating which meant Citycon would return to investment grade status and leave the index at month end. The he next day S&P cut their issuer rating to BB+, returning Citycon to Fallen Angel status. However, a more detailed examination of S&P's commentary showed that they had not actually downgraded the bond believing the value of the real estate portfolio would increase investors recovery prospects and therefore maintained the BBB- rating. As a result Citycon ultimately exited the Fallen Angel universe in March.

Performance and characteristics

The fallen angel strategy is a high quality high yield strategy with an average rating of BB.March and year to date strong outperformance was driven primarily through security selection within the retail and telecomunications sectors. Walgreen Boots announced a take private deal which saw the bonds rallying around 20 points on expectations that the change of control clause would be triggered allowing investors to put the bonds back to the company at par. We are not so sure as it would require a rating downgraded and materially add to the cost of the transaction. We therefore took profit and reduced our position. Struggling French Retailer Auchan also provided a positive update on both performance and potential debt reduction which the market took very positively. This is a name we have some concerns around and prefer to remain in the short-dated paper which will benefit most from any debt reduction and refinancing initiatives. Elsewhere in the sector there was some weakness in US department stores as a sector likely to be impacted by tariffs. French satellite company Eutelsat materially out-performed as it has become increasingly clear that a domestic, European defence capability is critical and that domestically controlled satellite coverage is critical.Outlook: Trump tariffs are dominating markets at present. While there is no immediate increase in Fallen Angels supply, the impacts of tariffs is a clear credit negative which suggests there is potential for further supply in due course. We will also look to take advanatge of any price dislocations in tariff exposed sectors where we feel the price action has been too extreme.