Fixed Income Market overview

March brought heightened geopolitical turmoil with landmark developments in both the US and Europe seeing Fixed Income post its first negative month of the year, culminating in the unveiling of an enormous tariff program in early April which sent vast risk off waves across markets. Focusing just on March moves, prior to the April announcements, European treasuries were the sizable underperformer, whilst spreads in high yield also suffered. US Treasuries were the only positive for the month, also supporting US IG corporate total returns to near flat for the month. Sectoral spread moves were broadly in line, with the only notable underperformance coming in the final week of the month from Autos as the crosshairs of tariff action fell upon them.

The month began with a sharp U-turn on fiscal spending rules in Europe, as the new German administration drew up plans to remove fiscal spending limits and push through an unprecedented fiscal package of infrastructure and defense spending. The market reaction was equally unprecedented, with bunds delivering the largest 1 day move in over 30 years, rising ~30bps on the day. The move comes to compensate for the loss of reliance upon US military support under the new Trump administration, with their shift in stance on the Russia-Ukraine situation causing a sudden shock to international allegiances. In a quite remarkable move, the plan was passed through the incumbent Bundestag, before the first sitting of the newly elected government, to ensure its passing, underlining the urgency deemed necessary by European powers to get it over the line.

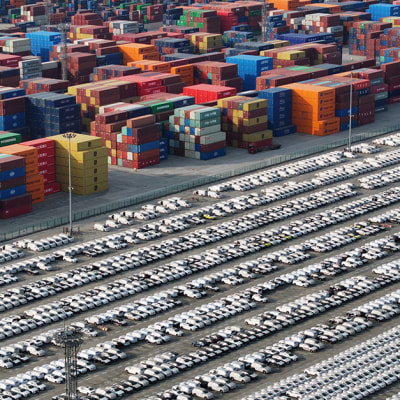

Not to be outdone, the political action on the other side of the Atlantic was equally as drastic. The Trump administration ramped up tariff talk and action, with targeted measures on several close trading allies, ranging from Candain Lumbar to European wines. The largest of which came towards month end, with a 25% tariff on autos globally, with a warning that tariffs plans were real and not just for negotiation purposes. The start date of these measures was added to an agenda for April 2nd, which was increased in prominence and dubbed 'Liberation day', with promises of unveiling a full tariff program.

The unveiling of the April 2nd tariffs was a monumental event, with the levies coming in much higher and broader than anticipated. A minimum level of 10% globally was implemented (with the notable exclusions of Canada and Mexico) with what was described as a reciprocal tariff regime applied to others. However, the numbers showed little resemblance to actual tariffs levied on the US, being more closely linked to trade balances as a percent of US exports. This left Emerging economies particularly hit, with the EU and Japan also heavily hit. Fall out is ongoing but the market reaction has been heavily risk off, with spreads spiking higher and yields falling, as negative growth concerns heavily outweighs the upside inflation impact.

Central bank meetings in the month were largely as expected, with the Fed holding and ECB cutting, but both unwilling to commit to their next moves with such uncertainty around the impact of fiscal events. The Fed in particular now faces a stagflationary mix which will be particularly complex to navigate, particularly as clarity on trade policy's impact likely won't be seen in hard data fully for a few months at least. Macro data itself continued to look weak growth wise in US soft data, but hard data still painted a more robust picture.

Elsewhere, advancement on solutions on global conflicts saw a lot of noise, but ultimately little concrete improvement. In fact, the middle east conflict moved in the opposite direction, with a breakdown in the Israel-Gaza ceasefire seeing military strikes resume. Finding a resolution in Ukraine - Russia also hit a wall, with highly conflicting demands for a truce making for very little common ground.

The tariff upheaval has accelerated the re writing of the geopolitical status quo, global trade relations being completely rewritten. The market has clearly chosen the side of recession fears over inflation concerns, which should continue to favour duration even after these sharp moves lower in yields. The risk off episode has been blanket and hit credit hard at a blanket level, but with such repricing comes the chance the pickup fundamentally robust names that have been caught in the crossfire and offer alpha potential. In risk off epsiodes, remaining nimble and ready to act is vital, as such times usually offer the best opportunities for alpha, but selectivity remains key.

Portfolio activity

With a number of bonds maturing and some cash inflows we took the opportunity to add some new names to the portfolio while increasing holdings in others.

We have continued our disciplined approach to the new issue market only adding a new hybrid bond from Unibail-Rodamco (URWFP). We had met senior management at a recent real estate conference and gained some further insight into their US strategy, particularly the likely impact of a slowdown in consumption by the US consumer in a post tariff world which we found supportive of credit quality. URWFP has an implied temperature rise (ITR) of 2.0c compared to a sector average of 3.6c and a carbon footprint of just 64. We were looking to increase our exposure having added some USD senior paper in the secondary and this was a welcome opportunity to increase our EUR exposure as well.

We also added bonds from German Real Estate company, Aroundtown (ITR 4.0c and a tiny carbon footprint of just 4), UK insurer Legal & General (ITR 1.5c vs sector average of 3.0c and carbon footprint of 338 vs 110 sector average), US Health Insurance company Elevance Health (ITR 2.5c vs 3.0c and very low carbon footprint of 20. Finally, we added Italian telecommunications infrastructure company Infrastructure Wireless Italiane (INWIM) which offers an attractive carry but, may also be subject to a take private bid which could trigger the change of control clause and therefore offers potentially five points of upside from where we bought the bonds. INWIM has an ITR of 2.5c and a carbon footprint of 30. None of these names are likley to be impacted by US tariffs.

Performance and characteristics

The fund modestly under-performed the benchmark in March with no material contributors in either a positive or negative direction.

Year to date the fund is ahead of benchmark on a gross basis but behind on a net basis. There is a modest positive contribution from our over-weight to BBB rated issuers but no single issuer stands out materially.