MARKET COMMENTARY

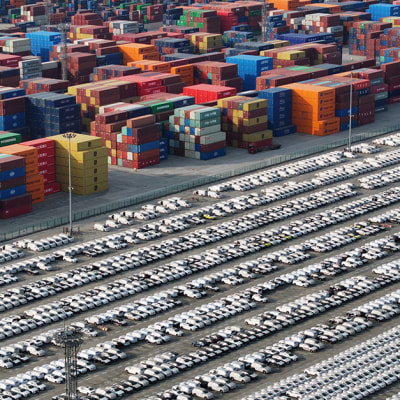

We have entered a period of extreme uncertainty following the missteps of the American government in terms of trade policy. As of the time of writing, the U.S. has imposed an additional 104% tariff on China with China in turn imposing an 84% tariff back on the U.S. in retaliation. Make no mistake, this will be costly for global growth if frozen at the current point. As Covid-19 showed, supply chains are extremely intertwined, and this will be viewed as a seminal point in history against globalization.

At first glance, it is tempting to conclude that the growth shock to Asia will be large. However, Asia is in a very different place in terms of resilience now compared to ten years ago. Central Banks in the region are generally flush with FX reserves and have significant flexibility in terms of how they can respond to this crisis. Case in point is India, where the RBI cut interest rates by 25bps this week and provided a dovish signal to the markets. Similarly, China will almost certainly respond with a large stimulus plan, especially as they reiterate the growth target for this year. Japan is toying with the idea of direct cash handouts to stimulate consumption. All this points to significant flexibility both via fiscal and monetary channels, and will be key to factor in before settling to an equilibrium path.

Perhaps counter to the general thinking, we believe that China and India will likely come out ahead following this series of events. We do think China will see a growth shock to the tune of 1-2pp of GDP in the first round but this has to be viewed in the context of the change in stance of the authorities to turn more stimulative towards the domestic economy. The April Politburo meeting will be key to observe, especially since China may now have to contend with using other growth levers to reach its 4-5% target (and to offset the drag from exports that will likely be present). The ability and the willingness to act is there for China, and this may propel them to pivot away from export oriented growth and industrial policy, to a mix of industrial policy and consumption growth.

India will be the relative safe haven given its closed economy and the strong balance sheet of the RBI. Despite the large headline tariff on India, we would point to the fact that a) pharma sector seems to be carved out for the moment (that could change); b) actual exports to the U.S. are still quite small in the context of the overall economy; c) RBI is already embarking on a liquidity easing position and has sufficient FX reserves to engineer a modest weakening of the INR to manage the growth dynamic.

The biggest loser from this uncertainty will actually be the U.S. as the immediate supply shock to prices will almost certainly be growth negative and inflationary. This would mean the Fed will likely have to be on hold for the next couple of quarters to observe the extent of the supply side shocks – electronics equipment will almost certainly become more expensive with company margins getting further squeezed (your next laptop/iPhone purchase is probably going to get quite expensive).

Overall, as we have mentioned in our previous publications, we are witnessing the spectacular unravelling of the US consensus growth view and ‘US exceptionalism’. Potential further global tariffs and trade wars will only lead to higher working capital, shrinking margins, and lower capex, for global corporates, especially SMEs across retail and industrial goods trading. As such, we expect the US economy to slow down in 2025, caused by (a) policy uncertainty, (b) lesser corporate spending and job hiring, and (c) less global firms/corps investing in US, (d) Trump’s administration’s efforts to shrink government spending via the DOGE campaign efforts.

All in all, when the dust settles, we believe Asia will come out ahead given the strong macroeconomic anchors and attractive valuation levels. This will be a multi-year buying opportunity for Asian assets over the medium term in our view.

PORTFOLIO COMMENTARY

The Asia Investment Grade Bond fund was down 22bps over the month of March, marginally behind the index that was +4bps. However, April has seen a drawdown of -2.5%, driven by the larger active beta share in the portfolio versus the index. At the time of writing, the portfolio has a yield-to-worst of 6.45% (USD terms), Z-spread of 297 bps, and duration of 6.1 years.

This is one of the few crises in the history of the Asian asset class where we believe the extent of the price action downward is discordant with the prospect of fundamental balance sheet deterioration for the companies represented in the index. There is little to no exposure to exporters directly into the U.S. Our financials exposure is close to 45% of the portfolio, and is diversified across high quality and large financial institutions, with predominantly Asian-based assets that have structural exposures to non-interest and wealth management businesses. Insurance companies are extremely well capitalised and well-regulated in developed market regimes. Another 15% of the portfolio is in infrastructure names that have stable, defensive cash flows and are domestically oriented. The balance of the portfolio is in diversified sectors where the export content is low and credit quality is high.

Over the past month, we have been very active in new issues before the current tariff blow out. We traded new issues such as Marubeni, MTRC, Bank Mandiri, and Jollibee Foods. On the other hand, we took the opportunity to add to spread names in new issues such as Bangkok Bank T2s and LG Energy Solutions. To fund these positions, we trimmed tight China tech names such as Meituan, Alibaba, and Tencent. This also helped to keep the duration of the fund at 6.1 years after a temporary duration extension towards 6.3 years in the prior month. We also reallocated our exposure within HBSC AT1s towards more attractive new issuances and trimmed out of the shorter-dated and tighter older bonds.

For the rest of 2025, we are confident that performance will bounce back as the high degree of uncertainty fades. We would advise investors to look through the immediate noise and invest in a portfolio with high carry, moderate duration that has the potential to provide compounded high single digit returns over the next 3-5 years.

Thank you for your continued support.

NIVEDITA SUNIL

On behalf of the LOIM Asia Fixed Income team